Zheng's eyes look at the market | pressure factors are temporarily, and the stock index continues to be sluggish

Author:Daily Economic News Time:2022.09.25

This week (9.19-9.23) A shares fluctuated weakly and the transaction was extremely sluggish. Petroleum, banking, telecommunications and other heavy stocks are relatively strong, with weak science and technology, subject matter, and small and medium -sized stocks. The Shanghai Composite Index fell by 1.22%to 3088.37 points throughout the week. The weeks of the Shenzhen Composite Index and the GEM folds were 2.09%and 2.74%, respectively, and the science and technology 50 index fell 3.76%.

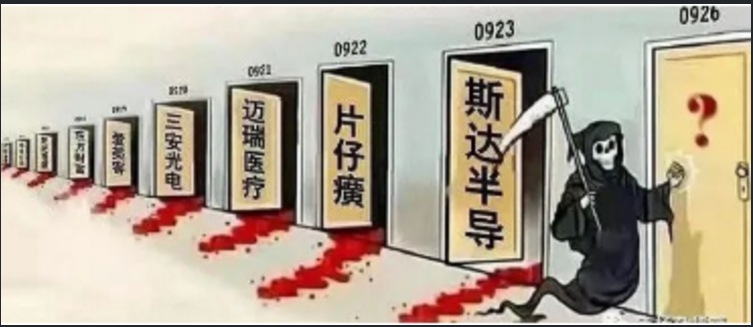

When the market is sluggish, for some reason, when individual stocks have a single institution to be fulfilled, diving will appear, because the turnover of each stock that can be "allocated" is fixed. If no one picks up, it will naturally be infinitely empty. In recent days, there are blue chips and falls every day. For example, on Thursday's Pianzi, it is because few people pick up the goods. Of course, there may be fund redemption behind this. But the further question is, "Why is the people who love to redeem?"

Photo source: netizen drawing

The deposit interest rate will increase the liquidity of the stock market or the property market according to the reason. The stock market will become more and the sales of the fund will increase, but the actual situation will not be the case. This can only show that there is a problem with confidence.

Regardless of the stock market or the property market, its direction is seriously subject to expectations. It is easy to rise when expected is good. As far as the stock market is concerned, it is difficult to tilt to financiers.

Although the weak stock market is too related to financing pressure, it is not all, and the market is weak and there are other macro factor. In China, the recently announced economic data has improved, but the absolute value is still low. Although domestic inflation pressure is less than expected, in the context of a global perverted interest rate hike, in the context of the RMB exchange rate to 7.1, domestic liquidity is also difficult to relax the opportunity.

Take a step back, even if the liquidity is better, the epidemic is unpredictable, such as tourism, catering, film and other companies, even if you support it again, where does the passenger flow come from? So it's not all the matter of money.

In terms of external factors, recent news is also very poor. In the early morning of this Thursday, the Federal Reserve raised 75 basis points. Although the incident was in line with expectations, because the subsequent interest rate hike signals released were extremely strong, the international stock market plummeted, non -US currency plunge, and most national bond markets plummeted.

Another major disadvantage of the international market is that there are many signs that the Russian and Ukraine war may be transparent for a long time, which makes the market's stability of the supply chain unpredictable at all, or the market has no reason for the future global economy at all.

Another major news this week was that the pound was degraded by 3%in a day, and the European and American stock markets fell again on Friday. If there is any negative in the pound, this newspaper has another detail introduction, and I will not start.

An obvious reasonable speculation is that because the Federal Reserve ’s interest rate hike exceeds expectations and the above -mentioned profits, the global economy has fallen into a decline. It is almost inevitable. The global economy is like a crazy gray rhino. Everyone knows that it is incompetent.

The last week before the National Day holiday, a major meeting will be held shortly after the festival. The market was originally a high wait -and -see mood, or further strengthened. What investors can do at present are also watching, and at most, they are based on their own understanding of the three quarters.

In terms of stock selection, personal suggestions are still mainly based on the blue chip or mid -market segmentation. Although such stocks often fall due to the lack of money in the fund. In the long run, the end of the stock price is still the performance of listed companies. When the stock price is low to a certain degree, it should be able to attract the most cautious part of the funds.

In terms of technology stocks, it may be more cautious for the time being, because the international interest rate environment has risen significantly, which is obviously not conducive to the valuation of global technology stocks. Of course, A -share technology stocks are somewhat independent, but investors' emotions will inevitably be affected by external emotions.

As for other fundamentals that are unprecedented, investors do less and more. Today's expansion speed is extremely fast, the stock is not scarce, and the stocks that are bland in fundamental aspects will decline in the long run.

Daily Economic News

- END -

Party building co -construction aggregate pairing to fight against revitalization

Party building co -construction aggregate pairing to fight against revitalizationW...

Fifth Hongqiao International Economic Forum | "Innovation and Development of Digital Trade: Opportunities and Challenges" sub -forum

Innovation and development of digital trade: opportunities and challenges sub -for...