@Everyone, personal pension has big news →

Author:Voice of Women's Federation o Time:2022.09.28

Personal pension that has attracted much attention

The preferential tax policy is determined!

Yesterday (September 27)

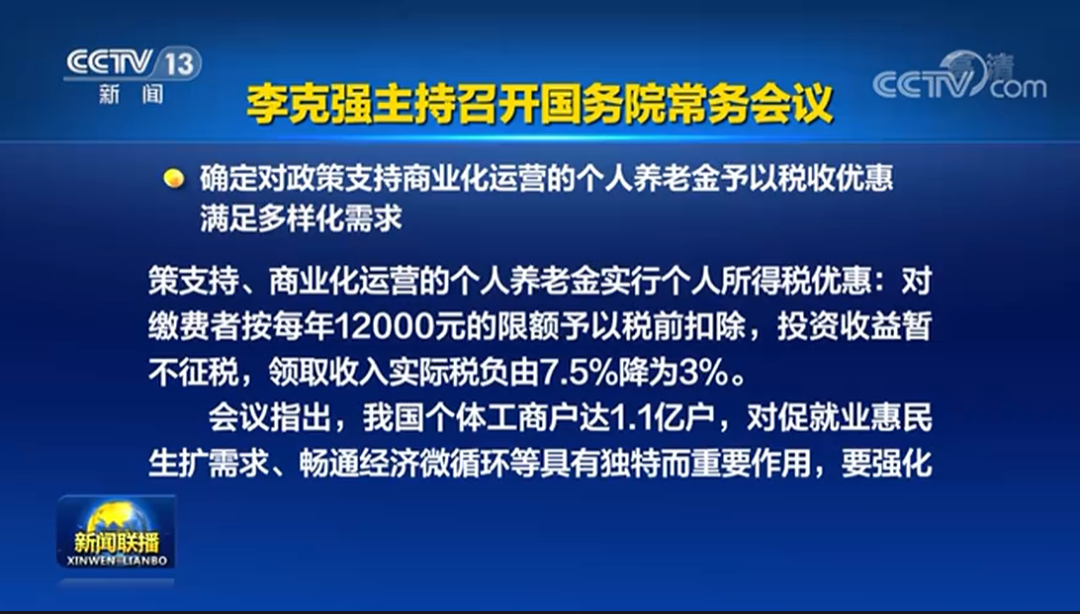

CCTV "News Network" report

//

On September 26, the executive meeting of the State Council decided: Personal income tax benefits for personal pensions for policy support and commercial operations: The payment of the payment of the payer is deducted from the limit of 12,000 yuan per year. The tax negative was reduced from 7.5%to 3%.

Industry experts say this means that the personal pension system ushered in a good tax policy. Whether it is a pre -tax deduction of 12,000 yuan per year, or if the investment income is not taxed, and the tax burden drops sharply, it will inspire more residents to participate in personal pensions, expand the third pillar coverage, and effectively respond to the aging of the population.

Zhang Lin, director of the Institute of Risk Management and Insurance Actuaries of Hunan University, said in an interview with reporters that the actual tax burden of the payment when the payment was received from 7.5%to 3%. This is considerable. And give a lot of discounts, which is quite good.

Shi Xiaojun, a professor at the School of Finance and Finance of Renmin University of China, also told reporters that the tax discounts this time are quite large, because 3%is equivalent to the tax rate of 5,000 to 8,000 yuan. The process of personal pension system needs to be continuously explored and perfected. How does the preferential tax of taxation are also the most concerned aspects of the academic and industry attention in recent times. A very powerful incentive.

In April of this year, the "Opinions on Promoting the Development of Personal Pension" (hereinafter referred to as "Opinions") issued by the General Office of the State Council clearly stated that workers who participated in the basic pension insurance of urban employees or basic pension insurance for urban and rural residents in China can participate in individuals Pension system. Personal pensions implement a personal account system, and the payment is completely borne by the participants and fully accumulate.

In simple terms, people who participate in social security and the personal pension system, after reaching the retirement age in the future, can receive social security pensions and personal pensions at the same time.

It is worth noting that the pilot policy of the tax extension pension insurance previously launched stipulates that the limit of the pre -deduction of the insurance payment tax is 6%and 1,000 yuan (or 6%and 12,000 yuan in annual income). The income is not taxing for the time being, and then pays 7.5%of the tax when receiving. However, as far as the feedback from people from all walks of life, the discounts of tax extension are still not enough.

It is understood that China ’s multi -level pension insurance system mainly includes three aspects, which is commonly referred to as the“ three pillars ”.

· The first pillar is the basic endowment insurance, which is the main part;

· The second pillar is corporate annuity and occupational annuity;

· In addition to the third pillar of personal pension and other personal business pensions, it is an effective supplement to the first pillar.

Promotion and implementation of the personal pension system

It is satisfied with the people

The inevitable requirements of multi -level diversified pension insurance demand

It is also promoting the high -quality development of social security,

Important measures for sustainable development

Source/"Shanghai Morning", Surging News, Daily Economic News

Edit/Liao Yunqing

- END -

Xinjiang: The proportion of nursing beds for pension institutions is not less than 55%

Pomegranate cloud/Xinjiang Daily News Recently, the General Office of the Party Committee of the Autonomous Region and the General Office of the People's Government of the Autonomous Region issued the...

The maximum decrease was reduced by a maximum of 1,000 yuan on June 24!Harbin consumer subsidy is here

The reporter learned from the Harbin Municipal Bureau of Commerce that from June 2...