The small loan industry concentrates to the head, and the Internet manufacturer accelerates integration of small loan business

Author:WEMONEY Research Room Time:2022.09.28

Produced | WEMONEY Research Room

Wen | Liu Shuangxia

The equity structure changes, applying for new trademarks, and the Sina small loan has ushered in new changes during the year. Sina small loan is an important part of Sina's financial business.

In fact, not only Sina Small Loan, this year, Tencent, 360 Division, Bytes, JD.com, Ctrip and other Internet companies have accelerated the integration of its small loan licenses. In the past two years, the number of small loan institutions has decreased year by year.

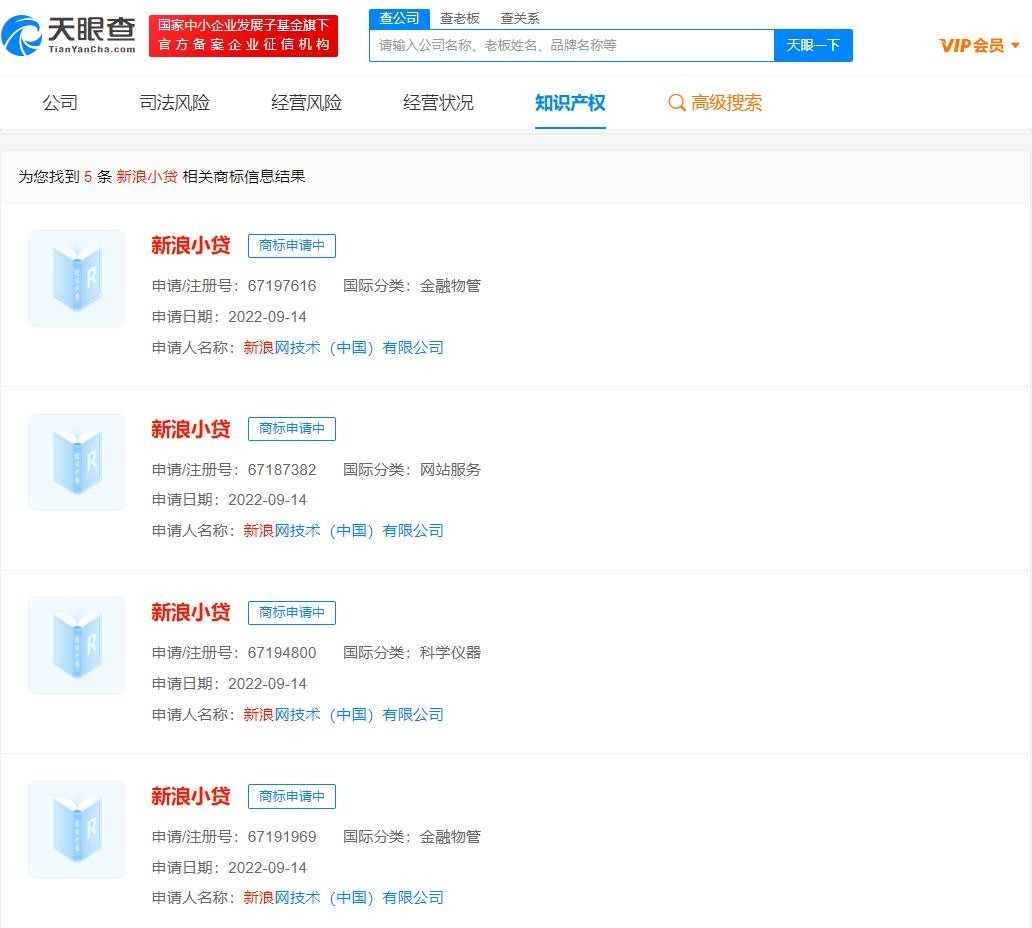

01. Sina apply for Sina small loan trademark

Tianyancha APP shows that recently, Sina.com Technology (China) Co., Ltd. and Beijing Sina Interconnection Information Service Co., Ltd. applied to register multiple "Sina small loan" trademarks. The international classification includes financial property management, website services, scientific instruments, advertising sales, etc. The current trademark status is in the application.

Sina Small Loan is transformed by the P2P platform of Sina's P2P platform, E -Loan (operating subject: Dongfang Rongxin). In October 2020, the Jiangxi Provincial Local Financial Supervision Bureau approved the consent of Jiangxi Dongfang Rongxin Technology Information Service Co., Ltd. ("Oriental Rongxin") to transform into a small loan company operating in the country in accordance with laws and regulations; Emperor Loan Co., Ltd. (referred to as "Sina Microfin").

Sina Small Loan was officially established on November 11, 2020. The legal representative is Li Chaoran with a registered capital of 1 billion yuan. The company held 99%of Beijing Sina Connected Information Service Co., Ltd. ("Sina") in the early days, and Lu Jianming held 1%of the shares. On November 16, Sina's equity increased to 100%.

Earlier this year, the equity of Sina Small Loan ushered in the change again. At present, Sina Small Loan is 95%of Sina, and Jiangxi Rongtuo Technology Information Service Co., Ltd. holds 5%. Jiangxi Rongtuo Technology is wholly -owned by Sina New Media Consultation (Shanghai) Co., Ltd.

Insiders believe that Sina, as an Internet giant, whether it is small loan or other financial businesses, the most obvious advantage is Internet traffic. In addition, its user activity is high, and the user group is more consistent with the Internet small loan customer group. Therefore, Sina's small loan has certain advantages in terms of customer acquisition and customer matching.

Public information shows that Sina has begun to deploy fintech business in 2015. In September 2021, the Sina Financial brand was upgraded to the "Sina Digest".

02. Internet manufacturers accelerate integrated small loan business

At present, large Internet companies are basically involved in the financial industry, and online small loans are the core part of Internet companies involving financial business.

With the continuous tightening of the financial business of Internet platforms, since this year, a number of Internet companies such as Tencent, 360 Division, byte beating, JD.com, and Ctrip have accelerated the integration of its small loan licenses. During the year, a number of Internet manufacturers were small loan companies to increase capital and seek the national exhibition industry. At present, Sina small loan registration is 1 billion yuan. If you want to exhibit the industry in the country, you still need to continue to increase capital.

In November 2020, the "Interim Measures for the Management of Online Small Loan Business (Draft for Opinions)" published by the Banking Insurance Regulatory Commission and the People's Bank of China issued the registered capital, business scope, loan amount and use, joint loan, etc. New regulations have aroused strong attention in the industry. Among them, the registered capital of online small loans is not less than 1 billion yuan; the registered capital of online small loan companies operating across provinces is not less than 5 billion yuan, and all of them are one -time actual monetary capital.

Under strict supervision, more than 80 % of online small loan companies will face the problem of transformation, transfer, or even exit.

In the past two years, the number of small loan institutions has decreased year by year. Especially for Internet manufacturers with hand -holding traffic and not bad money, small loan licenses are also an important part of the financial business layout.

However, from the perspective of regulatory trends in the past two years, the small loan business cannot rely only on the traffic advantage, and it depends on the company's true financial technology strength. Analysts believe that online micro -loan is essentially financial business and eventually depends on risk control capabilities. Whether it can build a digital -based financial service capabilities is the key to the success of the small loan business.

- END -

Chinese Farmers' Harvest Festival | Shandong Autumn Limited Colorful Harvest Season has overturned the color disk again!

Graphita Fengdeng, melon fruit flutteringA busy harvest scene of Qilu DadiColorful...

Liushan Town, Lintong County: Qiu Taoxi gets a bumper harvest

Right now, Qiu Tao, Liushan Town, Lintong County, entered a mature harvest period. The peaches full of branches are big and sweet, full of happy taste. On August 27, the reporter walked into the Tao