The US interest rate hike cycle has been extended again. How does the exchange rate of various countries "earthquakes" and how the US dollar hegemony is "ransacked" globally?

Author:Jiefang Daily Time:2022.09.26

On September 22, the middle price of the RMB was reported at 6.9798, and the 262 basis points were degraded again. After the mid -range price is released, more offshore RMB against the US dollar that reflects international investors will continue to decline, falling below 7.10.

Correspondingly, in the early morning of the 22nd Beijing time, the Fed announced the third consecutive interest rate hikes in the third consecutive year. Since then, the global foreign exchange market has fallen from non -US currency.

It can be seen that due to the Federal Reserve's radical interest rate hike policy, the RMB exchange rate and the global exchange rate market are fluctuating violently, and the US dollar index has risen significantly. This is exactly a reflection of the US dollar hegemonism.

Which is the most difficult exchange rate to depreciate?

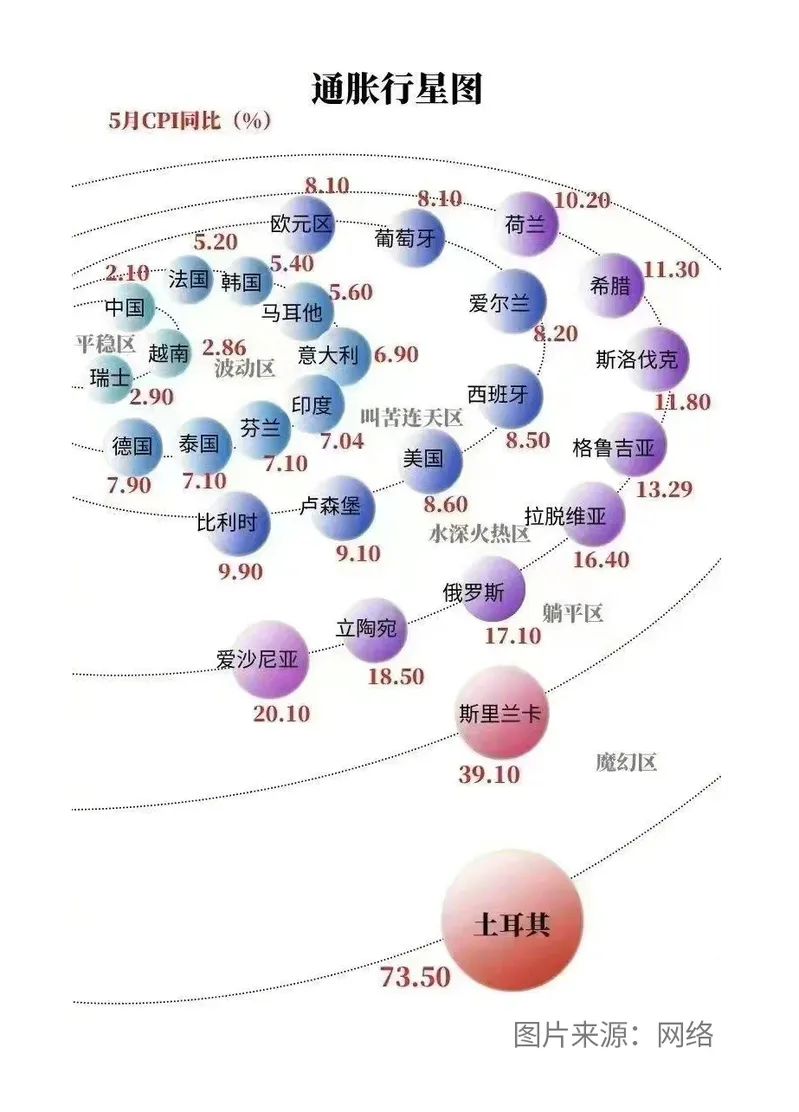

I believe that many people have seen this "inflation planet map", which is a comparison of inflation from all over the world since the Fed started the interest rate hike policy in March this year.

But in fact, since the Fed raised interest rates, the global economy has been affected by various dimensions, and the foreign exchange market is no exception.

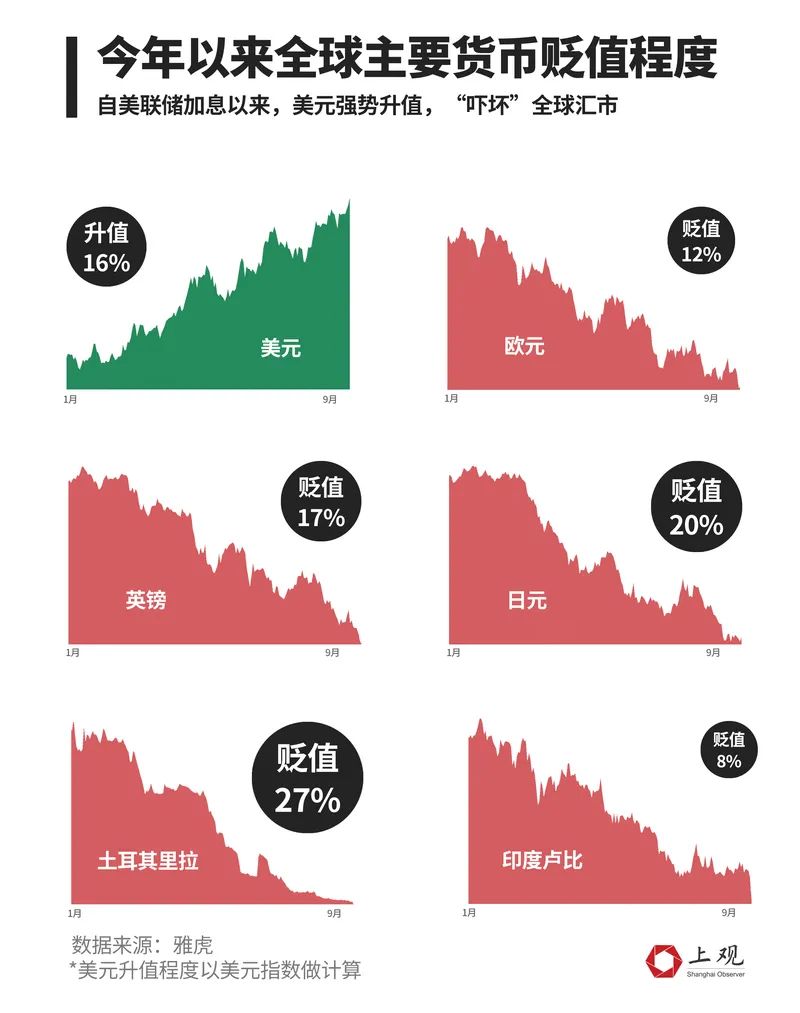

Mainly non -dollar currencies, the euro year depreciates 12%during the euro year, and a few days ago, it fell below the 1: 1 parity mark, setting a lowest record in nearly 20 years. Under the British "pigeon" interest rate hike policy, the US dollar might accelerate the pound of pounds to 1.1; the yen annual depreciation of 20%, falling to the bottom of the valley since 1998, the US dollar against the Japanese yen moved towards the 150 yuan mark.

It may be more difficult for developing countries, and currencies have depreciated by emerging markets in the world except Latin American countries. Turkish Millar has depreciated 27%during the year, the Thai baht depreciates 11%during the year, the Indian rupee has depreciated by 8%during the year, and the currency depreciation of Eastern European countries is generally 15%to 25%.

The news from the Federal Reserve ’s interest rate hike conference once again gave a“ stuffy stick ”to the global currency market. According to the Wall Street Journal, Fed officials are expected to raise interest rates until 2023. Most of them are expected to reach the federal fund interest rates of about 4.6%, which is higher than the 3.8%predicted in June this year. Essence

Affected by negative expectations, U.S. stocks continued to fall, and the exchange rates of countries around the world fluctuated violently. Following the pace of the Federal Reserve's interest rate hike, many major central banks around the world, such as Switzerland, Norway, and Britain, have also entered a cycle of rapid interest rate hikes. In addition, the Ministry of Finance of Japan also announced intervention in the foreign exchange market. This is a rare government since 1998 by the government. Intervention in the currency to prevent the rapid falling yen exchange rate.

US dollar hegemonism's conduction path

Compared with the fierce formation of the global exchange market, this year, the US dollar index has been singing up all the way, with a cumulative increase of 14%. On September 23, he stood on 112 and continued to brush a new high in 20 years.

How is the impact of the US interest rate hike to the US dollar and other currencies?

First of all, a clear concept is, what is the "interest" of the Federal Reserve? The "interest" here refers to the federal fund interest rate. This is the interest rate of more than 800 financial institutions under the Federal Reserve to borrow money from the Fed. After the Federal Reserve announced the interest rate hike, it is to reduce the currency circulating in the market and increase bank loan interest rates. In order to maintain customers, banks will also increase deposit interest rates accordingly.

When the US economy expects deterioration, the Fed tighten monetary policy and pushs high deposit interest rates, and international investment may have rapidly flowing out of countries to invest in the US local market investment. Cross -border capital return will cause the financial market to be turbulent in other countries, and the pressure of exchange rate depreciation has increased sharply.

At the same time, when the currency supply of a country increases compared to the US currency supply, it will inevitably lead to the increase in inflation pressure in the country, and the currency will be depreciated. Therefore, the two pictures mentioned earlier, the degree of inflation in the global countries and the depreciation of the global exchange market do have positively related conduction.

Of course, there is an exception that is the US dollar. In this year's global currency market, only the US dollar can achieve high inflation, but continue to appreciate.

This is because the dollar is an objective fact of the world -led settlement currency. Especially when the U.S. economy is expected to decline and the global market uncertainty increases, the US dollar will be continuously increased as the leading currency, thereby further pushing the US dollar index.

It can be seen that the Fed's successive issuance of radical interest rate hikes is to recover unprecedented inflation at the expense and make up for the wrong monetary policy errors of large water irrigation. However, in this "cost", it will not only sacrifice the expectations of US economic growth, but also increase global economic risks and inflation pressure.

It can be said that the dominant position of the US dollar in the international monetary system has given the United States a "privilege for doing whatever you want", which is actually a US dollar hegemonism. After the establishment of the Bretton Forest System, the United States can stimulate the economic growth of the country through the advantages of settlement, and then pass the inflation pressure by reducing the measures of currency interest rate hikes to quote the capital back to the United States, and leave it to the world's market and developing countries. The turmoil and anxiety, this is the "US dollar tide". In this way, the United States can use global wealth to support the country's market and repeatedly stimulate the development of the local market.

How to go for a long time?

Affected by the epidemic, international trade prospects have weakened, and the demand for foreign exchange and sales has declined. In this context, the global leading currency US dollar strengthening has caused the fluctuation of the RMB exchange rate.

Zhang Lijun, head of the Chinese financial industry in PwC, told reporters that around inflation, the current situation in China and the United States is very different. China's inflation situation can be controlled as a whole, so China does not need to follow the US interest rate hike policy. Regarding the fluctuation of exchange rates, he believes: "In any national economics model, independent monetary policy, complete and stable exchange rate and capital development are impossible, so what we need to do is to ensure independent monetary policy based on the independent monetary policy There is a relatively strong capital control for the exchange rate. "Huang Wentao, chief economist of CITIC Construction Investment, posted a prediction that in the middle and long period of time, there is still some period of time in the United States. There is a "broken 7" pressure. However, he also emphasized that the central bank has enough means to stabilize the exchange rate and the expected expected of capital flow. As long as the devaluation of the RMB does not exceed the mainstream non -US currency, the central bank can tolerate the fluctuation of exchange rates.

In fact, globally, the depreciation of the renminbi is better than the currency of currencies and emerging market countries in most developed countries. "In terms of the supply and demand of the foreign exchange market, or from the level of exchange rates and the trend of exchange rates, it is basically a state of stability." Ding Zhijie, director of the Foreign Exchange Research Center of the State Administration of Foreign Exchange Public indication.

On the other hand, the response to RMB fluctuations, both the central bank and the market have sufficient experience, because this is not the first time the RMB has "broken 7" in recent years. From February to July 2020, it was impacted by the new crown epidemic, and the RMB exchange rate also fluctuated up and down from the "7" mark for a long time. And the US dollar index at that time was still in the range of 95 to 100, which was lower than the current level, which means that the same "Break 7", and the current RMB trend is stronger than the "Break 7" period in 2020.

Zheng Houcheng, director of the Institute of British Securities Institute, believes that when the RMB exchange rate is reversed, it may be in the spring of 2023. At present, the central bank has released many positive signals. On September 5th, the central bank announced that starting from September 15, 2022, the foreign exchange deposit reserve ratio of financial institutions has been reduced by 2 percentage points, that is, the foreign exchange deposit reserve ratio is reduced from the current 8%to 6%. The direct purpose is to release the US dollar. The supply and demand relationship of the foreign exchange market can promote the RMB exchange rate. The signal of this move is of great significance. The purpose is to remind the market that the central bank has paid attention to the fluctuation of the RMB exchange rate. If the RMB exchange rate "breaks 7", further action may be taken in the later period.

Liberation Daily · Shangguan News Original manuscript, reprinting without permission

Author: Wu Danlu

WeChat editor: Antong

School pair: Xiaochuan

- END -

Dong'an Power disclosed the 2022 semi -annual report to achieve revenue of 3.240 billion yuan

On August 1, Dongan Power (Code: 600178.SH) released the 2022 semi -annual performance report.From January 1, 2022-June 30, 2022, the company realized operating income of 3.240 billion yuan, a year-on

2022 East Asian Marine Cooperation Platform Qingdao Forum opened in the West Coast New Area of Qingdao

The United Nations Ocean Ten Years Marine and Climate Cooperation Center was appro...