Baya Tea Industry again fights IPO, only 11 R & D personnel. Can it be difficult to break the listing of tea companies this time?

Author:Radar finance Time:2022.09.26

Radar finance produce | Li Yihui edited | Deep Sea

The eight -horse tea industry, which has been hovering outside the capital market for many years, has opened a listing journey.

On September 22, according to the CSRC, Baza Tea Co., Ltd. (hereinafter referred to as "Bazha Tea Industry") disclosed the prospectus and intends to be listed on the main board of the Shenzhen Stock Exchange.

As early as 2013, Bama Tea Industry once sought to list on the small and medium -sized boards of the Shenzhen Stock Exchange, finally chose the New Third Board, and ended its listing in April 2018. On April 15, 2021, the Baya Tea Industry GEM was accepted, but after three rounds of inquiries, IPO applications were withdrawn on May 10 this year.

After the last GEM, the main board of the eight -horse tea industry was increasing from 683 million yuan to 10.08 billion yuan. In terms of financial data, from 2019 to 2021, the revenue of Bama tea industry was 1.023 billion yuan, 1.266 billion yuan, and 1.744 billion yuan, respectively, and the net profit attributable to the owner of the parent company was 91.8816 million yuan, 116 million yuan, and 163 million Yuan.

In addition, Bama Tea is a typical family -style enterprise. Recently, the "giants marriage" of Tobe and the seven wolf also brought the marriage relationship between the founder of the Eight Horse founder Wang Wenbin and other companies in Fujian.

Increased inventory amount increases

According to the prospectus, Baya Tea is mainly engaged in the research and development design, standard output and brand retail business of tea and related products.

At the beginning of the establishment, the company focused on R & D, production and sales of Anxi Tieguanyin tea. After years of development, its products have shifted to full category tea and implemented franchise models to achieve cross -regional operations.

As of now, the company has established channels and own brands of "direct -operated+franchise", "online+offline", and the products cover Oolong Tea (Tieguanyin, Rock Tea, etc.), Black Tea (Pu'er Tea), Black Tea, Green Tea (Longjing), re -processed tea and other category of tea, as well as related products such as tea sets, tea foods.

According to data from the China Tea Circulation Association, before 2015, the average annual growth rate of the total domestic sales of tea in my country was double -digit; from 2016, the industry growth began to slow down. In the past 2021, the total number of domestic tea domestic sales reached 2.3019 million tons, a year -on -year increase of 4.56%; the total sales reached 312 billion yuan, an increase of 8%.

However, at present, the domestic tea market is relatively scattered and the industry concentration is low. The prospectus quoted the data of the China Tea Circulation Association. According to the sales data of various disclosed sales, the market share of Tianfu Group, Lancang Ancient Tea and Bama Tea in 2021 was 0.45%, 0.16%, and 0.48%.

In terms of performance, from the quarter of 2019 to 2022, the operating income of Bama Tea industry was 1.023 billion yuan, 1.266 billion yuan, 1.744 billion yuan, and 451 million yuan, and the net profit attributable to 91.8816 million yuan, 116 million yuan, 163 million yuan, 163 million yuan Yuan, 45.1469 million yuan.

On the sales side, the company's omnichannel sales model of "direct -operating+joining" and "online+offline", of which the offline franchise model sales accounted for more than 60%from 2019 to 2021, and the offline direct -operated direct -operated operating direct -operated direct -operated operations The proportion of sales has gradually decreased, and the proportion of online sales in direct business models has gradually increased. Taking the data in the first quarter of this year as an example, the company's offline franchise sales accounted for 56.41%in the first quarter; in the direct -operated model, offline direct sales accounted for 13.42%, and online sales accounted for 30.05%.

As of the end of the reporting period, the number of offline stores in the company exceeded 2,700, of which 400 stores had a total of 400.

During the reporting period, the gross profit margin of Bama Tea Industry was 53.66%, 53.49%, 54.03%, and 55.85%, which were basically stable. From the perspective of products, oolong tea has the highest gross profit margin, followed by black tea and white tea. According to channels, the gross profit margin directly operated offline is the highest, followed by online sales, and finally the offline franchise model.

It is worth noting that the inventory of Bama Tea industry accounts for relatively high inventory, and the amount has increased year by year. According to the prospectus, from 2019 to the first quarter of 2022, the company's book has a book value of 209 million yuan, 320 million yuan, 350 million yuan, and 380 million yuan, respectively, accounting for 43.46%, 54.27%, 50.84%, and 50.84%. 56.08%.

The company said that the company's account value increased year by year, and the company said it was mainly due to the growth of inventory goods. For example, as of the end of March 2022, the growth contribution rate of inventory goods was 103.72%, which mainly carried out some of the Pu'er tea strategic inventory reserves.

Compared with Chinese tea and Lancang ancient tea equivalent, the inventory products of Bama Tea Industry are also significantly high. The prospectus explained that the production model of the above two companies is mainly independent production, and the size of the raw materials in the inventory structure is relatively large in products and semi -finished products.

In addition to the independent production of oolong tea such as Tieguanyin and some rock tea, the remaining products are mainly based on custom procurement, which makes the company's inventory structure in the center of raw materials, the size of the product, and semi -finished products is relatively small. During the reporting period, the products sold by the company accounted for more than 50%of the products sold.

In terms of R & D investment, from 2019 to 2022, the company's expenditure was 5.702 million yuan, 3.2801 million yuan, 66.41 million yuan, and 148.85, respectively, accounting for 0.56%, 0.26%, 0.38%, and 0.33%of operating income, respectively. Essence

As of the end of March this year, the company's R & D staff had a total of 11 people, accounting for 0.49%of the company's total; 6 core technicians, including two actual controller Wang Wenli and Wang Wenchao brothers. In contrast, the company's sales expenses are much higher than that of R & D investment, and the proportion of revenue is higher than those of comparison companies. Specifically, from the quarter from 2019 to 2022, the company's sales costs were 358 million yuan, 429 million yuan, 576 million yuan and 155 million yuan, respectively, accounting for 35.02%, 33.85%, 33.04%, and 33.04%, respectively. 34.37%.

During the same period, the average sales rate of the company's sales expenses was 25.69%, 22.62%, 22.10%, and 22.86%, respectively, below the eight -horse tea industry.

Family corporate characteristics are obvious

From the perspective of controlling equity, Bama Tea is a typical family business.

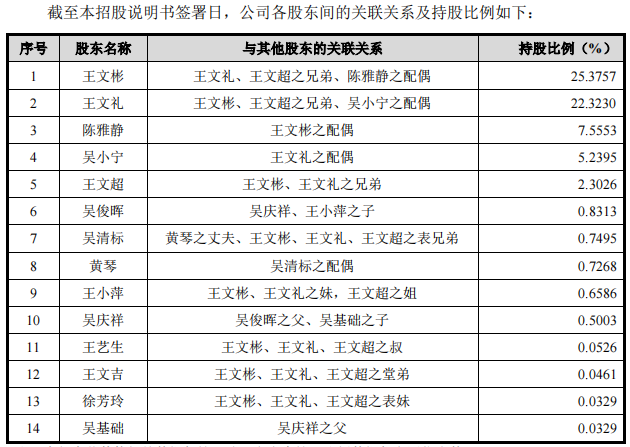

According to the prospectus, the company's controlling shareholder and actual controller Wang Wenbin, Wang Wenli, Wang Wenchao, Chen Yajing and Wu Xiaoning. Wang Wenbin, Wang Wenli, and Wang Wenchao are brothers, Chen Yajing is Wang Wenbin's spouse, and Wu Xiaoning is the spouse of Wang Wenli. Before the issuance, five people held a total of 62.80%of the company's shares.

Radar Finance sorted out the prospectus and found that in fact, the relationship between the management of the eight -horse tea industry and the relatives at the shareholder level will not be there.

For example, Wu Qingbiao, director and general manager of the company, holds 0.75%of the shares before the issuance. It is a cousin relationship with Wang Wenbin, Wang Wenli, and Wang Wenchao; Wu Qingbiao's wife Huang Qin also holds 0.73%of the equity before the issuance.

At the same time, Wu Qingxiang, director and deputy general manager who holds 0.5%of the company, is the spouse of Wang Wenbin and Wang Wenli's sister and Wang Wenchao's sister Wang Xiaoping. Holding 0.66%.

In addition, Wang Yisheng, a core technical personnel and 0.05%of the shares, has the relationship between Wang Wenbin, Wang Wenli, and Wang Wenchao; Wang Wenbin, Wang Wenli, Wang Wenchao's cousin Wang Wenji, holding 0.0461%of the equity before the issue; Cousin Xu Fangling, holding 0.0329%before the issuance.

In terms of office, Wang Xiaoping served as the product director of the Tea Equipment Division; the general manager of Huangqin E -commerce Division; Wu Xiaoning served as the director of the company's engineering department from September 2014 to June 2021.

Although the relative relationships between the company's shareholders are intricate, in August 2019, the controlling shareholder, actual controller and Wang Xiaoping negotiated the "Consensus Action Agreement". During the reporting period, only Wang Xiaoping and the controlling shareholder and actual controller were previously shareholders. All decisions are maintained in the conference.

At the board level, in addition to the three independent directors and directors He Lei, the other five directors have a relative relationship with the founder Wang Wenbin, which further reflects the company's typical family business attributes.

It is worth noting that the news of the marriage of the children of the two companies, the two companies of the two companies, rushed on Weibo to search on Weibo, and many netizens called it "strong union."

Tianyancha shows that Tsob and Seven Wolfs are from Fujian. According to media reports, marriage between well -known companies in Fujian is more common.

In addition to the second daughter Ding Jiamin, the second daughter of the CEO International CEO, Zhou Liyuan, the son of Zhou Shaoxiong, the son of Seven Wolf Chairman, also has the children of the founders of the founders of Jiuli, Anta, Gaoli Group, and Baba Tea. Essence

For example, at the beginning of 2020, Wang Wenbin, one of the actual controller of the Ba Ma Tea Industry Wang Wenbin, and Ding Shizhong, the chairman of the Board of Directors of Anta Group, held a wedding at the Xiamen International Conference Center. Some insiders said that Wang Yanheng and Ding Qing met during the study abroad.

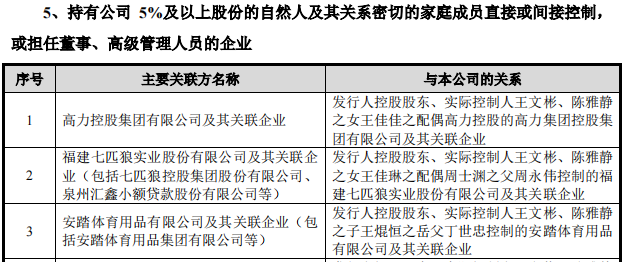

The prospectus also disclosed this relationship. Except for Wang Yanheng, the marriage objects of Wang Wenbin's two daughters are well -known entrepreneurs or entrepreneur children.

Among them, Wang Wenbin and the Queen of Chen Yajing's Queen Jiajia married Gao Li, the actual controller of Gaoli Group Holdings Co., Ltd. In August 2020, Gao Li's father Gao Shijun appeared on the Hurun Wealth List with a net worth of 6.5 billion.

The husband of Wang Wenbin and Chen Yajing's other thousand gold king Jialin is Zhou Shiyuan, the son of Zhou Yongwei, chairman of the Board of Directors of the Seven Wolf Group Co., Ltd., and Zhou Liyuan's cousin.

The prospectus shows that Anta, Seven Wolfs and Gaoli Group have a small amount of affiliated transactions with the Baza Tea Industry, and the other party does not hold the shares of the main body of the listed entity.

Why is it difficult for tea companies to break through the IPO?

Tianyancha shows that Baya Tea Industry was established in 1997. During the period from 2014 to 2021, the company disclosed a total of 4 financing. Investors include IDG Capital, Tiantu Investment, Tongchuang Weiye, Shenzhou Venture Capital, One Three Capital, etc. Essence

Although it is earlier with the capital market, it is not easy to achieve public listing.

According to public information, in 2013, Baya Tea Industry sought for the first time on the Shenzhen Stock Exchange, but finally traded on the New Third Board in 2015. In April 2018, Baza Tea Industry terminated its listing on the New Third Board and continued to impact A shares IPOs.

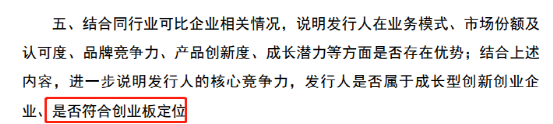

In July 2019, Baza Tea Industry announced the information on A -share counseling filing information, and submitted a prospectus to the GEM of the Shenzhen Stock Exchange in December 2021. But after three inquiries, the company withdrew the GEM for listing.

From the perspective of the outside world, this is related to the insufficient innovation attributes and the gap between the GEM. In the inquiry letter of the GEM issuance committee, it focuses on whether Baza Tea Industry is a growth innovative and entrepreneurial enterprise and whether it meets the positioning of GEM. In addition, according to the "Reporting and Recommended Interim Regulations of the Shenzhen Stock Exchange GEM Enterprise Enterprises", the "wine, beverages and refined tea manufacturing" belongs to the GEM recommendation temporary provisions of the "negative list" forbidden to enter the industry.

Baya Tea Industry has positioned itself as "the research and development, design, standard output and brand retail business of tea and related products, instead of" refined tea manufacturing ". For this, the issuance committee requested the issuer to supplement the rationality of such positioning.

In fact, tea companies are not listed smoothly, and Baza Tea is not the first. Previously, Lancang Ancient Tea was restructured in Hong Kong stocks because of the termination of A shares. Chinese tea disclosed in 2020 that the prospectus intends to land on the Shanghai Stock Exchange Main Board has not moved so far.

Longrun Tea, which was listed in Hong Kong stocks before, has been retired in 2021. At present, Hong Kong stock tea companies have only one Tianfu Group. "Said.

According to Zhu Danpeng, vice president of the Guangdong Food Safety Promotion Association, the traditional tea industry has not yet entered a stage of standardization, professionalization, branding, capitalization, and large -scale. At present, the overall operation of Chinese tea companies is not standardized. Internal audit and original materials need to be adjusted to meet the needs of listing.

Some investment banks believe that China is vast, and different economic levels and dietary habits have created different tea culture. They have their own representative varieties, such as Longjing, Anxi Tieguanyin, Yunnan Pu'er, etc. National brands have caused the embarrassing status of "category and no brand".

From this point of view, even if the eight -horse tea industry has come again, it is still uncertain whether it can solve the problem of the listing of tea companies.

- END -

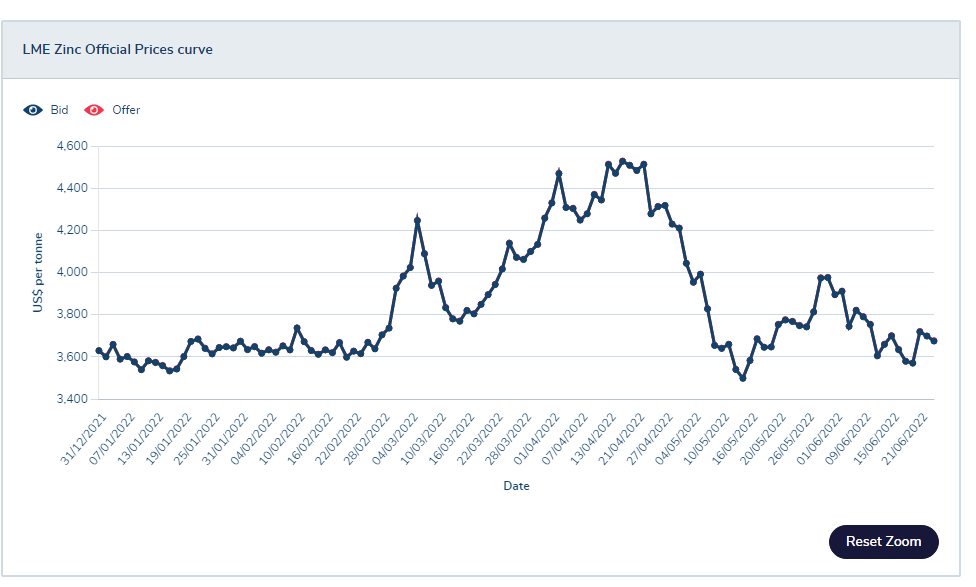

After "demon nickel", zinc is unstable?LME zinc inventory drops greatly, and the spot premium reaches 30 years.

The previous battle about demon nickel was booming. Will zinc repeat the same mist...

Walking in the front of the new bureau · Top Ten Innovation Binzhou 丨 Range for the "Test Field" of "Industry, Studies and Research"