17 new stocks broke on the first day, and the new strategy changed from "Fengxin must play" to "selected stocks"

Author:Huaxia Times Time:2022.09.28

China Times (chinatimes.net.cn) reporter Chen Feng, a reporter Zhang Mei Beijing reported

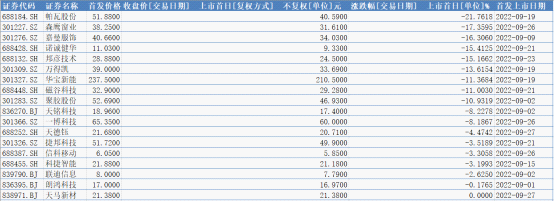

Recently, the phenomenon of breaking in the first day of the listing of new A -share shares has increased. Flush iFind data shows that since September, a total of 41 stocks have been listed, of which 17 stocks were broken on the first day, accounting for 41%.

The reporter's visit to many people in the industry, most of which have said that the era of A shares with new products as the core strategy of product has passed. Investors' new strategies should be transformed from the previous "Fengxin must play" to "selected stocks".

Why do new shares break?

On September 27, Tian Deyu (688252.SH), Tianma New Materials (838971.BJ), Jiaocheng ultrasound (688392.SH), China Textiles (873122.BJ) landed on A shares. Jiaocheng ultrasound and China Textiles opened high, rose 69.46%and 86.25%on the first day; Tian Deyu broke the first day, a decrease of 4.47%; the first day of Tianma's new material was basically the same as the issuance price.

What are the reasons for the increase in A shares? Yang Shu, a senior investment consultant of Huajin Securities, analyzed the reporter of Huaxia Times that first of all, due to multiple factors since 2022, market conditions have increased. In the first nine months, Wan De Quan's A index rose for only 3 months, and the remaining 6 months were in a state of closing and falling. The overall performance of the market was not good, restricting the popularity of the market and intra -field liquidity.

Secondly, the inquiry new rules have promoted the upward transfer of the price of new shares. The price of new shares is high, and nearly 40%of the valuation premium rate of nearly 40%of the new shares (the average price-earnings ratio of the industry when the P/E ratio of the distribution/starting is 100%. In addition, some new stocks have a weak profitability, and the new stocks of the new shares have not yet achieved profitability. Some new stocks have recently experienced a decline in performance or decline in profitability. These factors have caused some new stocks to break the first day.

Gao Le, senior vice president of China Galaxy Securities Products Center, told a reporter from the Huaxia Times that the core reason for the break is the weak market, the global risk preferences are low, and the effect of making money is difficult to reflect, especially the near -long holiday transaction volume gradually shrinks, which has exacerbated new shares to break through the break. Case.

Financial commentator Tan Haojun's point of view is that on the one hand, the current stock market has strong volatility and insufficient investor confidence. Under such circumstances, it is difficult to maintain a rising pattern after the issuance of new shares. On the other hand, there are still some new stock pricing pricing It is obviously high. Under the circumstances of high pricing, after listing, its valuation will naturally have problems, and there will be some breakthroughs. Tan Haojun reminded that new shares listed on the pricing issue should still be more cautious.

Can "hit new" still "make a stable"?

At present, is A -share "new" still a "stable and not compensation" business? "Huaxia Times" reporter asked many experts on this issue.

Yang Shu told the reporter of the Huaxia Times that on September 18 last year, a series of documents were released simultaneously to amend the underwriting system of the registration system. In addition to further strengthening online inquiry compliance management, it focuses on revising the online inquiry system, reducing the high-price removal ratio from the original "not less than 10%" to "1%-3%". At the same time, simplify the investment banking bank Break through the process of "four minimum low" pricing. With the revision of these two systems, the decrease in the proportion of the "high" and the breakthrough of the "Four Disted" pricing will reduce the phenomenon of "Bo Siege". Essence

Yang Shu concluded the characteristics of breaking new shares. He found that new shares with high issue prices, high -issue price -earnings ratios, and high valuation premium rates are more likely to break. At the same time Higher risk of breaking.

From the perspective of the characteristics of increase, Yang Shu found that the issuance price of less than 30 yuan, the issuance of the P / E ratio of less than 30 times and the issuance of the issuance of a market value of less than 5 billion yuan, the increase in the first day is better than other new shares. At the same time, new shares that are listed in the secondary market in the sector are often obtained.

Yang Shu suggested that at present, new investors need to be alert to narrowing or even breakage of new stocks. Whether it is institutional investors or ordinary investors, new strategies should be transformed from the previous "Fengxin must play" to "selected stocks".

Gao Le told this reporter that the era of A shares with new products as the core strategy of product has passed. In the future, with the coming of the comprehensive registration system, the break of new shares is inevitable. The first day of break will be gradually accepted by the market.

Tan Haojun said that corporate performance is the core factor of stable stock price. If the performance remains good, with the stable market in the future and the recovery of investor confidence, the pursuit of new shares will be expected to improve.

A -share medium and long -term is worthy of optimism

How to view the A -share market market? Gao Le pointed out that the rebound expectations before the holiday are relatively low, but the main index of A shares is near 90%of the historical division, and even approaching historical poles. The long -term configuration value is prominent. Value investors can open the gradually left layout; transaction -type investment Those who can focus on three seasons reports, the continuous high -prosperous industry, the micro -crowded track will be the key direction of October.

Yang Shu is also more optimistic about the A -share market. He said that although in the short term, the market lacks funds and consensus, the amount of shrinkage is obvious, and the risk appetite has fallen rapidly. At the same time, investors' crowded defensive transactions have enlarged market fluctuations under the downturn. However, from the long -term perspective, the fundamental characteristics of the Chinese market have large space, sufficient toughness, and large policy rooms. Considering that the overall valuation of the current market is already in a low historical position, the equity risk premium of the Shanghai and Shenzhen 300 indexes returned to the historical average near the standard deviation. The location of the bottom period has a certain valuation attractiveness. Follow -up need to focus on policy signals and fundamental signals, first seek stability, then seek advancement, and wait patiently for the right time. Tan Haojun said that the market behind A shares needs to pay attention to the recovery of the external environment and the domestic economy. Economic recovery in the third quarter gradually improved or supported the stock market. In addition, investor confidence has recovered well, and the market for A shares may rebound in the fourth quarter. Overall, the next A -share love is worth looking forward to.

Editor: Editor Yan Hui: Xia Shencha

- END -

deal!Cancel 29 and adjust 24 fines

On July 29th, the State Council held a routine blower of the State Council's policy to introduce the work of further regulating administrative tailoring and canceling and adjusting a batch of fines. Z...

Feihe was soldiers

@新 新 新Author 丨 Bai Yan Editor 丨 Moon SeeThere are many concepts of Mao, but t...