Gome is in arrears, and after response, he was questioned insufficient sincerity!Its company's stock price has shrunk by 90 %, and "back to that year" is difficult

Author:Financial Investment News Time:2022.09.27

A total of 2511 words in this article

About 5 minutes after reading

Recently, the news that Gome has not paid salary on time pushed the company to the cusp.

It is reported on September 26 that a number of Gome employees broke the news that Gome has not paid the earliest salary day on the contract, that is, pay the salary of August on the 25th of each month. At the same time, Gome has not yet been distributed for the semi -annual performance of employees.

The news also attracted attention from Gome's Hong Kong stock listed company Gome Retail (00493.HK). Since February last year, the company's stock price has been "do not exist", shrinking about 94%, and after 5 years of performance, the latest 2022 mid -2022 performance is still losing money, and the loss has expanded by half ... It is difficult to see it anymore. Previously, the home appliance retail industry was a big "king".

Gome arrears on the hot search

With the news of the news,#随 随 按 随 随 随 随 随 随 随 随 随 随 随 随 随 随 随 随 随 随 随 随 随 随 随 随 随 随 随 随 随 随 随 随 随 随 随 随 随 随 随 随 随 随 随.

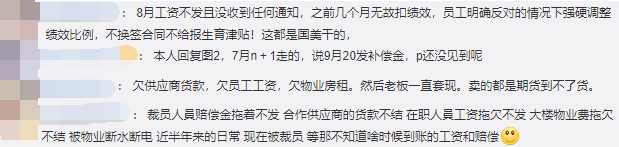

Regarding related news, there are many netizens who claim to be self -American employees on the social platform and say that not only did not receive the salary in August, but also "deducted performance for no reason", "tough adjustment performance ratio", etc. One after another, it was believed that "it is difficult to maintain wages to maintain wages", and it is difficult to go far, and pointed out that the company also has issues such as "owed suppliers, wages of employees, and property rent".

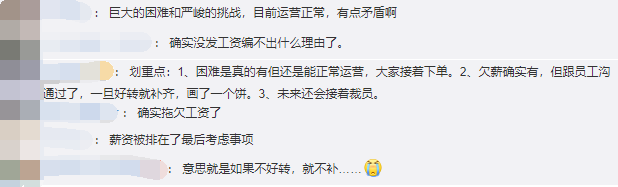

In this regard, Gome responded that at present, Gome has indeed encountered unprecedented huge difficulties and severe challenges. The transformation process of the enterprise is blocked, and the cash flow is obvious. The effort of the degree, but the cost of high -end operating costs is still the most heavy burden at present.

According to the company, in order to ensure the company's normal operation, the company has made some temporary and emergency adjustments on salary issuance this month. At the same time, the company does not rule out that it will continue to implement a job reduction plan to further reduce operating costs. In response to the problem of arrears, Gome said that the current operation is normal. Once the operation improves, the employee will make up for the salary as soon as possible, and at the same time, the corresponding compensation of the employees will be redeemed.

However, the relevant response is still considered by some netizens to be "lacking sincerity", and voiced that "avoiding the heavy" and "still crying for the wrong thing" and so on.

At the same time, the news of the arrears of salary was revealed, and Gome's layoffs and executives' departure were also attracted quickly.

At the recent performance briefing, Fang Wei, senior vice president of Gome Retail, publicly stated that Gome Retail has "optimized" the personnel structure in the second quarter of this year, and it is expected that the salary fee can be saved by more than 300 million yuan in the second half of the year.

On September 27, Gome Electric CEO Wang Wei was exposed to departure last Monday, and Heyang Qing, CEO, CEO of Gome Investment Company, has also left.

The stock price of its listed company is "ten without existence"

According to the data, Gome was founded in 1987 by Huang Guangyu, and has gradually developed into a “comprehensive product plus service plus service integrated product plus service integrated product plus service integrating retail, Internet, finance, research and development, and investment in intellectual manufacturing, real estate, and investment. The provider "Gome Group.

The Gome Retail Holdings Co., Ltd. (that is, "Gome Retail", code 00493.HK) is a listed company of Gome Group. When it was listed on the Hong Kong Stock Exchange in July 2004, the name and abbreviation of relevant listed companies were Gome Electric Holdings Co., Ltd. The company and Gome Electric did not change to the current state until 2017.

The founder of the company Huang Guangyu was born in May 1969. In 2004, 2005, and 2008, he won the "Richest Man" throne of the Hurun Rich List three times. In 2006, the Ferbes Chinese Rich List also ranked first. In November 2008, Huang Guangyu was detained by the public security organs. The causes include suspected "manipulating the market", and the listed company Gome Electric also suspended trading during the same period. It was not until June 2009 that Gome, which was suspended for more than 7 months, finally resumed trading. Essence

In February 2021, Huang Guangyu, who was in prison for more than ten years, was officially released. In April of the same year, Gome Retail held a conference call for global investors. Huang Guangyu, the founder of Gome Retail, attended the meeting. This time, Huang Guangyu attended the public meeting after returning to Gome. At that time, Huang Guangyu once said that Gome Retail has two major opportunities for growth space in the electrical field in the future.

It is worth noting that the stock price of Gome Retail also rose to HK $ 2.55/share in the month when Huang Guangyu was released. Hong Kong dollar/share, compared with the market value of 94%compared to the current market value.

Or due to the situation of the situation, in August this year, Huang Guangyu issued an open letter through the Gome public account that the previous idea of "returning to Gome in 18 months" was too optimistic, so the new three -year goal was given, indicating that it would be in the three -year goal, indicating that it was to be in that it was going to be in that it was going to be in that it was going to be. In 2023, it achieved high profitability and reached a high level in the past. In 2024, it reached the best level of history. In 2025, it significantly surpassed the best level of history.

It is just that this goal is still not easy to see, because the problems facing the company are far more simple.

Restore a lot of challenges in the past

On August 31, Gome Retail announced the mid -term financial report of 2022.

In terms of performance, in the first half of this year, the company achieved revenue of 1.2109 billion yuan, a year-on-year decrease of 53.46%; net profit loss of home mother was 2.966 billion yuan, an increase of 50.24%year-on-year. Mother's net profit lost 450 million yuan, 4.887 billion yuan, 2.590 billion yuan, 6.994 billion yuan, and 4.402 billion yuan. The company's debt issues are also reflected in the financial report. As of the first half of this year, Gome Retail's total liabilities reached 58.568 billion yuan. The short -term borrowing and long -term borrowing period expired for 24.775 billion yuan.

What I have to mention is that there are not only company employees who are "owed to the money" by Gome, but also companies that cooperate with many cooperations. These companies that encounter related conditions seem to be less "good".

Just this month, the subsidiaries of Gome revealed that the debt problem was due to debt, which caused the shares to be judicially frozen. On September 13, the listed company Zhongguancun (000931) issued an announcement saying that the company's controlling shareholder Gome Mei Electric Co., Ltd., Gome Mei Electric Co., Ltd., was unanimously frozen and waiting for the court's judicial frozen and waiting. At that time, Gome Electric Co., Ltd. was judged that the number of judicial frozen shares was about 34.722 million shares, accounting for 62.63%of its shares.

The problems brought by "owed money" are also suppliers to terminate cooperation. In April of this year, Whirlpool announced the termination of cooperation with Gome's electrical appliances on the grounds that Gome Electric and its affiliated affiliated companies did not pay the payment according to the contract.

In addition to these news, some analysts have pointed out that the company's recent stock price has continued to decline, which may have something to do with the company's founder and major shareholder Huang Guangyu and his wife.

Data show that as of the last reduction of holdings in December last year, the Huang Guangyu and his wife holding Gome retail shares was 20.584 billion shares. During this year, the two couples have reduced their holdings over 5 billion ... By September this year, Huang Guangyu's sister Huang Xiuhong was also reducing her holdings. On September 14, it reduced its holdings of 70.1 million shares, worth about HK $ 13.22 million.

In this case, Gome wants to restore the "former status", and may still have to face many challenges.

Edit | Chen Yuhe School Inspection | Yuan Gang Review | Qin Chuan

- END -

Surabaya: Optimize the service service model to ensure that climbing enterprises are speeding up

Faced with the complex and severe epidemic situation, the Headquarters in Surabaya County took a lot of measures to take advantage of it, to act on online and offline, fully optimize the air -to -air

Weifang City's 2022 Shandong Patent Navigation Project was launched in an all -round way

From September 20th to 22nd, the Municipal Market Supervision Bureau held four con...