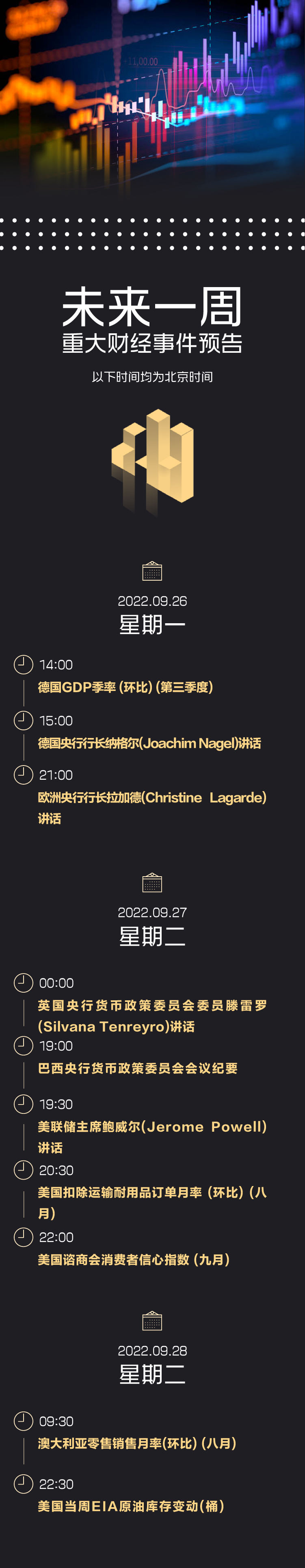

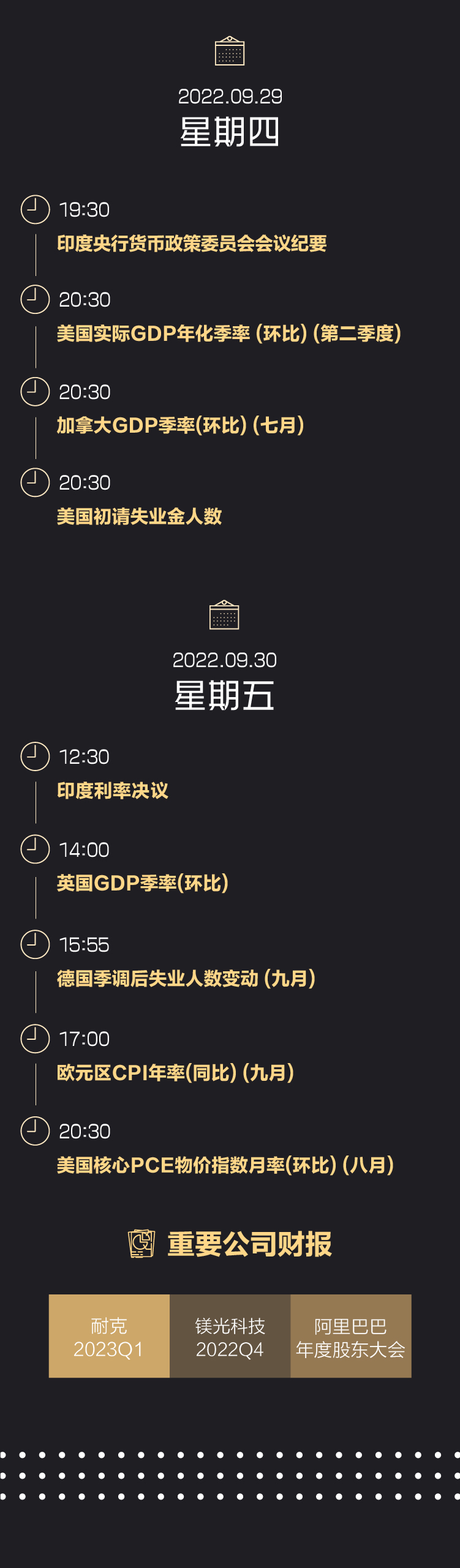

The Federal Reserve's interest rate hikes: The market value of the US stocks has evaporated 8.8 trillion US dollars. Japan intervened in the foreign exchange market, and the gold was not safe. Putin signed a heavy law;

Author:Daily Economic News Time:2022.09.25

This week, the Fed violently raised 75 base points, the largest continuous interest rate hike since the 1980s. In less than 24 hours, the central bank of the seven countries followed up, resulting in pressure on the stock and foreign exchange market. As of the closing of the US stocks on Friday, the three major stock indexes week K had all fallen by more than 4%. European and Japanese major stock indexes, Brent crude oil, and COMEX Golden Week K are also all green, recorded from 1%-6%, but the US dollar index stood at the 113 mark, renewing a 20-year high, and the Japanese government even shot even shot. Intervention in the foreign exchange market. What is the follow -up action of the Federal Reserve, and depends on the Barclays Bank of Barclays.

In terms of Russia -Ukraine conflict, the prerequisite for restoring negotiations is still not seen. Donedsk and other four places began to carry out "Entering Russia" referendum, lasting from September 23 to 27. Russia claims that it can defend the new territorial use of nuclear weapons, and sign a law on the 24th to extend the right to use two military bases in Belarus for 25 years.

Seeing that winter is coming, German and French go to the Gulf country to "snap up" natural gas. In addition, France has implemented energy -saving measures such as stopping the "Eiffel Tower" at night decoration lighting. Chinese electric blankets exploded in Europe, with a single month export of 1.29 million. Europe has also begun to increase investment in renewable energy, and French President has proposed a "ten -time plan" of solar energy.

In addition, the U.S. cryptocurrency mining company Compute North applied for bankruptcy protection, and the virtual currency contract for nearly 24 hours a total of 25,000 people broke out; Tennis King Federer officially retired; the British announced the "strongest" tax reduction plan in 50 years, but the newly appointed Prime Minister has been in office, but the newly appointed Prime Minister Tellas also encountered the first big trouble; Nvidia released the strongest autonomous driving chip in history this week, with a single computing power up to 2000TOPS.

More content is "One Week International Finance".

"Super Central Bank Zhou Come": The market "rot" cash is king

Photo source: every drawing

On September 22, Beijing time, the Fed announced that the interest rate of federal funds raised 75 basis points to 3.00%~ 3.25%. Since the beginning of the 1990s, the Federal Reserve raised 75 times in three consecutive interest rates for the first time with the federal fund interest rate. The base point, also the former chairman of the 1980s, Paul Walke's "violence" raised interest rates to inhibit the maximum continuous interest rate hikes since the inflation.

In less than 24 hours, the central banks of 7 countries in Asia, Europe, and Africa followed up successively, setting off a wave of interest rate hikes, causing the global stock market to shock. It is worth noting that the Turkish central bank unexpectedly cuts interest rates of 100 basis points.

As of the closing of the US stocks on Friday, the three major stock indexes have fallen by more than 4%. The Nasda Index and the S & P 500 are close to the lowest valley in the year of June. The Taoist Creation has closed at a new low since November 20, 2020. European and Japanese major stock indexes, Brent crude oil, and COMEX Golden Week K are also all green, recorded from 1%-6%, and the US dollar index station has 113 marks, renewed for 20 years high, and the Japanese government even intervened in intervention. The exchange market.

US media: "Integration is pushing the US stock market to the cliff"

The continuous radical interest rate hikes of the Fed have made the haze of the US financial market stronger.

According to media reports, since August 16, the market value of the US stock market has evaporated $ 8.8 trillion (equivalent to about 62 trillion yuan). On Friday, the atmosphere of panic gradually reached its apex. On Friday, there were more than 33 million copies of the contract. This is the busiest day since the data began in 1992.

According to the People's Daily quoted the Wall Street Journal: "Integration is pushing the US stock market to a cliff."

But at present, the Fed will not stop stepping on interest rate hikes, and economic recession is expected to continue to rise. In the report sent to the Daily Economic News, the bank's senior economist Jonathan Millar et al. By the end of this year, the target range of the federal fund interest rate will be 4.25%-4.50%.

Dian Baker, a senior economist at the US Economic and Policy Research Center, believes that the Fed should pay more attention to further tightening the downlink risk of policies.

S & P Global Market Intelligence told reporters that it is expected that the actual GDP growth in the United States will slow from 5.7%of 2021 to 1.7%in 2022 and 0.9%in 2023.

In this context, the US stock market may not have bottomed out. Goldman Sachs Global stock strategy analyst Dominic Wilson predicts that in the case of global economic recession, the S & P 500 Index will fall to 2900 points (Note: The closing data of the above Friday is the benchmark, and there is about 20%of the decline space).

The Japanese government intervened in the foreign exchange market. Where did the money come from?

In this round of the Fed's interest rate hike storm, the US dollar has strengthened significantly. The US dollar index of US dollars against the price of other currency prices in the US dollar breaks the 113 mark, renewed for 20 years of high, and the US dollar once broke the important psychological barrier of 145.

On September 22, in order to deal with the sharp depreciation of the currency, the Japanese government intervened the exchange rate for the first time in 24 years to sell the US dollar and buy the yen, which greatly shocked the market. The yen's exchange rate against the US dollar also rebounded on the same day to the front line of 450 points to 141, and finally recorded the largest single -day increase in March 2020.

According to Bloomberg's view of a number of Wall Street strategists, they estimate that Japan is stored in the Federal Reserve's foreign and International Monetary Administration's inverse repurchase of more than $ 110 billion. You can use it when you need funds to avoid selling government bonds to cause market turmoil. It is worth noting that the Bank of Japan's intervention in the foreign exchange market seems to fail to quickly reverse the decline in the yen. On September 23 (Friday), the yen's exchange rate against the US dollar fell again near 143.

However, for the future performance of the yen, some analysts believe that from the global perspective, the fundamental factor that has caused the weakening of the yen in this round of the US -Japan monetary policy has not changed. From the domestic level of Japan Rate curve control (YCC) policy and the Japanese government may launch financial measures later to help Japanese citizens cope with domestic prices rising, which is not conducive to the yen. Therefore, the effect of Japan's intervention in the yen will be limited and short.

SHIGETO Nagai, chief Japanese economist at Oxford Economic Research Institute, said that he analyzed that "the Bank of Japan will never adjust the monetary policy due to exchange rate issues. , But the Bank of Japan has no choice but to adhere to the current YCC policy, even after Kuroda Dongyan is over after the term of April next year. "

Why doesn't gold avoid danger?

Although the world is facing geopolitics and uncertain situations, gold has not benefited from the status of its hedge.

On Friday, Gold Futures closed down and set a new low in two years. The New York Commodity Exchange fell 1.5%in December and closed at $ 1655.60 per ounce, which is the lowest level of the most active contract since early April 2020.

"Daily Economic News" reporter noticed that the current US dollar has touched the 20 -year high, and the yield on the benchmark 10 -year US debt has jumped to the highest level since April 2010.

Edward Moya, a senior analyst of financial service provider OANDA, said: "We see that the US dollar continues to strengthen, which will keep gold weakly in the short term."

Bank of America analysts Michael Hampet wrote in a report that investors' emotions reached the most pessimistic level since the 2008 financial crisis, and investors have turned to cash and avoided almost all other asset classes.

Ole Hansen, director of the commodity strategy of the investment bank, also held a similar point of view. In a report, he said: "Before the Fed's Eagle Faches, gold and other semi -investment metals (such as silver and platinum) may continue to be undertaken Press. "

Note: The above interview content only represents the point of view of the interview, does not represent the "Daily Economic News" position, nor does it constitute investment advice.

Putin signed a heavy agreement!

Approval will be extended for 25 years in the use of Belarusian military bases

Ukraine pro -Russian volunteers call for referendum

Image source: Visual China-VCG111393654077

Virtue and France go to the Gulf country to "snap up" natural gas

1.29 million electric blankets in a single month are hot in Europe

Picture source: Xinhua News Agency reporter Ren Pengfei Photo

Seeing that winter is coming, European energy guarantee is imminent.

On September 24th, German Chancellor Tsutz visited the Gulf Three Kingdoms and sought cooperation in energy supply. French oil giant Dadal Petroleum also signed an important natural gas contract with Qatar.

In addition to buying natural gas and coal, a large number of Europeans will also look at China. All kinds of heating equipment produced here have become their new choices.

According to CCTV's report on the 22nd, one of China's heating production bases, Zhejiang Ningbo Cixi City, is different from that at this time in previous years, the demand for various heater continued to increase, ushered in a round of "make -up waves". According to media reports, data from the General Administration of Customs also show that the demand for electric blankets in Europe has increased. In January of this year, the number of Chinese electric blankets imported by 27 EU countries was 189,000, an increase of 521,000 in June, and in July, it rose to 1.29 million, an increase of nearly 150%month -on -month.

In addition, according to Xinhua News Agency, from the 23rd, many landmark buildings in Paris, including the Eiffel Tower, stopped decorative lighting in advance.

Faced with the continuous energy crisis, European countries have begun to increase investment in the field of new energy. On September 23, according to Bloomberg, the European Union will announce the "digitalization of energy system" plan next week to promote the development of renewable energy to end dependence on Russian fossil fuels. (About RMB 3900 billion).

In addition, France will have new plans. On September 22, local time, French President Macron revealed at the latest speech that France needs to accelerate significantly, and the speed of renewable energy projects is at least doubled. Before 2050, the French solar capacity was increased by ten times, and the power generation of the land wind farm doubled. Next week will be submitted at the Cabinet Meeting Act of Renewable Energy Development.

Bitcoin mineral company Compute North applied for bankruptcy

Virtual currency contract nearly 24 hours a total of 25,000 people burst out

Photo source: Photo Network-400087732

Recently, under the influence of the Federal Reserve's interest rate hike, the cryptocurrency market was also affected. On September 24, Bitcoin dived again and lost $ 19,000/piece. Digital currencies plummeted, and investors lost heavy losses. According to the real -time data of BTC126, as of 8:35 on September 25, a total of about 400 million yuan will be built within one day of the virtual currency contract. In the past 24 hours, there are nearly 25,000 people. It is worth 1.56 million US dollars in BitMex-Xbtusdt.

The cryptocurrency market fell, and mining companies couldn't hold it.

On September 22, according to CoinDesk, Compute North, one of the largest cryptocurrency mining companies in the United States, has officially applied for bankruptcy protection to the court.

Due to the decline in cryptocurrencies and rising energy costs in winter, the company faces more and more pressure. It is reported that Compute North is one of the largest mining data centers providers and has a number of transactions with other large mining companies. Its bankruptcy application may have a negative impact on the industry.

Federer officially retired, Nadal cried

Picture source: Visual China

According to CCTV News, on the evening of September 23, local time, at the Lavol Cup Tennis Tournament held in the Beginsi Stadium in London, tennis player Federer completed his last game in his career.

In this doubles match, the European teams formed by the European teams formed by Federer and Nadal. After two and a half hours, the final score was 1: 2. Federer did not say goodbye to his career of his professional tennis player.

On September 15, Federer announced on social media that he was about to retire, and the Ravor Cup in London will be his curtain battle. Federer won 20 Grand Slam championships and 6 Professional Tennis Federation Finals.

At the farewell ceremony after the game, Federer bid farewell to the fans who love him all over the world: "When I say goodbye, I don't feel lonely, thank my team and everyone."

Federer couldn't hide his excitement and hugged the European teammates one by one, tears burst out. Nadal on the side also burst into tears, crying red eyes.

The United States cancels some export restrictions on Iran

On September 23, local time, according to CCTV News, US Secretary of State Broskel announced that it will cancel some export restrictions on Iran and issue general licenses to improve the situation of Iranians' use of Internet services.

According to Xinhua News Agency, the Iranian Ministry of Foreign Affairs spokesman Kanani said in early September that if the United States lift sanctions against Iran, Iran can help meet European energy needs.

Kanney said at a regular press conference that Iran has rich oil and natural gas resources, and European countries are currently facing problems in energy supply. If the Iranian nuclear issue has been successfully resumed and the performance of the contract is successful and sanctions on III are canceled, Iran "can meet a large part of Europe."

The "strongest" tax reduction plan for 50 years in the United Kingdom

Tellas's first trouble after taking office

A pigeon walks in the lobby of the Waterloo Station in London, England

Photo source: Xinhua News Agency reporter Li Ying

On September 23, local time, the British government introduced the largest tax reduction measures since 1972, worth 45 billion pounds (about 351.5 billion yuan).

According to this plan, the United Kingdom will cancel the plan to raise corporate tax, and corporate tax will remain at 19%of the Group 20. In addition, the plan has also greatly reduced the income tax and house purchase tax rates, and the restrictions on bonus bonuses have been canceled.

However, many economists and former British Central Bank officials are not optimistic about this plan. According to Bloomberg, Martin Weale, a policy maker who had worked at the Bank of the UK, said that the government's plan to "tearly end" and stated that investors should shorten the pound. "Economists believe that these measures of the British government may soon become unbearable. The British Labor Party said that these measures will only benefit the rich and have almost no help to middle -income groups with increasing costs of living.

In addition, the British government's newly appointed Prime Minister Tras met her first trouble.

According to Reuters reported on September 22, the British Railway, Maritime and Transportation Workers' Unions (RMT) determined that 40,000 employees from British Railway Networks and 15 train companies will hold strikes on October 8. In addition, the unions of the two other railway systems have previously decided to conduct strikes on October 1 and 5.

Faced with the risk of paralysis of the transportation system, Tellas made a speech saying that it would formulate the lowest level of railway service level as soon as possible, requiring legislation to stipulate the minimum service level during the strike of railway workers to ensure that some railway systems during strikes, part of the railway system It can also be maintained.

It is worthwhile that in addition to the major railway strike, British bus drivers, fire unions, doctors groups, etc. are also planning a new round of strike. The suspension of these services may bring Britain's precarious economy and inflation of inflation in the UK. More impact.

Nvidia released the strongest autonomous driving chip in history

Single power up to 2000TOPS

On the evening of September 20, Nvidia threw another "nuclear bomb", and the new generation of smart car chips, Thor (Thor Sol), was officially released.

Due to the excessive performance (a single computing power 2000TOPS), Nvidia plans to directly replace the new product Altan, which is mass-produced in 2024-2025, which is currently Orin's next-generation product Altan SOC (1000TOPS).Huang Renxun said that only one ThOR chip can integrate the computing power requirements required by smart cars, including high -end autonomous driving, car operating systems, smart cockpit, and autonomous parking.

It is understood that the new chip will be launched on the polar model. Xiaopeng, ideal, and Qingzhou Zhihang also said that the chip will be followed up and will take the lead in using THOR chip for early testing.

Photo source: every drawing

Photo source: every drawing

Reporter: Tan Yuhan Zhang Lingxiao

Edit: Tan Yuhan

Vision: Liu Qingyan

Capture: Tan Yuhan

Daily Economic News

- END -

The strongest high temperature this year is coming. How much can you get this allowance?

Jimu Journalist Liu XiaobinThe strongest high temperature since this year is comin...

Xinhua Full Media+| From the Chinese Seed Conference, the seedling industry revitalizes action "open a good game"

In July 2021, the 20th meeting of the Central Reform Commission reviewed and appro...