What is the difference between 3100 points and 5 months ago?

Author:Capital state Time:2022.09.26

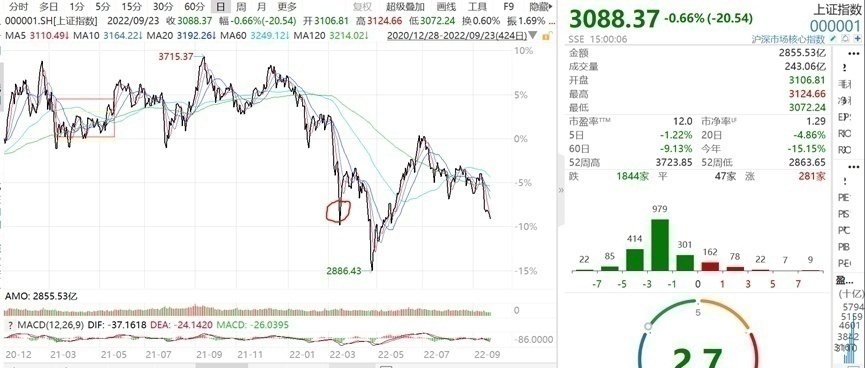

After the Shanghai and Shenzhen cities experienced a decline in the early morning, it once counterattacked the entire line under the fire in the afternoon. The three major indexes once became red. The incremental funds failed to follow up in time and caused it to fall again. Severe selling failures after continuous overcast falls, a small amount of funds can drive the market for a few minutes. The market for the market was 668.5 billion yuan, which was the highest value of the week. The reduction of the situation has not changed. The stocks still rose less throughout the day, over 4,200 shares fell.

As of the close, the Shanghai Index fell 0.66%to 3088.37 points, the Shenzhen Index fell 0.97%to 11006.41 points, the GEM index fell 0.67%to 2303.91 points, the science and technology 50 index fell 1.53%, the Shanghai Stock 50 index rose slightly by 0.02%; The transaction was 667.6 billion yuan, and the net sold of 506 million yuan in northbound funds was sold. The average market turnover of the market this week remained at 650 billion yuan, and after a shrinking trend of nearly 800 billion yuan a week, it further shrunk. The net outflow of the northbound capital was 506 million, of which the Shanghai Stock Connect was 681 million, and the net outflow of Shenzhen Stock Connect was 1.186 billion.

On September 23, the exchange rate of the RMB against the US dollar reached a new low, and the upcoming October's heavy meeting. The three major indexes were all challenging the bottom of April. The steady transaction reduced the transaction.

Data source: wind

Simple resume: Earlier this year, due to pessimistic expectations for growth and social integration, and rising interest rate hike expectations, the market fell from January to April. The back shock down to more than 2,800 points.

In April, the bottom of the economy was confirmed, and the heating of A shares continued until June, and the Shanghai Stock Exchange Index rebounded to more than 3,300 points. On the one hand, after the public health incident, the resumption of production and the recovery of consumption after the service industry is open. On the other hand, the growth policy is gradually effective, including real estate, automobiles, and infrastructure data. The abundant liquidity provides a good environment for the market rebound. When economic growth has just begun to recover but the center is not high and the liquidity is abundant, the difference between liquidity and economic growth is reflected in the active of the stock market.

There have been many disturbances since July, and the market has fluctuated in large fluctuations. The sporadic outbreak of public health events and lack of real estate credit.

Entering the decline in real estate sales in September, the growth rate of automotive retail sales rotated, and demand weakened. The economic recovery is not as good as expected, which prompts the market to continue to fluctuate down. This week's Shanghai Stock Exchange Index once again penetrated 3100 points, and this week has shrunk significantly.

Unlike the market optimism of the policy at the end of April, and the relaxation of the policy side, the current market is more concerned about the actual restoration of the economic end. In terms of the domestic economy, the decline in real estate sales in September expanded, the growth rate of car retail sales rolled, and demand weakened. However, it is also necessary to see the positive change of data. In August, the new social integration was 2.43 trillion yuan better than the market expectations. Although the new credit did not change much in the same period last year, the structure improved.

Looking back, the economy is expected to be disturbed in the short term, but the medium -term heating is not changed. The domestic macro liquidity is still relatively loose. The economic fundamentals are in a weak recovery state. There is no need to be pessimistic about the mid -term trend.

On September 23, as the market rose rapidly, Financial ETF (510230) and Securities ETF (512880) achieved a good rise. Financial ETF increased by 1.32%in the morning. After half an hour after the opening, the broader market fell quickly, and the Shanghai Index closed at -1.08%in the morning. After the afternoon, the large financial stocks showed their determination to protect the market, and banks and non -silver financial sectors increased.

Source: Wind

China Galaxy Securities stated that public health incidents have repeated, economic weak, and insufficient financing demand to put pressure on bank performance growth, but the growth policy is unchanged. The infrastructure is still an important starting point for boosting credit. The structural monetary policy increases the environment. In areas such as manufacturing and other fields are facing good opportunities, small and medium -sized banks with obvious advantages in some areas are expected to benefit from the improvement of credit margins. At the level of valuation, the current bank sector PB0.51 times is at a historical low, and the value of allocation of allocation is still vital to resolve the risk of loan.

In early September, economic data is better than expected, and the effect of low -base superposition policy growth is better supported and promoted in the formation of long -term investment and employment in infrastructure and manufacturing. The real estate and consumption remain to be repaired. The export data announced in the early stage has fallen, and the growth policy will continue. The 500 billion yuan special debt deposit limit will be issued before the end of October. Policy development financial instruments may continue to leverage investment. These policies may continue to promote the economy in August, which is conducive to bank stock markets.

In the context of lack of confidence in the market, the large financial sector showed unique anti -decline attributes. Before the October's heavy meeting, you can consider paying attention to the financial ETF (510230) to grasp the overall configuration value of the large financial sector.

On September 23, the game sector led a decline. The market was mainly concerned that the game business development in the next two quarters was not as good as expected (the preliminary version number was issued stagnation), the policy supervision changed, and the development of the Yuan universe was less than expected. In 2022, the stock price of the gaming sector has a large fluctuation, or mainly because: on the one hand, the continuous influence of the policies of the anti -induction policy of minors, mainly due to strict restrictions on the duration and paid of minors' games; After August 2021, the version number has not been distributed for a long time. The 2022 version number is issued normalized, but the structure lacks large companies and large projects. Until September this year, the fifth batch of game version number was released. Tencent and Netease this year In the first version number, small and medium -sized manufacturers still account for more. Data source: wind

According to the China Institute of Music Consistec (GPC) and the China Game Industry Research Institute, the "China Game Industry Report, January to June 2022" showed that the actual sales revenue of the Chinese game market in the first half of 2022 was 147.789 billion yuan, a year-on-year decrease of 1.8 %; In the first half of 2022, there were about 666 million Chinese game users, a year -on -year decrease of 0.13%. Judging from the latest data, the growth of users in the game industry has almost faded and entered the era of stock competition. The market is concerned about intensifying industry competition.

In the short term, the release of the domestic game version number has entered a relatively normal stage, and the rhythm and the number of reviews have been stable, which has driven the overall market emotions to recover further. Related games are expected to gradually release their performance in the next two years. Domestic games have also continuously expanded to new fields and overseas.

In the long run, entertainment is the rigid needs of the people. The gradually commercialization of the Yuan universe brings potential incremental space. As the concentrated point of the next generation of Internet technology and an important direction of the digital economy, its industrial space will gradually open. The game is generally considered to be the most likely to take the lead in achieving the "Yuan Universe" field, and it is expected to usher in a round of industrial revolution. As the supervision policy guides the industry to the high -quality development, domestic self -developed game products are constantly new, and the types of gaming gaming to sea are becoming increasingly diversified. The current sector's valuation is at a lower historical position, or has a long -term configuration value. You can follow the game ETF (516010) and the Shanghai -Hong Kong -Shenzhen ETF (517500).

In the end, there is a news to share with you. On September 26, the industrial mother machine ETF (product code: 159667) was officially issued. The issuance period was two days: September 26 and September 27. Industrial mother machines, such as their names, are machines that manufacture machines, are one of the most important tools for industrial production, and the cornerstone and cradle of the entire industrial system.

At present, the localization rate of high -end machine tools in my country is less than 10%. In the industrial parent industry, we mainly focus on high -end exports and low -end exports, and high -end machine tools are seriously dependent on imports. In 2019, the average import price of metal processing machine tools in my country was US $ 131,300 per unit, while the average price of metal processing machine tools exported was US $ 466.13 per unit, only 0.36%of the import average price. Only by transforming to high -end products can we improve product premium capabilities. In addition, high -end industrial parent machines are seriously dependent on imports, and their downstream are mainly high -precision areas such as aviation and military industry. Therefore, domestic replacement is urgent. Interested investors can pay attention to ETF (159667), a industrial mother machine released next Monday.

- END -

Provincial observation group enters Suining!Like the only in the province ...

This year is the implementation of Suining CountyThe first year of the pilot pilot...

Buyer consultant Qi Zhi Vietnam

For Wayne, the international trade like a river that is always flowing. Where ther...