Northbound funds buy over 4.2 billion yuan in institutions say "every squat may be involved in a good opportunity"

Author:Securities daily Time:2022.09.26

Our reporter Zhao Ziqiang on September 26, the three major indexes of A shares were lowered, and the Shanghai Index was once a red disk. The turnover of the two cities remained low. Can A shares stabilize after continuous decline? As of the closing of September 26, the Shanghai Stock Exchange Index fell 1.20%to close at 3051.23 points. ; Northern Wells Capital bought 4.277 billion yuan; in general, A shares rose more, rising to 924 stocks, and 3964 stocks. In terms of application in the industry, 7 categories of 31 industries rose, accounting for 22.58%. Among them, the beauty care industry rose to 2.02%. The third place; the biggest decline is petroleum petrochemical, with a decline of 4.23%. In addition, the decline in the defense military industry, steel, coal, agriculture, forestry, animal husbandry and fishing industries also declines exceeded 3%. On the day, 44 stocks were closed at a daily limit. Among them, there were 12 daily limit stocks, and the stock price had risen more than 2 trading days. In terms of limit, 44 stocks have been closed for daily limit. From the perspective of the industry, the number of daily limit shares in the industry of household appliances, machinery and equipment, and power equipment is among the top three, and the number of daily limit shares is 5; the number of daily limit stocks in the automotive industry is the top of 4. Table: Rising for 2 consecutive days, and the closing daily limit shares today. Watch: Zhao Ziqiangjunmao Capital partner Qiu Xiaoguang said that the Fed continues to raise interest rates sharply. Although it has fulfilled the pre -market expectations, at the same time, people's economic recession of the US economy decline in the US economy. Worry is also increasing. Therefore, after the latest issue of overseas interest rate hikes, the stock market did not stop falling due to the expected market expectations. In terms of the domestic market, the domestic macroeconomic economy is still in a recovery pattern in the past two months, and the macro fundamentals of major economies of peripheral economies may enter the accelerated downward period, and the market confidence is relatively fragile. After the market enters the risk aversion model, state -owned enterprise stocks with low valuations, high dividends, and stable performance have won the favor of funds, and the new energy sector that has previously led and the leading white horse stocks with higher correlation with macroeconomic operations. Zhou Gongguang, Director of Investment, said that the current market is still running in the second half of the bear market since February 2021. At present, the market valuation is in low -level areas, and in the short term, it is still in the "zooming shock and shade to find the bottom." The market outsole still needs time and space. For the market outlook, Liu Jixin, assistant to the manager of Rongzhi Investment Fund, said that we are not pessimistic about the future of A shares. The current stock market has basically reached the bottom, and each squat may be a good opportunity. In terms of specific strategies, we suggest that investors choose the high prosperity industry to involve high, and do not chase high. The 6 consecutive Development Environmental Protection rose on September 26, and the environmental protection of Dechin rose 10.04%to 14.36 yuan. Since September 19, the stock has risen for 6 consecutive trading days as of September 26, with a cumulative increase of 19.47%. The latest A -share market value of the stock is 2.981 billion yuan, and the market value of A -share circulation is 2.901 billion yuan. According to the public information released by the Shanghai and Shenzhen Exchange on September 26, 2022, the Dragon Tiger List was on the Dragon and Tiger List because of the securities with a departure value of 7%of the day. According to public information, the main business of Germany's environmental protection is smoke governance and solid waste governance. The company's flue gas treatment products include desulfurization equipment, dust removal equipment, denitration catalysts and regeneration. The product series is rich and flexibly meets the demand for exhaust emission reduction needs in different industries such as thermal power, steel, chemical industry, ships, building materials, and metallurgy. The company is a comprehensive service provider in environmental protection in domestic and overseas markets. Its products and services mainly cover the three sections of fust and waste treatment, water treatment and expansion. The company is a comprehensive service provider in the field of domestic flue gas management. The company is one of the few domestic key products that can produce desulfurization equipment, honeycomb peace plate denitration catalysts, and wet static dust collectors. It can also provide high -tech enterprises that can provide flue gas treatment engineering services. On September 26th, the beauty care industry led the beauty care industry in the industry in the industry, with an increase of 2.02%. 7 of the 28 stocks in the industry rose, accounting for 25%, of which the two stocks increased by more than 5%. Regarding the investment opportunities in the beauty care industry, the first securities stated that Li Jiaqi lived on the first day of the live broadcast room, and launched the Venona product on September 22. On the 23rd, Mibeir appeared in the live broadcast room. With Li Jiaqi resumed, it greatly boosted the market's confidence in the double eleven performance of the cosmetics of its main cooperation sector. Since September, major brands have actively listed new products and launched publicity activities for cooperative stars. The preheating double eleven promotion is expected to enter the peak season for cosmetics sales in October. Perlaya, Betai, and Huaxi creatures will be fully benefited. East Asia Qianhai Securities stated that he seized the opportunity of short -term callbacks and layout high -quality head listed companies. We are firmly optimistic about the medium and long -term growth of the medical beauty and cosmetics industry. In the background of the industry compliant and promoting the superimposed epidemic, head companies or use their brands, qualifications, markets, supply chains, and funds to expand their market share. Continue to be optimistic about Beati, the leader of the injection light medicine and beauty medicine, and the leading position in domestic anti -sensitivity skin care products, the relevant targets include Perlaya, Huaxi Biological, Haohai Shengke, and Lu Merchants Development.

Picture | Site Cool Hero Bao Map.com

The central bank enlarged the move!The net inflow of funds in the north is more than 4.2 billion yuan in institutions: look at less and patiently waiting for the market to stabilize

What do we do in the next step of my country's infrastructure construction?The latest authority of the Development and Reform Commission has responded!

- END -

From a box to a discount to selling the "Super Peasant Season" market?

Our reporter Jianyue ShiluRecently, popular routes are the decline in futures prices. The reason, on the one hand, the number of domestic export orders has decreased year -on -year; on the other hand

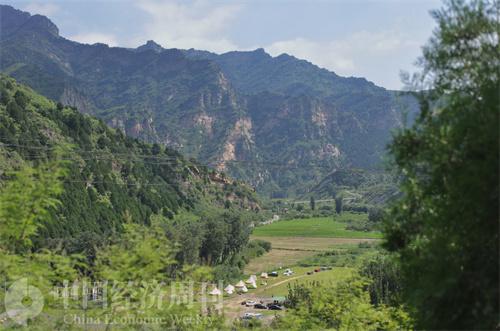

No trace camping

China Economic Weekly reporter Xiao Yan | Beijing Photography ReportSet up the sky...