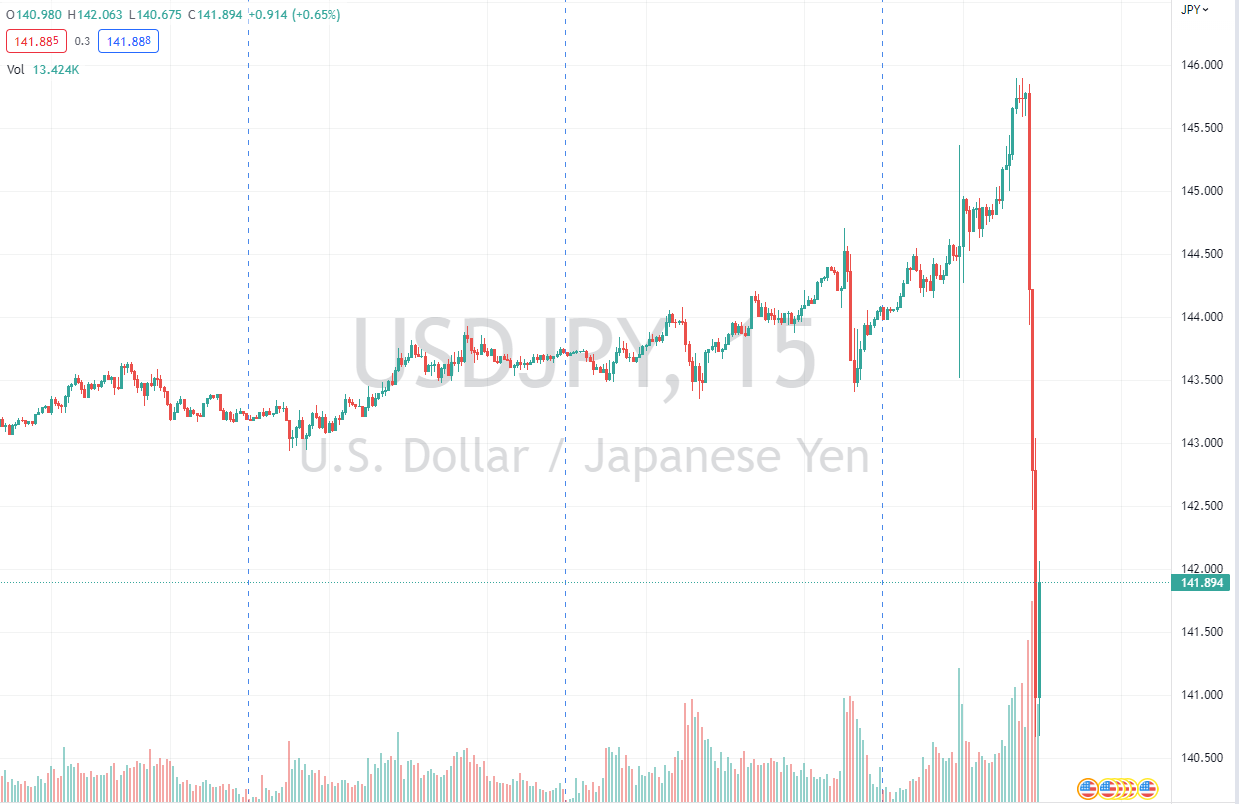

For the first time 24 years!The Bank of Japan intervened in the foreign exchange market, and the yen skyrocketed exceeded 450 points

Author:Daily Economic News Time:2022.09.22

On September 22 (Thursday), Beijing time, after the important psychological barrier of the dollar briefly broke the 145 in the US dollar, the Bank of Japan finally intervened in the foreign exchange market again after 24 years.

According to Reuters, Masato Kanda, deputy minister of the Ministry of Finance, said on Thursday that Japan has adopted a decisive action and has intervened in the foreign exchange market. "Speculation behavior is the reason for the sudden and unilateral fluctuations in the near future. The Japanese government pays great attention to the excessive fluctuations of the yen, which will maintain high urgency and closely monitor the trend of foreign exchange."

Stimulated by the above news, the yen exchange rate rose short -term, the US dollar continued to decline quickly, the short -term pulling up exceeded 450 points, and the lowest report was 141.17.

Picture source: Yahoo Finance

This morning, Beijing time, the Bank of Japan decided to continue to maintain a large -scale currency easing policy. At the same time, the Bank of Japan maintains the policy interest rate of -0.1%; maintaining the 10-year-old Japanese Treasury yield target is about 0%; the forward-looking guidance of maintaining interest rates is unchanged. The Bank of Japan said it will continue to carry out daily fixed interest rates.

At the subsequent press conference, the Governor of the Bank of Japan said, "We temporarily maintain the stance of loose monetary policies for a while. We will never change in the future." In addition The central bank will maintain forward -looking guidance in the next two to three years.

"Daily Economic News" reporter noticed that since Japan's long -term shrinkage in April 1995, the Bank of Japan has only had actual intervention on the yen. Specifically, Japan's last intervention in the foreign exchange market to sell US dollars to buy yen was when the Asian currency crisis was the worst in June 1998, and the last time it was sold in the market was in November 2011.

From November 1997 to June 1998, the Bank of Japan sold a total of 4.2 trillion yen in 11 times. On June 16, 1998, the dollar reached 146.78 against the dollar, a record high. The Prime Minister of Japan subsequently issued a statement that he promised to restore the health of the Japanese banking industry and boost domestic demand. In the four trading days from June 16th to 19th, 1998, the dollar fell from 146.78 to 133.69, a decrease of 9%. To 143.36.

Daily Economic News

- END -

Will "picking stars" bring new crowns?Wu Zunyou's interpretation is here

On June 30, Wu Zunyou issued a document through a personal social platform to inte...

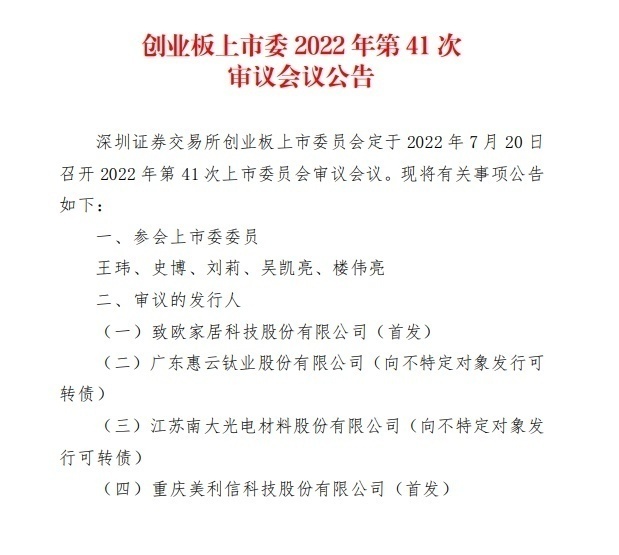

To Europe and Merimson will be on the GEM on July 20th, Huiyun Titanium and Nanda Optoelectronics Convertible Bonds Issuing Application

Shenzhen Stock Exchange's GEM Listed Committee is scheduled to hold a review meeti...