Vaccine ETF+Biomedical ETF+Innovation Pharmaceuticals CSI CSI ETF+Medical ETF Back

Author:Capital state Time:2022.09.27

Overall: overall:

The Shanghai and Shenzhen cities experienced the increase in the afternoon after the red market narrowed in the morning. The GEM indexes are leading and the first to regain the 10 -day line. The market has risen nearly 4,400 shares, the market sentiment recovers benign. When the index rose in the afternoon, a slight volume was increased.

As of the closing, the Shanghai Stock Exchange Index rose 1.4%to 3093.86 points, the Shenzhen Stock Exchange Index rose 1.94%, the GEM index rose 2.22%, and the three major indexes have achieved the best performance since August 11; Risked by 1.77%and 2.36%, respectively; the two cities sold 667.2 billion yuan throughout the day, and the northbound funds gradually entered the market to sweep the goods in the afternoon.

Reasons for the overall rising pharmaceutical rising: valuation base+emotion bottom

The overall growth rate of the pharmaceutical sector has slowed down, and it is expected to recover in the fourth quarter. In the first half of 2022, the overall operation of the pharmaceutical industry increased steadily. The overall operating income of the A -share pharmaceutical listed company increased by 10.59%year -on -year, and the net profit of the mother was 7.05%. Although the public health prevention and control is still repeated, the overall recovery trend is expected to continue.

Vaccine: Long -term prosperity is not enough, benefiting from the increase in penetration+domestic alternative, valuation is to be repaired

my country's vaccine penetration rate is low, and there is a lot of room for improvement in the future: Most of the second type of seedlings in my country still have great potential to increase the potential than foreign countries, such as HPV vaccine, tetravalent influenza vaccine, 13 -valent pneumonia -combined vaccine and other top ten global sales. The vaccine penetration rate is still less than 10%. The expansion of the 9 -valent HPV vaccine has greatly improved potential targets.

The import alternative space is large, and the heavy variety approval continues high growth: imported products occupy 42%of my country's vaccine market, import alternative space, and heavy variety batch issuance continues high growth. In terms of research and pipeline, more than 10 varieties of HPV vaccines are currently under research, but domestic HPV vaccines are generally expected to be listed after 2024 and 2025.

Among the bacteria vaccine, 13 -valent pneumonia vaccine Kangxino has the fastest progress, and 15 -valent pneumonia vaccine is the fastest. A hundred grams of organisms in shingles vaccine were notified of production approval acceptance in April 2022. It is expected to be approved for listing at the end of 2022. Other varieties such as Kangtai creatures are doubled in 2022, and those who are double -videls and tetravalent vaccines of Zhifei creatures are also expected to be approved in 2023 or 2024.

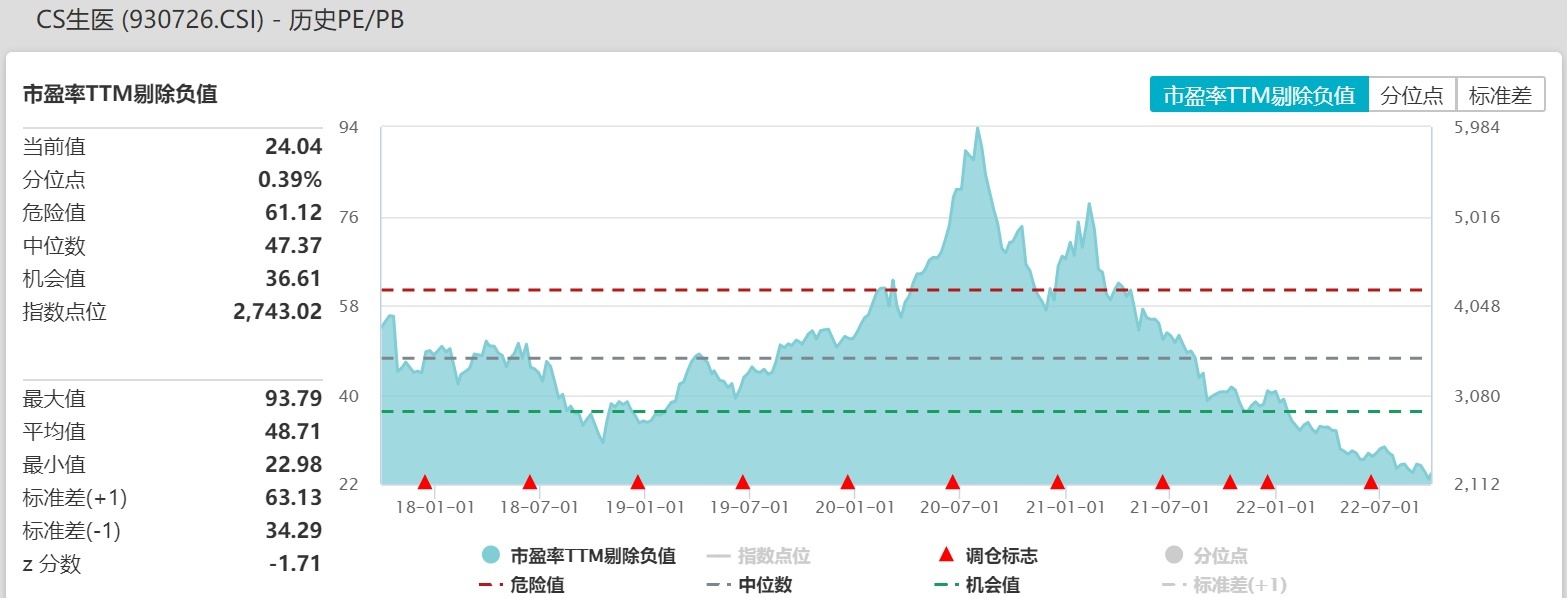

History of valuation is to be restored: At present, the valuation of the vaccine index is lower than the valuation before the start of 2019, and it is at a better medium- and long -term layout time. As of September 27, the State Cover Vaccine and Biotechnology Index PE were 24.17 times, which was located at 0.00%in the past five years. In the context of the relief of public health prevention and control seals and control measures in various places, domestic medical and health needs are expected to recover strongly. With the major trend of import substitution, consumption upgrades, and acceleration of medical infrastructure, vaccines and biotechnology are expected to continue to improve.

Medical: Long -term benefits from aging+consumption upgrade+domestic alternative, consumer medical needs need to be restored

The demand for aging+consumption upgrade driver: As the average life expectancy of the whole population continues to increase, the demand for medical devices and services is improved. Consumption upgrades will also be favorable for the pharmaceutical sector, especially in medical treatment, such as ophthalmology, physical examination, testing, etc.

Domestic alternative demand: There are two dimensions here. The first dimension is that the technical level of our domestic enterprises has improved significantly within five to ten years. Second, our country is willing to support related enterprises through domestic replacement, and reduce dependence on medical device -related facilities and equipment imported overseas.

Some instruments are included in the basic Price-in, and the valuation history is to be repaired.

Innovation medicine, biomedicine: innovation -driven general trend

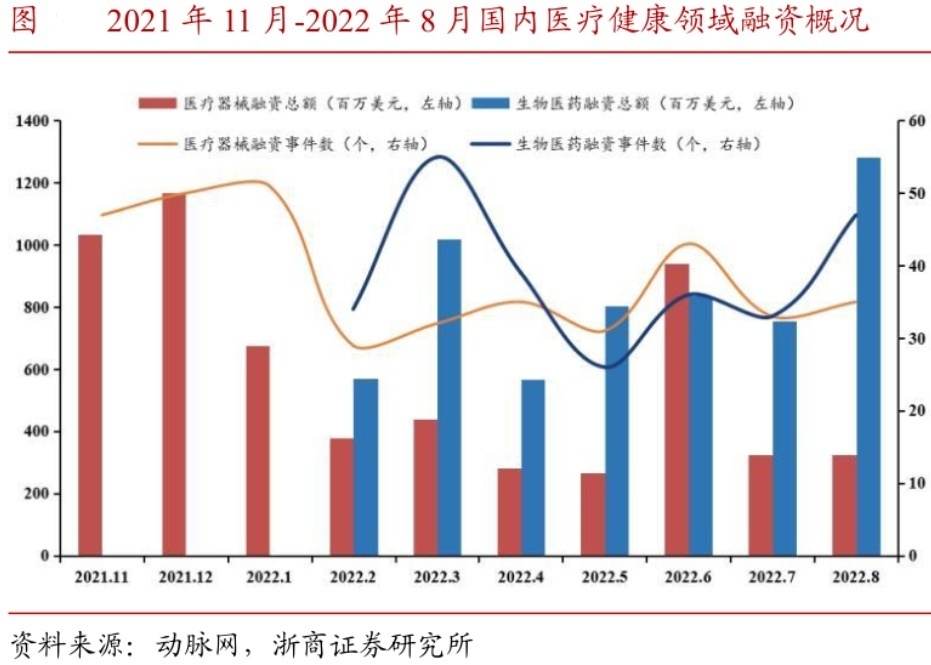

Emotional and fundamental repair. Public health incidents are still uncertain, but as the overall management of prevention and control and economic construction gradually advances, the overall impact will weaken, and the industry will usher in a recovery in twists and turns. The global research and development popularity has not decreased, and domestic R & D has rebounded; the overall investment in investment and financing is tight in the first half of the year, and the marginal improvement in the second half of the year. In the short term, public health incidents have weakened. After unblocking, with the talent recruitment, clinical R & D, production and sales, authorization cooperation, and internationalization of pharmaceutical companies, it will accelerate. In the next half of the year, pharmaceutical companies will resume normal operations.

Low valuations have medium and long -term investment value. Innovative drugs and biomedical sectors have undergone a long time and large -scale callback since 2021, and many high -quality target valuations have been in the bottom interval.

Through the early adjustment, the various concerns of the market have been fully reflected, and the market's early reflection is too pessimistic. If the growth rate of investment and financing has declined, it is a process of "de -pseudo -pseudo -savings". Innovation and upgrading brings the rise in the CXO requirements of pharmaceutical companies. Concentration will become a long -term trend.

Data source: wind

In the long run, under the drive of innovation, import alternatives and internationalization are still the long -term development trend of the domestic pharmaceutical industry. After that, the real product -capable product is landing overseas or the opportunity to increase valuations for innovative drugs. In addition, the long -term logic of population aging+consumption upgrade is still there. Investors can continue to pay attention to Innovation Pharmaceutical CSI ETF (517110) and Biomedical ETF (512290).

- END -

MLF operating interest rate

Reporter Liu QiOn June 15, the People's Bank of China released news that in order to maintain the banking system, the liquidity of the banking system was reasonable and abundant, and the operation of...

Xingfa Group: It is expected to make a profit of 3.62 billion to 3.720 billion yuan in the semi -annual profit of 2022

On July 6, Capital State learned that the A-share listed company Xingfa Group (code: 600141.SH) released the semi-annual report performance forecast. It was 3.620 billion to 3.72 billion yuan, and net