Soy sauce "rivers and lakes", it has changed

Author:Value Planet Planet Time:2022.09.28

Author | Tang Fei

Edit | Link Bili

In the past two years, the word "sauce" is particularly hot.

In fact, "sauce Mao" does not refer to the "sauce bottle Moutai" of ceramic bottles, but refers to the soy sauce white horse stocks similar to high growth, high return and long -term performance similar to Moutai.

However, this year, the sector changed its normal state and completely "fell out of favor". Many leading stocks encountered a sharp drop.

For example, from the beginning of the year to the present, Haitianwei has fallen by more than 20%, and the stock price of Qianhe Weiye has fallen by 30%. The stock price has fallen 58%.

In addition to the fluctuation of stock prices, most corporate performance has declined. Taking Haitianwei Industry as an example, since the listing on the Shanghai Stock Exchange on February 11, 2014, Haitian Weiye has maintained a double-digit growth rate. From 2014-2020, the company's average annual growth rate of revenue was 15.3%, and he returned to his mother. The average annual growth rate of net profit reached an amazing 21.9%, showing extremely high growth.

However, in 2021, Haitian Weiye's revenue increased by only 9.71%year -on -year, and the net profit of returning to the mother was only 4.18%year -on -year, which was the lowest value since listing. By 2022, this slump has not been substantially reversed. In the first half of the year, the company's revenue growth rate was 9.73%, and the net profit growth rate at home was 1.21%.

According to the data, Haitian Weiye is a leading condiment in my country. In the 2021 China Brand Index (CBPI) list, the company won the "four crowns" of soy sauce, oyster sauce, sauce, and vinegar.

This is still the same as the "boss" of the industry, and the rest of the soy sauce stocks seem to be more stressful.

The faucet falls to the bottom of the valley

For a long time, soy sauce has occupied an important position in my country's condiment industry. From the perspective of the condiment market, the proportion of soy sauce sales has reached 60 %. As a necessary condiment on the table of Chinese people, in a longer period of time, the soy sauce market has maintained a stable demand and growth.

Taking Haitianwei Industry as an example, the data shows that the products produced by Haitian Weiye have covered more than 600 varieties of more than 600 varieties such as soy sauce, oyster sauce, sauce, vinegar, cooking wine, chicken powder, bean curd, hot pot base material, etc. Specifications. Among them, Haitian tastes very fresh, Haitianjinbiao raw soy sauce, Haitian superior oyster sauce, sea -heavenly straw mushroom old soy sauce, Haitian soybean sauce, each single product has an annual sales value of more than 1 billion, which is the cornerstone to support the company's performance.

Since its listing in 2014, Haitian Weiye's revenue and net profit have continued to maintain double-digit growth. In 2016-2021, CAGR was 14.95%of the five-year operating income, and the net profit of 5 years was 18.60%. The year of 22.82%increased to 26.68%in 2021.

Coupled with the company's policies adopting the first payment and then goods, the company's cash flow is also better because many investors are called the "Sauce Mao".

However, after entering 2022, Haitian Weiye's performance suddenly changed his face.

According to data from the semi -annual report, in the first half of this year, Haitian Weiye's operating income was 13.532 billion yuan, an increase of 9.73%year -on -year, but the net profit attributable to shareholders of listed companies was 3.393 billion yuan, an increase of 1.21%year -on -year.

People in the industry said that the original catering channels were a major advantage in Haitianwei Industry. Under the invasion of the epidemic, the proportion of offline catering channels was too high to increase the instability of performance. According to Zhejiang Business Securities data, Haitian Catering channels account for more than 60%.

While the performance of Haitianwei Industry declined, the performance of other soy sauce faucet has emerged. Qianhewei Industry achieved operating income of 1.015 billion yuan in the first half of the year, an increase of 14.56%year -on -year; net profit attributable to shareholders of listed companies was 119 million yuan, an increase of 80.56%year -on -year.

In the first half of the year, Zhongzhu High -tech achieved operating income of 2.652 billion yuan, an increase of 14.52%year -on -year; net profit was 313 million yuan, an increase of 11.91%year -on -year.

However, although the performance of the company is happy and worried, the performance of each soy sauce stock is unsatisfactory.

From the beginning of the year to the present, Haitianwei has fallen by more than 20%, and the stock price of Qianhewei has fallen 30%. The largest decline in the middle of the torch high in the New Year has exceeded 41%. The stock price has fallen 58%.

If the time is stretched, the highest point of the stock price of "Sauce Mao" Hai Tianwei has fallen by 47.4%, which is only one step away from the back, and the market value evaporates exceeding 330 billion.

Structural inflection point is approaching

From the perspective of zero data in the first half of the year, the growth rate of catering revenue continued to fall, and the current recovery is still low. Data show that in June, catering revenue was 376.6 billion yuan, a year -on -year decrease of 4.0%; catering revenue in the first half of the year was 2004 billion yuan, a year -on -year decrease of 7.7%.

During the channel survey, most dealers feedback that the food and beverage shipments will only restore about 70%before the epidemic. Based on this, the absolute core of soy sauce consumption -restaurant and restaurant's overall demand for soy sauce has declined.

On the ordinary consumer side, due to the epidemic reasons, many consumers have more consumer goods stocking, and the inventory in the home is still digested. In addition, since the summer, there have been obvious precipitation in many places across the country, and there is a sporadic epidemic. Residents have a high willingness to stock up soy sauce, which leads to the weak feedback of the terminal consumption in the first half of the year.

Secondly, the prices of soybeans that have started soy sauce since the end of Q3 at the end of 2020 have risen sharply, and the prices of main packaged corrugated paper and glass have also risen significantly.

Taking soybean as an example, China Grain and Oil Information Network data shows that the price of soybeans in September last year was 5268.3 yuan/ton. By September this year, it has risen to 5921.4 yuan/ton. High. Picture source: China Grain and Oil Information Network

In view of the rise in the price of upstream raw materials, the gross profit margin of the sea Tianwei Industry has also declined, a year -on -year decrease of 2.68 percentage points.

In fact, the impact of raw materials on the performance of related enterprises has appeared in the first quarter of this year.

Sea Tianwei Industry, Zhongju High -tech, Qianhe Weiye and other condiments. The gross profit margin in the first quarter of this year fell 1.2, 2.6, and 0.5 percentage points compared with last year.

In addition to the factors from the industry, the changes in sales channels are also affecting the profits of related listed companies.

The rise of community group purchases has impacted the business model of traditional channels to a certain extent. Taking soy sauce as an example, Guotai Junan Securities pointed out that the community group purchase channels in 2021 will divert 12.63%of the soy sauce sales.

In addition to the problem of channel diversion, community group purchases have also severely disrupted the pricing system of soy sauce.

Under the traditional distribution system, it is generally a two -to -three distribution system. The product generally experiences one, two batchs, three batches (may not) and terminal links from the factory to consumers. The increase rate of each link is gradually increased All aspects of the supply chain are favorable. However, in order to fight for customers, the product retail price is more than 20%cheaper than traditional channels, breaking the original price increase system.

Under the comparable caliber, the unit price of soy sauce in community group purchases is also significantly lower than the commercial hyper -channel. For example, the retail price of the supermarket with a very fresh 750ml of Haitian is 11.8 yuan, but it can be bought for only 9.99 yuan on Meituan's preferred and more food. The difference is nearly 2 yuan. The retail price of Li Jinji's 500ml of Salt Sweet Sweet Sweet Sweet Sweet Sweet Sales is generally 10 yuan.

Consumers Longlong said that the ingredients that are commonly prepared such as rice noodle oil are purchased through online purchase or group purchase delivery. One is that these products weigh in large weights, and it is not convenient for buying to buy in supermarkets. , Sometimes you can get the chance of redeeming the price or the second half price.

In the end, the condiment industry is not high, which allows many opponents to stab this piece of cake. In the soy sauce industry, there are not only old -fashioned companies such as kitchen food, Qianhewei, Jiajia Food, and Li Jinji, but also "cross -border strong" such as gold arowana, Luhua, Shuanghui, and New Hope.

In the pattern of the Red Sea, the former "sauce" people have ushered in an inflection point.

What is the future trend

At present, the competitive pattern of my country's soy sauce industry is divided into three levels. One is national brands, such as Haitian Flame Industry, Li Jinji, and Zhongju High -tech. In addition, Xinhe in Shandong, foreign -funded brands are represented by Guida Wan and Heinz; third, small -scale factories or family workshops, generally adopt self -producing and self -selling, low products, and main attacks in rural areas and township markets.

In 2020, the output of 35 top 100 soy sauce companies accounted for 41%of the soy sauce industry, and the industry concentration was not high. Among them, the output of the leading enterprise Haitian Weiye soy sauce was 2.38 million tons, with a market share of 17.70%, and the second -ranked enterprise in the industry accounted for 3.74%, and the industry CR3 was about 24%.

Compared with the concentration of the Japanese soy sauce industry, the concentration of the soy sauce industry in my country has a lot of room for improvement. As early as 1975, the Japanese soy sauce industry CR3 reached 38%, and the CR10 was 48%. Since the 1990s, the Japanese economic recession has accompanied the westernization and convenience of Japan's diet, and the output of soy sauce has declined. During this period, the number of Japanese soy sauce companies decreased from 2,300 in 1989 to 1,192 in 2018. At the same time, Japanese soy sauce leading companies led the consumption upgrade, and the market concentration continued to increase. As of 2020, the soy sauce CR3 reached 53% And my country's soy sauce CR3 still has a gap of 29 percentage points from Japan.

According to the company's investigation data, as of July 2022, a total of 5,276 soy sauce manufacturing companies in my country have been survived or in the industry. Within 3 years (July 2019-July 2022), 852 related companies are established, and 134 companies have canceled them. Or the registration status is abnormal, and 239 companies are increasing each year. With the cold industry in 2021, the number of newly registered companies dropped to 161, and only 32 were registered in the first half of 2022.

Compared with the number of Japanese soy sauce companies decreased from 2,300 in 1989 to 1,192 in 2018, the number and industry scale of my country's soy sauce industry are still increasing. As the number of new entrants decreases, the rate of concentration increases is expected to accelerate. Essence

And compared to Japan, my country's soy sauce has a certain amount of price lifting space in large and medium cities, and offline cities and township areas have more room for upgrading soy sauce consumption.

In the early days, the ton price of Haitian Weiye fell during the sinking process, but in exchange for the strong growth of sales.

Later, after the price increase every 2-3 years, and the promotion of the upgrade of condiments, Haitianwei Industrial ton price increased from 5002 yuan/ton in 2015 to 5333 yuan/ton in 2021, and the 6-year CAGR was 1.09%. Although the growth rate is not high, sales have maintained rapid growth during the sinking channel.

In recent years, Haitian has also followed the consumption trend, and further launched high -end products such as 0 series products, organic products, headway products, and salt reduction series, which has driven the combination of soy sauce products to further upgrade at the C end. In 2010, the company's high -end, mid -range, and low -end sales ratio was 1: 6: 3. The current proportion is 4: 5: 1. The upgrade trend is obvious, but low -end products still account for 60%.

It is foreseeable that for a long time in the future, Haitianwei Industry will further explore the potential of the sinking market and aims to be "high -end".

Similarly, the competition of all soy sauce companies must be focused on the sinking market. However, it is limited to the regional market separation and scattered market competition pattern, which is much more difficult than imagined.

After the industry has been replaced by the two products of "single soy sauce products", "raw soy sauce, old soy sauce, etc.", it is currently upgraded to high -end and high -priced soy sauce products that meet the intense health needs of consumers.

"High -end" will be a place where the soldiers will compete.

Reference materials:

[1] "Throwing the cocoon, the influence and loss of community group purchase on the condiment", West China Securities

[2] "One of the reports of Haitianwei Industry: Hai Kuo Zhiyue, Long Sky Ren Bird Fly", Dongxing Securities

[3] "The second report of Haitianwei Industry Series: High Wall Wall Establishs, with Qian Kun inside", Dongxing Securities

[4] "2022H1 performance review: the leading growth, the performance meets expectations", Soochow Securities

*This article is based on public information, which is only used as information exchange, and does not constitute any investment suggestions

- END -

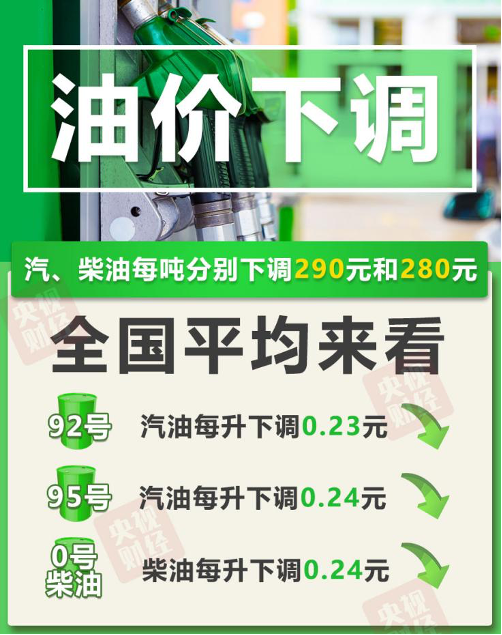

Oil price has dropped!

According to the National Development and Reform Commission, the new round of refi...

A number of shared bicycles have announced the price increase!

The bicycle sharing industry has an increase in price increases this year!The pric...