These public offerings have signed the principle of investment!What is the charm of this international organization?

Author:Broker China Time:2022.06.22

With the concept of carbon peaks and carbon neutralization, more and more mainland institutions have signed the principle of responsible investment (PRI) to invest in ESG.

Data show that as of June 19, a total of 101 mainland institutions signed PRI, including 22 public offerings and asset management institutions. Several professionals said that for public offerings, after realizing the importance of ESG, joining PRI will be a practical opportunity to apply cutting -edge theory to the local market. At present, PRI's improvement in public offering agencies is mainly in terms of systems, process and product innovation.

22 public offerings have signed the principle of investment in the person in charge

Responsible Investment Principles (PRI, Principles for Responsible Investment) is an important international organization in the field of responsible investment. In April 2006, the UNEP FI and the UN GLOBAL Compact (UNEP FI) and the UN GLOBAL Compact were jointly launched, and PRI was established in the New York Stock Exchange.

With the popularity of carbon peaks and carbon neutralization in China, PRI's influence has also increased day by day. In recent years, more and more mainland Chinese agencies have signed PRI.

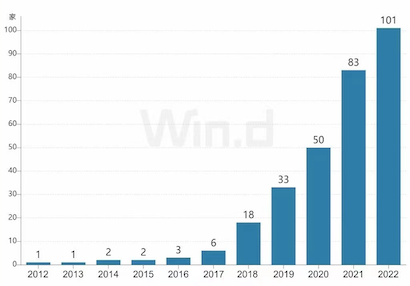

Number of institutions signed by Mainland China

Source: UN PRI, Wind

According to the official statistics of PRI, as of June 10, 2022, a total of 101 signed by PRI in mainland China, of which 74 were investment management institutions, including 22 public fund managers.

Among the 18 social security funds commissioned managers in my country, 13 have joined PRI. In addition, 15 of the 21 basic pension investment management institutions in my country have also joined PRI.

The cutting -edge concept drives local practice

Luo Nan, the person in charge of PRI China, said that different institutions have different power to join PRI. Some are external drives, and some are internal development and positioning. The reason why public funds join PRI mainly include: responding to the existing or potential needs of overseas customers, developing brands and competitive advantages, preparing for changes in future markets and supervision, and developing the development of responsible investment through the PRI platform, learning and participating in responsible investment.

"The six principles of PRI are guiding and encouraging. PRI does not think that there are all responsible investment methods that have the existence of four seas. The responsible investment policy, mechanism and process. "Luo Nan said," However, a obligation that must be fulfilled by the institution is to follow the requirements of the sixth principle of responsible investment principle. Each year reports to PRI to practice six principles. PRI provides a modular report template and online filling platform for the signing party. "

The six principles mentioned by Luo Nan, specifically, include incorporating environmental, social and corporate governance (ESG) issues into the investment analysis and decision -making process; become positive owners, integrate ESG issues to ownership policies and practice; request to be required The investment company properly disclose ESG information; promote the acceptance of the investment industry and implement the PRI principle; establish a cooperation mechanism to enhance the effectiveness of the implementation of the PRI principle; disclose the activities and progress of the implementation of the PRI principle.

In the interview, the reporter found that for the public offerings in the Mainland, joining PRI is mainly due to the attention of ESG investment, and we look forward to combining the concept of the industry with the frontier of the industry with local practice.

Southern Fund told reporters that companies with poor ESGs in investment portfolios can cause huge risk exposure. ESG Investment uses a more three -dimensional assessment of corporate value to eliminate the risk of tail in the combination. In addition, ESG investment will also consider the social costs overflowing by the company, re -examine the company's value creation and distribution of society, and truly screen out outstanding enterprises that can create economic value and can take into account social value.

"In 2018, we joined the UN PRI and promised to comply with the six principles of the UN social responsibility investment. The ESG factors were included in the entire process of investment. The combination of investment logic, "Southern Fund said.

Guangfa Fund said that my country has regarded carbon peaks and carbon neutrality as a major strategic decision -making and goal, which will promote new technological progress, lead new development methods, and give birth to new investment opportunities. Public funding funds can fully play the role of value discovery and asset pricing by fulfilling the principle of responsible investment (PRI), and promote the improvement of the development of investment companies in my country.

Improve the investment system and promote product innovation

Luo Nan believes that the ESG investment strategy adopted by Chinese public funds is not significantly different from the mature market, but there is still a gap between the development time and the stage of it.

"Chinese institutions can learn the best practices and advanced practices of mature markets, which can be reflected in the completeness of the responsible investment system and process, the transparency of the report, and the in -depth research and integration on ESG issues (such as climate change, climate change, change, In the issue of inequality, biological diversity, and SDGS), the cooperation between investors (such as investors jointly influence listed companies), as well as the initiative and enthusiasm of policy participation, "Luo Nan said.

As far as the current feedback of public offering agencies, after joining PRI, the institution has frequent actions in improving the ESG investment system and process, and it also has actively performing in terms of product innovation and distribution. Southern Fund told reporters that since the signing member of the PRI in 2018, in terms of ESG fusion, the Southern Fund has built a unique ESG investment system for the full -process ESG investment system of "pre -edge+event+afterwards". In the investment research of fixed income and cross -asset categories, the investment targets with excellent texture, outstanding ESG performance, and long -term value growth have been selected from various industries.

In order to improve the effectiveness of the ESG rating system, the company adopts a combination of qualitative and quantitative ways to select ESG investment indicators with high fundamental investment correlation, quantified and not reduced investment income, and use AI assisted data mining to use financial large financial large Data analysis supplements ESG news public opinion and major negative events, improves the efficiency and scope of ESG data acquisition, and realizes the integration of poly source data.

In terms of ESG investment management, the company has established an ESG organizational structure consisting of two levels of the ESG leadership group and the ESG working group. The first level is the ESG leadership group. deploy. The second level is the ESG working group, including four working groups: ESG integration, fixed income ESG fusion, risk management ESG fusion, and ESG products. The company also set up a sustainable development department as the leader and promoter of the entire Southern Fund ESG.

In terms of carbon neutrality, the company, based on the effective implementation of carbon emissions management and energy conservation and emission reduction measures, fully offset its own carbon emissions through procurement and cancellation of carbon offset indicators, becoming the first domestic operating system carbon neutralization Asset management company.

As of the end of 2021, the total scale of green investment under the Southern Fund reached 232.13 billion yuan, an increase of 130.695 billion yuan from the beginning of the year, an increase of 129%.

Guangfa Fund said that in the past two years, the company has attached particular attention to the construction of ESG investment capabilities, and hopes to guide listed companies and investors to the harmonious unity of economic benefits and social benefits through the evolution of the investment framework.

Specifically, the ESG Investment Leading Group is established to supervise and implement the ESG investment work; clarify the ESG investment process, establish an ESG investment basic evaluation system and screening indicators, and actively explore the integration of ESG investment concepts into the investment through quantitative and qualitative analysis methods. The framework is deeply integrated with research and investment decision -making; encourages ESG strategies to incubate, and continues to promote the integration of various types of investment combinations such as ESG investment and index, active quantification, and active fundamentals, and actively issue green investment theme products.

As of the end of the first quarter of 2022, the total size of the ESG Fund of Guangfa Fund has reached 29.3 billion yuan.

Responsible editor: tactics

- END -

The Federal Reserve's fierce interest rate hike "Domino effect": European and American stocks encountered vacant tide, the yen was sniped

21st Century Business Herald reporter Chen Zhi Shanghai reportAfter the Fed's significant interest rate hike 75 basis points caused the economic recession to worry about heating up, hedge funds once a...

"Good place" reappears "fireworks" "food+culture" detonation of consumption boom

Concerning Point News On the morning of June 17, 2022 China Yangzhou Huaiyang Cuis...