practical!The judge teaches everyone how to keep the pension "money bag"

Author:Ping An Inner Mongolia Time:2022.09.22

"In the recent hit drama" Zhang Weiguo's Summer ", Zhang Weiguo borrowed money for the auction of the auction of the auction and raised 700,000 yuan auction margin, and even borrowed the old -age money of the old man. 'Collection trap'? "

"Art comes from life. Such a plot will happen in life. In the cases we actually run, it is not uncommon for the elderly to be cheated by hundreds of thousands of yuan in the way of paying a deposit ..."

On the afternoon of August 22, the live broadcast of the "Stay away from the Pension Fraud Trap to Keep the Pension Cooking 'Capital Bag" live broadcast organized by the People's Court of Press and Media. , Kuaishou number, as well as a number of platforms such as the Tianping Sunshine APP. The live broadcast is the first live broadcast of the "Expiring Pension Fraud" series of live broadcasts planned by the People's Court of Journalism Media.

Shang Dengyu, a judge from the People's Court of Chaoyang District, Beijing, the police of the Beijing Anti -Fraud Center, and the well -known financial blogger@来自 来自 来自 来自 来自 来自 来自 来自 来自 来自 来自 来自 来自 来自 来自. Keep the pension "money bag" for sharing the law and perspective.

""

"What types of common investment and wealth management are involved in old frauds?"

According to Judge Shang Dengyu, from the perspective of actual cases, the core logic behind various types of fraud is consistent, that is, everything can be used to obtain the money or houses such as houses or houses in the elderly. According to the specific cause of fraud or routine, cases involving old fraud can be summarized into the following seven types:

1. "Pension with a house" trap: Under the name of investing in old-age care and revitalizing real estate, he promises to return to high interest rates. %Of the high-interest "wealth management project" (in the past two years, with the popularity of national anti-fraud, everyone has improved the vigilance of abnormal high interest rates, and the interest promised by the criminal gang has a decrease. For the elderly, the elderly hand over the real estate disposal (mortgage) to the lending institution or individual. At first, the elderly could receive the corresponding rebate every month. Once the capital chain of the criminal gang company was broken, the old man's income could not be obtained, and the principal could not be collected. And because he could not continue to return the loan interest, even his own house would be gold. The Lord exercises the mortgage to force the transfer, and the elderly will eventually face the situation of "two vacancies". This kind of fraud objective for the elderly is the most serious trap to infringe the elderly. We know that there is something to live and support the old. The most important guarantee for life.

2. "Financial Management Artifact" trap: counterfeit state -owned enterprise background, claiming that it is more reliable than Yu'ebao, saving 10,000 yuan to earn 3,000 yuan, and claiming to be low threshold, short cycle, high yield, download the app can invest, invite friends can get it, you can get it, you can get it. Ten tens of thousands of yuan red envelope. These self -proclaimed Internet wealth management artifacts can obtain the trust of the elderly through fictional state -owned enterprise background and capital guarantee, and then induce recharge investment through fictional projects and high returns (so -called financial recharge, in fact, it is controlled by the transfer of mobile banking to criminals controlled by the transfer of mobile banks to the criminals. Private bank account). Or trick investors to pull people's heads, this "investment" can also taste sweetness at first, but soon the platform will not be able to withdraw or even lose contact for various reasons. At present, there are all ages of this type of scam victims, and many of them are elderly people.

3. "Private Equity Population" trap: scammers use emerging financial concepts such as "private equity crowdfunding", "partners", "overseas equity" and "angel investment" to confuse the audiovisual, and use the blind spots of the elderly to set up traps for the elderly. The elderly purchased the product in the form of signing a partnership agreement, and became a partner, and the partnership investment needs to bear the risk. Finally, the partnership company was informed that the partnership could not make normal profits. And the funds invested have been transferred or lost.

4. "Virtual Currency" trap: virtual currency cash is similar to the cash mentioned earlier, because they are all investing through mobile phone software. Virtual currencies are on the virtual currency or digital currency platform app developed by criminals Operate. Criminals may be "zero" and "mining" if they do not need to invest money. They can "recommend rebates" when they are developing offline, or they can buy virtual currencies. Holbers. Such virtual currency funds often appear in the form of "0 threshold and 0 investment", and then seduce the elderly to develop offline by "recommendation and rebate", so that some elderly people will increase their investment and increase investment. No return.

5. "High -priced collection" trap: promoting slogans such as "high -priced auction", "limited issuance" and "peerless treasure", attracting the elderly, or selling ordinary commemorative coins, stamps, artworks, etc. to the elderly, or lied, or lied It is said that it can be auctioned by high -priced auctions for the elderly, collecting so -called service fees, commissions, membership fees, deposits, exhibition cabinets, etc., to deceive the money of the elderly. In this trap, criminals are the use of the elderly's lack of knowledge of collectible value, and a normal mentality of profitable to make a profit through collectibles to achieve fraud.

6. "Policy Subsidies" trap: impersonating state organs, calling the elderly who are poor and sick in their family members, lied that they could apply for "government subsidies" and medication subsidies to relevant state departments. , Agency fees, handling fees and other forms are misleading. 7. "Free Travel" trap: Through various ways to ask for warmth, obtain the trust of the elderly, seduce the elderly at low prices or free travel, or force the elderly to consume, buy items, or persuade the elderly to buy local real estate during the trip. If profit, or deceive the elderly after signing an agreement, if not traveling, the principal and a certain percentage of returns can be retrieved unconditionally after the agreement expires.

""

"What is the scam routine of‘ house -care ’?”

Judge Shang Dengyu: The first step is to get in touch and establish trust. Give some small gifts (eggs, insulation cups, shopping vouchers, etc.), low returns through other ordinary cash financial management, or health lectures, and get low returns. Trust the elderly.

The second step is to pick up real estate information and promote the elderly. In the process of getting along with the elderly, knocking on the side of the elderly's housing information on the side. After confirmation, it is promoted to the elderly with household information, which may be named by national policies and government support. In fact, our country does have a formal "house -care" project. From 2013 to 2018, the State Council, the CBRC and other departments launched the "Inverse Pension Insurance of the Elderly Housing", which is an innovative commercial pension insurance. The main content is eligible elderly people, mortgaged the houses under the name to qualified insurance companies. The insurance company issues pensions to the elderly every month until the elderly are in the old man. Real estate income is preferential to pay for pension insurance related costs.

The third step is to apply for mortgage and get funds. After the elderly agreed to handle it, the owner of the Golden owned the borrowing of the mortgage into the bank account under the name of the elderly. The fraud gang immediately transferred the money to the company's control account name. Payment rebate. After the company's capital chain breaks, the gold owner cannot receive the interest of the loan, and then sued the elderly to realize the mortgage. If there is no evidence to prove that the gold master and the fraud gang have the intention to have a common crime, the old man's house will be disposed of, and the money room will eventually be empty.

""

"How can we avoid falling into the trap of‘ house -care ’?”

Judge Shang Dengyu said that the reason why the elderly fell into a trap is mainly because of lack of awareness and discerning ability. To avoid traps, you can pay attention from the following aspects:

First, if you make any investment and financial management, you must let your children know, don't just handle it yourself. Especially when applying for real estate mortgage and changes in real estate, we must fully understand the content of the contract or authorization book that implements the white paper black words, and it should be operated with the help of professionals such as children or lawyers to prevent being deceived.

Second, when you are not particularly urgent to use money, you can treat everything as a private publicity without using real estate for financial management activities.

Third, when investing in financial management, we need to keep rational and calm at all times, and choose investment projects carefully. Do not trust high returns. High returns mean high risk. Before investing in financial management, you must investigate and verify the project and invest cautiously.

Fourth, if there is a need for borrowing, you must choose a regular financial institution with loan qualifications to go through the mortgage loan procedures. Do not trust false publicity advertisements such as “interest -free, unparalleled, unsecured” issued by non -qualified non -formal companies.

Fifth, once you find a "routine loan", or the phone intimidation of criminals, and violent collection such as late -night shooting, you must report the case to the police in time to protect yourself with legal weapons. Don't be wrapped in criminals because of fear, getting deeper and deeper in the "routine loan" trap, suffering from property loss and illegal violations.

Sixth, during the transaction process, we should pay attention to retain key evidence such as chat records and transfer records of both parties.

""

"In the recent hit drama" The Summer of Zhang Weiguo ", Zhang Weiguo raised 700,000 margin for auctioned a auction of ancestral porcelain and horses, borrowed money everywhere, and even borrowed the old -age care of the old man. . How can I avoid this pit? "

Judge Shang Dengyu, old friends who like antiques collection, they are buying or selling or selling them for sale. Before the collectibles, we must learn more about the relevant knowledge and procedures. For companies that claim to be qualified for generations, they must verify the company's qualifications with the help of their children, and can be traded after confirming it as a regular company. At the same time, when selling collectibles, if you encounter a required payment of deposits and service fees in advance, you must be vigilant. Do not easily hand over the collectibles to such companies. Pay the relevant expenses to avoid "the property is empty."

""

"Can you talk about the old fraud cases in the field of collections you have tried?"

Judge Shang Dengyu said that he had just concluded the old fraud case in the field of collectibles earlier this month. He tells that in this case, 14 defendants used the company's name and called by the company's words to organize the victims in the name of the company to organize some small gifts to the victims. The sale of collectibles at high prices, which derives more than 160 victims of more than RMB 2,400 yuan for charging membership fees, deposits, exhibition cabinet rents, service fees and other fees, including more than 140 people over 60 years old. In the end, the court sentenced the defendants to the defendants for a period of twelve years, six months to two years and six months.

"This case is a typical collection of collectible fraud. The criminal gang has never held auction, and it is also unable to take the high -priced auction of the collectibles in the hands of the victim. , Charge the victims a variety of fees. The actual controller of this gang is not in my case. He is very good at using the tricks of the golden cicada to set up another company. Revised, change another company after a while. In this way, the victim's rights protection and the investigation of the public security organs. "Judge Shang Dengyu said.

""

"Many scammers approach the elderly through Xiao En Xiaohui, and then use high -interest and other bait to attract the elderly to invest in additional investment. The more promised to invest, the higher the reward. The routine of the old scam about scams'? "

Judge Shang Dengyu: The core of Ponzi scam is that the perpetrator has no profitability. He takes out a part of the new customer investment, dismantle the east wall to make up the west wall, and return to the old customers to maintain the scams, and the old customers taste the sweetness Later, friends and relatives were often pulled, which led to the increasing radiation range and more and more victims. The types of pension fraud cases are mainly concentrated in three types of crimes: fraud, illegal absorption of public deposits, and fund -raising fraud. Such crimes mainly include the following three characteristics: investing in "pension projects", acting "pension insurance", and "pension gangs" with "pension gangs" In the name of "support," the name of the elderly, and the purpose of providing the name of the elderly service to cover up the purpose of illegally absorbing public deposits; to pay high interest, enjoy the subsidy quota, check in the preferential discounts of the pension apartment, attract the investment of the elderly, and achieve illegal illegal The purpose of fundraising and other crimes. Common routines are: the first step, setting up an empty shell company, generally the first impression of "blessing", "love", "music", "health", "health", etc. to create a happy and peaceful first impression. The second step is to recruit employees to distribute publicity materials on the street, especially in the gathering place of elderly people such as parks, supermarkets, and marketing markets to pre -sell "pension services" to the elderly. The third step is to pull closer the distance with "Xiao En Xiaohui", such as "registered members to send eggs, towels, cups, health products", "free physical therapy", "free travel", etc., so that the elderly have initially let go of their minds. The fourth step, according to the collected personal information, invite the elderly to "listen to classes" through irregular calls, visits and other methods, introduce the current current elderly current status and national support policies to the elderly, display projects such as elderly apartments, present government certificates Files and posting leaders inspect photos (these photos and documents are most likely Zhang Guanli), and constantly brainwashing the elderly. The fifth step is to claim that you can buy the pension beds in the next decades at a low price. If you do not stay for the time being, you can pay the principal and interest each year, and use 6%to 20%. In the name of "VIP Card", "Member Card", and "Prepaid Card" in advance, Illegal fundraising is charged by charging high membership fees, margin or membership card charging. Step 6, use high interest rates to seduce additional investment, the more promises to invest, the higher the return, and the higher the return. People "enter the pit".

""

"What work did the people's court do in cracking down on elderly fraud?"

According to Judge Shang Dengyu, the Beijing court combined with the characteristics of the living habits of the elderly to enter the community, street, bank outlets and other places, organizing 170 publicity activities on the spot, more than 18,000 publicity materials such as production, distribution of publicity manuals, and publicity posters. In cooperation with Capital Airport, Beijing Bus, Metro, and other promotional products that allow the elderly to "see clearly" and "understand", promote the formation of a good situation of "everyone knowing and futant".

Since the launch of the special activity of combating the special campaign to rectify the elderly fraud, the Chaoyang Court has actively invested and participated in all the following aspects: First, based on criminal trials to crack down on criminal business, successfully concluded a group of old fraud cases, and the defendant who had serious crimes against the crime was seriously crime defendant. People have been strictly punished, and the victims have recovered millions of dollars, which also recovered the property that some victims were deceived. Hundreds of copies, explain the knowledge of anti -fraud and anti -fraud, and answer related questions raised by the masses; third, actively extend the judicial functions, send judicial suggestions to relevant units such as the Cultural Tourism Bureau and other relevant units in the process of handling the case to help administrative organs To renovate from the source to help eliminate bad soils on survival of old fraud cases; fourth, actively participate in social propaganda for the work involving old -fashioned scams. The judge handling the case accepts in -depth interviews from CCTV, China Daily, Beijing Broadcasting and Television and other media. Preaching typical cases, analyzing fraud routines, proposed anti -fraud suggestions, and providing judicial guarantees for creating the social environment of the elderly to enjoy their old age.

In addition, the police from the Beijing Anti -Fraud Center Takayama combined with their own work experience and introduced a number of cases involving old fraud. "Elderly people should be particularly alert to scammers in the name of third parties, such as the staff who pretend to be a public prosecutor's authority, to ask the fraud routine of bank card deposits in conjunction with law enforcement and other words. "Pan." He reminded. For how to prevent fraud, high mountain suggestions, first, be sure to install the National Anti -Fraud APP and the National Anti -Fraud Center APP; Second, when receiving 96110 calls, it may be in time when it is encountered by telecommunications fraud. Performance numbers, bank card numbers, and mobile phone verification codes such as personal information to avoid personal information leaks and cause property losses.

Regarding what the elderly should consider when investing in financial management, the well -known financial blogger@关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于 关于First, the door is right. That is, the risk income match, the investment should find low risk; the second matchmaker must be formal. That is, the channel for buying wealth management must be formal, and the products you buy must be formal; the third person is preferred. Go to false financial management. "

"Old and old and old", I hope that the live broadcast will allow more elderly people to understand how to know how to break the scams, stay away from the trap of pension fraud, and learn to keep the "money bag" of the elderly.

Source: People's Court News Media Headquarters

- END -

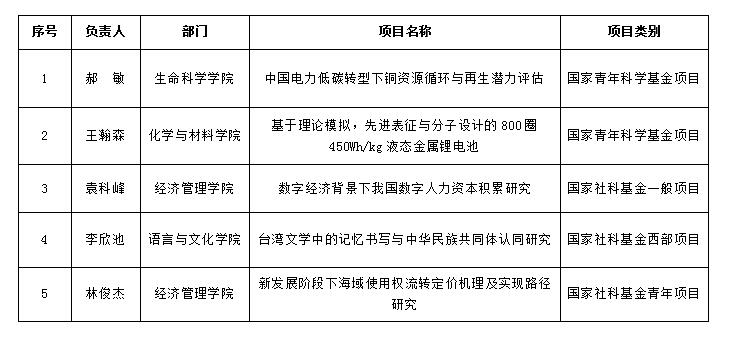

Five projects of Ningde Normal University were approved by the 2022 National Fund Project

Recently, the National Natural Science Foundation of China and the National Philos...

Shenzhen Baoan released a major space development strategy

Shenzhen Baoan released a major space development strategy.In the coast of the Sou...