The Federal Reserve raised 75 basis points, and the hike boots landed. Why did US stocks not rise and fall?

Author:Guo Shiliang Time:2022.09.22

Federal Reserve

The Fed announced a rate hike 75 basis points and adjusted the federal fund interest rate target range between 3.00%and 3.25%. Although this time the interest rate hike conforms to market expectations, the US stock market still fluctuates sharply. At the time of closing, the three major indexes of the US stocks have closed down, and the market has not taken out the shadow of the Fed's continuous interest rate hike.

The reason for the sharp decline in U.S. stocks is mainly because the Fed ’s interest rate hike cycle may exceed market expectations. From the analysis of the Fed's statement, the Fed's interest rate hike cycle may not stop in 2023, and even start to cut interest rates until 2024, which means that the Fed ’s interest rate hike cycle exceeds market expectations. Market expectations.

From the perspective of the Fed's continuous interest rate hike, the current determination of the Fed to control inflation is relatively firm. If the pressure of high inflation has not been relieved, the Fed may continue to take a significant rate of interest rate hike until the US inflation rate has decreased significantly.

It should be noted that after the interest rate hike, the Fed has raised 75 basis points for the third time this year, and created the maximum density rate hike since 1981.

From the perspective of the market, although the interest rate hikes meet the market expectations, the market is more concerned about when the pressure of high inflation will be substantially reduced, and when the Fed ’s interest rate hike cycle will end.

From the analysis of inflation data released in recent months, the problem of high inflation in the United States has far exceeded market expectations. It seems that it has not fundamentally solved the problem. Faced with high -end inflation data, the Fed may have greater efforts to cope with the pressure of high inflation, which is obviously unfavorable for the market.

Under the influence of the Fed's continuous interest rate hike, the US dollar index reached a new high and set a new high level in nearly 20 years. In the context of strong US dollars, it has undoubtedly constitutes the pressure of funds to escape from emerging markets, and has caused great fluctuations in the global market exchange rate, stock market and bond market.

Today, the federal fund interest rate target range is adjusted between 3.00%and 3.25%, but this is not the end of the interest rate target range. According to market expectations, the scope of Federal Reserve terminal interest rates may reach 4.75%to 5.00%in the future, and it will even reach a higher level.

The impact on the stock market is mainly reflected in several aspects.

Among them, the sharp increase in terminal interest rates may accelerate the restructuring risks of the valuation system of core assets of US stocks. If the federal fund interest rate target range is about 3.00%, the valuation of US stock core assets is about 30 times more reasonable. If the difference in interest rates of federal funds is raised to about 5.00%, the valuation of US stock core assets may be reduced to less than 20 times, and the risk appetite of the entire market is changing the importance.

In addition, the sharp rise in terminal interest rates means that the Fed has gone out of the dividend period of long -term ultra -low interest rates. With the end of the ultra -low interest rate dividend period, for U.S. -listed companies, it is no longer possible to rely on the advantages of low interest rates to dedicate a large -scale share repurchase and cancellation strategy as in the past. For listed companies with high debt ratios or weak debt capacity, it is difficult to withstand the next share repurchase demand, and the risk of borrowing repurchase is significantly increased.

The Federal Reserve raised interest rates sharply, but just reduced the inflation rate a little, it can be seen that the pressure of high inflation is still not substantially alleviated, and the willingness to turn the currency of the Fed is not high. The Federal Reserve raises a large interest rate hike. The interest rate hike cycle may exceed market expectations. Behind the Fed's continuous interest rate hike, the impact on the US stock market is also far -reaching. The impact on the sequelae of the US economy and the stock market is gradually showing.

- END -

Burning the summer!Chengdu 2022 Digital Cultural and Creative Carnival is about to start

Chengdu Cultural and Creative District, Chengdu Cultural and Creative Products, an...

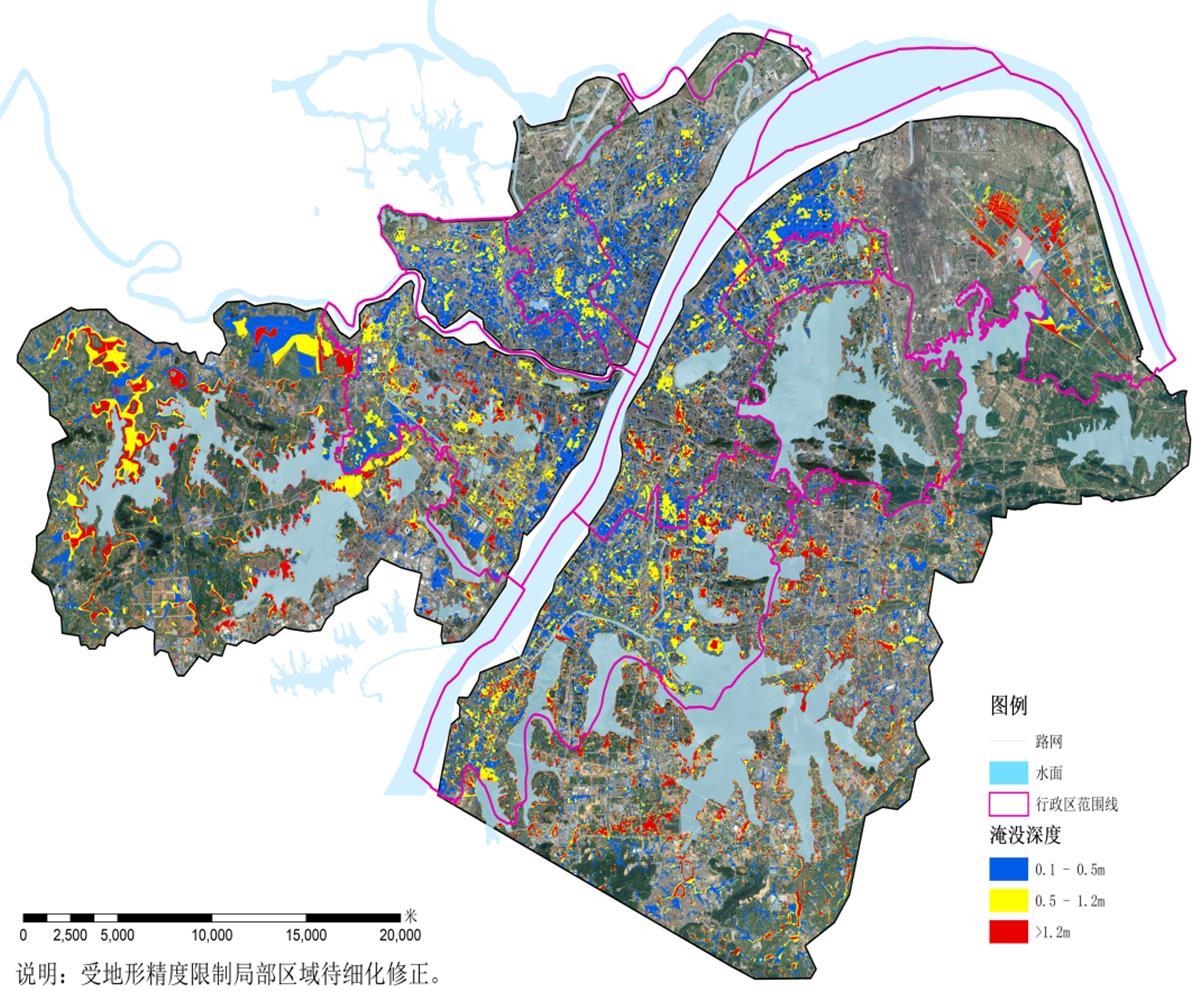

Where is the rainy rainfall, where is it easy to cause waterlogging?Wuhan delineates 21 risk areas

Jimu Journalist Pan XizhengIntern Xiang YuchenOn July 6, the Wuhan Municipal Gover...