Dacheng consumer opportunity mix (main code: 016287) Fund shares on sale

Author:Capital state Time:2022.09.28

Dacheng Consumption Opportunities Mixed (Main Code: 016287) Fund has been released on November 9, 2022 through October 20, 2022 through the online trading system of Daocheng Fund Management Co., Ltd., Shenzhen Investment Finance Center and other sales institutions.

The recruitment book shows that under the premise of strictly controlling risks, the fund is looking for high -quality companies with core capabilities and continuous growth, and strive to achieve long -term stable value -added of fund assets.

The fund's investment portfolio ratio is: 60%-95%of fund assets invested in stock and deposit vouchers (the share investment ratio of the Hong Kong Stock Connect bids does not exceed 50%of the fund's stock assets), of which the fund is invested in the fund The proportion of defined consumer opportunities related stocks and deposit vouchers is not less than 80%of non -cash fund assets; the fund will finally deduct the stock index futures contract and government bond futures contracts for each trading deposit every day. A government bonds with a cash of 5%of the net asset value of the fund or the expiration date within one year. Among them, cash does not include settlement reserve, deposit deposit, receivables, etc. Follow the relevant national laws and regulations.

Fund's investment strategy is divided into two aspects: on the one hand, it is reflected in the "top -down" method of "top -down" to allocate large categories such as equity, fixed income categories, etc.; on the other hand, it is reflected in the selection of individual investment varieties On the top, the main use of the "bottom -up" method, through in -depth research on the fundamentals of listed companies, based on the trade -offs of the business model, core competitiveness, industry status and management capabilities of listed companies, the layout of the large consumer industry chain In the industry with a large and long -term growth space in the downstream, select a combination of competitive advantages and attractive valuations.

The fund's performance comparison benchmark is: the yield rate of CSI Consumption theme index × 80%+Hang Seng Comprehensive Index yield (use valuation exchange rate adjustment) × 10%+comprehensive full price (total value) index yield rate × 10% Essence The consumer theme index of the CSI Mainland consists of the major consumption and optional consumer industry company stocks, which has strong representativeness.

- END -

A number of agricultural products companies in Xinxiang High -tech Zone appeared in the production and sales docking meeting of agricultural products

Top News · Henan Business Daily reporter Song Hongsheng intern Jin Ping correspon...

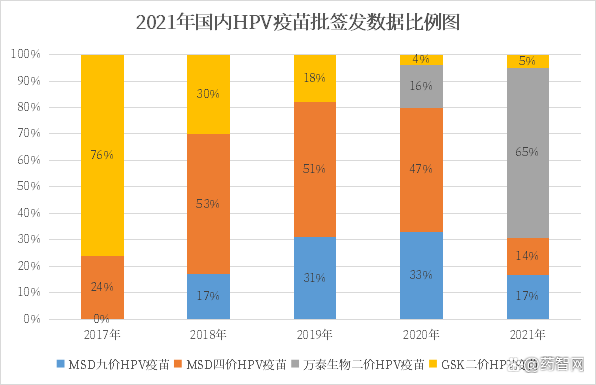

HPV expansion, targeting Wantai, Watson, Kangle Guardian, Ruike and Watson have lost their advantages!

HPV expansion is aimed at Wantai, Watson, and Kangle Guardians, and Ruko and Watso...