The hydrogen energy project has been delayed, but the company is renamed and the daily limit!What logic?

Author:Investment Times Time:2022.09.27

According to the requirements, listed companies need to explain the logical relationship between the main business and the term "new power", whether there is a misleading investor, and the reasons why the company's related hydrogen energy projects cannot be advanced for a long time.

"Investment Times" researcher Yu Fei

After the securities were renamed, the stock price ushered in a 20%daily limit. Xiong'an New Power Technology Co., Ltd. (hereinafter referred to as new power, 300152.SH )'s operation was "earned".

A week ago, the company's securities name was still Kerong environment. On the evening of September 21, the company disclosed the announcement that because the existing company's abbreviation can no longer comprehensively and accurately reflect the company's core industry and strategic development direction, and the company's full name is not high. From "Koorong Environment" to "new driving force".

On the second day when the new power was renamed, the company's stock price in the GEM was a 20%increase in the rise.

Regarding the reason for renamed, the company stated that the management had re -sorted the company's main business. Earlier, the company's main business was mainly "clean combustion and boiler energy saving and efficiency operation business", and now it has become "special combustion device technology and fuel -saving ignition system business".

What is the distinction between these two businesses, can they make the company block the daily limit? On September 23, the new power received a letter of attention issued by the Shenzhen Stock Exchange. According to the requirements, the company needs to explain the logical relationship between the main business and the term "new power", whether there is a misleading investor, and the reasons why the company's related hydrogen energy projects cannot be advanced for a long time.

At the same time, the company also needs to investigate and specifically explain the actual controller of the company, more than 5%of the shareholders holding shareholders, directors of directors, and its related parties to buy and sell the company's shares.

Change the name of the securities, the executives increase the holdings in advance

The new motivation had previously used the name of Ran Control Technology, and later renamed Kerong Environment. The company was listed on the GEM of the Shenzhen Stock Exchange in 2010.

According to the data, the company's main business of energy -saving, sewage treatment, waste incineration power generation, construction of hazardous waste industries, hydrogen energy, new energy -related industries, and Xiong'an New District's Baiyangdian Environmental Comprehensive Governance Services business.

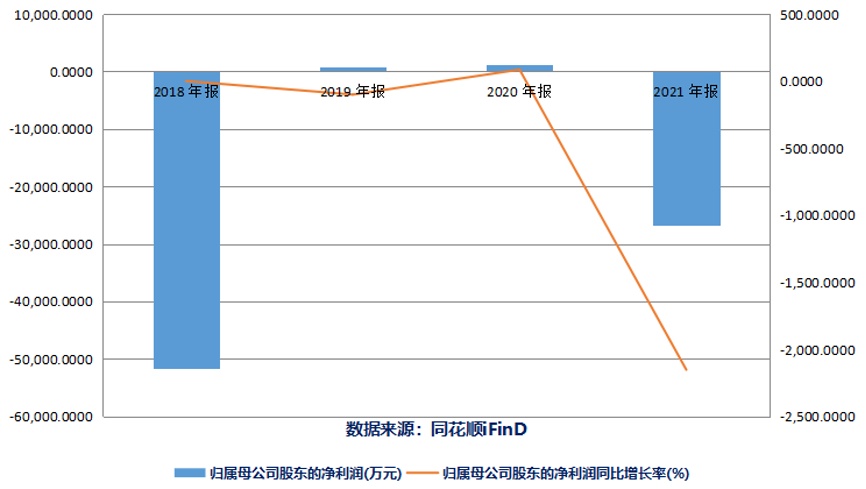

In recent years, the company's performance has often been in a state of huge losses. From 2018 to 2021, the new driving force realized operating income of 526 million yuan, 513 million yuan, 515 million yuan, and 176 million yuan, respectively, to achieve net profit-517 million yuan, 7.035 million yuan, 12.991 million yuan and -267 billion yuan, respectively Essence

In the first half of this year, the company realized operating income of 103 million yuan, an increase of 20.59%over the same period last year; net profit attributable to 17.497 million yuan, an increase of 165.49%over the same period last year.

Regarding the reasons for the change of this securities abbreviation, the new power announcement explained that at present, the company's special combustion device technology and fuel -saving ignition system business has accounted for 100%of operating income. The strategic development direction and the low degree of correlation with the company's full name are not high, which is likely to cause investors to misunderstand.

However, it is worth noting that the company's main business in recent years, the proportion of single products or services is extremely high. Why did the company have not mentioned the problem of so -called "relevance" in the main business composition in the previous year's report?

The new power semi -annual report shows that in the company's products or services in the first half of the year, the operating income of net combustion and boiler energy conservation and efficiency operations was 103 million yuan, accounting for 100%of the company's operating income. According to the 2021 report, its clean -up and boiler energy conservation and efficiency operating business revenue was 168 million, accounting for 95.4%of the company's main business income ratio.

In response to the company's statement in the reasons for the renaming announcement, the follow -up letter of Shenzhen Communication requests the new power in detail to indicate the product or service, application field and specific purpose of the company's main business in the past year, the situation of major customers, the market development status, the same industry comparable to the industry. The company's situation shows whether there is a difference between "special combustion device technology and fuel -saving ignition system business" and "clean combustion and boiler energy saving efficiency business".

It is worth noting that shortly before renamed, the new power director, general manager Cheng Fangfang and deputy general manager Hu Jianjiang all issued an increase in holdings.

According to the announcement, Cheng Fangfang increased the company's shares of 10,000 shares on July 22 and July 25, and the number of shares that increased their holdings from July 27, 2022 to January 26, 2023 were not low. In 200,000 shares, and no more than 400,000 shares. On June 29, Hu Jianjiang increased its holdings of 10,300 shares by concentrated bidding, and plans to increase the number of companies' shares from June 29, 2022 to December 28, 2022, and the number of shares of the company is not less than 2000 shares, and No more than 20,000 shares.

According to the request of the Shenzhen Stock Exchange, the new power needs to be self -inspection and specifically explain the actual controller of the company, more than 5%of the shareholders holding shareholders, the directors of the director and the affiliated parties to buy and sell the company's shares. The situation, and report to our department to change the insider information list of the company's full name.

New Power's net profit from 2018 to 2021

Data source: Flush iFind

The agreement has been signed for a long time, and the project has not made progress

After the stock price brought by the renamed event fluctuated, the new driving force previously announced that the hydrogen energy business matters involved were also mentioned by the letter.

In addition to energy saving and combustion, the new driving force has stated that the hydrogen energy field is one of the company's important development strategies. "The company continues to lay out in the field of hydrogen energy and accelerate the implementation of related projects. On September 14, the company stated in the online performance briefing that it would continue to lay out in the field of hydrogen energy and accelerate the implementation of related projects. Therefore, the company is also included in the concept of hydrogen energy by some media and securities terminals.

The so -called "business layout" of hydrogen energy, new driving force has actually signed relevant intentions and agreements, but it has not yet made progress after three years.

According to the company's announcement, in October 2020, the company participated in Beijing China Hydrogen Ringyu Hydrogen Energy Technology Service Co., Ltd. (hereinafter referred to as China Hydrogen Huanyu). In July 2021, the company participated in Beijing Kerong Huayang Feng Technology Co., Ltd. (hereinafter referred to as Kerong Huayang).

However, as of June this year's new power disclosure, the status of China Hydrogen Huanyu was only 4 million yuan in actual capital contribution. Related qualifications and licenses were still applying. The requirements of the project party have not yet contributed.

In addition, the company has disclosed the announcement in the past three years that the company and wholly -owned subsidiaries and China General Consulting Investment Co., Ltd., Hebei Baoding Urban and Rural Construction Group Co., Ltd., China Construction Bank Co., Ltd. Hebei Xiong'an Branch, Tsinghua University Nuclear Energy and New Energy sources Technology Research Institute and others signed a letter of intent for cooperation, strategic cooperation agreement, cooperation agreement, etc.

"Investment Times" researcher noticed that the company's relevant strategic cooperation agreements were signed in April and May 2019, but as of June 2022, the company's relevant announcement was disclosed. It was not until July of this year that the relevant report mentioned that "the new power hydrogen energy catalyst project signed and the site was selected", but the company did not disclose the relevant announcement for the company.

In response to this situation, the follow -up letter of the Shenzhen Communications required the company to supplement the disclosure. As of now, the shareholders of China Hydrogen Huanyu and Keong Huayang have paid the investment, the specific construction of the relevant projects, the progress of the operation, the operating income, the number of employees, etc. Information, the reasons for the long -term cannot be advanced by related projects, and the persistence of the relevant factors to explain the uncertainty of the above -mentioned investment projects.

At the same time, the new driving force also needs to combine the progress of the above -mentioned major investment and strategic cooperation projects in the past three years, and the reasons that cannot be advanced for a long time to analyze whether the company's relevant project cooperation, investment and disclosure are cautious and reasonable.

- END -

White paper in the real -time retail platform industry: It is expected to exceed the size of trillion in 2025, and the penetration rate will accelerate

Cover Journalist Lei QiangWith the rapid improvement of the new business model inf...

National Development and Reform Commission: Actively support the restoration and reconstruction of infrastructure in the affected areas of the Luding earthquake

Cover Journalist Dai RuiOn September 19, the National Development and Reform Commission held a routine press conference. Meng Wei, a spokesman for the National Development and Reform Commission, said