Jiu Gua | Under the downturn of the wealth management market, how does bank marketing?

Author:Jiu Gua Financial Circle Time:2022.09.25

Author | Zhao Jinjin (Writers of Jiu Gua Financial Circle column)

Source | Jiu Guo Financial Circle

Edit | Wu Wen Zhang Yundi

Beauty | Yang Wenhua

""

The National Day holiday is coming, and many banks have already opened a new round of financial marketing. However, from many reports, the popularity of the exclusive product of the National Day Festival this year has declined.

It is reported that the number, scale and expected return on holidays have been reduced since this year. According to Puyi Standard, this year, a total of 96 exclusive products of various holidays have been released in the entire market, which is far less than the same period last year.

my country has downgraded the deposit interest rate twice this year, and the three -year 5 -year interest rate inverted; the comprehensive net worth of financial management, the income of the income fell below the net value; In this market environment, how does bank product marketing?

01

The deposit interest rate is lowered during the second year

In the context of market interest rates, since September 15, the state -owned bank and share banks collectively lowered RMB deposit interest rates. The interest rate of the deposit period is generally reduced by 5 basis points. The time limit of different periods and varieties of deposit rates varies, and the decline has been relatively large.

There are two details of this adjustment. One is that the listing interest rate of the listing of the bank's official website was generally consistent with the trend of the basic interest rate changes, and there was no adjustment. This new observation window was formed. Adjustment. The change of the four major bank listing interest rates means that the bank's deposit interest rate has been adjusted accordingly. Second, the interest rate of the deposit of this time is the first time since 2015.

In recent years, the economy has declined, plus the impact of outbreaks. Globally, the profit of investment is getting lower, and it is more and more difficult to make money. If the profit of investment is very low or even loses, investors will tend to exist the remaining profits, and the money supply in the society will have a vacancy. In order to make up for this vacancy, the state must cut interest rates. Forced those investors who put the money in the bank to invest or consume money, so that the money supply on the market reached a balanced state. my country continues to promote the market -oriented reform of interest rates, give play to the decisive role of the market in interest rate formation, create a suitable interest rate environment for the high -quality development of the economy, and effectively benefit the real economy.

At present, the one -year deposit interest rate of banks in my country is generally 1.65%-1.95%, the three -year fixed deposit interest rate is 2.6%-3.25%, and the five -year fixed deposit interest rate is 2.65%-3.25%. Earlier, the bank's 3 -year and 5 -year regular deposit products also appeared. The interest rate was "inverted". Customers went to the bank to deposit money. The staff of the bank would recommend that it was relatively cost -effective for 3 years, and did not advocate a longer period of time. It is foreseeable that the trend of interest rates in my country's banks will still exist in the future.

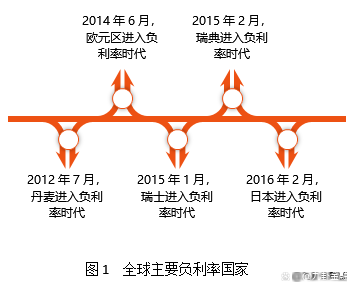

Some countries in the world have entered the era of negative interest rates. Taking the euro zone as an example, in June 2014, entering the era of negative interest rates. In view of the long -term level of inflation in the euro zone is far below 2%, money is lying on the European Central Bank's account without entering the real economy and cannot stimulate credit demand. Therefore, from July 2012, the European Central Bank has reduced the deposit rate to zero. By June 2014, it was further reduced to negative value, which means that the central bank will collect additional interest from the bank overnight deposit on the bank.

Today, European inflation is high. In 2022, Europe returned to the era of interest rates again after 8 years. On the evening of July 21, the European Central Bank announced that in order to ensure that the inflation rate returned to 2%of the goal in the medium period, it was decided to raise the three key interest rates by 50 50 50 A basis. This means that the European Central Bank has ended the negative interest rate policy that has been maintained in the past eight years, and it is also the first time to take interest rate hike operations in 11 years. In Europe to respond to inflation through interest rate hikes, making borrowing more expensive and savings more attractive.

Different monetary policies are adopted in different periods. When measures need to be taken to cope with high inflation, they usually take interest rate hikes. Conversely, low inflation is used to reduce interest rates. At present, my country's economy is down, consumption recovery is stressful, and more funds are encouraged to enter the market instead of entering the bank. At the same time, the storage rate of residents in my country is high. In addition, the bank loan interest rate has been reduced many times. Sumid reduction and stability of the banking system.

02

In the era of comprehensive net worth, wealth management is not satisfactory

In this year, bank wealth management entered the era of comprehensive "net worth" and broke the rigid redemption. In the first quarter, more than 2,000 bank wealth management products fell below the net worth. This year, over 80 % of bank wealth management subsidiaries' equity products were negative. However, the overall bank wealth management product is relatively stable during the year. According to Nan Finance Data, as of September 20, 2022, a total of 106,458 net worth wealth management products issued in the market, 82.47%is lower risk products (first -level risk). 92.95%invests in a fixed income category, which basically brings positive income to investors. However, due to the positive correlation with the performance of A shares, the yield of equity products is positively related, and even recently, due to various factors at home and abroad, the A -share market fluctuates greatly. Revising has become a high probability event, and even some products fluctuate greatly, and the income has fallen by nearly 10%in the past week.

The wealth management product after net worth is very low, even if the income is very low. Often, there are only tens of thousands of yuan of funds deposit. It is really difficult to accept. In addition, the regulatory documents released by the regulatory layer in mid -2021 require that bank cash wealth management products must be rectified by the end of 2022. Therefore, since the second half of 2022, various banks have adjusted the rules and cash management wealth management products, and the amount of fast redemption. Among them, the time -effective period of redeeming the redemption from "T+0" to "T+1", The amount of fast redemption drops from 50,000 yuan to 10,000 yuan.

In addition to the rules for redemption, cash management products refer to the management of currency funds in terms of assets. The investment scope is narrowed, the average period of time is shortened, the yield will continue to decline and move closer to the currency funds. In the second half of 2022, the yield of a variety of cash management products fell below 2%, the revenue continued to fall, and the benefits of currency funds were aligned.

03

The fund falls terrible

Looking at this year's fund, it is even more unsatisfactory. From the beginning of the year to September 21, the Shanghai Exchange 50 Index set a new low during the year. Affected by this, the public offering funds are also losses. In the first half of 2022, the average yield of 8,420 public funds was -5.09%. Among them, equity funds have a higher decline, with an average of -9.67%, and only 81 funds achieve positive returns, accounting for about 1.73%. The performance of bond funds is relatively stable, with a relatively low maximum retreat and volatility, especially in the first half of the year of pure bond funds, ranking first in yields.

Pure debt funds also accounted for the highest proportion of bond funds, but in the second half of the year, pure debt funds also had negative returns. Some of the former star funds have even declined even more than 20%, and the fund's fixed investment income has begun to die. In the turbulent market, any investment in any investment is risky.

Therefore, for banks, it is difficult to allocate suitable financial products to customers. The deposit income is too low, the earnings of wealth management no longer keep the capital, and the fund is losing money. For customers, there are no investment projects outside, there are banks and no suitable financial finance Products, for a while, have money and don't know how to configure it.

04

Insurance products are favored by customer managers

In previous years, near the New Year, banks will always make "sucking gold", and with the weakening of the yield of bank wealth management products, the insurance products selling for the consignment have been "recommended" by the customer manager.

On the one hand, insurance products are one of the important sources of receipts in the bank. On the other hand, the current benefits are stable and even higher than wealth management. In recent years, customers' acceptance of insurance has become higher and higher, not only the result of compliance sales. The decline in the revenue of wealth management products has driven customers to turn more secure products.

The recommendations of insurance for insurance are unprecedented, and the manpower and material resources are also the most complete. In the past, many banks launched specific financial insurance products on the day of New Year's Day. The income is considerable, the time is short, and it is often explosive spike products. Therefore, it is especially important to accumulate customers before New Year's Day, because often this product is limited to sale, and it is gone after selling. It is also an promotional product carried out by insurance companies. It is a gimmick. It is mainly due to futures, high collection, and long term. This is the main product of the insurance company. In fact, banks still tend to pay friends.

In addition, unlike the wealth management account and deposit account, recommending financial management to customers will affect the deposit, and the insurance account is opened separately. At the same time, the customer manager of the promotion of the product will also extract certain reward performance according to the sales cost. It has become the main direction of increased sales performance, especially small and medium -sized insurance companies. Generally, the sales costs are higher, and the incentives for customer managers are more in place, so it is more motivated to recommend it.

In the sales insurance products, the bank cannot only take care of the interests in front of the eyes. While doing a good job of compliant sales, it is also necessary to consider the overall asset allocation of customers, especially the risk of the product. If there is no good investment target, the benefits are difficult to achieve.

- END -

Carbon neutralization and ETF Environmental Stock Exchange (560550) rose 1.48%, Foster's daily limit

As of 11:15 on August 9, the carbon neutralization and ETF EMC (560550) rose 1.48%, with a turnover of over 38 million.From the perspective of individual stocks, Foster's daily limit, Huahong Technolo...

Yuntai County: The price of the major merchants and the price is sufficient in price. The price is stable

(Li Xinfang) During the prevention and control of the epidemic, Shuntai County ful...