The peak season is approaching, and the non -ferrous metal ETF (159871) has a net inflow rate of funds in the past 10 days of 6.91%

Author:Capital state Time:2022.09.28

On September 28, the non -ferrous metal sector was deeply adjusted.Tianqi Lithium Industry, Huayou Cobalt, China Mining Resources, and Ganfeng Lithium Industry are active, driving non -ferrous metal ETF (159871) current transition rates exceeded 26.53%.The market continues to pay attention to the performance of the non -ferrous metal sector, and the non -ferrous metal ETF (159871) has a net inflow rate of funds in the past 10 days.

Minsheng Securities said that under the pressure of interest rate hikes, the peak season supports prices, focusing on the recommendation of copper, aluminum, cobalt lithium and precious metal sectors.1) Industrial metal: In the context of "Golden Nine Silver Ten", the stock of the "Golden Nine Silver Ten" is opened before the National Day.2) Energy and metal: Lithium ore auction has reached a new high, lithium supply is tight and difficult to solve, battery factories have strong demand for lithium and nickel, and the contradiction between supply and demand will drive up prices.3) Precious metal: At the same time, the relevant US departments raised interest rates, and at the same time, they released a sharp interest rate hike signal in the future, and the price of gold was under pressure;

- END -

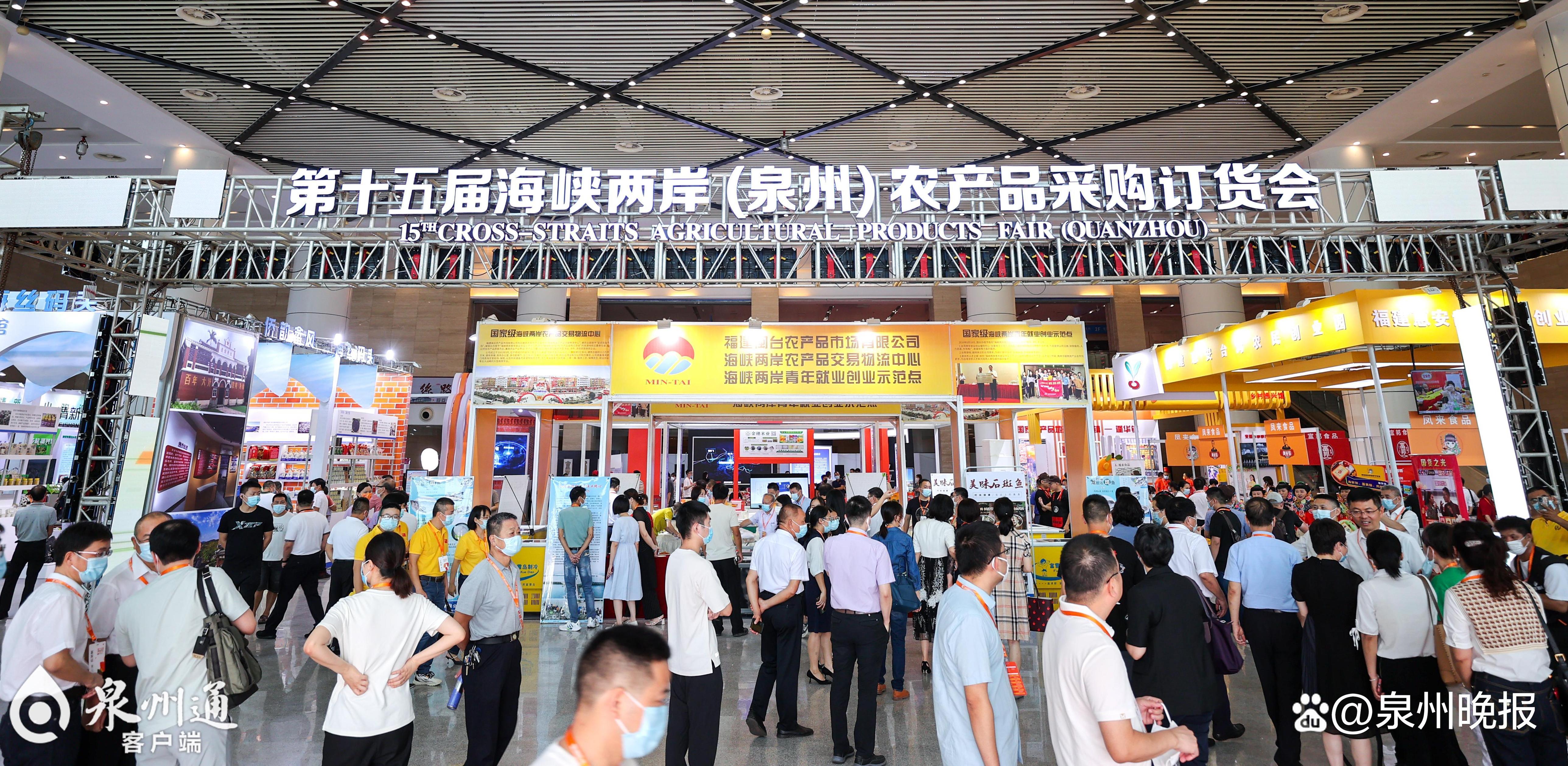

The 15th Straits of the Straits (Quanzhou) Agricultural Products Procurement and Ordering Association held a prefabricated vegetable exhibition area aiming at the air outlet

Quanzhou Evening News · Quanzhou Tong Client September 8th (Quanzhou Evening News...

People's Daily Zhan Shouguang: From "one good breed" to "good table", the whole chain enhances the competitiveness of the vegetable industry

From one grain of good varieties to good table, Shandong Shouguang-Full chain enha...