The Shanghai Index lost 3100 points, and the financial stocks were strong in the market. The institution: This round of adjustment has come to an end

Author:Securities daily Time:2022.09.23

Our reporter Zhang Ying, on Friday (September 23), the three major A -shares index fluctuated, and the Shanghai Stock Exchange Index lost 3100 points. Near the National Day holiday, how will the A -share market run? What other investment opportunities? On September 23, the total transaction between the two cities was 667.6 billion yuan, and the net sold of 506 million yuan in northbound funds was sold. Generally speaking, A shares have fallen more. From the perspective of Shen's one -level industry, today, five industries have achieved rising. Among them, banks, food, beverages, non -bank finance and other industries have risen, respectively, 0.43%, 0.38%, and 0.29%, respectively. In addition, electronics, coal, computers, media, automobiles, non -ferrous metals, and social services have fallen first, all in terms of over 1.5%daily limit board. On September 23, 27 stocks rose daily limit. It has risen more than 3 consecutive trading days. From the perspective of the industry, the number of daily limit shares in the industry of machinery and equipment and the power equipment industry is the top of 6 and 5, respectively. Table: On September 23, the daily limit of individual stocks: Zhang Ying's recent market performance, Zhou Ronghua, chief strategy officer of Mingze Investment, believes that the domestic economy has shown a weak recovery trend, the policy of steady growth is unchanged, liquidity has maintained loose, and the market is not in the market. There is a possibility of continuous decline. It is expected that this round of adjustments have come to an end, and there is an opportunity to configure low configuration. Chen Wen, manager of Gecko Capital Fund, said that in the past 10 years, A shares have often occurred in the risk of liquidity, low transaction volume, and market adjustment. After the risk is released after the holiday, the market emotions will recover. Looking forward to the market outlook, the allocation value of large -cap stocks is gradually prominent, and the market style will return to the best blue chip stocks. Investors can pay attention to leisure scenic spots, hotel travel, consumption and other industries, which are mainly information security, agriculture and performance restoration. Regarding the market outlook, Zheng Mingji, the research director of Longying Fuze Assets, believes that the global stock market continued to adjust in September, the market risks were fully released, the A -share market was abundant, and the structural market was sustainable. The market downturn is the good opportunity for layout, and it is continuously optimistic about the main investment of new energy and technology independent and controllable investment. Xia Fengjing, the manager of Rongzhi Investment Fund, a subsidiary of Pai Lai.com, said that the major stock indexes fell simultaneously this week, and the Shanghai Index reported below 3100 points on Friday. It is the sign of the turning point of the market, and the possibility of bottom -up and recovering in the A -share market around the National Day is greater. In terms of configuration, value stocks are the main. In addition, you can focus on the expected growth stocks that are expected to have better prosperity next year. Tongxing Environmental Protection 5 consecutive boards soared more than 60%on September 23. On September 23, popular stocks Tongxing Environmental Protection rose daily limit again. As of the close, it was reported at 26.1 yuan to achieve 5 consecutive boards, with a cumulative increase of 61.01%. A few days ago, Tongxing Environmental Protection announced that the company's restricted stock incentive plan was given the first part of the first part of the first termination period to meet the sales restriction conditions. There were 55 incentive objects. The company's current total share capital is 0.4402%; the listing and circulation date is September 28, 2022 (Wednesday). The 2022 interim report disclosure showed that the top ten shareholders held 89.2721 million shares, a decrease of 1.6013 million shares from the previous period, accounting for 68.37%of the total share capital, and the main force control plate intensity was higher. As of 2022, a total of 27 institutions held 28.9259 million shares, accounting for 43.82%of circulating shares; of which 20 public offerings were held, with a total of 41,400 shares, accounting for 0.06%of circulating shares. The number of shareholders was 15,556, and the previous issue was 15,658 households, with a variable range of -0.6514%. Public information shows that the company is a well -known domestic non -electricity industry flue gas governance comprehensive service provider, mainly providing an ultra -low -emission overall solution for non -electrical industry enterprises such as steel, coking, building materials, including dust removal, desulfurization, degradation projects, and general contracting and degradation projects. Low -temperature SCR denitration catalyst. The banking industry rose 0.43%on September 23, the banking industry rose 0.43%. Among them, Changsha Bank rose 3.29%. Regarding the investment opportunities of the banking industry, Galaxy Securities believes that the guidance of the stable growth policy is unchanged, and the infrastructure is still an important starting point for boosting credit. The structural monetary policy is facing good opportunities in small and micro enterprises, manufacturing and other fields. Small and medium -sized banks with obvious advantages are expected to benefit from the edge of credit. At the valuation level, the PB of the current sector is 0.51 times, which is at a historical low, and the configuration value still exists. Continue to optimize the investment opportunities of the bank sector and give "recommendation" rating. In terms of individual stocks, Bank of Chengdu, Bank of Nanjing, Bank of Hangzhou and Bank of Jiangsu. Tianfeng Securities stated that it is continuously optimistic about the expected future economic restoration. The current fundamentals of the bank sector are expected to accelerate to repair up. Some small and medium -sized banks have obvious location advantages. At the same time, the company's own operating level is excellent, and its growth is becoming more prominent. Continue to recommend Changshu Bank, Bank of Ningbo, Bank of Jiangsu, Bank of Chengdu, and Industrial Bank.

Picture | Site Cool Hero Bao Map Network review | Editor Zhao Ziqiang | Qiao Chuanchuan Final Trial | Zhang Ye

Recommended reading

Health and Health Commission: 40 national traditional Chinese medicine clinical research bases have been constructed, 30 high -quality Chinese medicine overseas centers will be deployed

The three major stock indexes fell, and the insurance sector rose nearly 1%against the market. The institution suggested that investors maintain a 60%position

- END -

300 billion financial instruments, 800 billion credit quotas ... These financial measures help the real economy to develop a arm!

The State Council executive meeting decided that the scale of 800 billion yuan in ...

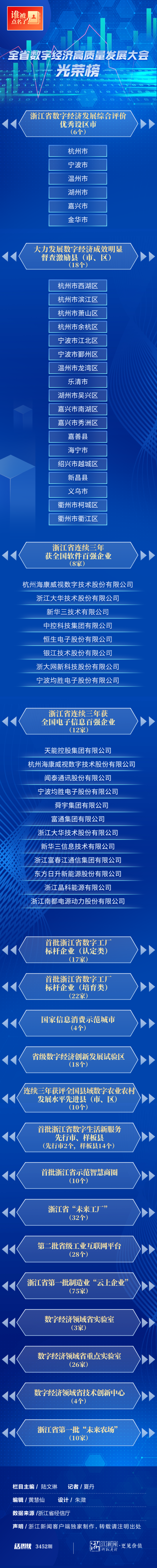

List on the 319 units of Zhejiang's "Digital Economy" golden business card!

Lu Wenlin, editor -in -chief of Zhejiang News Client column, editor Huang Huixian,...