Construction Bank was approved by 83.33% of consumer finance companies

Author:21st Century Economic report Time:2022.09.27

21st Century Business Herald reporter Li Yue Beijing report

Construction Bank's preparation of consumer finance companies was finally licensed.

On September 27, the Construction Bank issued an announcement that the bank intends to invest 6 billion yuan to invest in consumer finance companies, holding 83.33%of the bank, which is the first -level holding subsidiary of the bank. The other two shareholders are Wangfujing Group Co., Ltd. Beijing State -owned Assets Management Co., Ltd. holds 11.11%and 5.56%respectively. The total registered capital is 7.2 billion yuan.

Construction Bank said the matter had been approved by the CBRC. After the preparation work is completed, the application for opening to the regulatory authorities will be submitted in accordance with the procedures.

"In order to implement the country's strategy of expanding domestic demand and promoting the development of the consumer market, and expanding the coverage of consumer financial services with corporate and professional operations, the Bank intends to jointly build construction with Beijing State -owned Assets Management Co., Ltd. Xinxinjin Company. "Construction Bank explained that it would provide innovative products and services around residents' consumption upgrades and emerging consumer formats, to meet diverse and multi -level consumer needs, practice inclusive financial concepts, further cultivate consumption consumption further consumption The financial field brings new room for growth.

It is understood that as early as June 20, 2019, the Board of Directors of the Construction Bank reviewed and approved the "Proposal on the Establishment of Consumer Financial subsidiaries", agreed that the bank's capital contributed no more than 6 billion yuan, and jointly invested in the establishment of a consumer finance company with other investors. Essence

Construction Bank stated that, in view of the board of directors of the bank, the specific arrangement of this investment was uncertain when the bank was considered and approved. The disclosure of disclosure and exemption business management measures ", the bank carefully judged, decided to suspend the disclosure, and handled the internal registration and approval procedures for the disclosure of disclosure.

Construction Bank disclosed that CCB Consumer Finance is Beijing. The scope of business is: (1) issuing personal consumption loans; (2) receiving deposits of subsidiaries and domestic shareholders of shareholders; (3) borrowing from domestic financial institutions; (4) Approval of financial bonds; (5) Domestic interperture borrowing ; (6) Consultation and agency business related to consumer finance; (7) Agent sales of insurance products related to consumer loans; (8) Fixed income securities investment business; Essence

CCB Consumer Financial Company has a board of directors and consists of seven directors. Among them, there should be one director of employee representatives and at least two executive directors. The board of directors has one chairman, and the chairman is the company's legal representative. There is a president and a number of vice presidents.

Construction Bank stated that after the establishment of CCB Consumer Finance, in the future, it may face the impact of uncertain factors such as macroeconomics, industry policies, and market competition. There are certain market risks, business risks, and management risks. The bank will promote CCB Consumer Gold Company to continuously improve the internal control system, improve the risk prevention operation mechanism, and actively prevent and cope with the above risks.

After the establishment of CCB Consumer Finance, State -owned Bank Consumer Finance Corporation has increased to three, and the other two are China Post Consumer Finance under the Bank of China Consumer Finance and Postal Savings Bank.

A few days ago, the "Development Report of China Consumer Finance Corporation (2022)" released by the China Banking Association showed that as of the end of 2021, the number of consumer finance companies increased to 30, and the balance of loans exceeded 700 billion yuan, reaching 710.6 billion yuan, a year -on -year increase of 44.2%; The total assets reached 753 billion yuan, an increase of 43.5%year -on -year, which has a large recovery compared with the severe impact of the epidemic. The compound growth rates of loan balances and total assets 2020 and 2021 were 22.6%and 22.8%, respectively, which was close to the average annual growth rate before the epidemic.

(Coordinating: Ma Chunyuan)

- END -

Lianfei Xiang's half -annual net profit of 2022 increased by 160.12% year -on -year year -on -year

On August 18, Lian Feixiang (code: 430037.NQ) released the performance report of the 2022 semi -annual report.From January 1, 2022-June 30, 2022, the company realized operating income of 309 million y

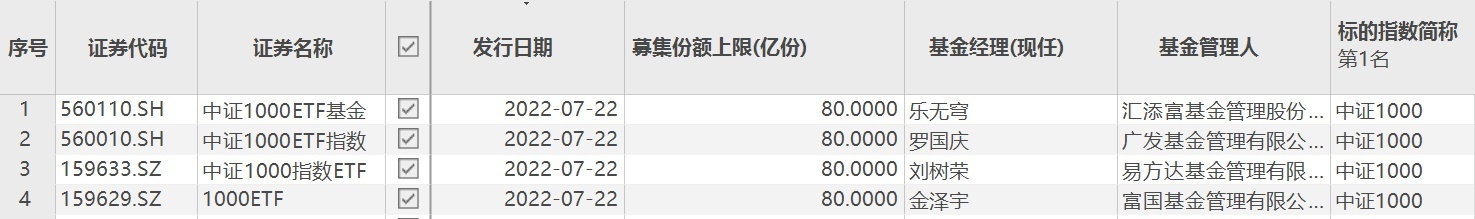

4 CSI 1000ETF collective first, the upper limit of the raising scale is 8 billion yuan

On July 22, 2022, the four CSI 1000ETF collectively launched, and the upper limit ...