Help the micro -plan to enter 19 provinces and cities across the country, government integration and online merchant banks help local small and micro operations

Author:China Economic Network Time:2022.09.22

In the peak season of "Golden Nine Silver Ten", September is not only the season of harvest, but also the peak period for small and micro enterprises to produce and sell.

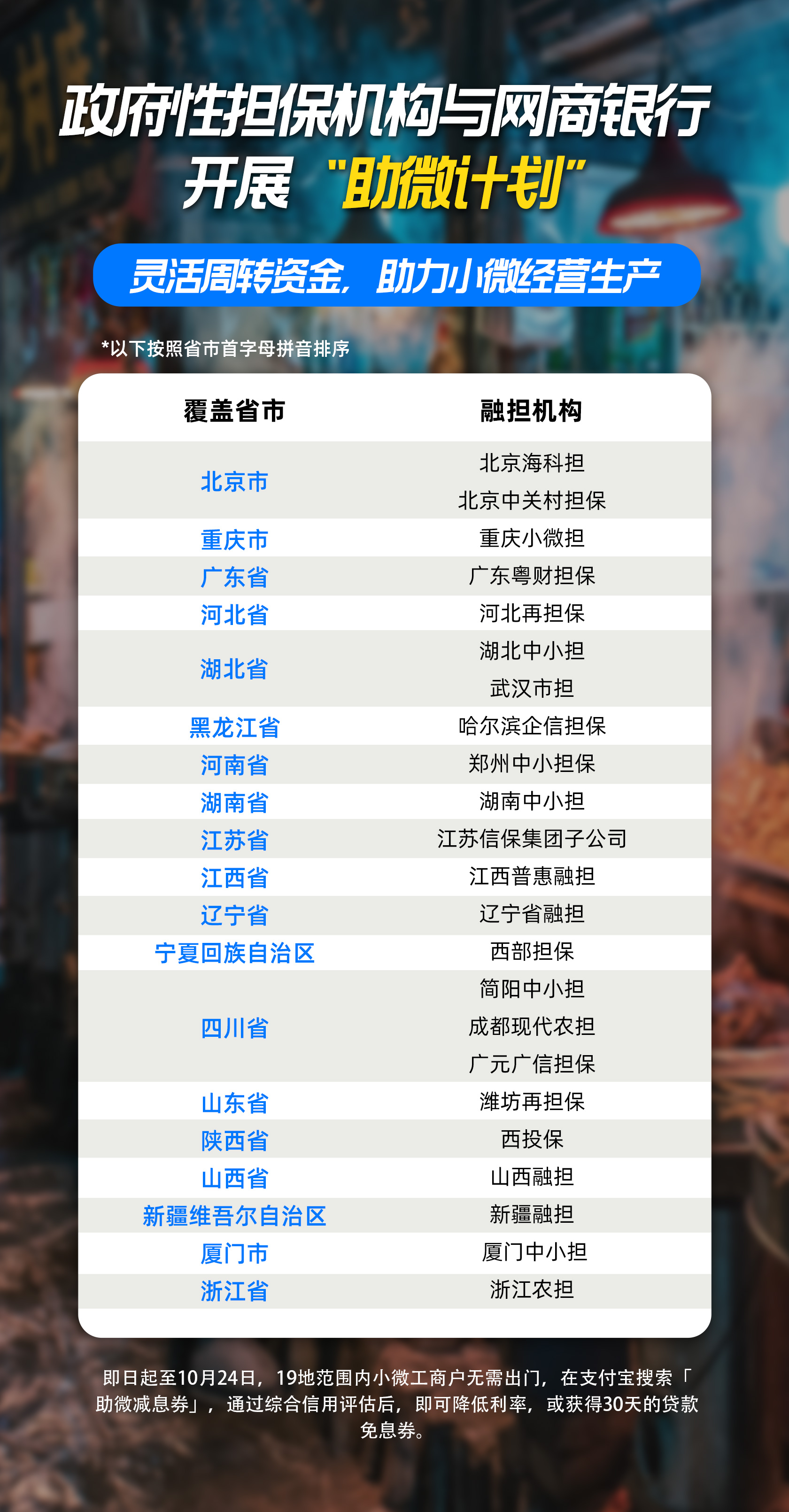

In order to support the flexible turnover of small and micro operators and enhance the vitality of the market, the "help micro -plan" initiated by the National Federation of Industry and Commerce and the online commercial bank has pushed new measures. The reporter learned that Jiangsu, Sichuan, Fujian, Liaoning, Guangdong and other local government financing guarantee agencies jointly provided interest rate reduction loans to small and micro operators with the establishment of an online merchant bank initiated with Ant Group to help the real economy.

From September 22nd to October 24th, small and micro industrial and commercial households and farmers' farmers within the scope of 19 provinces and cities do not need to go out. , Can reduce interest rates, or get 30 -day loan interest -free vouchers.

A toy manufacturer in Shantou, Guangdong has operated a children's toy manufacturer for more than ten years. It not only exerts the domestic market, but also sells overseas through foreign trade. From May 2022, the demand for children's toys in overseas markets has recovered. He plans to purchase more raw materials and appropriately expand the scale of production, but it has not yet received enough sales. Use the business loan of online merchant banks to fill in the funds gap, so that he seized the peak of sales, and also reduced the cost of funds through interest -free vouchers. "Now, we are busy, and the production lines have been opened."

Song Yunzhi, the person in charge of the Inclusive Finance Department of Jiangsu Province Xinbao Group, said that government financing guarantee agencies should further improve their service capabilities, use mature digital risk control technology, further reduce fees to make profits, and provide pure credit, pure online interest rate reduction Loans help small and micro enterprises and "agriculture, rural areas, and farmers" to develop faster and better, and contribute to the high -quality development of the economy.

Since 2022, localities have been focusing on promoting inclusive financial innovation. At present, it has reached a cooperation with the government financing guarantee agency of the 21st local government. Through the joint issuance of loan interest -paying coupons, it has effectively reduced the financing cost of small and micro operators, reducing the financing costs of small and micro operators, reducing the reduction Their worries in production and operation, thus stabilizing employment and promoting industrial development.

- END -

Invite you to participate!APEC SME Innovation and Professional (Specialized New) International Cooperation Symposium will be held tomorrow online

Reading Client · Shenzhen News Network, September 1, 2022, APEC SME Innovation an...

It has maintained double -digit growth for 6 consecutive years -how can my country's R & D investment hit a new high

The Statistics of the National Science and Technology Investment Investment in 2021 recently released by the National Bureau of Statistics, the Ministry of Science and Technology, and the Ministry o