The annual salary of 1.2 billion, Shen Hui "eat poor" Weima?

Author:New entropy Time:2022.09.26

Recently, in March this year, the IPO's zero -run, announced that it will be successfully landed in Hong Kong stocks at the end of September, and only submitted the IPO 3 months later than zero. Waiting for listing hard, but his founder Shen Hui has recently fell into a controversy of "high price".

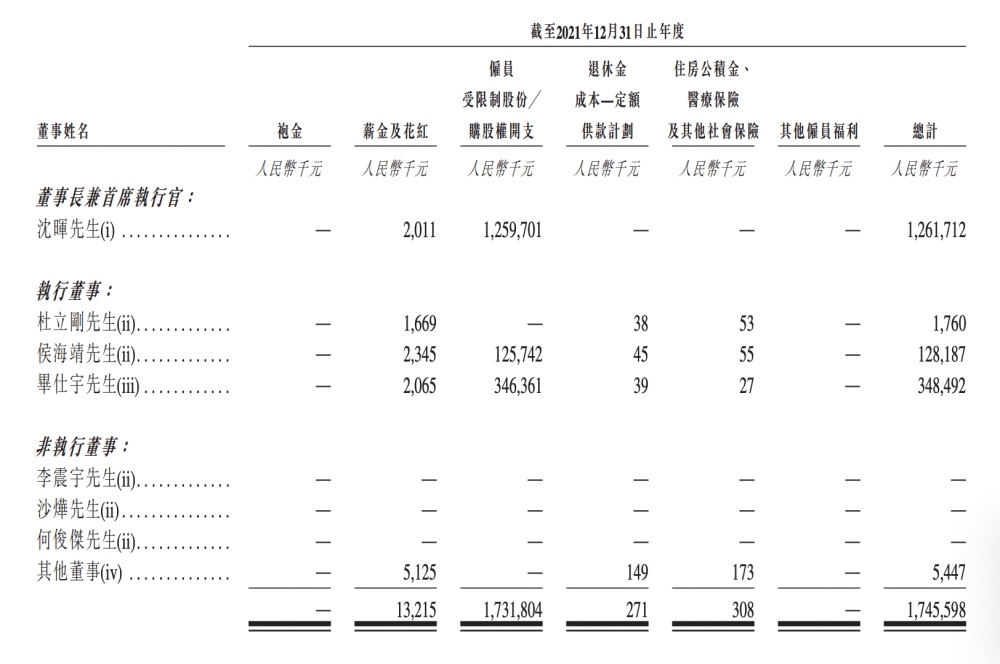

According to the Weimar Prospectus, Shen Hui, the founder, chairman and chief executive officer, was a salary of 1.26 billion yuan in 2021. Compared with 2020, its salary increased by 777 times. However, in the past two years, Wima's financial situation is worrying, not only continued to fall into losses, but also the sales volume has continued to fall behind.

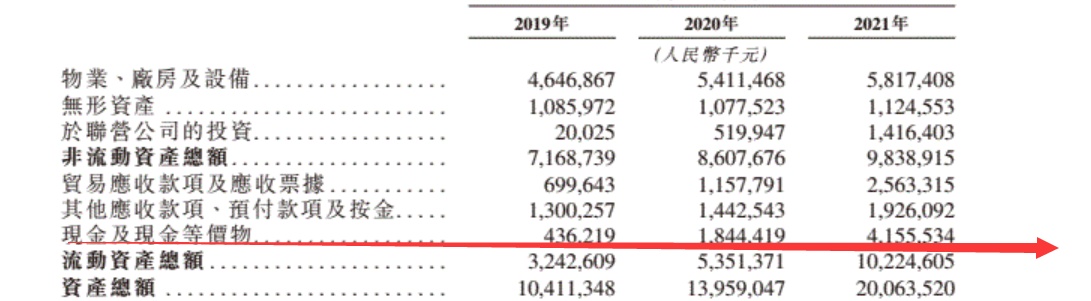

The first is revenue data. According to the prospectus, from 2019 to 2021, Weimar's revenue was 1.7621 billion, 2.671.7 billion yuan, and 4.7425 billion yuan; net losses were 4.145 billion yuan, 5.084 billion yuan, and 8.206 billion yuan. The cumulative loss of 3 years is as high as 17.435 billion yuan.

As of December 31, 2021, Weimar's cash and cash equivalents were 4.156 billion yuan. In conjunction with its operation and investment of about 4 billion yuan in expenditure, if Wima was not able to go public, or got a new new market, or got a new new market, or got a new thing In financing, the company will soon encounter the embarrassment of nothing in the bag.

Weima also stated in the prospectus, "If you fail to obtain sufficient financing in accordance with acceptable terms, it may have a major adverse effect on our business and business performance."

Behind the cash flow is so tense, the sales volume of Weimar has fallen behind year, and the gross profit margin that is difficult to mention. Let's look at its sales in recent years. In fact, in 2019, Wima had boarded the "List 2" of the new forces of the new forces at the time of the delivery of 16,876 vehicles at the scale of 16,876 vehicles, second only to Weilai.

Perhaps based on such a good result, Wima had applied for listing on the science and technology board at the end of 2020. Unfortunately, only 4 months later, Weimar took the initiative to withdraw from the listing application. related. Since then, Wima's results have been behind year -old.

In 2020, Weimar ranked in Weilai, ideals, and Xiaopeng with the scale of delivery of 22.495 million vehicles, and became the "List Four" in the market; in 2021, Wima was rising brands such as Nezha and Zero Run. Getting out of the limelight, ranking fifth in the market, after the gap between Xiaopeng, Weilai, ideal, and Nezha, the gap between zero running is only in the slightest.

In the first half of 2022, Wima's "drop behind" was even more obvious. After not only in Weilai, ideal, Xiaopeng, Nezha, and zero running, but also the delivery scale of 21,700 vehicles, which ranked fifth in the fifth. The delivery scale of 50827 vehicles in the name Weilai is almost half less.

As the first profit -making brand in the new car, Tesla President Musk once used "massive hell" to describe the life and death of new car companies, that is, only by opening the sales scale as soon as possible and realizing mass production can we reduce the car manufacturing The marginal costs achieve profitability and survive.

The founder of Weilai Li Bin and the founder of Weimar Automobile have all stated in public that the annual sales volume of 100,000 vehicles is the "life and death line" of many new forces of cars, but at present, Weima is still trapped in "mass production production In Hell ", it is in the dilemma of" selling one, losing one ".

From the data of Weimar's prospectus, from 2019-2021, its gross profit margin is -58.3%, -43.5%, and -41.1%, respectively. Compared %, 12.5%, and 21.3%gross profit margin, Weimar's loss is even more worrying.

Because of this, under such a bad financial situation, the founder Shen Hui won the salary of nearly 30 % of the salary of Veima's income last year, which made the market feel "bizarre". As a comparison, Xiaopeng and his ideal family members He Xiaopeng and Li Xiang, their annual salary was 1.352 million yuan and 1.504 million yuan, respectively.

Although soon, some people in the industry came out, saying that 1.26 billion yuan may not be the salary of Shen Hui. Because this includes two parts: ordinary salary and restricted shares. Among them, the ordinary salary of about 2 million yuan is Shen Hui's actual income. Early income.

Nevertheless, once Wima successfully listed, Shen Hui will be able to win 1.2 billion yuan in dividends. Although, as the founder of the brand, without Shen Hui, there was no Wama, but in the development of Weimar's many years, Shen Hui did not seem to lead the giant wheel to the way.

On the one hand, the gross profit margin of Wima is not allowed to "turn right" as an example, and behind it is Wima's endless sales expenditure "black hole". In the past three years, Weimar's annual sales costs have increased significantly, with 2.788 billion yuan, 3.834 billion yuan, and 6.689 billion yuan, respectively, about 1.4 times the total revenue.

However, in contrast, its investment proportion decreased year by year, with 892.8 million yuan, 992.1 billion yuan and 981.2 million yuan, respectively, accounting for 50.7 %, 37.1 % and 20.7 % of the proportion of revenue during the period.

The reason why the first model of Wima's first model EX5 was able to be related to the "List 2" of the current year, which is largely related to the marketing. The less consumer calls "can't understand", which may even be the reason why it pays high -priced sales costs, but it cannot be exchanged.

For example, Shen Hui once came to the stage on the stage on "Weima Changshen Day", and even touched the porcelain Tesla. Make complaints. On the other hand, the poor sales of Wima have something to do with its influential positioning. Since Wima accepted Baidu's investment in 2017, its subsequent models have been implanted with Baidu's Apollo autonomous driving system, and Wima has also become the supporter of "autonomous driving".

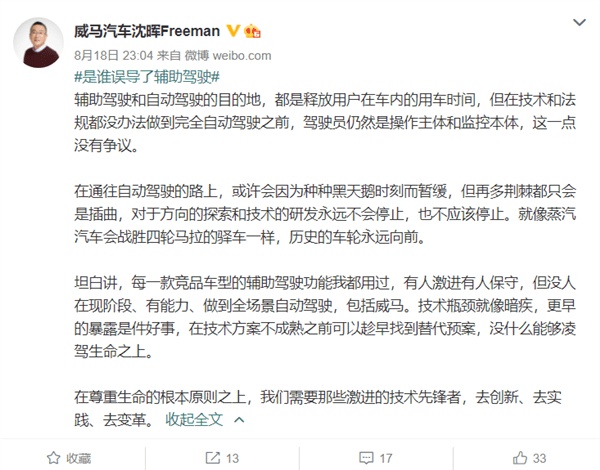

However, after a auxiliary driving accident in Weilai, Shen Hui posted that "no one can do the autonomous driving of the whole scene at the moment." Such an uncertain attitude made Weimar's brand positioning more embarrassing.

Compared with the "spring" of the capital market in 2019, many new car companies even have "bleeding and listing", and the market will be more tolerant of them at that time. However, in a more stringent investment environment at the moment, if the new car is still trying to go public through "blood transfusion", it is probably difficult to do it. The capital market not only requires stories, but also actual performance.

It is true that Shen Hui is in Weima, and even the entire car circle has special significance. Shen Hui, who came out of traditional car companies, is different from the three founders of "Wei Xiaoli" with the three self -Internet genes. Shen Hui can be regarded as a test of the domestic traditional automobile industry for new energy vehicles.

It was close to the "Year of Destiny" to start a business. Shen Hui needs to forget, or it has represented Geely Automobile to talk about the glorious history of domestic car companies' first acquisition of well -known foreign car brands. However, whether Shen Hui can make a new opportunity in the new energy vehicle market, it obviously requires more efforts and attempts.

Prior to this, help Weimar "stop loss" and then talk about listing dividends, or make people feel more comfortable. Intersection

- END -

Ninghai Gejia Village opened the "Village Bao Entrepreneur Season" Renmin University of China "Professor Professor of Pants Foot" to teach the Entrepreneurship

Mobilize the conference site.Gejia Village has entered the second three years. Our...

Bejet: The total amount of the three projects won 103 million yuan

On July 7, Capital State learned that A -share company Bergat (300774.SZ) announced that the In shortlizer notice from Sinopec International Business Co., Ltd. was received. It was 103 million yuan,