Use the "policy loan" to answer the "inclusive finance" question

Author:China Agricultural Credit News Time:2022.09.27

Use the "policy loan" to answer the "inclusive finance" question

Xing Wenyun

As the bank of Zhaoyuan's own bank, Shandong Zhaoyuan Rural Commercial Bank always adheres to the business purpose of serving the "agriculture, rural areas" and the development of the real economy, and strives to create Zhaoyuan's "the best mechanism, the best service, the highest efficiency, and the most competitive market competitiveness. The "strong bank, inclusive bank, family bank, and agriculture and rural banks" performed the social responsibility of local banks with practical actions. In recent years, the bank has made full use of policy loans, continuously increases credit support, improves the business environment, further provides customers with comprehensive financial services, and has comprehensively promoted the steady improvement of various businesses. Up to now, various policy loans The balance is 570 million yuan and 2641 households.

The problem of solving problems is really rescue, and the strength of the household is strong. Zhaoyuan Rural Commercial Bank has continuously deepened the cooperation mechanism of provincial agricultural burden companies, veterans, the Human Resources and Social Affairs Bureau, and the Science and Technology Bureau to strive for policy support, and vigorously promote "Lugu Hui Agricultural Loan", "Veterans Entrepreneurship Loan", "Entrepreneurship Guarantee Loan" "" Science and Technology Achievement Conversion Loan ", such as a series of policy credit products that benefit the people and enterprises, distribute the" Datian Trusted Grain Capital Planting Loan "in the first place in Yantai, which effectively reduces financing costs for market entities. 276 million yuan, 1129 households, with a balance of entrepreneurial loans of retired soldiers, 96.91 million yuan, and 498 households. Strictly implement the "six stability and six guarantees" policies. Enterprises have not repaid non -repayment loan loans. In accordance with the principle of "depletion of deduction", all the stock loans and new mortgage loans of all stock loans and less than 10 million yuan are exempted from evaluation.

Careful service to the ground and improve the data as the foundation. Zhaoyuan Rural Commercial Bank constantly sinks the focus of marketing, adheres to the concept of "small, zero, and scattered", meets the needs of different customer credit, and conducts in -depth "one person, one village, one -grid" format management to carry out the "whole" "Village credit", build credit projects, transform the collection advantage of stock information into a marketing advantage of loan increase households, deeply dig resources, screen customers, follow up and quickly release loans to meet the demand for funds in the field of rural credit blank fields; Zhang Shanlian "is the starting point, and comprehensively promotes the" inductive credit ", allowing customers to obtain credit with credit, and can lend online online, effectively improving customer credit convenience; actively carry out the office of the customer manager in the village office, implement accurate services and management Customers do accurate identification, accurate portraits, and "what services need" and "what services are provided". Up to now, Zhaoyuan Rural Commercial Bank's five basic information improved by 491,500, the improvement rate exceeded 90%, effectively connected 405,000, and a total of 73,000 creditors were granted.

Migrant finances have entered thousands of households and visited emergency sales solidly. Zhaoyuan Rural Commercial Bank actively carried out "Red Vests Visits", taking the government's discount as the highlight, continued to increase the publicity of policy loans, and visited the households and farmers from the house in the jurisdiction. Understand the customer's family population, assets and liabilities, and capital needs, and prepare for credit, and at the same time focus on credit funds to the agricultural and characteristic agricultural industrial projects, condense the planting and breeding professional households, and realize the unified management of funds, technology, and production. Cooperate with mutual assistance to meet the reasonable loan needs of credit farmers and new -type agricultural business entities in all aspects, realize convenient services to villages, households, and rural areas to achieve financial services from "opening the last mile" to "fly into ordinary people The leap of "home" has carried out a total of 317 red vest visits and 3436 times in the village in the village since this year.

- END -

Pailang cooperation with strong revitalization momentum

Together with Shanghai, Jiangsu and Zhejiang, and revitalizing northern Anhui, the new kinetic energy of coordinated development is accelerated. Since last year, our province has taken a breakthrough

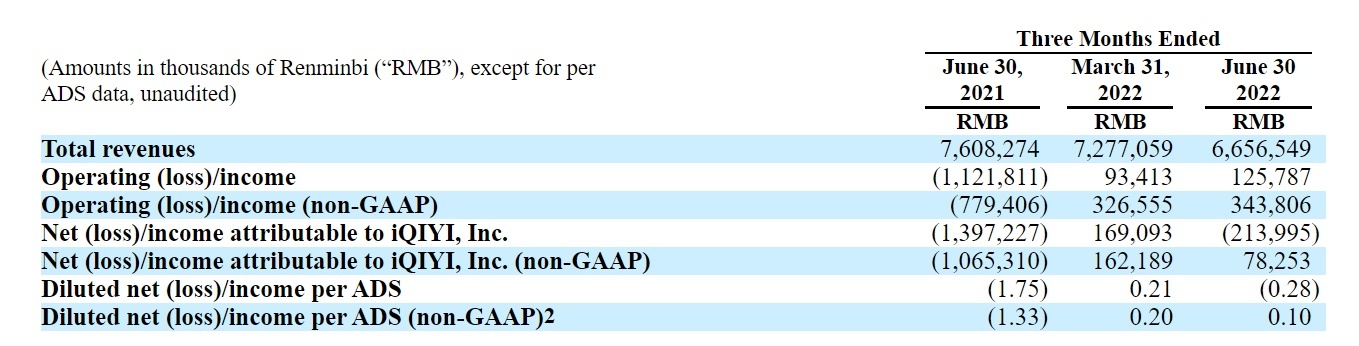

The total revenue of iQiyi in the second quarter of 2022 decreased 13% year -on -year

On August 30, 2022, the US listed company iQ.US announced the second quarter of 20...