Another bank was fined 1 million!

Author:China Fund News Time:2022.09.23

China Fund reporter Wang Jianqiang

There are also banks receiving millions of tickets, and the penalty sword refers to the illegal loan business.

Jin Commercial Bank was fined 1 million yuan

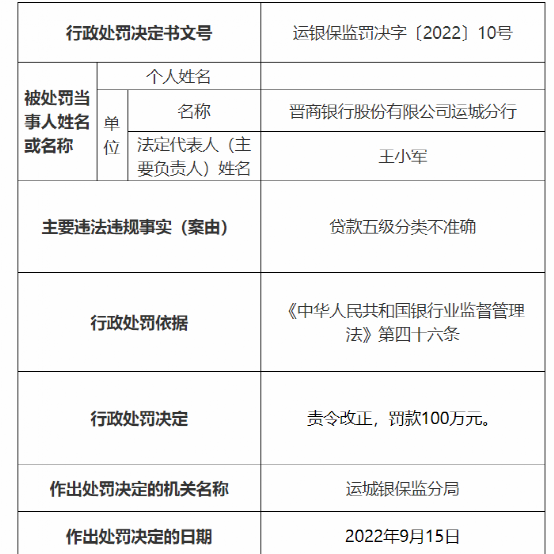

On September 22, the punishment information released by the official website of the China Banking Regulatory Commission showed that the Jinshang Bank's Yuncheng Branch was fined.

According to the information of the punishment, the main illegal facts (cases) of the Yuncheng Branch of the Jinshang Bank of China are not clearly classified by the fifth level of loans. According to Article 46 of the "People's Republic of China Banking Industry Supervision and Management Law", the Yuncheng Banking Regulatory Bureau shall order the Yuncheng Branch of the Jinshang Bank Co., Ltd. to make corrections and fined 1 million yuan. The date of the penalty decision is September 15 this year.

The reporter noticed that Article 46 of the "People's Republic of China Banking Supervision and Administration Law", the banking financial institutions have one of the following circumstances. If the plot is particularly serious or not corrected by the circumstances, it may be ordered to suspend business or revoke its business license; if a crime constitutes a crime, criminal responsibility shall be investigated in accordance with the law:

(1) Those who are appointed directors and senior managers who are appointed without qualifications;

(2) Reject or hinder non -on -site supervision or on -site inspection;

(3) Provide false or concealing reports, reports and other documents and materials;

(4) If the information is not disclosed in accordance with the regulations;

(5) Those who seriously violate the rules of prudent business;

(6) The measures stipulated in Article 37 of this Law are rejected.

The loan business is still a severe severe disaster -stricken area for banks

It is not difficult to find a ticket issued by the recent banking insurance supervision system that the field of loan business is still the hardest hit area for banks to violate laws and regulations. The supervision of this has not been relaxed, and many banks have received a ticket to a million yuan.

A few days ago, the Mudanjiang Banking Regulatory Bureau issued a ticket show that Longjiang Bank Mudanjiang Zhendong Sub -branch, which was fined 1.5 million yuan due to "the lending quality classification of loans in violation of regulations, and inaccurate loan classification". In addition, Du was responsible for the "illegal adjustment of the quality of the loan and the inaccurate loan classification" of the Mudanjiang Zhendong Sub -branch of Longjiang Bank.

On September 15th, Shanxi Yongji Rural Commercial Bank Co., Ltd. was ordered to make corrections due to the inadequate loan "three investigations" and inaccurate loan classification. The ticket shows that Zhao was responsible for the "three investigations" of Yongji Rural Commercial Bank's loans and inaccurate loans, and was not accurately responsible for being inaccurate, and was punished by warning.

Also a few days ago, Zhejiang Rural Commercial Bank of Zhejiang was fined 1.15 million yuan by the Jiaxing Banking Insurance Regulatory Bureau for two violations of laws and regulations. Specifically, illegal and violations were not in place after loan inspection, and loan funds were misappropriated to open banks. Acceptance bills deposit; second, the loan investigation is not due to due diligence, and the second -hand housing mortgage loan is issued in violation of regulations. As the directors who are directly responsible, Shen Mouming and Wu Mouquan have been given warning and punishment.

As one of the core business of banking institutions, the loan business has always been the focus of supervision. According to the Southern Metropolis Daily, all 122 tickets were issued by the Guangdong Banking Regulatory Bureau and the CBRC Branch and the Shenzhen Banking Insurance Regulatory Bureau in 2021, all involved illegal behaviors of bank institutions in loans and other related parties. , 85 % of the total number of penalties.

Among these tickets, the loan business seriously violated the principle of prudent business, business loans and consumer loans were misappropriated into the real estate market, and inadequate mergers and acquisition loans were occupied. The cost of passing the passage of the borrower shall bear the issue of the mortgage evaluation cost, and exposes that some banking institutions still have "stubborn diseases" with irregular business in the loan business process.

Industry insiders predict that in combination with the main business structure of the bank, with the continuous strengthening of the flow of bank credit funds to the supervision and the rectification of operating loan specifications, regulatory may issue more large tickets under the illegal acts in the field of credit business, supervision or regulation. Strong will continue to upgrade.

Edit: Xiao Mo

- END -

The Ministry of Finance and the State Administration of Taxation issued an announcement to clearly stamp taxes' policies for implementation caliber

Announcement on the implementation caliber of the policy of stamp dutyThe General ...

Nancai Insurance Weekly (No. 31) | "White Paper on the Development Trend of China Home Pension Development" released the "Fosun" to be significantly reduced to Yongan Property Insurance

Southern Finance All Media Reporter Sun Shihui Shanghai reported,Industry News:1. On September 9th, the China Insurance Industry Association and Swiss Reinsurance Revolution Research Institute jointly