The Fed's radical rate hike stimulates global currency

Author:Global Times Time:2022.09.23

The Fed announced on the 21st that 75 bases raised interest rates, and raised the federal fund interest rate target range to between 3.00%and 3.25%. This is the fifth interest rate hike this year, and it is also the third consecutive interest rate hike in the year. After 5 hikes, the Federal Reserve has accumulated a total of 300 basis points. American Consumer News and Commercial Channel (CNBC) believes that this is the most radical currency tightening operation since 1990. The only thing that can be compared in 1994, but the Federal Reserve raised interest rates only 225 basis points.

The Fed's continued strong interest rate hike pushing the US dollar index to continue to strengthen. On the 22nd, the US dollar index rose 111.83, located at a 20 -year high. In the report, Reuters believes that because the Fed will continue to raise interest rates in the future, this trend will still support the US dollar to strengthen.

The Fed's radical monetary policy coupled with the continuous strengthening of the US dollar allowed the global market to fully feel the "mountain rain is full of wind and full building." The Fed's Eagle Positions first impact the performance of U.S. stocks. According to Bloomberg report, the US stock market is crazy on the 21st. The S & P 500 index fell to the low point when closed. More than 20 %. At the end of the 21st, the Dow Jones Industrial Index fell 1.70%, and the Nasdaq index fell 1.79%.

After the news of the Fed's interest rate hike was announced, a strong US dollar swept the world's major non -dollar currencies. The largest component of the US dollar index fell to 20 years, reached a 37 -year low of 1 euro against 0.9810 US dollars, and the pound fell to a pound of $ 1.1237.

On the 22nd, after the opening of the Asia -Pacific market, the impact wave of the Fed's interest rate hike continued to pass to the market. On the same day, the major Asia -Pacific stock market generally opened down. The Seoul Composite Index of South Korea fell 1.2%. As of the afternoon, the major stock indexes in the Asia -Pacific market closed down.

The Fed's radical interest rate hike also tests the policy choices of the Global Bank of the World. The exchange rate against the US dollar lost its 1400 mark on the 22nd, setting the lowest record in nearly 13 years. Since the beginning of this year, Han won has plummeted more than 15%, becoming the worst emerging Asian currency in the same period. Yonhap News Agency reported on the 22nd report that the South Korean Minister of Finance promised to introduce measures to alleviate the downward pressure of the won.

On the 22nd, the Bank of England announced the latest interest rate resolution. The Bank of England raised its interest rates at 50 basis points as scheduled, increasing policy interest rates from 1.75%to 2.25%, and Britain has raised interest rates 7 consecutive times in December last year.

After the British Central Bank announced the resolution, the British pound dived at 70 points against the US dollar. Market analysis believes that the reason why the central bank officials choose to raise interest rates 50 basis points is because the government has recently adopted measures to restrict energy prices.

On the same day, the Swiss Central Bank announced a rate hike of 75 basis points, raising the policy interest rate from -0.25%to 0.5%, ending the 8-year negative interest rate policy, and the interest rate level has reached a new high since December 2008.

Faced with the pressure brought by the strengthening of the US dollar, the use of the euro as the minimum level of global payment currency decreased to the lowest level of more than two years last month.

According to data from Bloomberg, according to the data of the Bank of China Financial Telecommunications (SWIFT), the proportion of euro in global payment fell to 34.5%in August, a full percentage point lower than July. At the same time, the report released on the 21st shows that the proportion of the US dollar has continued to rise since May, and it has first ranked first in the 15th consecutive month, accounting for 42.6%.

Bloomberg reported that in the face of recorded inflation and the deterioration of the energy crisis caused by the Russian -Ukraine conflict, Europe is at the edge of economic recession, and the euro has lost the attraction of transactions as it. On the contrary, investors are pouring into the US dollar to seek security, thereby further consolidating the status of the US dollar as the preferred currency of investors.

Although the transaction volume has declined for three consecutive months, the euro is still the second largest currency in the world and continues to lead the pound and yen. In addition, the proportion of yen, which continued to fall in 2022, has not improved in global payment. It fell to 2.7%in August, the lowest level since May, and the yen against the US dollar exchange rate has fallen by about 20%this year.

Bloomberg also reported that the US dollar interest rate hike further decreased the charm of Southeast Asian currencies because the US interest rate hike foreshadows that these currencies will continue to fall. A strategic strategist of market institution Natwest Markets in Singapore believes that "as long as the U.S. Eagle School continues to exceed market expectations, it seems that it is the most prudent approach to making more dollars." ▲ ▲ ▲ ▲ ▲ ▲ ▲ ▲ ▲ ▲ ▲ ▲ ▲ ▲ ▲ ▲ ▲ ▲ ▲ ▲ ▲ ▲

Reporter Ni Hao

- END -

The first August of the district's state -owned enterprises were running steadily and continuously

Xinjiang Zhongtai Jinhui Technology Co., Ltd., a subsidiary of Zhongtai Group, has...

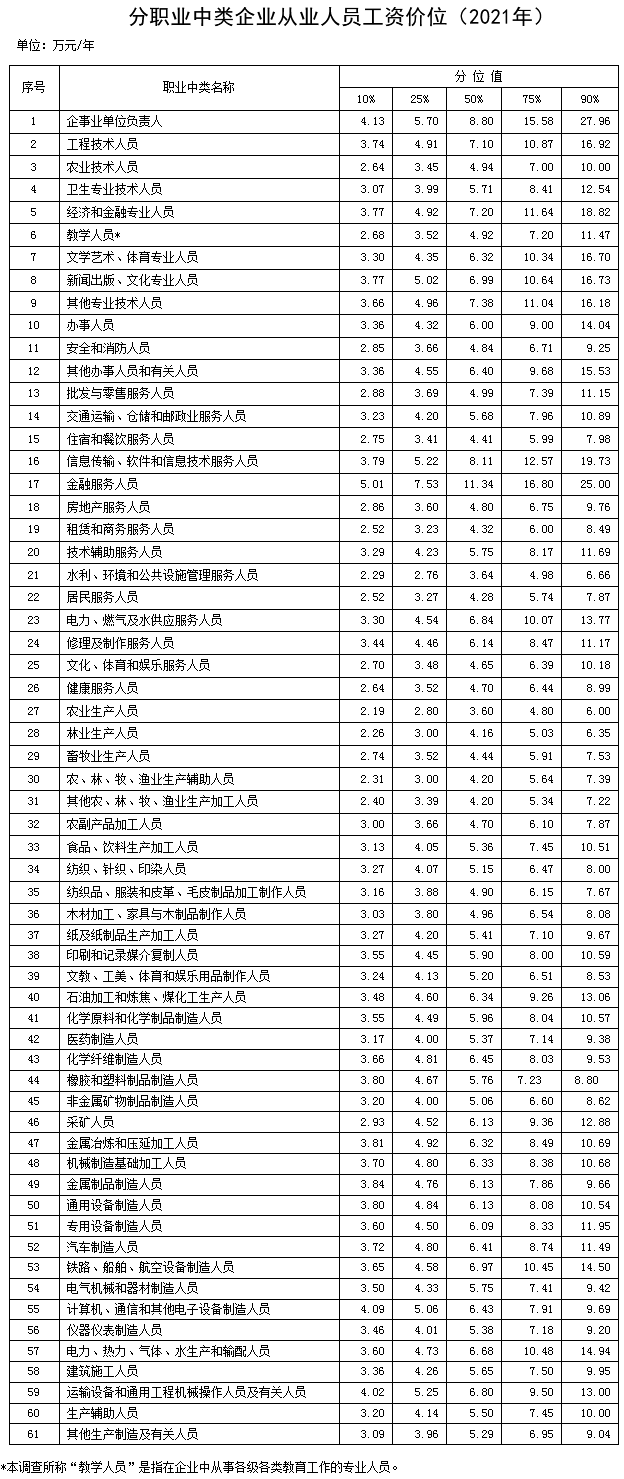

The latest salary price is here!Where are you?

The Ministry of Human Resources and Social Affairs recently released information a...