The international financial environment has improved, and foreign exchange reserves have been reduce

Author:Huaxia Times Time:2022.06.08

Ran Xuedong

The State Administration of Foreign Exchange released data on June 7 showing that as of the end of May 2022, the scale of foreign exchange reserve in my country The end of April rose 8.1 billion US dollars, this data ended the previous four months of continuous decline.

In the rise of my country's foreign exchange reserves in May, the foreign exchange bureau's explanation is that in the international financial market, due to factors such as monetary policy and expectations of major countries, the prospects of global economic growth, and geopolitical situations, the US dollar index fell slightly. , The price of financial assets in major countries is fulfilled. The foreign exchange reserves in my country take the US dollar as the currency, and the non -US dollar currency is converted into the increase of the amount of US dollars, and the overall role of factors such as changes in asset prices has increased.

The US dollar index rose to the highest point of this round of 104.98 on May 16, and then began to fall, and the whole month fell 1.2%to 101.8. Non -US dollar currency against the US dollar appreciated. Among them, the euro rose 1.8%, the yen rose 0.8%, and the pound rose by 0.2%. To put it simply, in fact, it is the comprehensive role of factors such as exchange rate converts and asset price changes, which leads to rising foreign exchange reserves in May. So it is certain that in May, the phenomenon of continuous capital outflow may have become net inflow or general balance, which is very important for the financial market.

An important reason for the beginning of the US dollar to fall is that the US economic growth shows signs of slowing down. Many people even predict that the US economy may decline, and the inflation in the United States has also shown signs. The expectation of interest rate hikes may stop.

At the end of May, data released by the US Department of Commerce showed that in the first quarter, the annualized GDP annualized quarterly seasons of the United States shrinking 1.5%month -on -month, rather than the atrophy of 1.4%announced by the initial value, which is also lower than the expected atrophy of 1.3 1.3 %, For the first time in the middle of 2020.

The main reason why GDP is revised downward is the weak inventory and family investment. Family investment is mainly because real estate investment has begun to be weak. cautious.

But consumer expenditure was very strong. In the first quarter, consumer expenditure was repaired to 3.1%, which was higher than the initial value of 2.7%. Another indicator of US economic and health is the credit card consumption. According to the Federal Reserve ’s data on Tuesday, the US consumer credit has soared again in April, which has set a new record compared to the growth of March: the total amount of consumer credit increased by 38.1 billion from March 38.1 billion The US dollar, March data adjustment to an increase of 47.3 billion US dollars. Economists who were surveyed by Bloomberg expected that the median value of unwritten adjustment was increased by 35 billion US dollars.

Among them, the circular credit balance including credit cards increased by 17.8 billion US dollars, soaring to the second highest high since the record, and it has soared 25.6 billion US dollars in March;The balance of environmental credit increased by 20.3 billion US dollars. The annual rate of consumer credit is increased by 10.1%.

The US economy is a consumer economy. Consumption comes, indicating that consumer income increases, consumers have good expectations for future income, which will lead to economic inertia. Therefore morning.

The slowdown in investment caused by the Federal Reserve's interest rate hike is also to prevent the economy from overheating and inhibit inflation. This will allow the US economy to move towards soft landing. The financial market is undoubtedly a good news.

It is precisely due to the expectations of the US economy that the US dollar index has begun to adjust. At the same time, the surge in US Ten -year Treasury yield also began to adjust after reaching the highest point of this round on May 9, until the end of the month reached 2.71%. At the same time, China's ten -year Treasury yield has also declined, from 2.883%at the end of April to 2.756%at the end of May. In this round of downward, the difference between China and the United States narrowed, and even stopped inverted in the short period of time, which had a certain impact on the flow of domestic and overseas funds. This is one of the reasons why the Foreign Exchange reserves ended four months after the end of May, and then achieved positive growth.

Of course, factors such as the increase in foreign exchange reserves, exchange rate converts, and asset price changes are temporary. The long -term influencing factors are the difference between capital projects and the difference between cargo trade. Of course Change, for example, during the new crown period, my country has uniquely controlling the epidemic, and most of the new crown epidemic in the country abroad has spread, the production and life pauses, and China's exports make up for this gap, which has led to the prosperity of exports in the past two years and expanding its surplus.

However, with the further end of the epidemic, most countries resumed production and life, and the production and life of ASEAN countries such as Vietnam resumed the advantages of their labor force and other advantages. In the future, exports may return to normal, narrowing the surplus, and changes in foreign exchange reserves may be another scene, which must also pay attention to the domestic financial market.

Responsible editor: Meng Junlian editor: Ran Xuedong

- END -

Tai'an High -end Chemical Industry Chain: Aiming at the new track to promote the rapid development of star companies

Tai'an's high -end chemical industry chain adheres to policy -oriented, aiming at ...

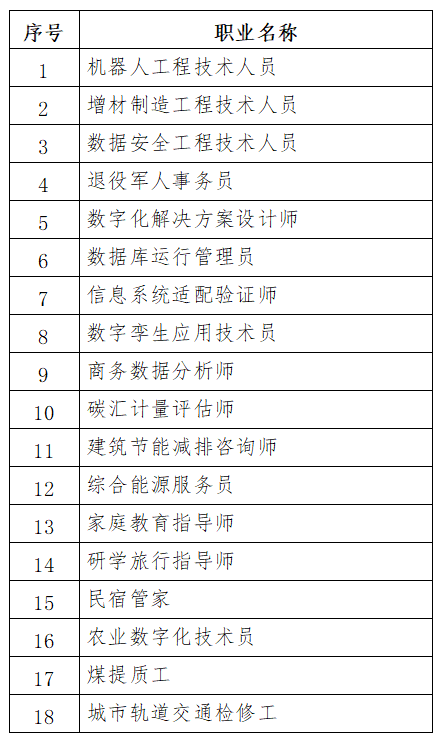

Research Travel Instructor, B & B Manager ... Let's see if these new professions are suitable for you!

In April 2021, the Ministry of Human Resources and Social Security, the State Admi...