Both the RMB on the shore and offshore fell below 7.2

Author:21st Century Economic report Time:2022.09.28

21st Century Business Herald reporter Ye Mai Sui Guangzhou report

On September 28, the renminbi was under pressure in the early morning of the RMB, and both shores and offshore RMB fell below the 7.2 mark against the US dollar, and the daily decline exceeded 500 points. On the morning of the 28th, the People's Bank of China authorized the China Foreign Exchange Trading Center to announce that the inter -bank foreign exchange market RMB to the US dollar exchange rate was reported to 7.1107, and 385 basis points were depreciated, and the lows since June 30, 2020 have been refreshed.

Pang Yan, chief economist and director of the research department of the Digang Langlian Federation, pointed out that the recent trend of the RMB exchange rate is more depreciated with the passiveness of the US dollar in the background of the US dollar index recently. In the short term, the US dollar curve still has a motivation to rise to the right end, and if the Fed continues to use the eagle position to radical interest rate hikes, the difference between China and the United States may continue to increase. Factors such as the haze of the energy crisis and geopolitical uncertainty may increase the "shelter" attribute of US dollar assets. The US dollar is expected to continue to maintain a strong position for a period of time, and the RMB exchange rate may still be under pressure.

Facing the continuous decline of the RMB to the US dollar, the central bank shot again before the opening on September 26. At 9:16 on September 26, the People's Bank of China released news that in order to stabilize the foreign exchange market expectations and strengthen macro -prudential management, the People's Bank of China decided to prepare for foreign exchange risks of foreign exchange sales business from September 28, 2022, starting from September 28, 2022. The gold rate is raised from 0 to 20%.

To put it simply, after adjustment, assuming that a bank's signing signing amount last month was US $ 10 billion, then this month, the central bank needs to pay a reserve of $ 2 billion. Before adjusting, the bank does not need to pay the money.

BOC Securities analyst Zhu Qibing said that since August 2015, the central bank has increased a total of three foreign exchange risk reserves and a two -time foreign exchange risk reserve ratio. The reserves of foreign exchange risk reserve have occurred during the period of the RMB depreciation. Recently, the offshore and the RMB exchange rate on the shore has fallen below 7.1, and the closing price of the RMB exchange rate on the shore has increased from the degree of deviation from the intermediate price and the expected depreciation expectations, or the central bank has increased the foreign exchange risk reserve ratio. The central bank's reserve for foreign exchange risk on financial institutions will be passed on to customers' long -term purchase reporting prices to inhibit the needs of long -term foreign exchange purchase and help prevent the RMB exchange rate from devaluation. Since the introduction of foreign exchange risk reserve measures in 2015, in the case of the central bank's 20%foreign exchange risk reserve for derivative transactions, banks' forward transactions in the foreign exchange transactions are indeed lower than the foreign exchange risk reserve ratio is to be lower than the foreign exchange risk reserves. 0 situation. BOC Securities said that there is no need to overly worry about the risk of adjustment of the RMB exchange rate. First, the market entity is more rational and mature, which can reduce the impact of exchange rate fluctuations. Second, the government has sufficient policy tools that can respond to the risk of over -adjusting the RMB exchange rate and ensure the smooth operation of the foreign exchange market.

Nanhua Futures Analyst Zhou Ji judged that the US dollar index was a new high and currently runs around 114. Under the pressure of a strong US dollar index, the US dollar exchange rate was basically running above 7 and continued to rise. Looking forward to the market outlook, the RMB is expected to continue to run passively in the short term. In addition, the central bank's inverse cycle factor regulation and the recent frequent shouts may be conducive to the stability of the US dollar against the RMB trend. It is expected that subsequent disadvantages will relatively converge, 7.2 or a key position.

(Coordinating: Ma Chunyuan)

- END -

Agricultural distribution of Nanyang Branch strengthens publicity and improves a good image

Recently, the Nanyang Branch has effectively carried out the integrity cultural concept and professional psychological visual promotion and application work in accordance with the requirements of the

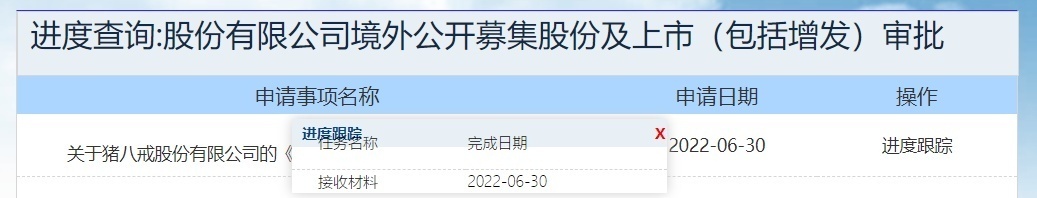

Zhu Bajie.com ’s first public issuance of shares for the first public issuance of the application for receiving materials for the China Securities Regulatory Commission

On July 1st, Capital State learned that Zhu Bajie Co., Ltd. submitted the approval...