It was "ended" in the evening!How long will the public offer REITs match and sell frequency record?

Author:Huaxia Times Time:2022.09.24

China Times (chinatimes.net.cn) reporter Chen Feng, a reporter Zhang Mei Beijing reported

The public offering REITs market continued to be hot. Following the selling of 72.7 billion yuan in the Great Taijunan REIT, the Dongjiu REIT under the capital management of Guotai Junan exceeded 85.5 billion yuan.

On the evening of September 22, the results of the subscription applications of Guotai Junjiu New Economy REIT (hereinafter referred to as "Dong Jiu REIT") were released. Data show that Dongjiu REIT was enthusiastically sought after by public investors. The actual confirmation ratio of the public was only 0.3375%. In other words, public investors subscribed for the product of 10,000 yuan, and the amount of obtained was only 33.75 yuan.

On the evening of September 21, the official website of the Shanghai Stock Exchange issued the results of the subscription application of Guotai Junang Port Innovation Industrial Park REIT (hereinafter referred to as "Lingang REIT"). Data show that after the online investors set a 148.03 times subscription multiple, public investors subscribed enthusiastically, and the actual confirmation ratio of public investors was only 0.3287%.

Relevant sources of Guotai Junan told the reporter of "Huaxia Times" that the public offering REITs explosion is essentially due to the scarcity of high -quality resources. Some investors may be used to entering the market at the end of the product raising period, reducing the time cost of capital vacancy. REITS The "gameplay" of the fund is not the case. Because REITs is a kind of scarce equity and debt assets, which helps the overall risk of managing investment portfolios, REITS funds are often snapped up on the first day of sale. After picking up the "leftovers", the "plate" may have been taken away.

Zhang Bixuan, a researcher at the Ji'an Jinxin Fund Evaluation Center, told the reporter of the Huaxia Times that in recent years, the volatility of the capital market has poor money -making effects, and the risk preferences of investors have continued to decrease. No relief. In this context, due to the low degree of correlation with the underlying asset attributes with the underlying asset attributes and other large types of assets such as stocks, bonds, and has the characteristics of stable cash flow and good return, it has become a relatively scarce asset at this stage.

Public funds REITs frequency record

The sought -after public offerings REITs, not only Dongjiu REIT and Lingang REIT.

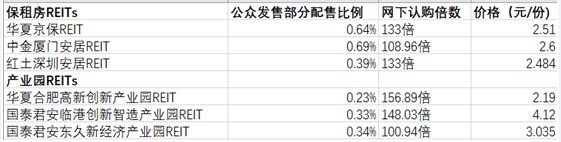

Our reporter counted the recent hot REITs found that three rental houses including Huaxia Jingbao REIT, Zhongjin Xiamen Anju REIT, and Red Earth Shenzhen Anju REIT were all less than 0.69%.

The three industrial park REITs including Huaxia Hefei High -tech Industrial Park REIT, Guotai Junan Lingang Innovation Intelligent Manufacturing Industrial Park, and Guotai Junjiu New Economic Industrial Park REIT, which are all as low as 0.34%.

From the perspective of subscription multiple, the first batch of three -guaranteed rental housing public offer REITs, which attracted much attention from the market, has exceeded 108%of the online subscription multiples. Among them, on August 8th, the promotion of the red earth Shenzhen Anju REIT showed that the planned purchase volume was 133.03 times the initial release of the Internet, setting a industry record for the industry's public offering REITs at that time.

Since then, the subscription multiple of the three industrial park REITs will be more than 100%, and the proportion of the distribution ratio of Huaxia Hefei High -tech REIT public sale is 0.23%, which once again refreshed the public offering of the public offering of the public offer. The sub -subscriber is 156.89 times the initial release of the Internet, which once again surpassed the 133.03 times record set by the previous Red Earth Shenzhen Anju REIT.

The same statistics of the Flush iFind data, since the beginning of 2022, a total of more than ten REITS funds are declared. Among them, Hongtu Shenzhen Anju REIT, Zhongjin Xiamen Anju REIT, Huaxia Beijing Security Housing REIT has been listed, Huaxia Hefei High -tech REIT, Guotai Junjiu New Economy REIT, Guotai Junan Lingang REIT has been raised. Housing closed infrastructure securities investment funds, CICC Anhui Traffic Control Highway closed -end infrastructure securities investment fund, Huaxia and Da Haoki industrial park closed infrastructure securities investment fund, Huatai Zijin Jiangsu traffic control highway closed infrastructure securities securities securities Investment funds et al. In the application, inquiry and feedback stage.

Sun Guiping, a senior analyst at the Shanghai Securities Fund Evaluation Research Center, analyzed the reporter of the Huaxia Times that in recent times, the public offering REITs has a acceleration trend. Professional operation platforms have significant demonstration and leading role in revitalizing stock assets to reduce corporate liabilities, enhance operational efficiency to achieve value -added assets, expand financing channels, and promote the long -term healthy development of the infrastructure industry. The policy is vigorously promoted; the second is from the perspective of product demand, REITs is different from traditional stock debt assets, and has unique advantages in terms of high dividend income and low correlation with other assets. It has received the attention and extensive participation of investors, the proportion of distribution and sales in the first -level market has continued to decline, and the secondary market has maintained better liquidity.

Relevant sources of Tianxiang Investment Consulting Fund Evaluation Center said that first of all, the public offerings REITs, as assets with low correlation with stocks and debt, have good allocation value and are conducive to the fluctuations of the asset portfolio. , The previously issued public offering REITs can basically meet the expectations, which indicates that the public offer REITs can provide investors with a relatively stable source of income in the current volatility of the current equity market; It has a certain scarcity. Compared with the size of market funds, it is easy to cause snap -up. Will the public offer REITs continue?

How to think of the follow -up direction of public offerings? Sun Guiping told the "Huaxia Times" reporter that in the past, REITS assets were relatively high -quality and had long -term investment opportunities. Although the short -term performance was differentiated, the overall performance was better. In addition, REITs performance is even more eye -catching when the current equity market is not good. At the same time, REITS dividends are relatively stable and have a high dividend rate. Under the current trend of interest rate decline, dividend income is more objective. Of course, as the target of investment in equity, investors should also pay attention to the risk of price fluctuations, avoid chasing up and killing, and pay more attention to long -term investment opportunities.

Sun Guiping believes that in the long run, in terms of supply, the current infrastructure assets and future construction increments are huge; in terms of demand, my country's capital market is large, and many funds are involved in it, and have long -term configuration needs for REITs. In the future, REITs will continue to grow, product innovation will continue, and new types of assets will emerge. In addition, REITs will also appear, making REITs bigger and stronger. With the increasing number of REITs assets and the number of products, and the difference in product differences, investors can analyze and identify, and choose suitable REITs for long -term investment.

Zhang Bixuan analyzed this reporter that although the public offer REITs is constantly expanding and the number of products is increasing, because the category is still in the early stage of development, the capital withdrawal capacity is limited, and the overall supply is still in short supply, so it may still be compared in the short term " Has the state. The overall distribution of subsequent public offering REITS products tends to be normalized, and the number and scale of products may gradually cool down after reaching a certain level.

Relevant persons from the Tianxiang Investment Consulting Fund Evaluation Center told this reporter that as of September 20, the total scale of the public offer REITs is less than 60 billion yuan. Rareness, coupled with its relatively independent risk income characteristics and relatively stable income, is expected to be sought after by investors in the short term. In the long run, the issuance of public offer REITs is of great significance for revitalizing stock assets and reducing debt risks. Therefore, it is expected that the public offer REITs will be issued normally in the future. Increased, the participation of the participation may decrease relatively.

Editor: Editor Yan Hui: Xia Shencha

- END -

Look at Jiangsu | In the first half of the year, Jiangsu's "cultural enterprise" grew steadily!

Xinhua Daily · Jiaojiao Reporter Li Yan Ge Yitan

Guangshen further increased the car purchase index encouraged local governments to continue to issue consumer coupons

Guangdong introduced several measures to increase consumptionYangcheng Evening News reporter Sun Qiman reported: On August 31, the General Office of the People's Government of Guangdong Province issue...