Reverse repurchase single -day net invested 173 billion yuan "red envelope" to take care of the "red envelope" at the end of the day of care

Author:Huaxia Times Time:2022.09.27

China Times (chinatimes.net.cn) reporter Liu Jia Beijing report

Yang Ma sent the "red envelope" before the festival.

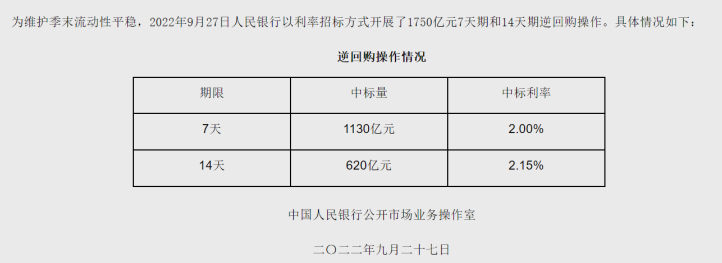

On September 27, the central bank announced that in order to maintain the stable liquidity at the end of the quarter, it carried out 175 billion yuan 7 -day and 14 -day reverse repurchase operations in interest rate bidding. Among them, the 7 -day period was 113 billion yuan, and the 14 -day period was 62 billion yuan, and the bid interest rate was 2.0%and 2.15%, respectively.

Wind data shows that because there were 2 billion yuan of reverse repurchase expiration today, the net investment was 173 billion yuan on that day.

It is worth noting that since September 19, the central bank has restarted for 14 days back to the 14 -day reverse repurchase at a time after 7 months, and has carried out the "7+14" reverse repurchase operation for 7 consecutive trading days.

"Recent central bank operations are in accordance with previous practices." Zhou Maohua, an analyst of the Financial Market Department of Everbright Bank, told the reporter of "Huaxia Times". From the end of the month, the end of the quarter, and before the festival, the central bank will appropriately increase market operations according to market demand. Steady funding, stabilize market expectations.

"7+14" combination fist increase price increase

Since last week, the central bank has increased the scale of inverse repurchase operations. In addition to the conventional 7 -day reverse repurchase operation, 14 days of reverse repurchase operations have been opened since September 19.

On September 19, the central bank announced that the day of the 12 billion yuan reverse repurchase operation, including the 2 billion yuan 7 -day reverse repurchase operation and the 10 billion yuan 14 -day reverse repurchase operation, the bid interest rates were 2.00%and 2.15, respectively. %.

Among them, the 14 -day reverse repurchase interest rate was reduced by 10 basis points from the previous time.

The central bank's last 14 -day reverse repurchase was still in January this year. At that time, in order to maintain the stable liquidity before the Spring Festival, it carried out a total of 1.1 trillion yuan for 14 days of reverse repurchase operations within 7 consecutive days. Essence

Dongfang Jincheng chief macro analyst Wang Qing told the reporter of the Huaxia Times that the 14 -day reverse repurchase interest rate was reduced, which belongs to the central bank's MLF interest rate and 7 -day reverse repurchase interest rate on August 15, and the policy interest rate system The linkage adjustment is not a new interest rate cut.

Talking about the reasons for the 14 -day reverse repurchase, Wang Qing further analyzed that the central bank's move has a certain degree of "lock short and long" nature, which is intended to guide the moderate upward market interest rates including DR007 and the guidance of maintaining policy interest rates. effect. To avoid excessive market interest rate deviations from the policy interest rate center, it also helps to curb funds for air -to -turn interest and promote wide currency to wide credit transmission, that is, in the current wide currency background, guide banks to increase the investment in the real economy loan at a low interest rate level Essence

"The central bank restarts the 14 -day reverse repurchase operation, which is basically the same as the recent two -month -old policy intention of MLF." Wang Qing said.

CITIC Securities Chief Economist clearly said that the central bank restarted on September 19 last Monday for 14 days of reverse repurchase, and the 14 -day fund of the 10 billion yuan will be on the first working day after the National Day, that is, October in October, October, October The expiration of the 8th, it can just cross the end of the month of September. "This is the active supply of funds across the month, stabilize market expectations, and care for the end of the season."

The reporter of Huaxia Times noticed that it was not the first time that the central bank continued to carry out the "7+14" days of reverse repurchase operations before the "Eleventh" holiday. From the eve of the "Eleventh" last year, the interest rate of the 14 -day reverse repurchase operation has lowered 20 basis points.

Not only that, there are also differences in the amount of inverse repurchase operations. Among them, the scale of reverse repurchase operations last week remained at 2 billion yuan, while the highest scale of the 14 -day reverse repurchase was 24 billion yuan.

Entering this week, 42 billion yuan 7 -day reverse repurchase operation and 93 billion yuan 14 -day reverse repurchase operation on the 26th. On the 27th, the 7 -day reverse repurchase operation volume was increased to 113 billion yuan, while the 14 -day reverse repurchase operating volume was reduced to 62 billion yuan.

Behind "one liter and one drop", Zhou Maohua said that the market interest rate has risen rapidly in the near future, reflecting the recent market demand for cross -month, cross -seasons and cross -section liquidity increased significantly. Flexible selection of open market operation tools for hedge, rationally increase the open market operation, care for liquidity, and ensure stable capital.

Monetary policy in the fourth quarter is worth looking forward to

Affected by the change of funds, the interest rates of various varieties of the inter -bank inter -bank inter -bank inter -bank inter -bank interbank interest rates have risen differently. As of 11:00 on the 27th, the variety was reported at 1.3990%overnight, a 3.00 BP decrease from the previous trading day; 1.6970%of the 7 -day variety, which was 14.30 BPs from the previous trading date; the 14 -day variety reported 2.0250%, compared 7.20 BP on the previous trading day.

In addition, in terms of inter -bank pledge repurchase interest rates, China Currency Network shows that as of 16:00 on the 27th, the DR001 plus equity rate was reported at 1.3901%, the DR007 plus rights rate was reported at 1.6541%, and the DR014 plus equity rate was reported at 2.0574%, all from the previous transaction. There is a downward day.

Looking forward to the future, industry insiders believe that the central bank's monetary policy remains a stable tone.

Obviously, thanks to the central bank's flexible and appropriate use of open market operation tools, the fluctuation rate of capital interest rates has converged in recent years, and the 7 -day mobile annualization of DR007 has returned to near 2%. At the price level, the central bank decisively lowered the OMO interest rate; at the quantity, the central bank flexibly adjusted OMO sequels to avoid excessive deviation from policy interest rates. "Subsequent central banks will continue to play the effectiveness of structural policy tools, and flexibly use the OMO tools to fluctuate capital." Obviously said.

Wang Qing judged that in order to support the stability of the economy, the regulatory layer clearly demanded that "to increase the investment in the real economy." Although the new RMB loan recovery in August increased slightly, the annual growth rate of the balance of various loans continued to decline slightly for two consecutive months, which means that this round of wide credit process is twists and turns. "In the process of continuous increase in loans, it is still necessary to support wide credit with moderate wide currencies, which means that the possibility of a substantial increase in market interest rates in the short term is not great."

Zhou Maohua predicts that the flow of domestic funds in the fourth quarter will continue to be reasonable and abundant, mainly because the domestic economy is in the recovery stage, and the fiscal and monetary policy will continue to be active; there are many tools in response to short -term capital disturbances.

"Considering the large amount of MLF expiration in the fourth quarter, it is not ruled out that the central bank may perform a hedging reduction operation, providing financial institutions with long -term low -cost funds, stabilizing the funding for financial institutions, increased medium and long -term loans for financial institutions, reducing the real economy The space for financing cost expansion, etc. "Zhou Maohua added.

Editor -in -chief: Meng Junlian Editor: Zhang Zhiwei

- END -

In the first 8 months, Gansu Province's import and export of members of SCO Organizations increased by 17.4% year -on -year

New Gansu client Lanzhou News (New Gansu · Gansu Daily reporter Cai Wenzheng) reporters from Lanzhou Customs learned that in the first eight months of this year, Gansu's import and export of members...

Just tonight, domestic oil prices fell!

According to the National Development and Reform Commission, domestic refined oil ...