Asian Gold Coordinated Green Committee: When ESG financing is justified, the Asian version of the green financial cooperation development framework is promoted

Author:21st Century Economic report Time:2022.09.28

21st Century Economic Herald reporter Li Dchangyu intern Chen Fen Beijing reported

Recently, the Asian Financial Cooperation Association (hereinafter referred to as the Asian Gold Association) Green Financial Cooperation Committee (referred to as the Green Gold Commission) 2022 International Forum was held online at the same way in Beijing, Brussels, and Beirut.

The Asian Gold Green Committee is one of the first cooperation committees established since the establishment of the Asia Gold Association in July 2017. It is committed to promoting the Asian version of the green financial cooperation development framework. The meeting was jointly organized by the Asian Gold Association, the World Savings and Retail Bank Association, and the Arab Banking Alliance.

At this forum, Mr. Liu Feng, Executive Deputy Director of the Green Committee of the Asia Gold Association Green Committee and chief economist of Galaxy Securities, released the "Green Financial Practice Report (2021)" on behalf of the Green Gold Commission, and made specific reports on the report. introduce.

"The Asia -Gold Association Green Gold Commission is committed to making the report into a professional green financial practice display brand in Asia, and summarizes relevant suggestions based on the report's practice cases, promotes the experience of greening financial practice, promotes the Asian version of green financial cooperation and development The framework has a positive reference significance to form a green financial consensus. "Liu Feng said.

The report contains 60 outstanding cases of green financial practice in Asia, including green loans, green bonds, green ABS, green funds, green insurance, and other green financial products. The work done provides a model for regional green financial development.

The report shows the overall pattern of Asian green finance and the current status of green finance in some countries and regions, and explores the opportunities and existing challenges faced by Asian green finance under the new crown epidemic; The investment situation shows that Asian Green Investment is in its position in the world and explores future development space.

Under the leadership of China's "double carbon" goals, at present, green finance has achieved certain results in China. The domestic green financial system has become increasingly improved, and the national carbon emissions trading market has been established. It has formed a variety of green financial development models at the national, regional and urban levels.

As far as international cooperation is concerned, green financial identification and classification standards are gradually connecting with international standards, and multi -level green financial cooperation among financial institutions has begun. Chen Kewen, Secretary -General of the Asian Gold Association, said in the forum that "green" and "sustainable" have become the common economic development concept of countries around the world. Green Finance, as a necessary support and powerful starting point for building a green economy system, has integrated into the development of various countries. As a schedule, as a specific executor of green finance, financial institutions need to carry out in -depth cooperation.

The Asia -Gold Association expressed its hope to cooperate with financial institutions, government agencies and international organizations to coordinate advantages, so as to help the global ESG development and build a sustainable future. On the one hand, the Asian Gold Association strengthened and cooperated with the industry to deepen members' awareness and practice of ESG concepts; secondly, the Asian Gold Association strengthened cooperation with government agencies to promote membership to participate in the formulation of relevant policy standards; finally, the Asian Gold Association strengthened and the international international Organize cooperation to expand the international development space of members.

This forum is divided into three round table discussion conferences with the theme of "ESG financing supervision methods", "incorporating ESG factors into the risk assessment system" and "responsible financing instruments and practice". Participants shared the practical experience and wonderful views of ESG development from multiple perspectives such as regulators, associations, and financial institutions.

Ni Gaiqin, a second -level inspector of the China Securities Supervision and Administration Council's Bond Department, Dr. Dr. KalyALYA, President of Zambia Central Bank, Ray T. Klien, chief operating officer of the Bank of Ghana Republic, and members of the Asian Gold Association. Dai Dan, assistant manager, and Zhang Dabao, deputy general manager of the Credit Management Department of the Agricultural Bank of China, participated in the round table discussions of these three themes.

- END -

up to date!The minimum wage standards for 21 cities and states in Sichuan

Chuanguan News reporter Liu ChunhuaOn August 12, the reporter from Sichuan Guan learned from the Sichuan Provincial Human Resources and Social Affairs Department that the latest minimum wage standards

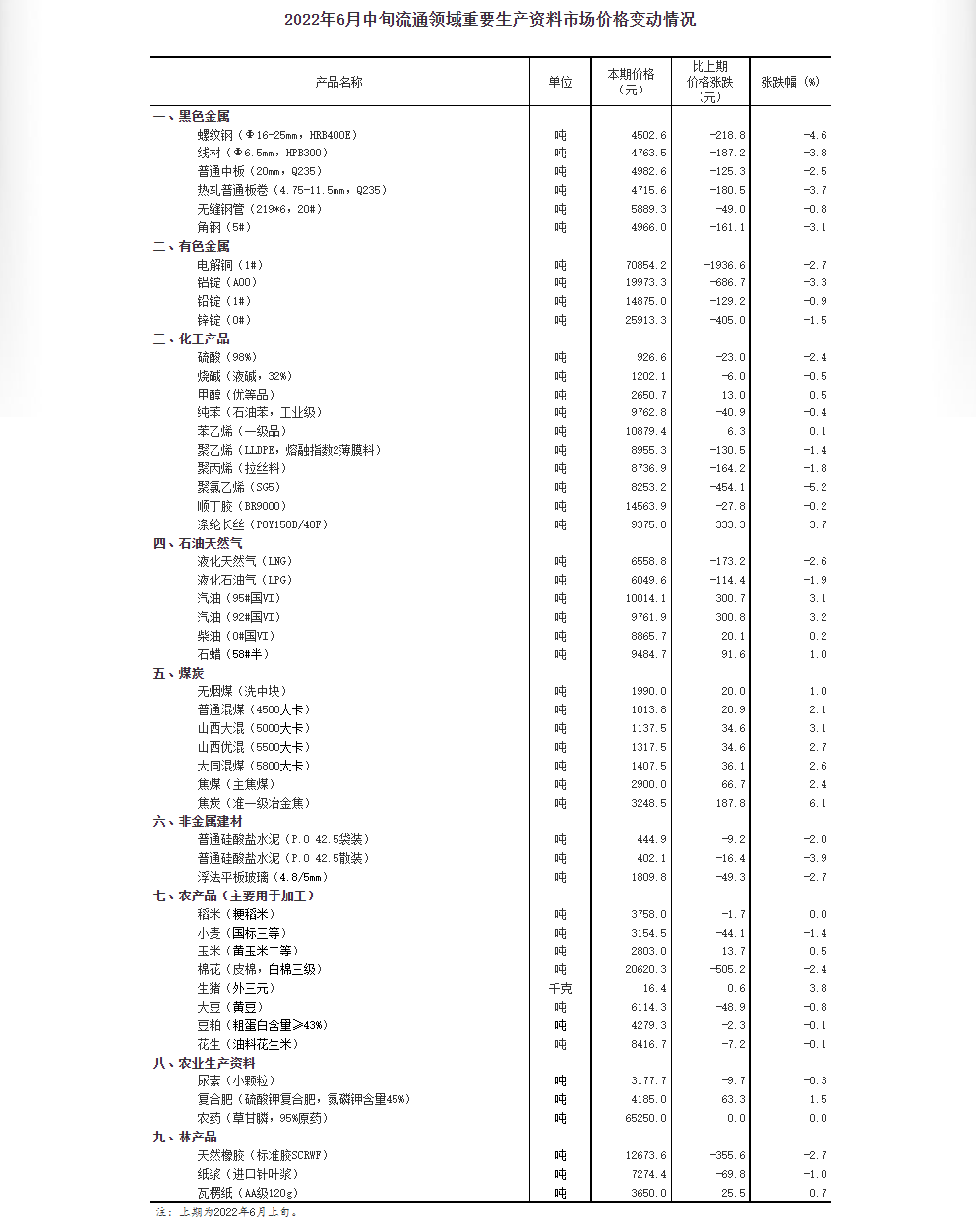

National Bureau of Statistics: In mid -June 2022

China Economic Net, Beijing, June 24th. According to the website of the State Bure...