The first anniversary of the bond "south direction": the industry expects investment varieties and the scope of investors to further expand

Author:Securities daily Time:2022.09.25

24Sep

Our reporter Liu Qimengko has been running for more than 4 years in the bond "north direction". On September 24, 2021, the bond "south direction" was officially launched. Open a new chapter. Throughout the year from September 24 last year, the custody volume of "south direction" showed a leap -up growth. The "Securities Daily" reporter sorted out the data published by the Shanghai Clearance Institute and learned that at the end of September last year, the number of "south directed" bonds was custody through the financial infrastructure interconnection mode, and 339 at the end of July this year; and the balance of custody balance also From 5.525 billion yuan at the end of September last year, it has increased significantly to 224.11 billion yuan at the end of July this year. Li Bing, president of Bloomberg Asia Pacific, said in an interview with a reporter from the Securities Daily that in the past year, as an important part of the two -way open structure of the Chinese financial market, "South Win Tong" is gradually playing its important role to provide domestic investors with providing domestic investors The opportunity for diversified asset allocation to meet different risk preferences is also conducive to meeting the more diversified financing needs of the real economy, and inject more vitality into the financial market of Hong Kong in China. Investment in domestic financial institutions' investment and risk management capabilities "South Tongtong" provides a channel for mainland institutional investors to invest in Hong Kong and the global bond market by strengthening cooperation between the two places. Talking about the significance of "south direction" in my country's capital market, Huang Jiacheng, managing director of Jingshun and the fixed income director of the Asia -Pacific region, said in an interview with the Securities Daily reporter that he has "milestone meaning". At this point, the funds in the Mainland and Hong Kong bond market have achieved a complete closed loop of north -south and interconnection. Huang Jiacheng believes that the "south direction" allows the domestic funds to flow out in an orderly manner, which will help the flow of cross -border capital that is more balanced in the medium and long term; on this basis, the opening of the "south to The channels for the allocation of assets in the financial market enable the investment portfolio of domestic investors to better achieve diversification. In addition, the launch of the "South Tongtong" has also accelerated the development of the Hong Kong bond market, and the Chinese US dollar bond market and snack debt are accelerated. The development of the market has a very positive significance. Zhang Jinqiu, deputy governor of HSBC (China) Co., Ltd. and joint director of the capital market and securities service department, told reporters of the Securities Daily that the successful operation of "South Tongtong" provides more mainland investors with more participation in the international financial market Opportunities have further expanded the Hong Kong offshore RMB capital pool, which helps to consolidate Hong Kong's international financial center status. At the same time, the management mechanism of "South Win Tong" has also been proved to be an effective practice of steadily promoting the two -way flow of domestic and foreign capital. "We deeply feel that domestic financial institutions are also participating in overseas markets through 'southbound". In the process, their investment and risk management capabilities have been improved, which is very popular for Chinese financial institutions. It is important. "Li Bing said. The number of custody and balance has increased sharply since May. According to the data of the Shanghai Clearance Institute, since May this year, "South Tongtong" has ushered in a leapfrog growth. At the end of May, the number of custody bonds of "southward" was 178, with a hosting balance of 87.89 billion yuan, an increase of 196%from the previous month. Yuan, created the most monthly growth since the opening of the "south direction". The latest released data show that at the end of July, the financial infrastructure interconnection model custody "Southbound" bonds 339 bonds, with a balance of 224.11 billion yuan. Li Bing believes that the number of "southbound" custody has increased significantly, and the scope of investors participating in the "Southbound Tong" transaction has also expanded. The reason is that the relatively high yields in the offshore market and the increase in investment bond issuance. While achieved results, "South Tong" also faced some difficulties and challenges in the development process. "One of them is cross -border fund management." Huang Jiacheng said that the People's Bank of China is currently setting up the annual total amount and daily quota to avoid large -scale capital outflows. However, as "south direction" gradually matures, the market is also discussing whether such a quota mechanism needs to be extended. As the heat gradually increases, investors' demand for "south direction" expansion may increase. At that time, how the People's Bank of China will adjust the quota mechanism of "South Tongtong" and maintain orderly flow of cross -border funds. Huang Jiacheng said that in general, domestic investors' investment in overseas bonds is still in a relatively primary stage. The better development of "south direction" is inseparable from the further simplification of transaction registration procedures and the continuous improvement of market support. These can help mainland investors to buy bonds more conveniently. "We also understand that investors are currently looking forward to further simplifying investment transaction processes, expanding the scope of investment products, and enriching derivative varieties." Li Bing said. Zhang Jinqiu said that it is expected that the investment varieties and investors in the "south direction" will be further expanded, and the operating mechanism will continue to improve. This cross -border investment channel will interact with other interconnected mechanisms and supplements each other to jointly promote the high -level two -way opening of China's financial market.

Recommended reading

One picture understands | In the first half of the year, the total profit of the listed company of the central enterprise was 1.17 trillion yuan in 81.39% among the central enterprises

Will the "serial order" in Beijing's second -hand housing be accelerated, will it solve the "pain point" of the house change?

Photo | Bag Picture Network Station Cool Hero Production | Zhou Wenrui

- END -

Economy 丨 talk show with fire ST continent, Shanghai Stock Exchange reminds investors to pay attention to risks

/When preparing the Fifth Season of the Talk Show Conference, maybe House did not...

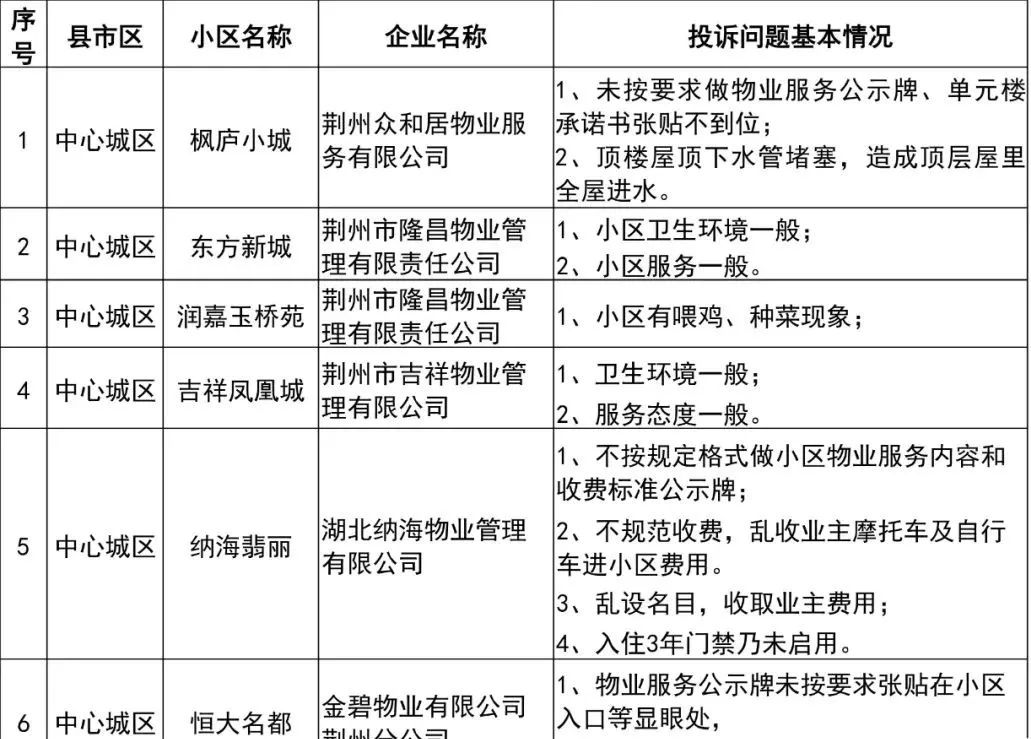

up to date!These properties of Jingzhou are exposed

recentlyJingzhou Housing and Urban -Rural Development BureauannouncedJingzhou Prof...