Fult!

Author:Zhangjiajie Time:2022.09.25

On Friday, local time, the market's concerns about the central banks around the world have caused economic recession. Investors have sold stocks and bonds to accelerate the purchase of risks in the US dollar. The three major stock indexes in the New York stock market fell across the board. As of the closing, the Dow fell 1.62%, the S & P 500 index fell 1.72%, and the Nasda Index fell 1.80%. Among them, the Dow has fallen for the first time since June 17 this year that has lost 30,000 important integers to the new low since November 2020. Among the 11 sections of the S & P broader, the energy sector fell nearly 6.8%due to the sharp decline in international oil prices on the day. In terms of individual stocks, the marathon oil fell 10.94%, German energy fell 8.60%, and the energy giant Chevron dragon fell 6.53%.

On the 23rd

Falling to a new low in 8 months

In terms of crude oil market, it was suppressed by factors such as strong dollars and investors' decline in the world's economic prospects. The international oil price was severely frustrated on Friday and fell to a new low in 8 months. New York oil prices have fallen below the $ 80 mark per barrel since January this year. Essence

International oil prices have fallen sharply this week

This week, with the impact of the global central bank's interest rate hike and strong US dollar, international oil prices have fallen. New York's oil price fell 7.48%, and Brent oil prices fell 5.69%.

The market further looks at the outlook for the US economic prospects

Wall Street Investment Bank Goldman Sachs believes that the risk of "hard landing" in the US economy has risen significantly, and has lowered the expectations of the S & P 500 index at the end of this year, from 4,300 points to 3600 points. CNBC's latest questionnaires initiated by economists, fund managers and stock market strategists show that interviewees generally predict that the possibility of decline in the US economy in the next 12 months has risen to 52%.

The three major stock indexes of U.S. stocks have fallen sharply this week

Fall more than 4%

This week, the central banks of many countries around the world followed the Fed's pace to raise interest rates sharply. The interest rate hikes impacted investor confidence, exacerbated the risk of recession in the global economy, and also set off a wave of selling in the stock market. Affected by this, the three major US stock indexes fell sharply in the second consecutive week, the Dow fell 4.06%, the S & P 500 index fell 4.64%, and the Nasda Index fell 5.07%.

The three major European stock markets in Europe have a heavy frustration on the 23rd

In Europe, the latest euro zone and German economic data on Friday have caused investors to further see the European economic prospects. The three major European stock markets have fell across the board that day. As of the close, the British stock market fell 1.97%, the French stock market fell 2.28%, and the German stock market fell 1.97%.

On the 23rd, the British and euro exchanges against the US dollar continued to fall

In terms of the foreign exchange market, a large number of risk aversion funds rose to the US dollar, pushing the US dollar index to rise by 1.65%within a day of Friday to above 113. In the British side, in order to cope with the economic recession, the comprehensive tax cuts proposed by the British government have worried investors to Britain's fiscal situation and sold a large number of British Treasury bonds. Affected by this, the GBP's exchange rate fell sharply, down 3.69%within a day, breaking two levels of 1 to 1.12 and 1.11, and closed at 1 pound to $ 1.0847, hitting a new low in 37 years. The economic prospects of the euro zone are worrying. The exchange rate of the euro to the US dollar fell below the 1 to 0.97 mark on Friday, and closed at 1 euro exchanged for $ 0.9674, a new low in the past 20 years.

The international gold price fell significantly on the 23rd

In terms of the precious metal market, the US dollar index rising and US debt yields climbed the international gold prices to decline significantly. The golden future price price of the New Business Institute fell 1.52%on Friday, at $ 1655.6 per ounce.

Source 丨 CCTV Finance

Edit 丨 Liu Zijing

Duty head teacher 丨 Duan Xiaohui

Final Appeal 丨 He Shaoqun

Produced 丨 Zhangjiajie

- END -

[Learn and implement the spirit of the 14th Provincial Party Congress] West Lake Town, Guazhou County: "Production" of the Honeydles Industrial Park "produced" sweet life

In the summer solstice, walk into the honeydel industrial park in Xihu Town, Guazhou County. The rows of honeydew melon conjoined greenhouses are connected in an orderly manner, and the fields are arr

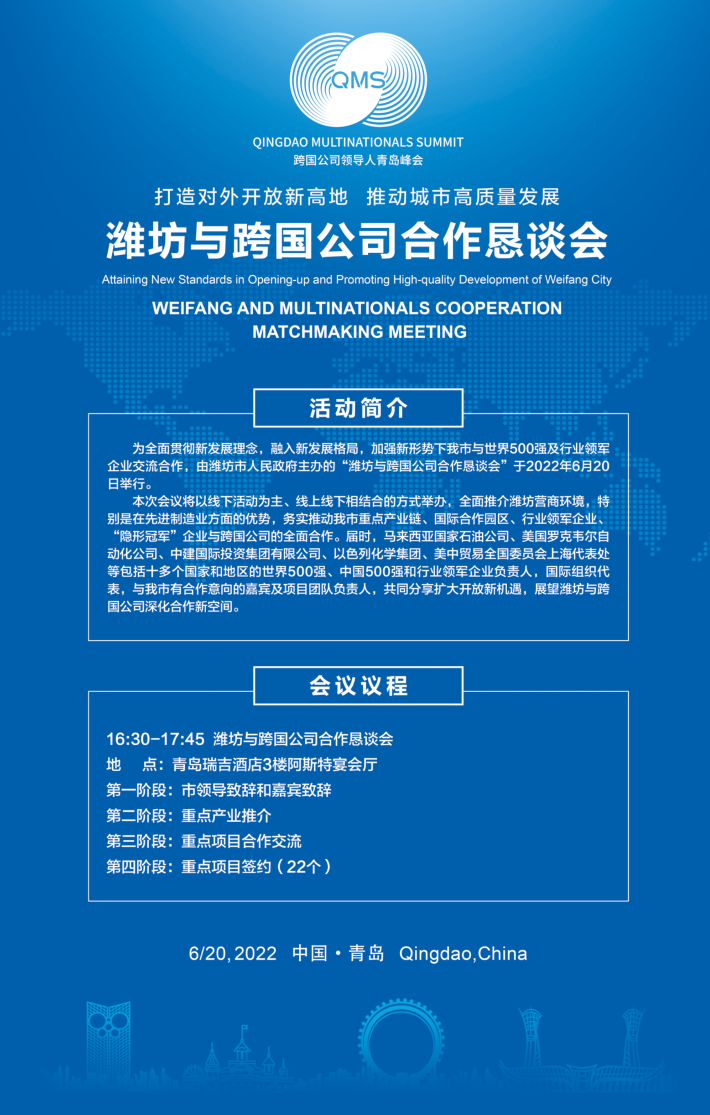

By the summit Dongfeng to promote the development of Weifang -the cooperation between Weifang and the multinational company will be held on June 20

Weifang Daily Weifang Rong Media News in 2022 will be held in Qingdao from June 19...