Who would be the next victim to raise interest rates?

Author:Henan Daily Client Time:2022.09.25

As the market expects, the Federal Reserve raises interest rates again.

On September 21, 2022 local time, the Federal Reserve Commission announced that it raised 75 basis points to raising the federal fund interest rate target range to 3%to 3.25%. In response to the continuous high inflation problem in the United States, the Fed started the interest rate hike cycle in March this year. This is the fifth rate hike this year, and it is also the third consecutive interest rate hike 75 basis points. The picture shows the Federal Reserve Chairman Powell attended the press conference on the day of the meeting.

The continuous rate hike is to "reduce fever" for long -term high inflation.

However, a series of radical operations in the Federal Reserve inhibit inflation. In August, the consumer price index (CPI) in August (CPI) appeared from the previous month and year -on -year to exceed expectations.

On September 13, 2022, local time, a consumer purchased chicken in a supermarket in San Monica, California.

But radical interest rate hikes have caused real harm to the world economy.

In the past few decades, the story of the United States abuse the US dollar hegemony and repeatedly "harvesting" global wealth has been staged.

The US dollar appreciation, global suffering

Promoted by the Fed's continuous interest rate hike, the US dollar index reached a new high in nearly 20 years, and multinational currencies have depreciated sharply against the US dollar.

On September 22, 2022 local time, the Han Dynasty's exchange rate on the US dollar fell below the 1410 to 1 mark, setting the lowest record since March 31, 2009. The picture shows a large screen in real time in a bank in Seoul, South Korea that day.

Because about 70%of global trade is priced in the US dollar, appreciation of the US dollar will not only increase the import costs of many countries, take away the investment in emerging market countries, and enhance the inflation problems of the central bank. The development of the economy is in a debt crisis.

Under the influence of the Fed's 75 -basis point, on September 22, local time, the Indian rupee's exchange rate against the US dollar reached a record low of 80.95 rupees against $ 1. Since the beginning of this year, the exchange rate of India's rupee against the US dollar has fallen by more than 7%. Industry insiders predict that if the Federal Reserve raises further interest rates, the exchange rate of the Indian rupee against the US dollar may further fall. The picture shows a vegetable vendor in Mumbai, India in July this year.

As the Wall Street Journal's recent article pointed out, for the United States, strengthening the US dollar means that the price of imported goods has fallen, the efforts of curbing inflation have been strongly promoted, and the relative purchasing power of Americans has reached a new high. However, the appreciation of the US dollar is putting pressure on other countries, making it more expensive to repay the US dollar debt borrowed by emerging market governments and enterprises.

This article entitled "The Approval of the US dollar to the global economy brings trouble" quoted data from the International Financial Association that by the end of next year, the emerging market government will have $ 83 billion in US dollar debt expiration. The report quoted Gabriel Steen, the head of the emerging market research of Oxford Economic Research Institute: "The cutting -edge market is already at the critical point of crisis ... If the US dollar appreciates further, it will become the straw that crushes the camel."

Lagram Ranzan, a professor of finance at the University of Chicago, believes that the impact of interest rate hikes on other countries has just emerged.

One day after the Fed announced interest rate hikes, the central banks of the United Kingdom, Switzerland, South Africa, and Indonesia all announced their interest rate hikes.

On September 22, 2022 local time, the central bank of the Swiss central bank announced that it raised 75 basis points, raising the policy interest rate from -0.25%to 0.5%, ending the 8-year negative interest rate policy. The picture shows Thomas Jordan, chairman of the Board of Directors of the Swiss National Bank, at the media conference.

A report released by the World Bank recently pointed out that with the simultaneous interest rate hikes of the central banks of many countries, the world economy may fall into a decline in 2023. Emerging markets and developing economies will be caught in a series of financial crisis and suffer from endurance of crisis.

The report pointed out that the central banks of many countries around the world have been raising interest rates with the degree of synchronization that have not been seen in the past 50 years. The central banks of various countries have increased interest rates and the global economy is moving towards decline. s level.

The report pointed out that developed economies should fully consider the spilling effect of its own monetary policy adjustment.

Who is the next victim?

"The dollar is our currency, but it is your trouble."

This sentence of former US Treasury Secretary Connery should say the voices of many countries.

Before entering this round of interest rate hikes this year, the Federal Reserve has had 6 interest rate hike cycles in the past 40 years. And every time the United States tighten the monetary policy, almost triggering the turbulence of the world economy, especially developing countries.

An article on Australia's "Dialogue" News Network states: "The Fed has an incredible influence on the world economy, but to some extent it really does not care about the world."

The most bloody disaster and wealth harvesting is around the 1980s, the Federal Reserve's expected interest rate hike overlay the US economy decline, leading to Latin America's "lost ten years".

According to data from the International Monetary Fund, in the 20 years from 1998 to 2019, Latin America's economic growth has lagged behind the average level of emerging markets. It can be seen that the impact of "lost ten years" is not limited to the 1980s.

In the 1970s, the Fed implemented a low interest rate policy to stimulate investment and employment, and the loose monetary policy caused a large amount of funds to pour into Latin American countries. Some Latin American countries took the opportunity to borrow a large amount of low interest dollar to invest in oil development, and the scale of foreign debt continued to swell. From the end of the 1970s to the early 1980s, the Fed suddenly opened the interest rate hike period, the US dollar appreciated, the price of oil fell, and the Latin American countries that mined oil borrowed the US dollar suddenly fell into the US dollar trap.

In August 1982, Mexico took the lead in the debt crisis, and then a large number of Latin American countries successively encountered debt repayment difficulties.

With its own convenience of dominating international financial institutions, the United States has carefully designed a loan policy for Latin American countries. Latin American countries have become more and more obvious by the trend of US financial systems.

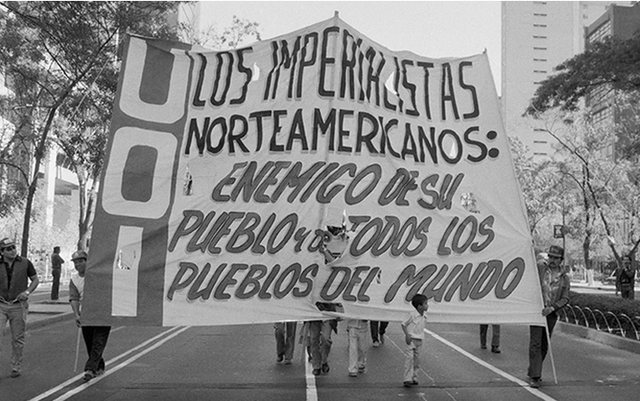

In 1986, people on the streets of Mexico City, Mexico, protesting the policies of the International Monetary Fund and the Mexican government.

In addition, the United States also used the opportunity to depreciate the currency of Latin American countries to purchase high -quality assets such as telecommunications, oil and other industries at a low price, which fundamentally cracked down on the debt repayment capabilities of these countries and worsened its economy.

This debt crisis was called "lost ten years" by Latin American countries -the Latin American country economy has been stagnant in the past ten years, and the previous development results have been harvested by the United States ... Until now, Latin American countries are still trapped. Old "debt quagmire is difficult to get away.

Local time on September 10, 2022, a slum on the bank of the Pasari River in Brazil.

Argentine sociologist Marcelo Rodriguez believes that the United States is the culprit of long -term debt trap in Latin America.

Marcelo Rodrigue: Latin America has been trapped in debt traps for decades. The United States should bear the greatest responsibility. This is part of the United States controlling Latin America and imposing influence plans. Implement a policy that benefits US capital.

The U.S. inflation rate is now the highest point in the past 40 years. Who will be the victim this time?

- END -

Consumption reference 丨 "burden reduction" pigs

Reporter He Hongyuan and Chen Sha reports from the 21st Century Business Herald reportersThe pig industry is starting a burden reduction movement.On September 19, the Ministry of Agriculture and Rur

Suizhou High -tech Zone accurately scheduling and answering "period volume"

Stabilize the basic market to sprint Double Half Half——Souzhou High -tech Zone a...