Guangdong Property Insurance Industry quickly pays the "Dragon Boat Water" agricultural insurance reporting amount the highest

Author:21st Century Economic report Time:2022.06.23

Southern Finance All -Media Li Jingjing Guangzhou Report

"On the 14th, the two ponds on the field had occurred in the pond, and immediately reported to the China New Agricultural Office and the Renmin Insurance Company. They arrived on the spot for investigation and guidance in less than half an hour. The recovery of the materials for breeding production have brought great support and help to our rapid recovery of production. "Corporate representatives of Guangzhou Xifuquan Agricultural Development Co., Ltd., which suffered great losses in this" Dragon Boat Water ".

From 20:00 to 17:00 on June 13, 2022, there were heavy rainfall in Zengcheng District, Guangzhou, and local heavy rains. Paitan, Zhengguo, Zhongxin, Shitan, Xiancun and other towns were affected. The maximum precipitation is 238.4 mm. This round of heavy rainfall caused serious affected crops and aquaculture. Among them, Xifuquan Company insured more than 13 acres of fish pond collapse of more than 13 acres of fish ponds, and a lot of losses such as grass carp and catfish breeding.

After receiving the report, Guangzhou PICC Property Insurance immediately launched the emergency plan of the bad weather claims, and quickly determined the losses with the help of scientific and technological power to open the green channel for farmers. On the morning of June 22 Under the witness of the unit, the representatives of Xifuquan Company received more than 230,000 yuan in fast compensation from the staff of the Guangzhou PICC Property Insurance.

Since June 13, Guangdong has entered the "big splashing water" model, and "Dragon Boat Water" has swept into multiple cities. The people's property has been damaged safely, and the insurance industry in Guangdong has quickly supported the "protective umbrella". According to statistics from the Guangdong Insurance Industry Association, as of 17:00 on June 16, the Guangdong Property Insurance Agency has received a total of 3799 reports of the "Dragon Boat Water", with a loss of 192 million yuan. Among them, the amount of agricultural insurance was the highest, about 104 million yuan, the property insurance loss was 23.4 million yuan, the auto insurance loss was 211.667 million yuan, and the engineering insurance loss was 11.938 million yuan.

At present, various fixed loss and claim work are stepping up, providing capital guarantee for post -disaster reconstruction, re -production and re -production.

From June 18th to June 22nd, Ping An Property Insurance Guangdong Branch received a total of 2262 reports on this heavy rain, with an estimated damage of 31.72 million yuan, of which 2230 was reported in auto insurance and 32 of property insurance; it has been in the affected area; 191 people were invested, 105 investigations were sent, 96 rescue vehicles were sent, and a trailer service was provided for 1635 trailers.

In Meizhou, the farm of the Fuxing Professional Cooperative in Wuhua County collapsed due to heavy rain, and a large number of pigs died. After receiving the report, China Property & Casualty Insurance quickly launched the investigation and approved losses, opened the green channel for fast claims, and paid 50,900 yuan in prepaid compensation for disasters to help farmers emergency and resume production after disaster.

In Foshan, China Tai Penalized Insurance Foshan Branch rushed to the Guangdong Juhua Bay Agricultural Park in Beiyi Town to pay more than 700,000 yuan in policy agricultural insurance to farmers who had affected the first 11 households in severe weather. It was initially determined that more than 200 local damaged farmers were determined, and the estimated amount of losses reached 3.5 million yuan.

In order to cope with the heavy rain in this round, according to the data provided by the Guangdong Insurance Industry Association, Guangdong Property and Insurance Institutions sent a total of 229 person -times to the affected site, 2,374 rescue vehicles for survey, 1603 trailers rescue services, 36 drones for driverless investigation Essence Not only that, the application insurance technology plays an important role in emergency command and disaster prevention and relief, and conducts disaster investigations, rescue and damages through intelligent and digital methods to improve the efficiency of claims with science and technology.

- END -

"Six unification" model+resource centralized management!Ningjin: Large -scale promotion of corn and soybean composite planting

Qilu.com · Lightning News June 24th In order to save planting costs and improve ...

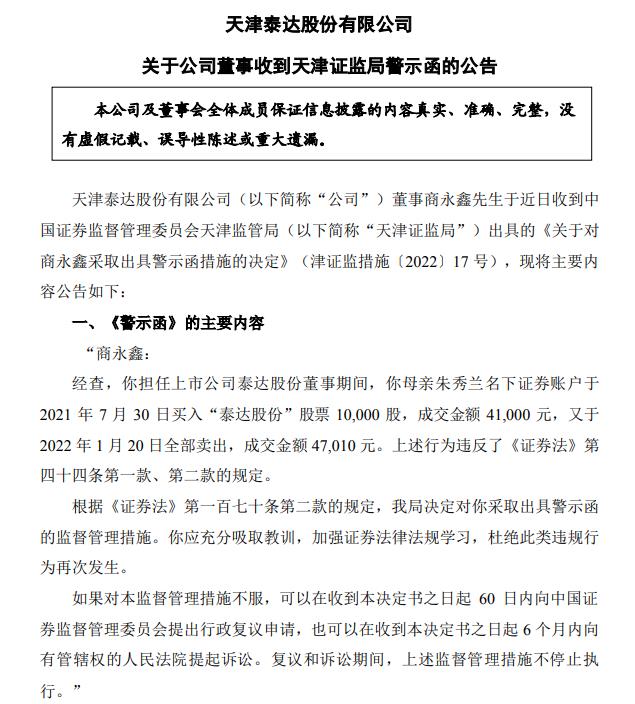

V View Finance Report | Relative account illegal short -term transaction TEDA shares directors'

Zhongxin Jingwei, June 13th. Teda shares announced on the evening of the 13th that...