From the latest data, the hidden concerns and support of the Chinese economy

Author:China News Weekly Time:2022.09.27

It is necessary to treat the process of China's economic recovery rationally

Under the influence of the promotion of low bases, optimization of epidemic prevention policies, and stable growth policies, the Chinese economic data exceeded expectations in August. Essence

At present, the hidden worry of China's economy is that the growth rate of real estate investment has declined, the export growth center has moved down, and the endogenous energy of the growth of manufacturing investment has weakened. With support, the growth rate of manufacturing investment will continue to maintain stability, and the trend of slow consumption recovery is expected to continue, and infrastructure projects and physical workloads are accelerating.

In August, the real estate investment of the economy was further increased. In August, the year-on-year growth rate of real estate development investment was further declined from -13.8 % last month to -13.8 %. In August, the month-on-year decline in land purchase area expanded to 56.8 %. However, under the advancement of the "Insurance Transfer Building", the new construction and completion of real estate have improved. In August, the monthly growth rate of the real estate completion area was "jumped" to -2.6 % from -35.7 % of the previous month; the new monthly growth rate of the newly started area of real estate increased by 2.0 percentage points to -43.9 %.

It is worth noting that the real estate sales area has narrowed to -22.0 % year-on-year, and the growth rate is also higher than the seasonal average. However, whether it can continue to be observed. The low -level margin of real estate sales has stabilized, making the source of real estate development funds, personal mortgage loans, deposits and pre -collection of deposits narrowing year -on -year, and the two exogenous funds of domestic loans and self -raised funds have also improved under the advancement of "insurance delivery".

In addition, the growth rate of China's exports fell significantly in August, and the downward pressure began to appear. This was the result of the common effect of both internal and external factors. In terms of internal causes, the domestic epidemic has spread more again since August, and some coastal provinces have sporadic epidemic conditions. High temperature limit in Sichuan and other places has caused some export industry chain to be blocked, which has a negative impact on exports. In terms of external causes, external demand from developed regions in Europe and the United States cannot be ignored. South Korea, which has similar export structures in China, has also declined significantly in recent months. In the context of the high probability of undergoing demand for developed economies in Europe and the United States, it is necessary to continue to open up the ASEAN market and to ensure the stability of the industrial chain supply chain.

In terms of manufacturing investment, its year -on -year growth rate rose to 10.6 % in August, but the endogenous vitality of its growth was weakened. On the one hand, the support of new kinetic energy for manufacturing investment is still strong: the investment of high -tech manufacturing investment in the first eight months increased by 23.0 %. A percentage point to 12.9 %. On the other hand, the growth rate of some export -related industries has slowed down, including general equipment, special equipment, metal products, railway ships, aerospace, aerospace, and other transportation equipment manufacturing industries, textiles, etc. Export dependence measured by the proportion of operating income exceeds 10 %.

In the next few months, despite the continuous bottom of the real estate investment, the pressure on the decline in foreign demand, and the more epidemic situation will continue to disturb the domestic consumption and production, the policy continues, and the subsequent economic restoration will also be supported.

This is first manifested in manufacturing investment. Recently, policies are actively developing in terms of stable manufacturing investment. On September 8th, the State will often mention "the purchase and renovation of new loans for the purchase and renovation of equipment in some fields, and implement a phased encouragement policy. "In the year", on September 14th, the State Council often refined and proposed "manufacturing ... updated the transformation equipment in the fourth quarter to support national commercial banks actively investing in medium- and long -term loans with interest rates of not more than 3.2 %. 100 % of the special re -loan support for commercial banks. The special re -loan amount is more than 200 billion yuan, and the actual needs are met as much as possible. In the fourth quarter of this year, the actual loan cost of the loan main body of the renovation equipment was not higher than 0.7 %. "

Secondly, the infrastructure force still has "stamina". In August, the year -on -year growth rate of infrastructure investment reached 15.4 %, a new high since March 2021, and infrastructure fund allocation and physical workload have been accelerated simultaneously. From the perspective of high -frequency data, in August, the operating rate of asphalt refinery related to infrastructure and the operating rate of cement abrasive machines have obviously rebounded, or it indicates that the physical workload of infrastructure is accelerating. In terms of funds, as of August 26, the first batch of 300 billion yuan in policy development financial instruments issued by the National Bank of China and agricultural issuance have been put on. Frequently requiring special debt funds to strive to use it by the end of August, and also provide certain support for high growth of infrastructure investment.

In addition, on August 24th, the "19" continuation policies for the newly issued by the National Association include the new policy development financial instruments of more than 300 billion yuan, and issued more than 500 billion yuan in special debt deposit limits before the end of October, for the place of deposit limit for more than 500 billion yuan. Infrastructure investment further provides financial support. In terms of physical workload: August 31st, the National Frequently will promote the implementation of infrastructure projects. For example, it is clear that "local governments can make commitments to land use, environmental assessment, etc. in accordance with their duties, and make up for the procedures for the project after landing."

In addition, the trend of slow recovery of consumption is expected to continue.For example, the strong performance of automobile consumption may continue, and other consumption also has more room for repair.

In short, the process of China's economic recovery is needed rationally.On the one hand, the recovery of the follow -up economy depends on the implementation of the steady growth policy, and on the other hand, to prevent the abnormal disturbance of the economy brought about by the economy in some regions.

(The author is the chief economist of Ping An Securities)

Send 2022.9.26 Total Issue 1062 "China News Weekly" magazine

Magazine title: From the latest data, the hidden concerns and support of the Chinese economy

Author: Zhong Zhengsheng

Edit: Wang Xiaoxia

Operation editor: Ma Xiaoyi

- END -

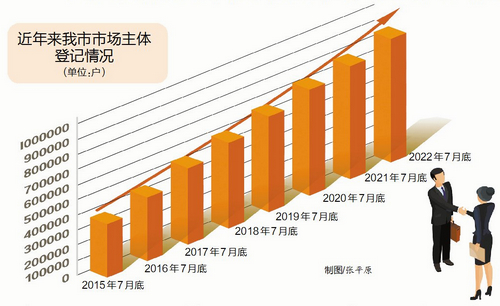

Optimize the business environment!The main body of Xiamen market exceeds 800,000 households

The main body of the market is an important force for economic and social developm...

Meituan profit triple door

@新 新 新Author 丨 Gu FuEdit 丨 Yi PageProfit is becoming the main theme of all In...