The loss of 38.05%during the year, Cai Songsong, the "gambler" fund manager, came to the edge of the "cliff"

Author:Kanjie Finance Time:2022.09.26

"The most sharp Mao in the market", Cai Songsong's words were slightly mad, leaving a deep impression on investors.

However, as the top -flow fund manager of the Noon Fund, Cai Songsong did say that this is "qualification" -in 2019, which is close to 100%of the investment yield, 18 months have made the Nuoan growth mixed fund of 30 times the size of the fund. Every result can be called "myth".

However, the fund has never lacked myths, and the fastest destroy is often these myths.

After achieving dazzling results in 2019 and 2020, since 2021, with the significant recovery of the semiconductor sector, the net value of Nuoan's growth and mixing has also experienced a significant retreat; and in 2022, in the context of a large retracement, it has been retracted. The decline in the growth of Nuoan has not stopped. As of the closing of September 22, Nuoan's growth has fallen by 38.05%during the year.

With the continuous recovery of Nuoan's growth and mixing in the past two years, Cai Songsong was also involved in the vortex: first, Zhuo Shengwei, who had been a card, was hotly debated by investors. The fund manager lost contact. "Although Cai Songsong and Noon Fund quickly clarified, it was clear that the fund manager who had been sought after by investors was now slowly discarded by investors.

Cheng Wang defeated, this is the only unchanged law of survival in the fund industry; from now on, Cai Songsong, who once rely on his outstanding investment results, has now gradually whispered.

The loss of 38.05%during the year, the most sharp Mao "folded"

"Don't make money, call me President Cai. If you lose money, call me a vegetable."

The above sentence comes from a post on the Internet in 2021. It is also this post that made Cai Songsong successfully lap.

However, before this post appeared, Cai Songsong was already famous in the industry.

According to the media, Cai Songsong is an out -of -the -box "genius". At the age of 15, he was admitted to the Chinese University of Science and Technology. At the age of 25, he took a PhD in chip design. After graduation, he joined the domestic independent core chip provider "Tianjin Tianjin "Feiteng", the future is bright; however, the genius teenager did not choose to continue deep cultivation in the chip industry, but chose to switch to the financial industry and become an industry researcher.

The unexpected choice allowed Cai Songsong to get a very high degree of attention, but from now on, this is just the beginning of Cai Songsong's "myth", and what really made Cai Songsong a top flow is still the fund manager and the Nuoan growth mixed mixed mix Later, achieved eye -catching results.

On February 19, 2019, Cai Songsong, who had been in the post of Nuoan Fund for two years, officially "transferred" to become a fund manager, and began to manage the growth of Noon with another senior fund manager Wang Chuanglian, another senior fund manager of the Noon Fund.

From the data point of view, after Cai Songsong began to take over, Nuoan's growth mixed has ushered in "transformation" -from 31.18%in 2018, it directly changed to 95.44%in 2019, and the ranking jumped from the bottom of the bottom to 7th. As a result, Cai Songsong became famous in the First World War. Due to his outstanding results, Cai Songsong began to manage Nuoan's growth and mixing separately in May 2020, and gradually grew into the "top card" of the Noon Fund.

However, Cai Songsong's brilliant achievements did not last long. In fact, as early as 2020, Nuoan's growth and mixed performance fell significantly. The earnings of the year were only 39.1%, which was significantly declined compared with the yield of 95.44%in 2019. By 2021, accompanied by semiconductors, accompanied by semiconductors The industry began to recover, and Cai Songsong ushered in the first Waterloo in his career.

According to statistics, after the highest net worth of 2.626 yuan on July 30, 2021, the Nuoan growth mixed will start sharply. By December 31, 2021, the net value of Nuoan's growth mixed fell to 2.118 yuan. Five months fell as high as 19.34%.

However, from now on, the decline in last year may be just the beginning of the growth of Noon's growth.

Since entering 2022, the growth of Nuoan's growth has begun to accelerate downward. As of September 23, Nuoan's growth has fallen by 38.05%during the year. Compared with high points, it has been cut. Mao's "Cai Songsong, which fell into the altar.

"Gambler" investment style, hit the south wall without turning back

In fact, the revenue of Nuoan's growth and mixed revenue is mainly related to Cai Songsong's investment style.

According to media introduction, Cai Songsong's investment framework is "1+2" mode: "1" is the direction of the top -level guidance, that is, the direction of national strategic support. Cai Songsong's investment model introduces very "high -end atmosphere", but this is not the case from the actual operation. In a sentence, the model of Cai Songsong is simply described as "all in semiconductor".

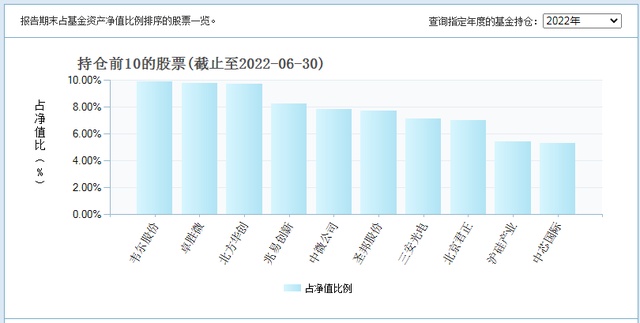

Judging from the data of the semi -annual report, all the top ten positions in Nuoan's growth mixed are all from the semiconductor industry, and the stock stocks cover the upstream and downstream of the semiconductor, which has become an indispensable "semiconductor fund".

In addition, from the control of the position, Cai Songsong's investment style is also very radical.

According to statistics from Xingye Securities, the position of the positioning of partial stock hybrid funds in recent years is about 80%, while Noon's growth has been mixed in the past two years, and the position has been maintained at more than 90%. Essence In fact, it is not difficult to understand Cai Songsong's investment choice -after all, as a doctorate in chip design, Cai Songsong has in -depth research on the semiconductor sector, and it is normal to configure most of the positions in the direction of semiconductor; however, every industry will be able to There is a cycle. After the sharp rise in the previous two years, in recent years, the semiconductor industry has gradually entered a period of recession. At this time, it is still unreasonable to choose heavy warehouse semiconductors.

Recently, when the semiconductor sector had been adjusted sharply, Cai Songsong continued to choose a position.

On September 14, the chip leader Zhuo Shengwei issued an announcement saying that the Nuoan Fund Management Co., Ltd.'s Nuoan Growth and Hybrid Securities Investment Fund has increased its shareholding of 519,500 shares. Stocks, accounting for 5.0065%of the stock.

According to media reports, since the second quarter of last year, the growth of Nuoan's growth has continued to increase its holdings. This is the six consecutive quarters of Zhuo Shengwei. On this road, Cai Songsong had decided to "hit the south wall and not look back."

The scale shrinks more than 6 billion, and there is not much time left to Cai Songsong

As a fund manager, Cai Songsong's "gambling" investment is actually not responsible for the foundation.

After all, many of the foundation people have a professional semiconductor research background because Cai Songsong has a professional semiconductor research background. I believe that Cai Songsong's professionalism has chosen to buy Noon and mixed; In addition, Cai Songsong does not have too many operations, and there is no obvious difference from ordinary small and medium investors.

In addition, although it is hailed as a semiconductor expert, it is embarrassing that the trend of Nuoan's growth mixed is not as good as the trend of semiconductor ETF.

According to data from the Tiantian Fund Network, the National Lian'an Semi -C Securities Semiconductor ETF (512480) has fallen by 35.05%this year, a decline of 38.05%of the growth of Nuoan's growth. The return semiconductor ETF's income in the past three years was 24.74%, while the income of Noon's growth mixed for nearly three years was 14.89%.

Affected by the sharp retreat of net worth, the size of the funds of Nuo'an's growth also declined significantly. From the data point of view, after the growth of Noon's growth in the fourth quarter of 2020, the scale of 32.776 billion at the largest period of net assets began to decline gradually. As of June 30 this year, the scale of Nuoan's growth mixed was 26.636 billion. Compared with the peak period, the scale has shrunk by more than 6 billion.

From the scale of the fund, it is not difficult to see that in the face of the former "top -flow" fund manager, investors have gradually lost their patience. Even under the circumstances that they have been clamored, many investors still choose to redeem.

In the fund industry, "the king defeats" is the only unchanged truth. Cai Songsong once succeeded quickly with the gambling semiconductor, but now it has quickly fell into the altar. Perhaps in some time in the future, Semiconductors will also go out of the market as rising as 2019, but it is obvious that there is not much time left to Cai Songsong.

- END -

Gathering to build a "new city of ecological industry" and "a demonstration zone for the integration of the city"!Zibo University Town built nests for the industry to enter the city

□ Zibo Daily/Zibo Evening News/Expo NewsReporter Shi DejianThere is no industrial...

Hebei Lizhou: 50,000 kg sold in 3 days!Live and bringing goods for rural rejuvenation

The oily peach hangs on the branches. Photo by Liu MingmingGreat Wall Network · J...