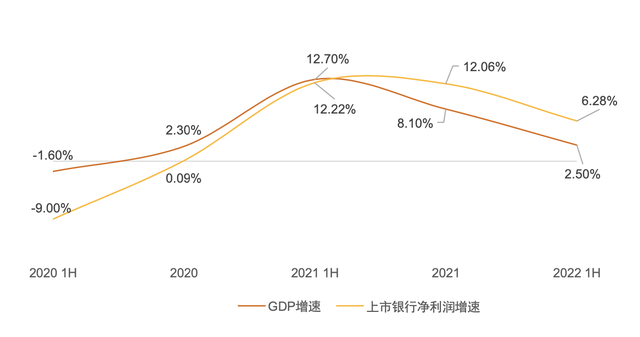

The overall net profit of 59 listed banks in the first half of the year increased by 6.28%year -on -year, and the banking industry was stable.

Author:Yangcheng Evening News Yangche Time:2022.09.25

Text/Yangcheng Evening News all -media reporter Hang Yingtu/Interviewee confessed

On September 23, Pricewater -Yongdao released the "Banking Industry Quick News: Ambitions in the same boat, breaking the waves and breaking the waves -the semi -annual Chinese banking industry review and outlook". The report shows that in the first half of 2022, it was affected by super -expected factors such as the impact of the domestic epidemic and profound complex evolution of the international environment, and the downward pressure on the economy increased. The banking industry is generally stable, the profit growth rate has slowed down, the total assets have accelerated, and the overall asset quality remains stable but polarized.

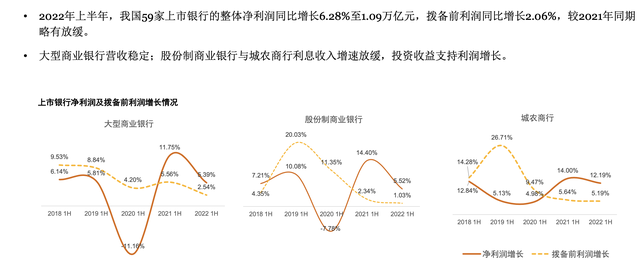

According to the report, in the first half of the year, the overall net profit of 59 listed banks increased by 6.28%year -on -year to 1.09 trillion yuan, and the previous profit increased by 2.06%year -on -year, which was slightly slowed from the same period in 2021. The revenue of large banks is stable, and the interest income growth of joint -stock commercial banks and urban agricultural and commercial banks has slowed down.

Zhang Lijun, the head of the Chinese financial industry in PwC, said: "With the increase in the challenges facing the real economy, the banking industry's operating environment also faces greater complexity and uncertainty, but there are also active development factors. Banks should take the initiative to adopt adoption Measures, do a good job of regulating counter -cyclical adjustment, strengthen the resilience to resist risks, continue to promote reform and strategic transformation, and help economic stability and recovery. "

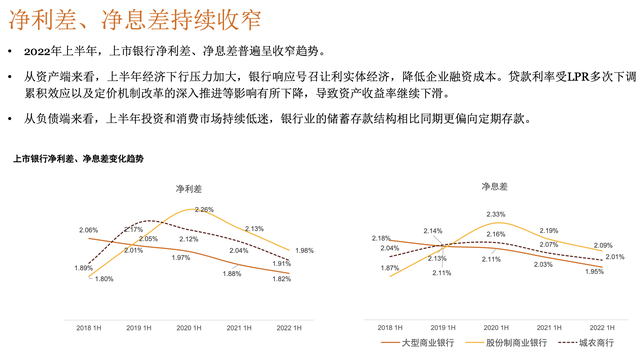

In addition, in the first half of the year, the net profit difference and net interest difference between listed banks generally narrowed. Xie Ying, partner of the Chinese financial industry in PricewaterhouseCoopers, said that the compression of the overall interest margin of the banking industry has caused each listed bank Increase efficiency is less efficient than before. "Large -scale commercial banks and joint -stock commercial banks have a general convergence of profitability indicators. The city's agricultural and commercial banks rely on a lower interest difference between the joint -stock commercial bank and the growth of investment income, and the average total asset yield is more stable. "

From the perspective of the asset side, the economic downward pressure in the first half of the year has increased, and banks responded to the call to make the real economy and reduce the cost of corporate financing. From the perspective of the debt side, the investment and consumer markets continued to be sluggish in the first half of the year. During the same period, it is more preferred to deposit. As of the end of June 2022, the overall assets of listed banks increased by 7.99%compared with the end of 2021, a significant acceleration from the second half of 2021. In terms of asset structure, customer loans of listed banks have continued to grow, and the proportion of total assets is basically stable. Government bond investment has risen, and interbank assets have risen short -term.

By the end of June 2022, the loan quality index of 59 listed banks remained stable as a whole. The total liabilities of the listed banks were 2.366 trillion yuan, an increase of 8.43%from the end of 2021. source. The balance of deposits of listed banks continued to increase, and the growth rate increased significantly compared with the first half of 2021.

In addition, by the end of June 2022, wealth management products existed at 29.15 trillion yuan. In the first quarter of 2022, the influence of the “net” of financial products was “broken”, and the scale of wealth management products decreased slightly. However, in the second quarter of 2022, the market stabilized and rebounded.

As of the end of June 2022, the core first -level capital adequacy ratio of listed banks showed a downward trend. The profit growth of the banking industry has slowed down, the replenishment capacity of endogenous capital is limited, and the core first -level capital adequacy ratio of listed banks has decreased to varying degrees. The core first -level capital adequacy ratio of individual joint -stock commercial banks and urban commercial banks is approaching regulatory requirements. Under the influence of factors such as the increasing difficulty of capital replenishment, these listed banks are facing the pressure brought by the decline in capital adequacy ratio, and capital management needs to be further strengthened.

Source | Yangcheng Evening News · Yangcheng School

Editor -in -law | Shen Zhao

- END -

Chen Hongfei: launched commercial REITs as soon as possible, which can provide the source of funds "Boao on the Boao Discussion House" for the belonging to the insurance.

China Times (chinatimes.net.cn) reporter Li Beibei, a reporter Liang Baoxin Guangz...

Standardized construction of Grand Grab Park to pry the industry's inverse cycles Investment in Quanzhou Promotion Park construction area exceeds 10,000 acres

Faced with the current downward pressure on the economy, Quanzhou inherited and promoted the Jinjiang experience, adhered to the real economy's unwavering, grabbed the machine in danger, and vigorou...