Nearly 6 billion Hong Kong dollars against the trend to raise experts: Hong Kong stocks are not pessimistic for a long time

Author:Securities daily Time:2022.09.29

Our reporter Chu Lijun on September 28. On September 28, the Hong Kong stock market trend was sluggish. As of the close, the Hang Seng Index fell 3.41%, and the Hang Seng Technology Index fell 3.85%. 5.924 billion Hong Kong dollars, also the 15th trading day of the 19th trading day since September. Looking back, since September, the Hong Kong stock market has brought up a lot, causing investors' attention. Specifically, as of the close of September 28, the Hang Seng Index fell 13.55%during the period, and the Hang Seng Technology Index fell 17.49%during the period. In this regard, Chen Li, chief economist and director of the research institute, who was interviewed by a reporter from the Securities Daily, said that since the beginning of this year, it has been affected by factors such as geographical conflicts, tightening of the new crown epidemic, and overseas liquidity. Fall. In September, the Fed announced that it had raised interest rates of 75 basis points, and overseas liquidity tightened further, which caused market panic to spread. Hong Kong stocks valuations were greatly impacted, especially high -growth and high valuation sectors, which continued to undergo pressure. After a sharp recovery, the valuation of Hong Kong stocks at this stage is at a relatively low position, and its attractiveness in the global capital market has been increasing. "The Hong Kong stock market has maintained a relatively weak trend in September. In terms of fundamental terms, the pressure of corporate operations that have a greater impact in Hong Kong stocks have increased. In terms of capital, in the near future, major European and American economies have strong interest rates, especially the US dollar index rapidly rising rapidly. Increased the pressure of Hong Kong market funds, and the benchmark interest rate in Hong Kong followed the United States to pressure the level of the valuation of Hong Kong stocks. At the same time, the impact of overseas geopolitical conflicts and European and American market shocks did not slow down. "Yuan Huaming, general manager of Huahui Chuangfu Investment Investment. The reporter said. Facing the callback of the stock price, many Hong Kong stock companies have opened repurchase. For example, on September 27, Tencent Holdings issued an announcement that the company repurchased 1.26 million Tencent shares on the Hong Kong Stock Exchange on September 27, 2022, and the price range per share was 275.4 Hong Kong dollars to HK $ 283.0. HK $ 100 million. On the same day, Xiaomi Group also issued an announcement that the company repurchased 2.6 million shares today, with the repurchase price per share from HK $ 9.69 to HK $ 9.72, with a total cost of approximately HK $ 25.22 million. Regarding Hong Kong stock companies have launched a repurchase plan, Hu Peng, manager of Rongzhi Investment Fund, said that repurchase has a very positive significance for listed companies to maintain the stock price, but the current location of Hong Kong stocks is more affected by liquidity. Under the expected global economic recession, if the liquidity of the United States starts to return to the country, it is difficult for the overall Hong Kong stocks to perform well. But at the same time, for this low -level listed company, if the dividend rate can be maintained, the income of investors can be achieved through dividends. Regarding the market outlook, Chen Li said that considering the current geopolitical situation tightening, Federal Reserve's monetary policy uncertainty, and a global energy crisis, Hong Kong stocks may maintain a shock market. From the middle and long term, it is expected that the domestic economy will maintain a steady recovery situation in the fourth quarter, coupled with the continuous improvement of the interconnection mechanism, the southbound capital flows steadily or boosted the Hong Kong stock market. With the rise of market sentiment, Hong Kong stocks are expected to go out of the bottom of the bottom rebound. Quotes. "A few major uncertain factors affecting the Hong Kong stock market take time digestion or elimination. The short -term market is more likely to maintain vibration consolidation and wait for the direction guidance. The opportunity to stabilize the rebound in the first half of the year is not small. If several uncertain factors have weakened by then, the medium and long -term trend of the Hong Kong stock market should not be pessimistic. "Yuan Huaming said.

Picture | Site Cool Hero Bao Map.com

Recommended reading

Ministry of Transport: In the first August

You chase me, reappear of tens of billions of investment! Experts remind the risk of overcapacity of lithium battery!

- END -

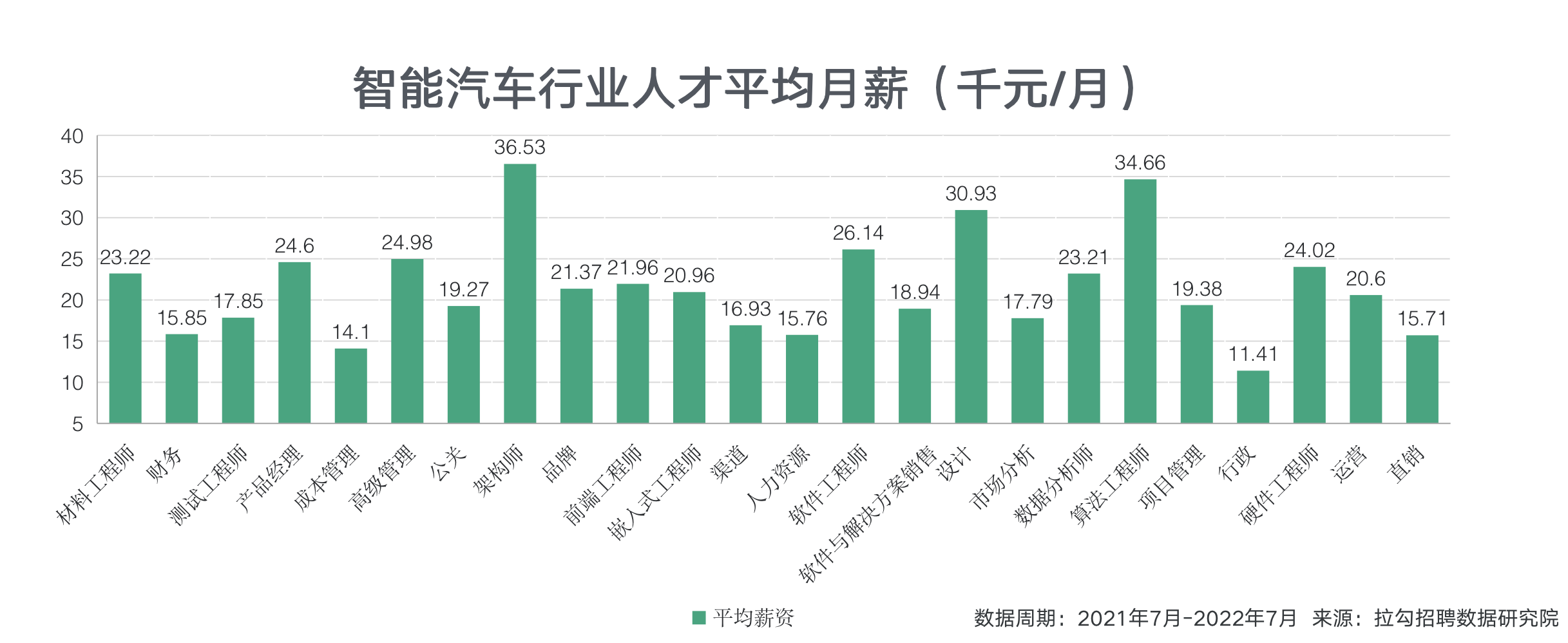

China's first smart car talent recruitment festival officially launched

Under the influence of a new round of scientific and technological changes, the gl...

The full refund of the policy industry of VAT tax deduction is expanded!One picture to understand the policy points

related policyAnnouncement of the General Administration of Taxation on expanding ...