Line for half a year, just to save money

Author:Leopard change Time:2022.09.23

Author | Zhou Chunzi

Edit | Popular pudding

It's not second again!

Zhang Jing (pseudonym) sighed at her mobile phone, which was her third time she failed this month. What she wants to grab is a large deposit list of 200,000 yuan in the bank app.

"Every time I buy it, I am like fighting." She talked to the author because the product was irregular and could only wait for the customer manager to notify the same day. When I received a notice this time, she couldn't care about herself in the hospital to see a doctor. She immediately pulled out her mobile phone and joined the snap -up army, entered the familiar interface, and kept refreshing. Still never succeeded.

Almost at the same time, at 9 am on the morning of September 20, at a city commercial bank counter in Wanliu, Beijing, a 60 -year -old Beijing aunt arrived first. She also came to consult a large deposit bill. When we learned from the customer manager's mouth, the interest rate of the large deposit bill of deposit in the bank may follow the six major banks after the National Day, she immediately transferred to 1 million and purchased 5 3 -year large deposit orders at one time. The interest rate was the interest rate. 3.55%.

As a diamond customer of China Merchants Bank, Zhang Jing has more opportunities to communicate with exclusive customer managers. Seeing that a large deposit list with a rate of 3.3%could not be grabbed at all, the customer manager advised her to retreat and be a second. Strong. "

Zhang Jing was persuaded by the customer manager. Indeed, the property market is restricted and downlink, the stock market is losing money, and the financial management does not keep the capital. In this way, a large deposit bill that keeps the capital and has both liquidity has become her best choice.

In the past two years, there are not a few people like Zhang Jing -have become more conservative for investment, hoping to find some products with the highest benefits under capital preservation; while standing at the bank's position, the pressure of net interest rate differences continues to narrow the pressure on the stance Below, they need to pressure as much as possible to reduce some high -cost deposit products.

Under "more monks and less porridge", large depositors have begun to become "difficult to find."

Line for half a year waiting for money

A state -owned bank loan business supervisor told the author that even if the interest rate of large deposits has declined for many years, it still cannot stop the enthusiasm of residents' purchase. Under the downward channel of interest rates, everyone hopes to lock the three -year preferential interest rate or large deposit list. Therefore, the current large deposit quota is very tight and basically sold out at the beginning of the month. Considering the customer's willingness to buy, her bank cuts the quota to weekly, allowing customers to buy regularly on mobile banks.

A branch manager of Agricultural Bank of China also said that at present their large deposit orders still have a quota, but they need to make an appointment to snap up. It is not easy to grab. According to him, the interest rate of the three -year large deposit bill is still 4.125%, which has now dropped to 3.25%.

According to the author's understanding, some urban commercial banks with relatively high interest rates are currently in the three-year large-scale deposit interest rates of 3.45%-3.55%, which is higher than the six major banks and joint-stock banks, but also has a trend of tight and low interest rates.

For Li Hui (a pseudonym), a bank wealth management manager who has worked in the joint stock bank and the city commercial bank, in recent years, large deposit orders are very easy to sell, and there are many people who come to consult. Essence

From 2018 to 2020, the three-year interest rate of the large-scale deposit in her shares at that time was reduced from 4.18%to about 3.8%, and now it has dropped to 3.4%.

The large -scale deposit rate of large -scale deposit deposits three years ago in the urban commercial bank was 3.55%, but the quota began to decrease slowly from last year, and it has become nervous by the end of the year. The bank is open to the purchase limit at 8:30 every day, and is usually snatched within three minutes. "Especially for some elderly people, there are no mobile banks or not so sharp, they must not grab it." She said that in order to take care of the needs of these elderly groups, some urban commercial banks even launched large deposit orders limited to counter purchases, such as such as the counter purchase, such as At the beginning of the article, the aunt was a "lucky man" bought offline.

Li Hui told the author that because the large deposit list is too difficult to grab, they will change the purchase system in the first half of this year, and the user will make an appointment once a month. There is no limit at all.

According to the author's understanding, Weizhong Bank's large -scale deposit orders have also implemented a queuing appointment system. At present, customers who have just reserved in March this year means that the waiting cycle will be more than half a year.

"At present, the interest rate of our three -year large -scale deposit orders is 3.45%. At this stage, we only undertake the stock, and the quota has basically been used up." A city -based commercial bank headquarters in Jiangsu and Zhejiang told the author.

The bank is finally "not bad money"

Behind the large -scale interest rate interest rate is the fact that the bank is "not bad". This year's bank interim report shows that the deposits of residents of many banks have surged, and the mountains that were "pulling deposits" in the bank employees in the past have been a lot easier this year.

Take the "Universe" ICBC as an example. In the first half of the year, their personal deposits and corporate deposit balances exceeded 13 trillion yuan. Among them, personal deposits increased by 1.2 trillion yuan over the end of the previous year, an increase in historical record high; the "King of Retail" China Merchants Bank In the first half of the year, the annual deposit task was completed in advance. The balance of the customer's deposit reached 6.8 trillion yuan, an increase of 11.23%from the end of the previous year.

According to statistics from the central bank, in the first half of 2022, RMB deposits increased by 18.82 trillion yuan, an increase of 4.77 trillion yuan year -on -year; of which, residential deposits increased by 10.33 trillion yuan, an increase of 2.88 trillion yuan year -on -year. The deposit has increased significantly, but the cost of interest liabilities of banks will not decline; on the other hand, under a series of measures that make the real economy, the lowest level of corporate loan interest rates has created the lowest level since the statistical statistics of the corporate loan. Small pressure. Taking the China Merchants Bank as an example, the financial report data shows that the net interest difference between China Merchants Bank in the second quarter of this year fell to 2.37%of the 14 BPs, and the management of China Merchants Bank even described this change with a "cliff -type" decline.

Many banks mentioned at this year's mid -term performance meeting that the management of liabilities is a top priority to relieve the pressure of interest deviation. Wang Kang, deputy governor of CITIC Bank, mentioned that in the second half of the year, the cost of deposit should be strictly controlled. For high -cost funds, such as large deposits, structural deposits, etc., limited management and strict approval.

This is also the main reason why large -scale deposit interest rates have been reduced and the active limit of banks.

In the view of the director of the Shanghai Financial and Development Laboratory, there are many benefits to the downward settlement of deposit interest rates. From a macro perspective, it helps reduce the cost of bank capital, thereby supporting the bank on the loan side to reduce interest rates and let the enterprise be beneficial; From the perspective of banking, it can help banks respond to interest margins and better manage the balance sheet.

According to the data monitored by Rong 360 Digital Technology Research Institute, the number of large -scale issuers issued by banks in February 2022 was 623, a decrease of 56.03%month -on -month and 40.04%year -on -year.

The author of "Prism" counted the issuance of large deposit forms since its launch in 2015: before 2019, the increase in large -scale depositors has increased rapidly, and in 2019, it exceeded 10 trillion yuan, reaching a peak of 1.2 trillion yuan. Subsequent increases slowed down, and in 2020 or even year -on -year decreased 2.3 trillion yuan.

Large depository since its launch in 2015, the author of "Prism" authorized by the "Prism"

Li Hui told the author that they are currently promoting regular deposits. The interest rate is lower than large depositors, and it cannot be transferred in advance. For banks, the cost is lower.

From the cold to being sought after

The time returned to June 2015, the central bank officially released the "Interim Measures for the Management of Large Stocks". , Incorporate the scope of deposit insurance. The biggest difference between it is that the biggest deposit can be transferred, withdrawn and redeemed in advance, and the liquidity is better. Of course, it is also higher than the requirements of regular deposits, that is, the starting point amount is not less than 300,000 yuan.

This was a big step in the market -oriented marketization at the time, because the large deposit bills got rid of the deposit interest rate limit and were a tool for fully market -oriented pricing. The purpose of the central bank's launch is to order the market -oriented pricing scope of debt products in an orderly manner and improve the market -oriented interest rate formation mechanism.

It is worth mentioning that although the duration of large -scale deposits includes 9 varieties such as 1 month to 5 years, the most issued variety is the 3 -year -old variety, which can even reach about 40 %. Because the short -term variety interest rates are low, the storage households favor more interest rates with higher interest rates.

One year after launch, the central bank announced that the starting point of the subscription of individual investors to subscribe for large deposit orders was not less than 300,000 yuan to no less than 200,000 yuan. The scope of the distribution subject.

Despite the frequent favorable policies, from the perspective of research institutions at the time, the market response was relatively cold since the launch of large depositors and was not attractive to individual investors. The main reason is that the interest rate of Treasury bond tickets at that time was 3.9%at that time, which was about 3.85%of the large -scale large -scale large deposit orders.

Not only that, at that time, high-yield products on the market were everywhere: P2P, 7%-8%of the income of more than 10%of the annualized income, and the income of the income just over 5%of the bank wealth management. Lian Yu'ebao's T+1 is a flexible base -based product, and the income remains at about 4%.

However, as the interest rate enters the downward channel, the P2P industry that is constantly linked has been banned, bank wealth management has entered the net worth management, and the capital market will not be kept. In just a few years, regular deposits have become everyone. The first choice, and as the highest profit in deposit products, has become a "fragrant", which is difficult to find.

High income gradually farther away

On September 15, the six major banks successively announced the deposit interest rate. In terms of regular deposits, the largest decline is the three -year -old deposit and large deposit orders, the interest rate decreases by 15 BP, and the entire period of the period of the period is reduced by 10 BP; the interest rate of the deposit period is reduced by 5BP. Subsequently, many shares such as China Merchants, CITIC, Everbright, and Ping An also announced that the deposit interest rate was also announced. Among them, the interest rate of the deposit rate of current deposits generally lowered 5 BPs, and various types of regular deposit products ranged from 10-50bp.

It is worth noting that this is the second time the bank has lowered deposit interest rates during the year. According to the implementation report of the monetary policy disclosed by the central bank, in late April this year, the six major state -owned banks and most joint -stock banks of Workers and Peasants' Creation Communications and Microelectronics have lowered the interest rate of more than one period of time and or higher. Make down.

In the report of the central bank, the central bank also stated that the establishment of a market -oriented adjustment mechanism for deposit interest rates, that is, "banks refer to the bond market interest rate represented by the 10 -year Treasury yield and the loan market interest rate represented by the 1 -year LPR, reasonably adjust the deposit deposit deposit Interest rate level. Therefore, after the LPR1 and 5 -year interest rates were reduced by 5 BP and 15 BPs in August this year, the market was not surprised by the reduction of this deposit interest rate.

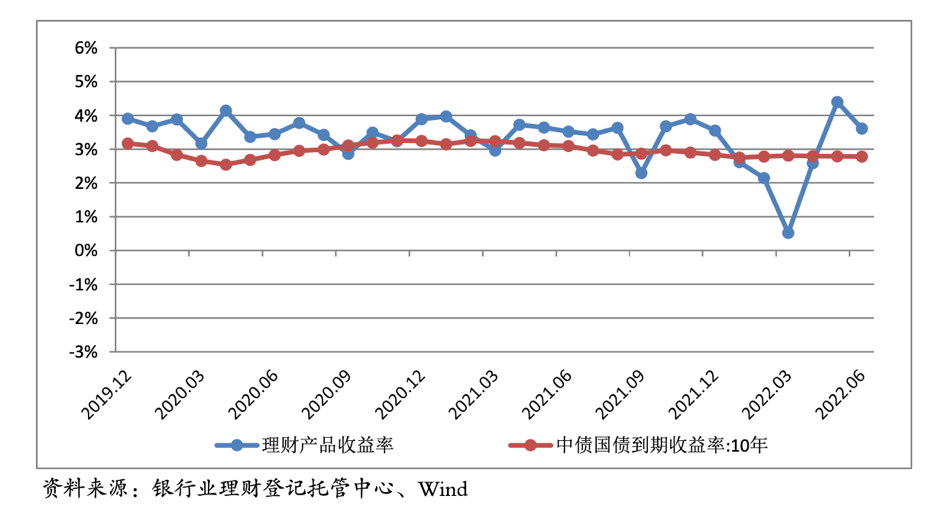

More than just a deposit interest rate. The bank wealth management favored by residents has also faced "volume and price falling." According to the "Annual Report of the China Banking Wealth Management Market" issued by the banking wealth management custody center every year, the weighted average annualized return of the newly issued wealth management products in 2019-2021 is 4.16%, 3.93%, and 3.55%, respectively, year-on-year, year-on-year The decrease of 23 basis points and 34 basis points, the decrease is obvious.

In addition, according to the report, the number of newly issued wealth management products in the first half of this year was 15,200, with a total of 4.792 trillion yuan of funds raised. In contrast, in the first half of last year, there were 25,500 new products, and a total of 62.41 trillion yuan was raised. The number and scale of issuance decreased year -on -year.

More importantly, after the end of the new regulations of the asset management regulations last year, bank financial management entered the era of net worth, and became no longer guaranteed, and experienced a severe pressure test in the first quarter of this year. Judging from the data of the banking wealth management registered custody centers, the rate of return of wealth management products after net worth management has increased significantly, and it reached a trough around March this year. The author of "Prism" previously sorted out based on Wind data. As of March 21, in the 28750 wealth management products of the duration, the product of "breaking net" (that is, the net value fell below 1) reached 2,361, and the proportion of the net accounted for approximately was approximately the proportion of about the net. 8.21%.

Before deciding to buy large deposit orders, Zhang Jing also inspected many bank financial management, but she found that the so -called stable financial products in the mouth of the customer managers did not perform well the previous year or last year, but this year's yield is particularly low. Some are even less than 1%, "dare not buy at all."

Zeng Gang mentioned to the author that in the current economic environment, China's risk -free interest rate level will continue to decline. In the future, there is still a certain downlink space. Large deposit orders are used as a type of risk -free assets. Although its interest rate is reduced, it is reduced. But residents will still hold it with strong investment preferences. He predicts that bank deposits will not only "move" in the next period of time, but also maintain a faster growth rate.

- END -

@, Please check this online medical insurance payment tip!

CurrentlyWuhan Flexible EmployeesCan choose to cooperate bankThrough the monthly d...

Rural revitalization see Yang Ling | "Planting" a good scene in the greenhouse

Recently, in the vegetable base of Lingdong Village in Gua Town, Yangling District...