Wind Observation | Double Run!The two companies in Shandong have updated the listing progress.

Author:Costrit Finance Time:2022.09.28

Fengkou Finance reporter Liu Jian

On September 28, Zhuochuang Information GEM was launched. A few days ago, Bangki Technology's stock issuance was approved by the Securities Regulatory Commission. The pace of listing of the two companies is expected to officially log in to the capital market in the near future. One is a commodity information service enterprise, and the other is a large feed manufacturer. Their place in common is that they are registered in Zibo, Shandong.

Fengkou Finance has noticed that Zibo has increased its support for listed companies in recent years. The capital market is expected to usher in the harvest season. At present, there are 29 A -share listed companies. With the addition of Zhuo Chuang Information and Bangki Technology, 31 will soon reach 31 companies. In the short term, it surpassed Weifang with 30 listed companies.

Zhuochuang Information is opened for purchase, IPO is priced at 29.99 yuan/share

On September 28, Shandong Zhuochuang Information Co., Ltd., located in Zibo, opened its purchase for the first time on the Shenzhen Stock Exchange GEM.

According to the company's previous announcement, this issuance uses a direct pricing method. All shares are issued to the public investors who hold the market value of non -restricted A -share shares and non -limited deposit certificates on the Shenzhen market through the Internet. And sale. The number of issuances this time is 15 million shares, of which the number of online issuance is 15 million shares, accounting for 100%of the total issuance. All issuance shares are new shares and do not transfer old shares.

The issue price is 29.99 yuan/share. Investors are based on the Shenzhen Stock Exchange trading system on September 28, 2022 (day T) and adopt online subscriptions by market value.

The online subscription date is September 28, 2022, and the online purchase time is 9: 15-11: 30, 13: 00-15: 00. Investors do not need to pay purchase funds on September 28, 2022 (T).

According to calculations, Zhuochuang Information has a total funding of 450 million yuan, and the prospectus shows that 283 million yuan is planned to be raised, and two projects are invested in the large data platform of the commodity commodity big data platform and the price benchmark system of commodity spot market. In other words, according to the direct pricing of 29.99 yuan/share issuance, Zhuochuang Information will be over 167 million yuan, and the super -raising ratio will exceed 59%.

It is reported that as of June 30, 2022, Zhuochuang's total information assets were 564 million yuan, an increase of 2.35%over the end of the previous year; the total liabilities were 289 million yuan, a decrease of 7.37%from the end of the previous year; 275 million yuan, an increase of 15.06%over the end of the previous year.

Public information shows that Shandong Zhuochuang Information Co., Ltd. was established on April 22, 2004, and the legal representative Jiang Hulin. Zhuochuang Information is a leading domestic commodity information service company. It is a professional service provider focusing on the monitoring, transaction price assessment and industry data analysis of the commodity market. The company adheres to the principle of "neutral, professional, and focused", monitor, records, analyzes, evaluates and research the commodity spot market, and provides customers with energy, chemical, agriculture, metal and other industries. Services to improve the transparency and transaction efficiency of the commodity spot market. The company's cumulative number of registered customers exceeds 3 million, and more than 150 global Fortune 500 companies and their subordinate companies have been served. The company is the "National Bureau of Statistics Big Data Cooperation Platform Enterprise" and "Shandong Province Big Data Key Package Enterprise".

In recent years, the performance is generally average, and the income increase is not profitable

Zhuo Chuang's journey of information on the market is not smooth. In 2017, Zhuochuang Information entered the tutoring period. On June 30, 2020, its IPO materials were accepted by the Shenzhen Stock Exchange, and entered the inquiry stage on July 26, 2020. The Shanghai Municipal Party Committee's meeting was reviewed and approved, and it was submitted to the Securities and Futures Commission to register on April 18, 2022. On August 24, the official website of the CSRC issued a approval opinion and agreed to the registration application for the first public offering of the stock.

Financial data shows that from 2019 to 2021, Zhuochuang Information's operating income was 220,255,500 yuan, 218.379 million yuan, 250.528 million yuan, and net profit was 58.757 million yuan, 51.8587 million yuan, and 50.098 million yuan.

The data shows that Zhuochuang Information operated from January to June 2022, with a operating income of 134 million yuan, an increase of 7.81%year-on-year; the net profit attributable to shareholders belonging to the parent company was 35.9368 million yuan, an increase of 18.35%year-on-year; after the deduction of non-recurring profit or loss The net profit attributable to shareholders of the parent company was about 38.126 million yuan, an increase of 31.68%year -on -year.

The operating income from January to June 2022 increased compared with the same period of the previous year. The main reason was that Zhuochuang Information focused on the needs of large customers, optimized the customer structure, the number of large customers and contributions continued to increase, driving the continuous growth of operating income.

From January to June 2022, the net profit increased by the owner of the parent company after the deduction of regular profit or loss is higher than the increase in operating income. It is mainly due to the characteristics of Zhuochuang information business. The operating costs are mainly labor costs. The scale of scale is obvious, and the growth rate of operating income in this period is faster than the operating cost growth rate.

Zhuo Chuang Information Vice Chairman and General Manager Cai Jun said on September 27th that the company stated on the listed roadshow on September 27 that the company plans to continue to develop steadily and healthy in the next three years, adhere to the "neutral third party" position, take root in the field of commodity information services, and follow closely tracking, and follow up closely.未来信息技术与大数据领域的发展趋势和市场需求,通过完善和优化自身的技术研发体系及创新机制,努力实现团队专业化、管理和服务规范化、价格标杆化、数据产品化、产品智能化、 Index financial goal, further consolidate and expand the company's leading advantage in the industry's industry in the field of commodity information services, enhance the company's service and product innovation capabilities and market share, and make the company the leading enterprise with core competitiveness in the Chinese commodity information service industry Essence At the same time, further serving the global market, establishing a large -scale commodity price benchmark system suitable for China's economy and market size, so that commodity transactions are evident. Bangji Technology focuses on not breeding feed, and has been approved to issue 42 million new shares

Fengkou Finance noticed that Zibo's recent capital market was hot. Zhuochuang Information has opened up purchase. It is expected to officially land on the GEM recently and become the 30th A -share listed company in Zibo. Another company in Zibo, a company, has also made new progress recently.

On the evening of September 22, the CSRC stated that the approval of Shandong Bangji Technology Co., Ltd. for the first time publicly issued no more than 42 million new shares. This shows that Bangki Technology is one step closer to the main board of the Shanghai Stock Exchange. This feed company may become the 31st A -share listed company in Zibo.

According to the data, Bangji Technology is a company focusing on animal life and animal nutrition. It has been involved in pig materials, pig breeding services, pre -mixing eggs, animal and pharmaceuticals, biotechnology, etc. Standardized farms provide service group companies that provide professional products and management technology.

The prospectus shows that Bangki Technology was established in 2007 with a registered capital of 126 million yuan. It has a high market share and brand awareness in Shandong and Northeast China.

Fengkou Finance noticed that Bangki Technology's last announcement of the progress of the IPO was on August 11. On the same day, the 180th Working Conference of the Eighteenth Securities Regulatory Commission was reviewed in 2022, and Shandong Bangji Technology Co., Ltd. (starting) was approved.

This time Bangji Technology plans to issue no more than 42 million new shares, and it is planned to raise RMB 68,95,300. The construction of 10,000 tons of high -end feed projects, as well as the R & D center construction project of Bangji (Shandong) Agricultural Technology Co., Ltd..

Financial data shows that Bangji Technology's operating income from 2018 to 2020 was 1.16 billion yuan, 1.05 billion yuan, and 1.724 billion yuan, respectively. The net profit attributable to the owner of the parent company was 43.575 million yuan, 53.429 million yuan, and 112 billion yuan Yuan.

At present, many listed feed companies in China mostly adopt the "feed+breeding" model, and Bangji Technology is based on the long -term raising industry in my country. The unique model of focusing on feed not breeding ".

The company stated that it is mainly based on the consideration of the industry cycle. The company focuses on the feed business. It is relatively small due to the period of pig price and animal epidemic. In the long run, there is no obvious periodic fluctuations, and the operating stability will be stronger.

According to the equity structure, Bangji Group holds 66.67%of Bangji Technology and is the company's controlling shareholder. Wang Yicheng holds 53.50%of the equity of Bangji Group and directly holds 1.24%of Bangji Technology. people.

According to disclosure, Wang Yicheng was born in 1975 and has a college degree. He is currently the chairman and general manager of Bangji Science and Technology. Wang Yicheng has been in the feed industry for many years, and has served as a marchian, marketing manager, and general manager of the branches in Shandong Liuhe Group.

The number of listed companies in Zibo may catch up with Weifang

According to statistics from Fengkou Finance reporters, as of September 28, the number of listed companies in Shandong was 282, but the gap between regions was large.

Among them, Qingdao Yantai Jinan ranked first grade, with 60, 49 and 42 listed companies. Next, there are 30 and 29 in Weifang and Zibo. There are 15, 11 and 10 of Weihai, Texas, and Jining. Binzhou, Tai'an, Linyi, Dongying, and Liaocheng have 8, 5, 5, 5, and 5, respectively. There are 5 or 5, there are 4 Zaozhuang, and Rizhao and Heze each have two.

At present, there are 29 listed companies in Zibo in the middle tour. As Zhuo Chuang Information and Bangki Technology are about to be listed, the number of listed companies will reach 31, which may surpass Weifang in the short term. In June this year, another company in Zibo Shandong Yahua Electronic Co., Ltd. GEM IPO has passed. In addition, this year, Zibo City also has Shandong Yifuwei Polyurethane Co., Ltd. and Shandong Kaitai Petrochemical Co., Ltd. The Shandong Xintong Electronics Co., Ltd., which is listed on the main board of the Shenzhen Stock Exchange in September 2021, was waiting for the update after the pre -disclosure.

Weifang City, which has 30 listed companies, is currently in the IPO queuing status. Only High Silver Eagle New Materials Co., Ltd. and Shandong Boyuan Pharmaceutical Chemistry Co., Ltd. From the current point of view, the listing progress of the two companies is temporarily difficult to catch up with Zhuochuang Information and Bangji Technology. In the past two years, Zibo has strengthened the support of listed companies. In 2021, Zibo issued the "Zibo Capital Market Breakthrough Action Plan (2021-2023)", and proposed to strive to achieve about 20 new listed companies at home and abroad in the city for three years, and announced a series of service policies and awarding plans. Given a maximum of 1.3 million yuan in cultivation subsidies to the eligible listing reserve enterprises, and the financial sequence of enterprises listed on the Shanghai and Shenzhen Stock Exchange will award 10 million yuan. Last year, 6 companies in Zibo were listed.

This year, Zibo's encouragement policies have also been released. The Zibo Local Finance and Administration Bureau reported on September 9 this year. This year, the "Special Action Plan for the Listing of the Beijing Stock Exchange of Zibo Enterprises in 2022" was formulated to clarify the path measures for the listing of the North Stock Exchange and the listing of the New Third Board. Formulate "Several Measures on Further Promoting the Development of the Financial Industry", "Notice on Modifying the Capital Market Breakthrough Action Plan (2021-2023) in Zibo City", increase the standards for listing of the Beijing Stock Exchange. 10,000 yuan, strengthen policy incentives, and actively implement various corporate support policies.

In addition, make good use of the service mechanism of "Qingshanding Management Butler" and "One Letter of the Office", coordinate and solve more than 40 problems in the process of listing of the enterprise, promote 4 companies to report IPO materials, 7 companies enter the listing counseling, 4 listing The company implements re -financing. The joint Shenzhen Stock Exchange and the Peking Stock Exchange held a discussion and exchange activity, and "one -to -one" guided 37 companies to go public.

Zibo also strengthened resource integration, actively established platform carriers, connected to the Shenzhen Stock Exchange, Bei Stock Exchange, and Qingdao Kingdoms Dingcheng, etc., and improved the service function of the capital market service base. Promote the signing of the strategic cooperation between the pilot districts and counties of the provincial listed company incubation and gathering areas. Relying on the capital market service base, the establishment of the Zibo City Secretary Salon, carried out various cultivation and training activities such as "capital+listing", set up new carrons for listed companies, communicate with information resources and share information resource sharing to promote the interaction of various resource elements in the capital market Coupling to enhance the energy -level energy efficiency and vitality of the city's capital market. There were 21 consecutive theme training, with a total of nearly 20,000 training. Give full play to the nursery cultivation function of Qilu's equity trading center. Since this year, 4 newly listed companies have been added and 860 listed companies have been added.

Then it is to build an echelon and strengthen the cultivation service of enterprises. The "Implementation Rules for the Management Service of the Reserve Enterprise Library in Zibo City" is issued to promote the convenient declaration, layered reserves, accurate cultivation, and accelerated listing of listing reserve enterprises. Establish a normalized collaborative communication mechanism with industrial information, technology and other departments, and excavate high -quality enterprises with high technological content such as "specialized new" and other high -quality enterprises to enter the listing reserve corporate library. Grasp the best time to list the listing of the Beijing Stock Exchange, establish accounts to be listed on the North Stock Exchange and the listing of new three boards to be listed, and accurately provide coordinated services. Since the beginning of this year, there are 3 new IPO companies, 3 IPO companies, and 3 listed counseling filing companies, forming a good listed echelon. So far, 16 companies in the city are planned to listed.

- END -

In the first half of the year, the five major listed insurance companies returned to their mother's net profit of 122 billion yuan by more than 15 % year -on -year

As Xinhua Insurance released the semi -annual report on the evening of August 30, the business situation of the five major insurance companies in A -share was disclosed in the first half of the year.

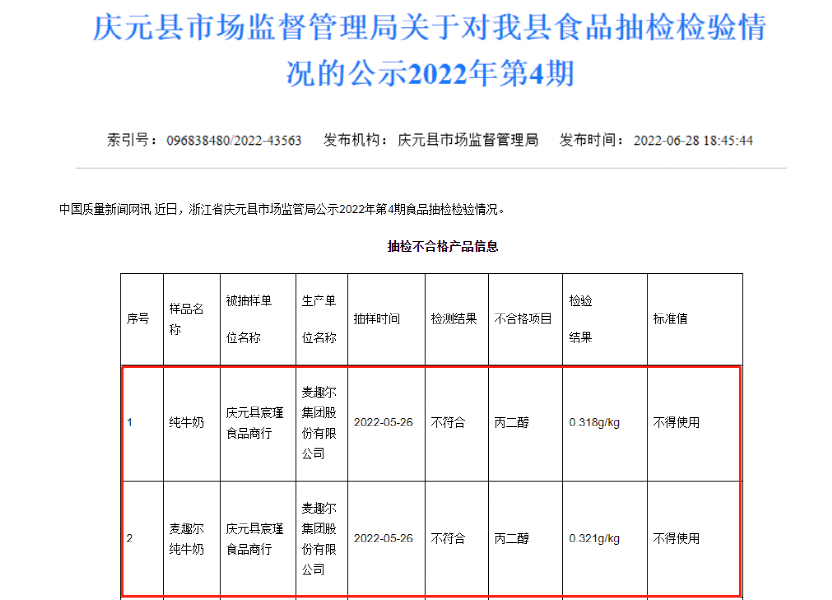

Drop the shelves, sealed!Well -known milk was detected by low toxic substances, and the latest response came

milkRich nutrition and easy to be absorbed by the human bodyCoupled with affordabl...