Futures Weekly | The commodity fluctuations are weak, the Federal Reserve's fifth rate hike boots landed, 3 ETF option contracts landed on the Shanghai and Shenzhen Exchange

Author:21st Century Economic report Time:2022.09.25

Southern Finance All -Media reporter Weng Rongtao intern Sun Yongle Guangzhou reported

This week, the Federal Reserve ’s fifth rate hike boots have been on the ground this year, in line with market expectations, but the“ Eagle ”position signal has not yet reversed, and the demand for community is expected to further shrink. At the same time, with the rapid rise of interest rates, the risk of economic recession in the United States will rise, which will accelerate the market's concerns about economic recession and impact on financial markets and commodity prices.

During the week (September 19th-September 23rd), the domestic commodities were weak, and the performance of each sector was differentiated. Among them, the black sector generally rises, and the prices of chemical energy and agricultural sectors are lower.

From the perspective of the domestic futures market, the energy chemical sector has fallen 1.87%during crude oil, the fuel increases by 0.04%, and the LPG has fallen by 4.76%; the black sector, the iron ore rose 0.56%, the coke coal rose 3.93%, the coke rose 3.93%; The non -ferrous metal sector rose 0.37%, Shanghai nickel rose 3.06%, Shanghai aluminum fell 0.56%; agricultural product sector, palm oil fell 0.31%, soy oil fell 0.50%, and pigs fell 4.66%.

Hot spots of trading market:

Hotspot 1: After the Federal Reserve raises interest rates, pay attention to the harvest period of soybeans

Since June, soybeans have surged down at a high level and broke the deadlock after the Russian -Ukraine conflict. The September soybean report of the US Department of Agriculture in September formed a short -term profit for soybean prices. After the report was released Maintaining shocks, the pretty bean price pattern is expected to not change much.

Domestic weather in China is a benefit for the yield of soybeans in Northeast China, but it is not optimistic about the most impact on international soybean prices. The high temperature and drought in summer have continued to increase the drought area of the bean production area. Dropped all the way to 58%.

In the case of domestic consumption is generally cautious, terminal consumption does not improve much, and the consumption prospects of the domestic soybean market are equally optimistic. It is expected that the amount of soybean imports in China will decrease in September, and the season of US beans will be approaching, and the slightly tight status of the supply side will be greatly alleviated.

The Federal Reserve has raised 75 basis points three times in a row. The oil market and copper market are gradually reflecting the negative effects caused by interest rate hikes. The response of agricultural products is relatively lagging behind and is expected to appear after the autumn harvest of the northern hemisphere.

Analysts of international derivatives think tanks believe that the oscillating of Mime Doudan waits for the first week of harvesting data to be announced. After the estimation of the high and low report of the report from August-September, the market re-evaluated the prospects of the production of US beans, waiting for the results of the progress of the progress and interest rate hikes.

Hotspot 2: European natural gas fills in inventory gas prices may fall for the fourth consecutive week

The price of natural gas in Europe may decline for the fourth consecutive week, because the sufficient liquefied natural gas supply helps European countries to fill the inventory before the start of the heating season. As of the 24th, the price of natural gas in the Netherlands in recent months has fallen 2.4%to 183 euros per MWh, and this week has fallen by about 2.6%.

European gas storage libraries have been filled with about 87%. At the same time, ship tracking data show that four other US LNG (LNG) cargo ships said they will use northwestern Europe as their destination, three of which will arrive in early October.

LNG imports have always been the key to helping European countries achieve winter reserve goals. Germany is the largest natural gas consumer in the region and is seeking to obtain more natural gas supply from the United Arab Emirates in the next few days. At that time, German Chancellor Salz will visit the UAE.

Because the current price of natural gas is still about 6 times higher than the average level of 5 years, demand destruction will continue. Volkswagen, the largest car manufacturer in Europe, said on Thursday that if natural gas continues, the company may transfer production from Germany and Eastern Europe.

Nevertheless, after the impact of the Russian -Ukraine conflict reduced the supply of natural gas, the European natural gas market is still sensitive to any potential interruption. As Asia's consumption increases, the liquefied natural gas that will flow to Europe in the next few months may also decline.

Industry policy news:

Maintenance 1: The Federal Reserve's interest rate hikes are in line with market expectations of commodities in the short term

The Federal Reserve has once again radical interest rate hikes, which affects geometry on commodities?

In the early morning of September 22, Beijing time, the US Federal Reserve announced 75 basis points to raise interest rates, raising the federal fund interest rate target range to 3.00%to 3.25%. This is the fifth interest rate hike this year, and it is also 75 basis points for three consecutive interest rate hikes.

From the perspective of the commodity market, as of September 22, the market closed in the market, and the global commodity response was relatively mild, of which the main contract of commodity futures in the country rose.

In this regard, a number of people in the futures industry analyzed that the response of the early morning on the 22nd was mainly because the Federal Reserve's interest rate hike met market expectations. The short -term market may be the rebound after the hike boots landed. However, the subsequent interest rate hikes will continue. The overall profit is profitable, and the impact of different varieties has different impacts. Products with tight supply and less inventory pressure will be less affected. big.

Looking forward to the fourth quarter, industry insiders believe that the macro environment at home and abroad is expected to be suppressed to commodities. The probability of commodity trend is that the focus of shock is slightly shifted. In terms of investment strategies, the current commodity of commodities still lack trending trend, and it is not advisable to perform unilateral long -short configuration on a large scale.

Maintenance 2: 3 ETF option contracts landing on the Shanghai and Shenzhen Exchange

On September 19, the three ETF options contracts that received much attention were listed on the Shanghai and Shenzhen Exchange. The total turnover of the three ETF options was 2.339 billion yuan on the first day.

Among them, the target of the option contract of the 500ETF of the Southern CSI 500ETF was listed on the Shanghai Stock Exchange, with a transaction value of 941 million yuan on the first day; the futures contract of the CSI 500ETF was listed on the Shenzhen Stock Exchange, with a transaction amount of 483 million yuan; the target was the GEM ETF of the GEM ETF of the GEM The GEM ETF options landed on the Shenzhen Stock Exchange, with a transaction value of 915 million yuan on the first day.

ETF option contracts are simply to give option buyers the right to buy or sell ETFs at the agreed price of both parties within the prescribed period. ETF is an index fund containing a basket of stocks. The GEM ETF option listed this time is the first risk management tool for GEM for innovative growth stocks. The CSI 500ETF option is the first intra -on -option product based on the CSI 500 Index.

The three ETF options listed this time have further expanded the ETF options to 6, and at the same time expand the scope of options, fill the gap of the CSI 500 index and the GEM index options. Coupled with CICC's 300 -Shenzhen -Shenzhen -Shenzhen -Shenzhen stock index options and 1,000 -stock index options of CSI, the derivative market in the A -share market has initially formed a full coverage of the options of large and medium -sized broad -foundation index options.

Looking to the performance of the market outlook:

Energy chemical sector:

Crude oil: The Fed announced the 75 basis points of interest rate hikes. The eagle tone made the market worry about economic hard landing, market risk aversion heating up, and the US dollar index refreshed over 20 years of high. The EU implements the oil sanctions plan for Russia. The G7 will set the upper limit for Russia's oil prices. Argus data says that the OPEC+output gap expansion to a record of 3.58 million barrels per day. EIA US crude oil and refined oil inventory increased. The prospects of the European and American central banks have slowed market anxiety to slow down the economy and demand. Slowing supply risks and demand to continue the game. The short -term crude oil futures continue to fluctuate. (Ruida Futures)

Black system:

Coking coal: Supply side, coking coal supply for short -term tightening, recent mining safety supervision is relatively strict. Recently, coking coal and coal mine accidents are more frequent, and the output has been disturbed. In addition, at the end of the month, the Daqin Line maintenance and power plant replenishment led to the tight power coal. Some coal mines had provisioning tasks, and the supply of focusing coal had an indirect impact. In terms of Mongolian Coal, Gan Qidu Port has maintained a high level, but the proportion of weathering coal pulling continues to increase the short -selling freight and support the price of Mongolian coal. It should be noted that the proportion of coal has fallen recently. In the demand side, the prices of coking coal before the National Day of coke enterprises are supported, and the prices of coking coal in some areas have risen. In summary, it is expected that the coke coal before the holiday is affected by the tight supply, the downstream replenishment, and the price is supported. After the festival, the profit of the end of the festival will support the profit of the steel mill. (Research on Chaos Tiancheng)

Nonferrous metal sector:

Shanghai Copper: The Federal Reserve's interest rate hike was raised at 75 base points, and Powell stated that it would firmly promote inflation and decline, suggesting that it will still raise interest rates on a large scale in the future. In the fundamental aspect, the import supply of upstream copper mines has increased, the processing fee of copper mines has risen, and the lack of electricity is relieved, which facilitates the recovery of the production of refineries. The demand for downstream during the peak consumer season has improved, but the price of copper is higher and the high water is rising, which will stop downstream purchases, and the import profits will expand, and subsequent overseas resources inflows will increase. Recently, domestic inventory has shown a slight decline, and it is expected that the recent adjustment of copper prices. Looking forward to next week: It is expected to adjust the copper price, the Fed's attitude, but the inventory will continue to be eliminated. (Ruida Futures)

Agricultural product sector:

Pig: The peak season of pork consumption is coming. The weather is cooling, and the demand for pork consumption in schools, restaurants and other places has increased to a certain increase, and farmed households have strong anti -prices, and pig prices have risen. The pig market will enter the Eleventh National Day stock preparation stage. In order to maintain market supply and suppress pig prices, the state stabilizes pig prices by putting a large amount of frozen meat and interviewing pig companies. In the later period, the consumption of the pig market did not increase significantly. The market emotional guidance. Under the sale of the retail pig farm and the secondary fattening counterattack, it was difficult for the slaughterhouse to collect pigs smoothly, it was difficult to ensure daily slaughter orders. The spot price of pigs rose, and the future price fell. Looking at the policy next week, the policy side will continue to put pork reserves to maintain the market supply. Pig prices will be difficult to increase, demand or increase, the breeding end may have a good price, and it is difficult to collect pigs. Pay attention to the pork reserves of the central government. (Hehe Futures)

- END -

The Shanghai Index shock rebounded by 0.42%, and the concept of natural gas concept stocks rose to rise.

On September 5, the broader market was narrowed throughout the day. The three majo...

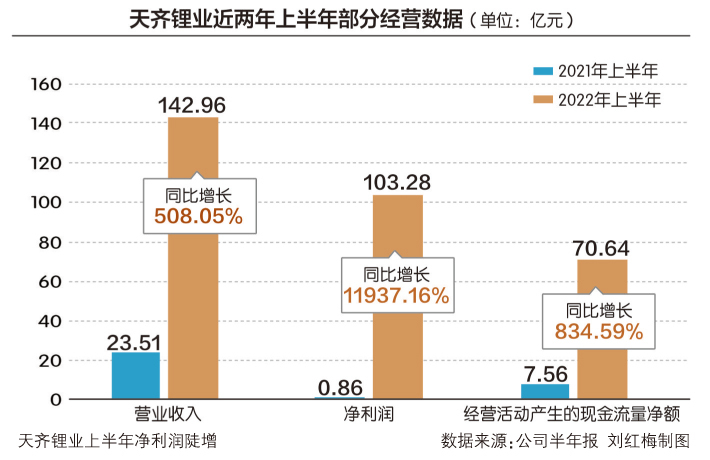

Does "0 yuan purchase" harm the interests of small and medium shareholders?Analysis of the employee holding plan of Tianqi Lithium: The production capacity assessment or "precision" meet the standard

On September 9, the Shenzhen Stock Exchange issued a attention letter to Tianqi Li...