The rate of 155 funds is reduced!After "conducive to the foundation of the people", the problem of "funding for money and not making money" is needed

Author:Huaxia Times Time:2022.09.25

China Times (chinatimes.net.cn) reporter Chen Feng, a reporter Zhang Mei Beijing reported

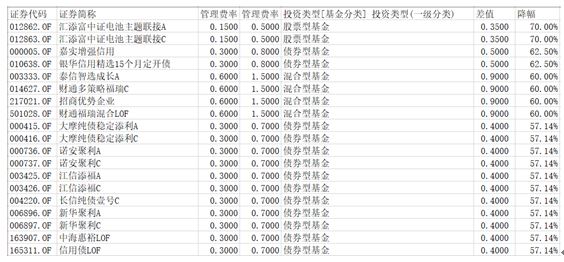

Recently, the news of fund companies has been cut. According to Wind data, as of September 24 this year, a total of 155 fund products issued announcements to reduce management fees and custody fees, and the cost reduction was generally large.

A few days ago, the General Office of the State Council issued the "Opinions on Further Optimizing the Cost of the Institutional Trading Costs of the Orthopedic Institutional Institutional Institutional Transaction", which mentioned that "encourages securities, funds, guarantee and other institutions Reduce trading, hosting, registration, liquidation and other costs. "

What is the impact of fund reduction? Relevant sources of China Merchants Fund told the reporter of Huaxia Times that the public fund industry to reduce service charges is a market -oriented process. Fund reduction fees are conducive to reducing the cost of fund holding of investors, increasing investment experience, and promoting a virtuous cycle of fund investment ecosystem Essence

Huang Yichi, deputy director of the Ji'an Jinxin Fund Evaluation Center, told the reporter of the Huaxia Times that the fund reduction of the fund is equivalent to allowing investors, and it also helps the fund performance improvement, especially the solid income fund.

Fund management costs have decreased significantly

Recently, funds have been greatly reduced. China -Canada Fund, a subsidiary of China -Canada, announced on September 22 that the annual management fee rate was adjusted from 0.40%to 0.30%, a decrease of 25%. Furong Fund's Furong Currency Market Fund announced on September 20 that it will reduce the custody rate from 0.1%to 0.05%since the date of date, a decrease of 50%. Noon Fund's Noon Xinxiang regularly opened on September 14th that the annual management rate was reduced from 0.4%to 0.3%, a decrease of 25%.

There are also more fund management fees. Taixin Fund's Taishinzhi selection grew up on September 16 that the management fee was reduced from 1.50%/year to 0.6%/year, and the custody rate was reduced from 0.25%/year to 0.1%/year. It is 60%.

The announcement of the China Merchants Enterprise Mixed announced on August 16 stated that the annual annual rate of fund management fees was reduced from 1.5%to 0.6%, and the decrease was as high as 60%; Decrease 40%.

Data show that as of September 24, there were 155 fund products that lowered management fees within the year. From the perspective of fund investment type, the number of bond funds had the largest number of reductions, with 78; 44; the number of hybrid funds is ranked third with 22. In addition, FOF funds, QDII funds, and stock funds also have reduced fees.

Among them, the theme of Huitianfuzhong Battery Theme A, Huitianfuzhong Battery theme connection C This year's fund management fee decreased by 70%compared with last year.

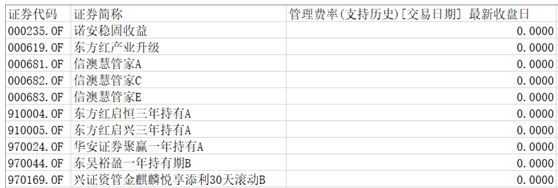

In addition, Wind data shows that there are more Noon's revenue, the East Red Industry upgrade, Xin'ao Australian steward A, Xin'ao Hui Hutch C, Xin'ao Hui Hosterke E, Dongfang Hong Qi Heng held A, Oriental Hong Qixing Xing for three years Three years of holding A, Hua'an Securities Julin for one year holding A, Soochow Yuying one year's holding period B, Xingzhi Asset Management Jin Kirin Yuexiang Tianli 30 -day rolling B and other 11 fund management rates as low as 0.

What are the considerations of the fund's rate? Relevant sources of China Merchants Fund told the reporter of Huaxia Times that it is mainly to better meet the investment and financial needs of investors, reduce investors' financial management costs, and fully make investors.

Will the cost reduction affect the income of the fund company? Relevant sources of China Merchants Fund told this reporter that with the growth of the management of the entire industry, the fund reduction of funds is the general trend. Fund companies reduce the cost of investors' wealth management and increase their investment experience by reducing fees. In the long run, it also helps fund companies and products to enhance competitiveness.

Huang Yichi pointed out that for fund companies, fees reduction can improve the competitiveness of fund products in the market. If the scale effect can be formed, the profit may not increase.

Fund cost reduction is the general trend

Wang Tieniu, director of the Ji'an Jinxin Fund Evaluation Center, told the reporter of "Huaxia Times" that from a policy level, the fund reduction of funds is the requirements of the General Office of the State Council's "Opinions on Further Opposing the Cost of the Institutional Trading Costs of the Orthopedic Institutional Institutional Institution", " Reduce the relevant rates of financial institutions such as funds to make it beneficial to the people. At the same time, it is also the relevant requirements of the CSRC's "Opinions on Accelerating the High -quality Development of the Public Fund Industry". It has a certain positive role in the future high -quality development of the fund industry and promoting the formation of a certain differentiated business model.

According to statistics from the Ji'an Golden Fund Evaluation Center, the lowest management rate of pure debt funds is 0.15%, the highest is 0.8%, and an average of 0.31%. Huang Yichi told the reporter of the Huaxia Times that taking this year as an example, the annualized yield of pure debt -type fund is about 4%. If the management fee can be reduced by 0.2%, the annual yield will increase to 4.2%, and the increase will be 5%. It is not high.

Statistics show that as of September 17, 2022, since 2016, different types of public funds have been in a downward trend. Among them, the average management rate of active equity funds has dropped from 1.4926%in 2016 to 1.4581% , The average custody rate decreased from 0.2492%to 0.2386%; the average management rate of bond funds decreased from 0.5262%in 2016 to 0.3704%, and the average custody rate fell to 0.1044%; Rate from 0.1543%in 2016 to 0.1391%. Wang Tieniu analyzed this reporter that from the perspective of overseas practice, the product rate of various types of common funds is also a long -term trend. Fidelity has launched the "zero-rate rate" full market index fund-Fidelity zero-rate international index fund. Although the overall rate of overall rates in the domestic public fund industry is continuously decreasing, compared with foreign -headed asset management agencies such as Fidelity Fund and Pioneer Fund, the overall management rate is still significantly higher than the international level.

However, the cost reduction does not completely solve the problem of the foundation. Since 2022, the overall income of public funds has not had good income. In the first half of the year, many types of funds such as hybrid funds, stock funds, FOFs, and overseas investment funds were mostly negative, and the people were suffering.

Wang Tieniu said that for equity funds, fund investors pay more attention to income and risk fluctuations. Compared with the decrease in management rates, the foundation hopes that the question of "fund making money and not making money" can get better. Solution; whether the industry can generally adjust the floating management rate according to the performance of the fund within a certain period of the fund; or even when the people are suffering from a large loss, whether it can be given to the citizen to compensate. The direction.

Editor: Editor Yan Hui: Xia Shencha

- END -

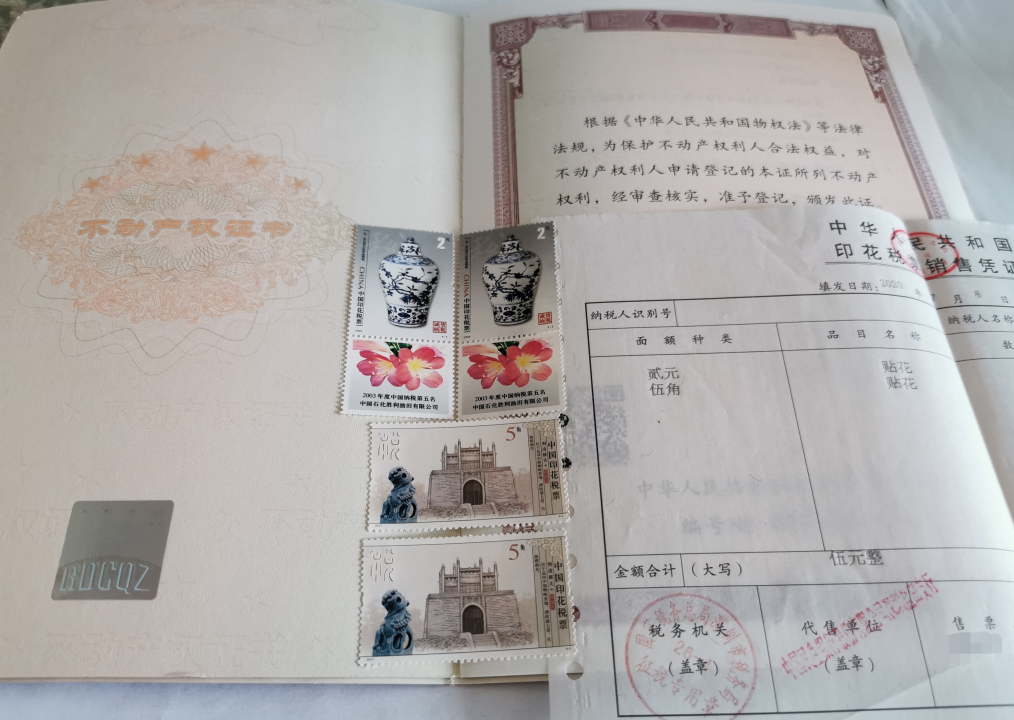

Starting in July, the registration of non -motion property rights will be collected at 5 yuan stamp duty

The Passing Duty Law of the People's Republic of China will be implemented from Ju...

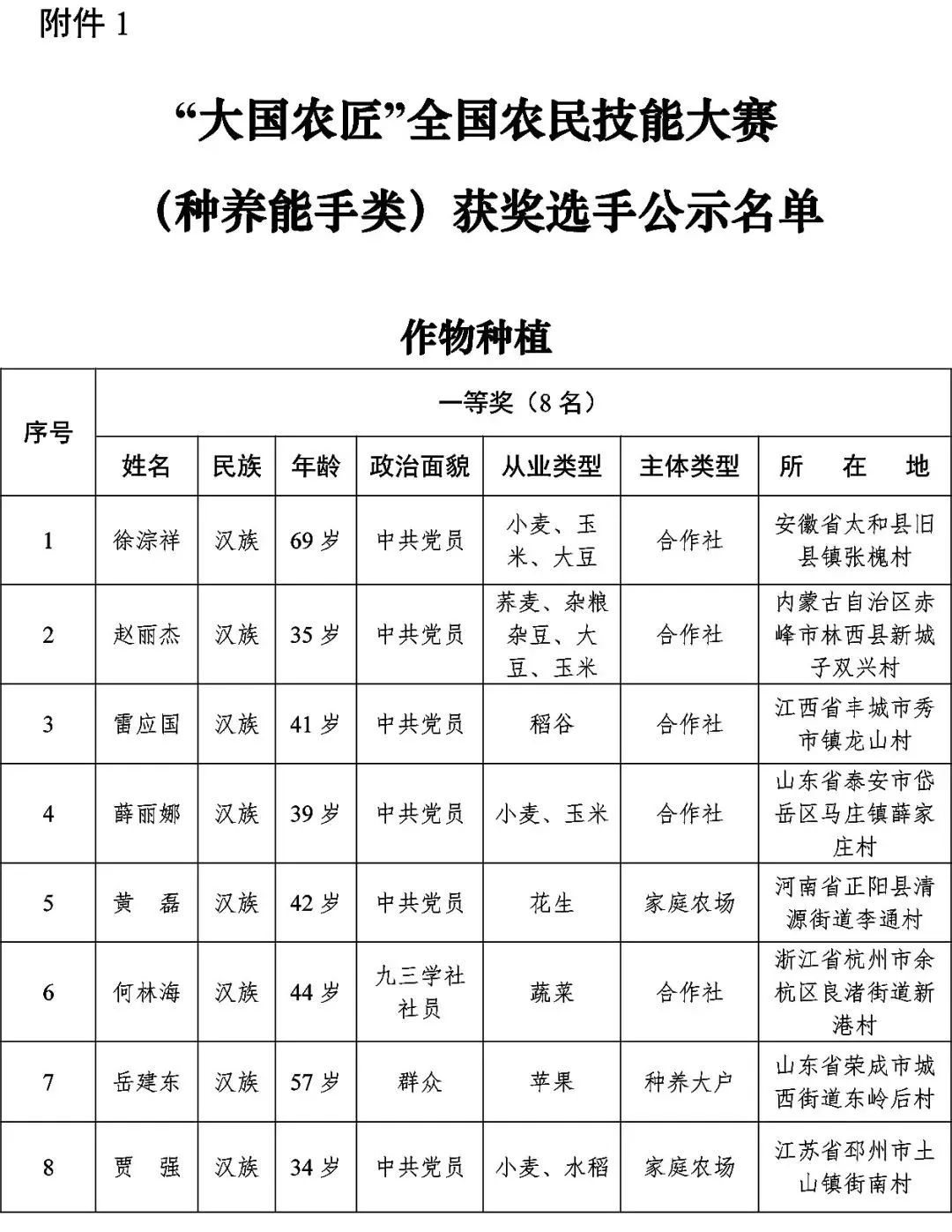

"Great Country Craftsman" National Farmers Skills Contest, Condor Energy, Entrepreneurship Innovation, Rural E -commerce Talent List List Public Announcement Announcement

According to the overall arrangement of the Chinese Farmers Harvest Festival in 20...