One week's solidarity research | The Federal Reserve ’s interest rate hike has limited impact on the debt market, and the convertible bond market or structural quotation

Author:Daily Economic News Time:2022.09.26

Last week, the news of the Fed's 75 -basis point in raising interest rate hikes again disturbed the investment community. In addition to affecting equity investment, bonds and futures bonds were also affected. For the domestic bond market, this round of interest rate hikes may further affect the selling emotions of the bond market. However, from the analysis of institutions, the Fed's interest rate hike has limited impact on the debt market.

In terms of convertible bonds, some institutions have pointed out that some industries have a low overall valuation and investment opportunities. Guoxin Securities analysis pointed out that many current factor factors (such as the normalization of epidemic disturbances, Fed's tightening, etc.) may have been reflected in the stock price, and the market's further decline is limited, and there is a structural market opportunity.

Photo source: Photo Network-500450700

Agreement in the bond market

Last week (9.19-9.25), the bond market showed a narrow shock market under the weak rebound. The main reason was that under the tight balance of the tax period and the cross-seasons, the central bank began to put on seasonal funds. Exchange, the gradual balanced supply and demand of funds.

In terms of funds, the central bank's open market last week invested a total of 100 billion yuan, with a total of 8 billion, and a net invested 92 billion. The seven -day reverse repurchase interest rate of the open market operation is 2%. The overall fund surface remains neutral. Last week, the pledged repurchase of overnight plus equity rate remained at 1.5%, and the pledge repurchase also remained at 1.5%overnight.

First -level market. Last week, a total of 21 interest rate bonds were issued, with a total issuance of 341.33 billion, and net financing of 149.62 billion. Among them, a total of 25.553 billion yuan was issued, net financing was 139.07 billion yuan, a total of 85.8 billion local bonds issued, and net financing was 10.55 billion. This week, the total interest rate bonds are expected to issue 108.44 billion yuan and net financing of 27.04 billion, which is at a low level compared to the previous weekly quota.

Secondary market. Last week, Ten Debt Active Coupon 220010 was in 2.6525-2.6975. In terms of monetary policy, in the open market operation, the central bank was lowered in the 2 billion days of inverse repurchase, and began to invest in the monthly liquidity of 14 days.

Looking forward to the market outlook, Dongfang Jincheng analysis pointed out that the downward pressure on the economy still exists. The core is that the downward momentum of the real estate is not stopped. At the same time, the weak consumption and the increase in export downward pressure are also worthy of attention. support. Based on this, it is expected that subsequent monetary policy will continue to maintain a loose orientation, especially in order to boost the recovery of the property market, the possibility of the central bank's restore interest rate reduction in the fourth quarter still exists.

Investment income of pure debt funds has improved

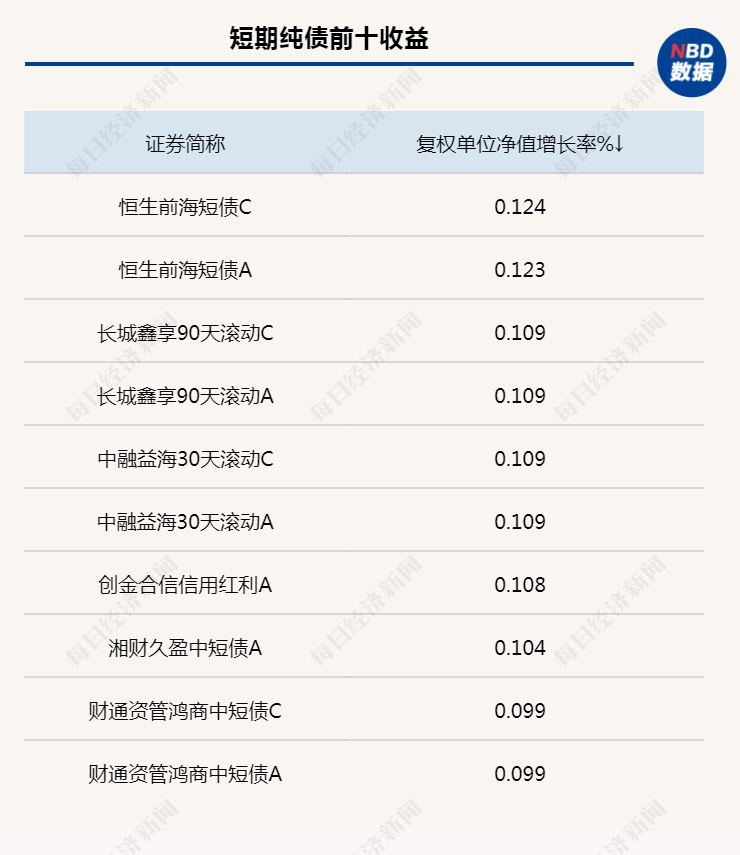

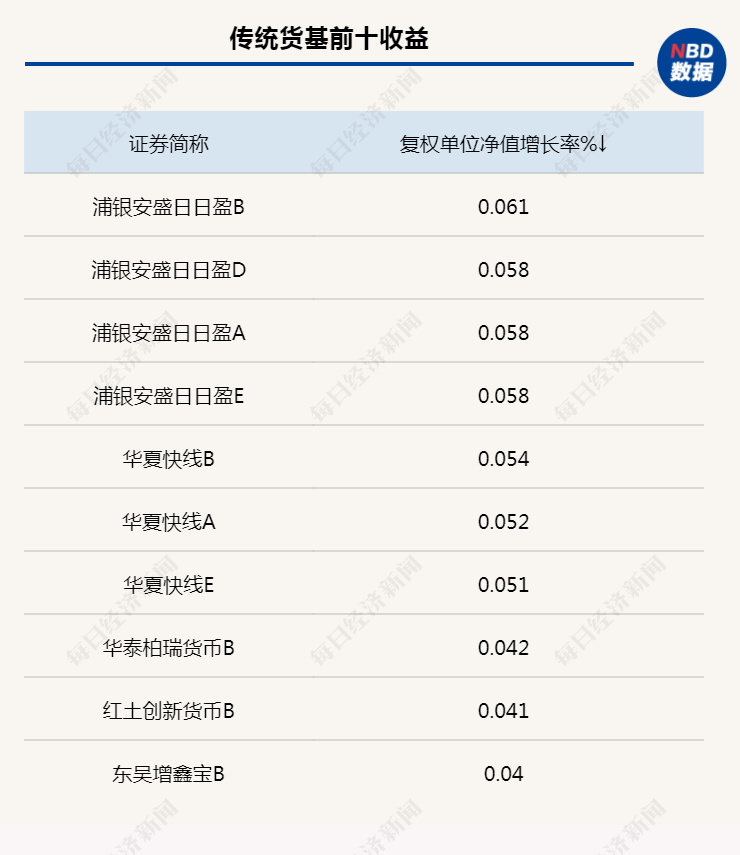

During this week, the yield of bond funds has increased from the previous week, which is mainly reflected in pure debt funds. Wind statistics show that the short -term pure debt fund index rose 0.03%during the week. ; The medium and long -term pure debt fund index rose 0.06%, which was significantly increased from the previous week.

In terms of rights base, the yields of mixed bond secondary funds continued to fall last week, but the decline in the week was narrowed. Statistics show that last week, the second -level fund index of the mixed bonds fell 0.26%, compared with the decline of more than 1%compared with the mixed bond second -level fund last week.

Source: Wind statistics (Time: 9.19-9.25)

In terms of subdivision, in the past half a month of research and statistics, among the above four major types of asset allocation, the income level has changed rapidly during the week, especially in terms of rights containing debt bases. The first ten sequences often change. Individual funds have been retracted this week, but the reasons for the analysis are both the reasons for further compression of the interest deviation, as well as the impact from the stock market callback.

In terms of bonds, from the expected debt data observation, the analysis of Oriental Securities pointed out that the overall period of bonds showed first and then declined. Last Monday, the central bank conducted a 14 -day reverse repurchase operation, and the scale of reverse repurchase in 14 days last Tuesday was increased. Last Wednesday, Russia issued a mobilization order, rising risk aversion, and period debt continued to rise. On Thursday, the Fed's statement was neutral, and the domestic bond market was slightly adjusted. Due to the continued upward of the US debt yield, the RMB exchange rate fell sharply on Friday. As of the close of September 23, the settlement price of the main contract for two, five, and ten years of Treasury futures was 101.19 yuan, 101.81 yuan, and 101.25 yuan, respectively, respectively, from the change of+0.055,+0.080 and +0.00 yuan compared with last weekend.

However, in terms of convertible bonds, some institutions give positive investment signals. Guoxin Securities analysis, according to the current stock price of current convertible bonds and the consistent expected net profit of Wind, calculate the static and static and profitable stocks (n = 299) with profit forecasts (n = 299). Dynamic valuation. PE (22E) the first -level industries include beauty care (60.25X), agriculture, forestry, animal husbandry and fishing (42.20X), social services (39.69x), food and beverages (37.33X), bank (5.37x) and business retail (14.50 X) The valuation of the positive stock of the convertible bonds is lower than the end of April.

From the perspective of Guoxin Securities, the valuation of most industries has been adjusted to a historical low. At present, many air factors (such as the normalization of epidemic disturbances, the Fed's tightening, etc.) may have been reflected in the stock price, and the market's further decline is limited. In the future, the market may gradually transition to find the demand for the fourth quarter and 2023.

Looking forward to the next trend of the bond market, Dongzhi Futures stated that it is expected that the bond market will face a certain amount of adjustment in the near future: the high -frequency data such as the recent bill interest rates is not bad, or it indicates that the various economic and financial indicators or marginal improvement in September; The pressure has not been fully released; in order to avoid the uncertainty during the National Day holiday, some institutions may reduce their holdings next week to hold the currency; However, due to the economic restoration or twists and turns, the adjustment of the bond market is relatively limited, and the possibility of strengthening in the mid -term. Federal Reserve ’s interest rate hikes have limited impact on the debt market

Last week, the news of the Fed's 75 -basis point in raising interest rate hikes again disturbed the investment community. In addition to affecting equity investment, bonds and futures bonds were also affected. For the domestic bond market, the Fed ’s interest rate hike or further affected the selling emotions of the bond market. However, from the analysis of institutions, the Fed's interest rate hike has limited impact on the debt market.

It should be pointed out that the reason why interest rate hikes will lead to the decline in the country's bonds because the face value and ticket rate of the bonds are fixed. The price of bonds is less than 100 yuan. In short, increased demand will promote the rise in bond prices, and decreased demand will lead to a decline in bond prices.

However, some analysts pointed out that although the Federal Reserve ’s interest rate hikes will reduce the price of bonds in the short term, bond funds will lose money, but for our country's bonds, the influence is less influence. The first is because China and the United States are two independent trading markets. Even if there is a certain impact in the short term, if our country has corresponding policies, the two will offset each other. In addition, the fund manager can adjust the position. The price may rise.

In addition, after the Federal Reserve has entered the interest rate hike cycle, our country still implements loose monetary policy. Then the bond trend is the same as before. If the Federal Reserve raised interest rates, our country also raised interest rates, and bonds would fall in the short term.

In this regard, the analysis of Tianfeng Securities pointed out that in combination with historical review, and then drawing on the Japanese market, we found that the continued inverted inverted domestic and foreign currency spreads does not necessarily cause the exchange rate to continue to depreciate. Promote market confidence. Logically, the economy is stable and interest rates can only be stable. So the problem is not the spread, but in our own.

Looking at the follow -up, considering that the Fed has raised interest rates to the limited interest rate level significantly higher than the neutral interest rate, we expect that the domestic demand in the United States will gradually fall after interest rate hikes, but the economy will still have a certain toughness and the possibility of rapid weakening. Inflation will still maintain a high level during the year. It is necessary to fall to 2%year -on -year from the end of the third to the fourth quarter of next year to the beginning of the fourth quarter of next year.

Daily Economic News

- END -

Zhucheng Technology IPO: The cash flow of business activities is continuously negatively negatively traded by the affiliated parties.

The cash flow of Zhucheng Technology has continued to be negative in the past thre...

[Shandong News Network] The final

Qilu.com · Lightning News, September 14th, the finals of the Great Power Craftsm...