Limu Cranes Crane Small and Micro -Enterprise financing difficulties, Caramay City's first non -performing loan risk compensation

Author:Tianshan.com Time:2022.09.22

Tianshan News (Reporter Ran Hu Report) Recently, Caramay SME financing guarantee company received a 2.4 million yuan risk compensation received by the Municipal Finance Bureau. A non -performing loan risk compensation.

Earlier this year, a aquatic company in Karamay was unable to repay the 3 million yuan operating loan due to unexpected unexpected situations. After the Caramay Branch of China Agricultural Development Bank was collected, it was launched according to the "risk compensation policy" and launched it. Guarantee compensation mechanism.

Caramay SME financing guarantee companies first compensated the aquatic company to a bank loan of 2.7 million yuan, and subsequently submitted an application for risk compensation to the financial department. After the Clarimi City Finance Bureau jointly reviewed and fulfilled the government's approval process, it gave the guarantee company a 2.4 million yuan risk compensation from the risk compensation fund.

Simply put, the "risk compensation policy" is that the company is not yet on the bank's money, and the guarantee company helps to pay back; the guarantee company's losses, government finance helps to make up for it. "The government establishes the practice of building a letter to establish confidence for the bank's continued to do a good job in small and micro enterprises inclusive finance, and has also established a virtuous cycle of ecological environment for the healthy development of inclusive finance in small and micro enterprises." Manager Gao Feng said.

This policy comes from the "Interim Measures for the Management of the Pilot Fund of the Comprehensive Reform of private and small and micro -enterprise financial services in Clarmai City." The regulatory bureaus and other departments have jointly formulated and issued to guide financial institutions to provide inclusive financial services for small and micro enterprises to alleviate the financing problems and development difficulties of small and micro enterprises.

The "risk compensation policy" stipulates that after a loan issued by banks to small and micro enterprises has a non -performing loan, the government, guarantee agencies, and banks shame the risk according to the ratio of 8: 1: 1. Sales agency compensation.

It is understood that since the "risk compensation policy" was introduced last year, banks and government financing guarantee agencies have boosted confidence and increased credit support and financing guarantee for small and micro enterprises in Clarmai City. The continuous increase in loan balances ensure the stable operation of the market entity.

As of the end of August this year, the balance of inclusive financial loans of small and micro enterprises in Clarimi City was 2.704 billion yuan, an increase of 28.95%over the end of the previous year, and the number of loans was 5,120, an increase of 16.55%over the end of the previous year; Yuan, an increase of 100%compared with the end of the previous year, the number of loans was 664, an increase of 127.4%over the end of the previous year.

- END -

Customs increase in taxes in the first half of the year

Xinhua News Agency, Beijing, July 16th (Reporter Zou Duowei) The reporter learned ...

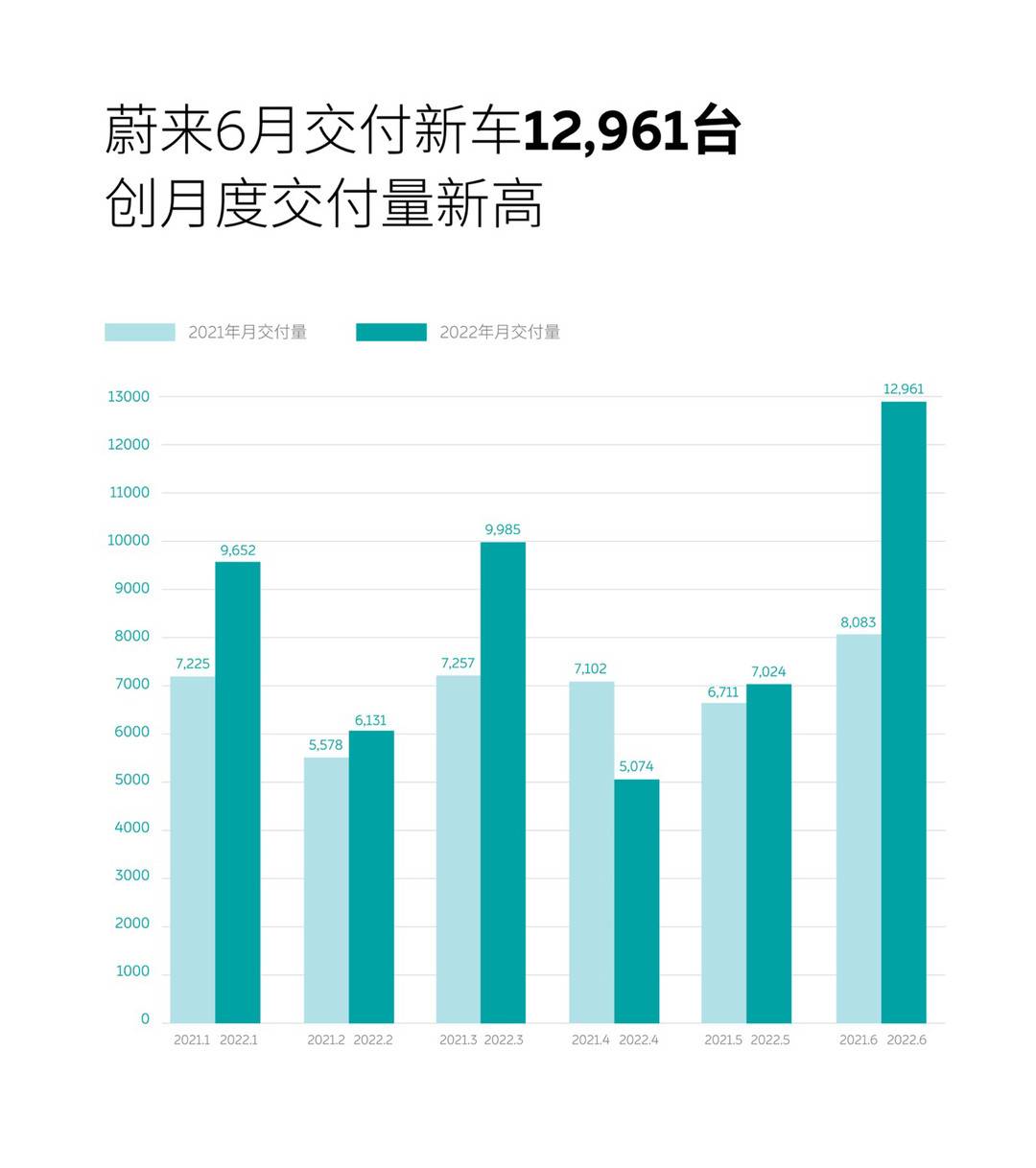

The semi-annual report of the auto market | January-June year-on-year increased by 21.1%!Weilai, who was "shorted" by the Grizzlies, responded with the transcript of the middle school entrance examination

Cover news reporter Zhang FuchaoOn July 1, Weilai announced its June sales data, w...