Heavy!Han Tingyi Reform Typical Published in China Development Online

Author:Hanting Rong Media Time:2022.09.28

In recent years, Han Ting District has tried it first to actively promote financial empowerment work, and solve the problem of difficulty in financing, expensive financing, and slow financing of enterprises, especially small and medium -sized enterprises. The relevant practices have been published by China Development Network and are now reposted and promoted.

To revitalize the credit resources of the enterprise, crack the financing problem of small and medium -sized enterprises

Han Ting District actively tried it first, and gathered the CNC Company to innovate and develop digital energy -enabled financial service platforms, make good use of the key support of corporate credit, and open up data sharing channels between government departments, public institutions and other data source units and financial institutions The change of intangible data resources is a tangible credit proof, solving the problem of difficulty in financing, expensive financing, and slow financing of enterprises, especially small and medium -sized enterprises, do a good job of "six stability" work, fully implement the "six guarantees" tasks, accelerate the construction of a new development pattern 2. Promote high -quality development to provide strong support. Since the launch of the platform on March 31, 441 registered enterprises have released 1.13 billion yuan in financing demand, helping 100 companies get bank credit for 416 million yuan, handled 370 million yuan in loans, an average interest rate of 5.25%, and the average use of a single use is about about about about In 2 days, it is expected that the company will apply for a loan of more than 1 billion yuan for the enterprise.

"Credit Change of Assets"

Cracking the "difficult financing" problem of small and medium -sized enterprises

The first is to wake up "sleeping" data assets. Enterprise government data, social data, and third -party data have a wide range of amounts. In particular, the relevant enterprise information information can comprehensively and accurately reflect the corporate credit situation, which has high value for enterprises, especially small and medium -sized enterprises, especially small and medium -sized enterprises. Innovative use of blockchain and big data technologies in Hanting District, from more than 10 departments including administrative approval, taxation, power supply, etc., collect more than 60 categories of credit data information such as business conditions, tax declaration, and judicial litigation. Data, social data, and third -party data barriers to wake up "sleeping" data assets for small and medium -sized enterprises to financing "roads". The second is to intelligently generate credit "golden business cards". Through digital supporting financial platforms, enterprises can supplement and improve financial, taxation, invoices, electricity, and judicial data such as "voluntary reporting+credit commitment" and other methods to form a "corporate information library" that can be truly accurate and available for credit evaluation. On this basis, the platform uses the eight major models such as intelligent marketing, customer verification, credit score, and quota calculation to identify customers. , Analysis and judgment of the five dimensions of corporate strength "how" and financing demand "loan non -loan" to form a corporate credit rating report. According to the credit scoring score, the enterprise is divided into AAA, AA, A, BBB, BB, B, C, C, and C Wait for 7 levels. Enterprises above the A or above are directly included in the "whitelist" enterprise of digital empowerment financial financial finance, with a "digital gold business card", and the state -owned guarantee company "see loan is guaranteed" to increase credit; BBB is a general enterprise, which can be repaired for credit. Select other financial products or release personalized financial needs on the platform; below the BB level is "dishonesty" enterprises, there is no loan qualification on the platform, and credit services are "well -based" and "rest assured". Since the operation of the platform, the proportion of first loan customers and first loans has been greatly improved compared to the traditional way. Among the 100 companies that have completed credit and loans, 51 first loans and 51%of them have been completed. The proportion of loans for guarantee and credit methods reached 93%, and the proportion of non -mortgage loans was greatly increased. The third is to be a good financial institution "staff". By generating a credit rating report of the enterprise, the "credit" of invisible and invisible enterprises can be quantified, and the data dimension is more complete, the data content is more realistic and more realistic. , Fear loan switch to energy loan and dare to loan. At the same time, establish an information security guarantee mechanism, relying on the six technologies of "Data -specific transmission, face living identification, CFCA digital visa, security sandbox, modeling isolation area, federal security calculation" Administrative data can be visible. The access behavior is monitored throughout the process to ensure that all operation steps can be queried and traceable. Recently, Weifang Runting Industry and Trade Co., Ltd. has financing demand, but as a light asset entrepreneurial company, loans have always been "boss difficulties". Traditional methods can only loans 200,000 yuan. For data analysis and scores such as corporate exports, taxation, electricity, and social security, the credit rating report was promoted to the Cold Pavilion Branch of Zhejiang Commercial Bank in real time to help enterprises get a credit limit of 900,000 yuan, which greatly solves the demand for corporate funds.

"Platform Symbol"

Cracking the problem of "expensive financing" of small and medium -sized enterprises

The first is to innovate the "intelligent comparison" mechanism. Due to the variety of financial institutions and loan products and different advantages, small and medium -sized enterprises lack professional financing consultants, and it is difficult to quickly and accurately choose the most suitable financial products. To this end, the digital -enabled financial platform innovates the "intelligent comparison" service. Based on the needs of corporate loans, the use of blockchain technology and intelligent algorithms to analyze the types of loan types and guarantee methods released by different financial institutions in the platform to analyze the types of loan types and guarantee methods. , Interest rate range, loan quota, loan period and other information, intelligent "goods than multiple goods", accurately matching financial products with the lowest interest rate and optimal service. The second is to innovate the "two or eight -point insurance" mechanism. By improving the credit system and evaluation system, a state -owned guarantee company is introduced, and a "white list" enterprise with high -quality credit "see loans". At the same time, the establishment of a "two or eight -point insurance" mechanism, the national, provincial, municipal, and district -level guarantee system bears 80%of the risk, and the cooperation bank will bear 20%risks. The national and provincial guarantee funds pay 0.2%of the guarantee premiums, and pay less 0.3%of the guarantee premiums than the previous ordinary guarantee business, which greatly reduces corporate financing costs. The third is to innovate the "private customization" mechanism. For credit products pushed by the platform, companies can choose or release personalized financing needs. Financial institutions combined with the actual innovative credit service model to provide "private customization" for enterprises. At present, the platform has settled in 19 financial institutions such as China Construction Bank, Zhejiang Commercial Bank, and Weifang Bank, providing 69 credit products such as "tax ticket loans" and "scientific and technological achievements transformation and loan", which fully meets the differentiated and specialized financial finance of small and medium -sized enterprises. need. Taking Shandong Quansheng Medical Technology Co., Ltd. as an example, the company used to apply for pure credit loan interest rates above 6%, and it also needs to pay high agency fees. The financing cost is high. Matching the "Cloud Tax Loan" product of China Construction Bank, handling 1 million yuan in credit, interest rates as low as 4.05%. "Data runs more legs"

Cracking the problem of "slow financing" of small and medium -sized enterprises

The first is to explore the development of "online fast loans". Embeds the "Swift" full -process digital bank intelligent loan system on the platform. From the initial customer application to the final signing loan, only the data can be uploaded. The platform can quickly complete the customer portrait and risk analysis. Multiple links such as the application for loan on -site and field surveys to achieve online, paperless, and intelligentization of all business, the greatest "excellent process, voltage time limit, and efficiency capacity". The second is to implement the "one -to -one" housekeeper service. Establish a "Enterprise Financial Services" consulting window on the platform, set up a professional service team, and implement the "one -to -one" full -process housekeeper service, requiring each service commissioner to apply for the company's "telephone return visits on the same day, the next day on -site visit" to achieve the realization Enterprise "real -time loan". At present, the platform has been equipped with 12 service commissioners and has carried out more than 400 corporate visits. The third is to innovate the "post loan evaluation" system. The platform conducts a full process monitoring of the management of enterprise financing business. Three parties of enterprises, competent departments, and service commissioners can inquire the progress of loan processing online in real time, and focus on the slow progress of business. After the company's loan is completed, there is a comprehensive scoring of credit products, batch efficiency and services provided by financial institutions. Financial institutions improve service efficiency. Taking Shandong Foyan Traditional Chinese Medicine Technology Co., Ltd. as an example, as a small and medium -sized and micro agricultural enterprise, three new products have been developed this year. It plans to produce and seize the market in batches and seize the market. In two or three months, only one day was used through digital energy -enabled financial platforms. Without running legs, he got a loan credit credit for Weifang Bank's 1.5 million yuan, which truly realized "worry -free, time -saving, and effort".

Source: China Development Network

- END -

The revenue of 20 liquor listed companies in the first half of the year was 185.35 billion yuan "Mao Wu" accounted for nearly 60 %

31AugOur reporter Wang Lixin, an apprenticeship reporter Li Jing, as of August 30,...

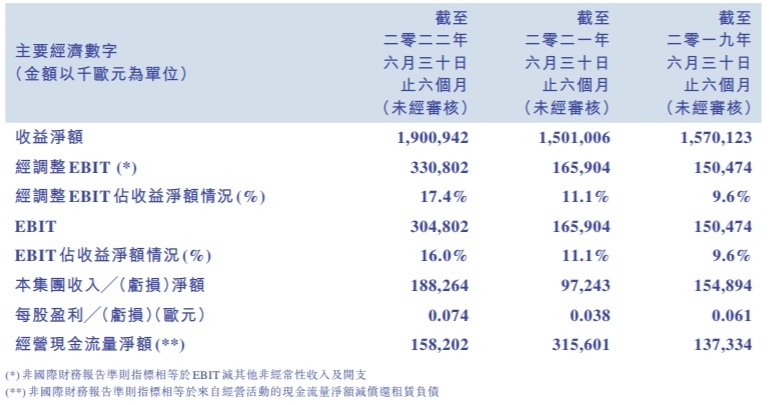

Prada 2022 was adjusted by 331 million euros in the first half of the year, an increase of 99.39% year -on -year

On July 29, 2022, the Hong Kong stock listed company Prada (01913.HK) issued the a...