Policies for the continuation of a combination tax support policy -VAT in production and living service industries are deserved

Author:State Administration of Taxati Time:2022.09.27

In order to facilitate the timely understanding of the applicable tax support policies in time, the State Administration of Taxation has sorted out the newly introduced and continued implementation policies, and forms a new combined combination in accordance with the compilation of the subject, the preferential content, the conditions, and the policy basis for the policy basis. Tax and fees support policy guidelines will continue to be updated in accordance with the new tax policy situation. Today, I will take you to understand: Continuing the implementation of tax support policies for implementation — VAT in production and living service industries to reduce the reduction policy.

Value -added tax for production and life service industries to deduct reduction policy

Enjoy the subject

Production and living service industry taxpayers

Content

1. From April 1, 2019 to December 31, 2022, the taxpayers of production and living service industries are allowed to increase the amount of input tax in accordance with the current period to reduce the taxable amount.

2. From October 1st, 2019 to December 31, 2022, the taxpayers of the living service industry are allowed to pay 15%in accordance with the current period of deducting input tax to deduct the taxable amount.

Enjoy condition

1. The taxpayer of the production and life service industry refers to the provision of postal services, telecommunications services, modern services, and life services (hereinafter referred to as four services). The specific scope of the four services is implemented in accordance with the "Sales Services, Invisible Assets, Real Estate Notes" (Cai and Tax [2016] No. 36).

Taxpayers established before March 31, 2019, from April 2018 to March 2019 (if the operating period is less than 12 months, according to the actual operating period of sales) meets the requirements of the above regulations, from 2019 From April 1st of the year, the decline is applied.

If the taxpayer established after April 1, 2019, the sales of the three months from the date of establishment meet the requirements of the above provisions, the decline policy will be applied from the date of registration as the date of the general taxpayer.

2. The taxpayer of the living service industry refers to the taxpayer who provides sales of more than 50%of sales of sales services. The specific scope of life services is implemented in accordance with the "sales service, intangible assets, and Real Estate Notes" (Cai Tax [2016] No. 36).

Taxpayers established before September 30, 2019, from October 2018 to September 2019 (if the operating period is less than 12 months, according to the actual sales period) meet the above requirements, from 2019 From October 1st, the decrease was applied to a 15%policy.

If the taxpayer established after October 1, 2019, the sales of the three months from the date of establishment meet the above requirements, the decrease of 15%of the policy will be reduced from the date of registration as the date of registration.

Policy basis

1. "Announcement of the General Administration of Taxation of the Ministry of Finance on Promoting the Development of Affairs Value Tax Policy in the Difficulties in the Service Industry" (No. 11, 2022)

2. "Announcement of the General Administration of Taxation of the Ministry of Finance on Deepening the Relevant Policies on Deepening the Reform of VAT" (No. 39, 2019)

3. The "Announcement of the General Administration of Taxation of the Ministry of Finance on Clarifying the VAT of Value and VAT in the Life Service Industry" (No. 87, 2019)

- END -

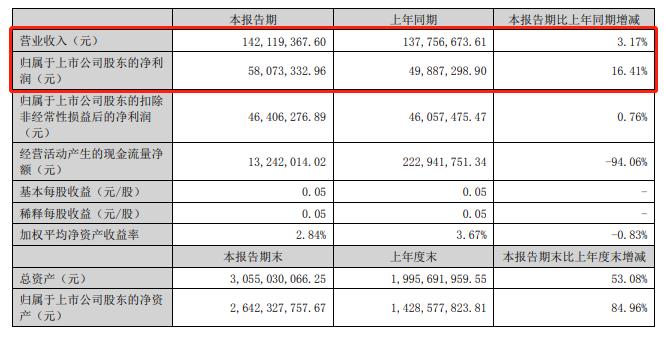

V Guan Finance Report | China Automobile Co., Ltd. in the first half of the year of cash flow dropped by 90 % of the stock price, the stock price was near the "back" during the year

Zhongxin Jingwei August 24th. On the 24th, China Automobile issued a semi -annual ...

In the second half of the year, the 42 listed companies intend to enter the New Third Board innovation layer

On September 9th, the National Stock Transfer Company released the first list of l...