The decline is difficult, and the market value has evaporated more than 100 billion!Who abandoned "Sweeping Mao" Cobos?

Author:Kanjie Finance Time:2022.09.29

The weakness of consumer electronics deeply affects every company in the industry.

According to people familiar with the matter, due to the decline in demand, Apple also "carried" it, and gave up the iPhone's production increase plan. This means that the keywords in the consumer electronics industry have changed from "differentiation" to "general fall".

On the one hand, the price of raw materials rises, and on the other hand, the consumer is weak. Those once -popular consumer electronics companies face the deepest chills and feel the cruelty of the capital market.

Under the blessing of capital, some companies were held on the "altar", and under the abandonment of capital, they quickly fell into the "altar", and the logic behind it was the cycle and the air outlet.

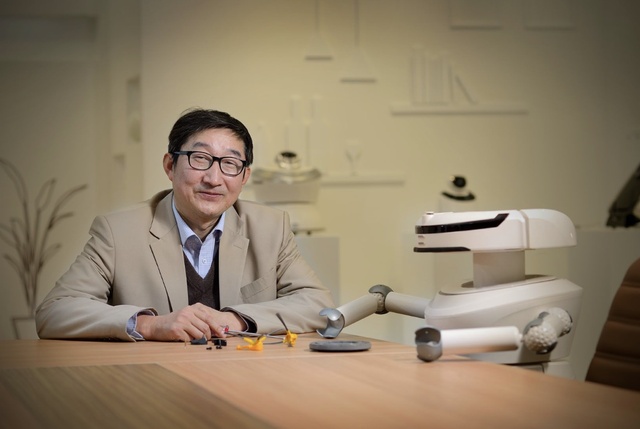

In 2020, at the beginning of the epidemic, the global economic environment began to change, and industries related to the pharmaceutical industry and epidemic were quickly tapped. Then, under the blessing of analysts, some companies became star companies. Two famous companies, one is a stone technology that has inextricable relationships with Lei Jun, and the other is Kobos, known as "sweeping the floor".

If it is calculated in March 2020, Cobos has risen 15 times in 14 months, and its market value exceeds 140 billion yuan, crushing most of the most scientific and technological companies. But if it is miserable, it is also one of the most tragic "Mao" companies. In 14 months, its stock price fell 70%, and the market value evaporated exceeded 100 billion yuan.

At present, Cobos has fallen from a maximum of 251.64 yuan (previous repetition) to 68 yuan, and has not yet stopped signal. If the dynamic price -earnings ratio is used as a reference, the dynamic price -earnings ratio of 22.24 times is lower than the average of the industry's average dynamic P / E ratio. So who pushed this company to the "altar"? Who abandoned it again?

If we dismantle the development of Colos, we will find that Cobos has gone through a total of three development stages:

The first stage, the foundry stage;

The second stage, independent research and development and production stage;

The third stage, the internationalization stage.

In 2009, after Kobos launched its own brand, it began to get rid of the identity of a single foundry. Kobos landed in the capital market in 2018, and according to the prospectus at the time, six of the top ten customers in Cobos in 2017 still as foundry customers, and these six customers accounted for total revenue. 34.27%.

How to get rid of the identity of the foundry and increase the proportion of its own brand's revenue has become the topic of Kobos. In 2019, Cobos made a poor financial report with revenue of 5.312 billion yuan, a year -on -year decrease of 6.70%; net profit was 121 million, a year -on -year decrease of 75.12%. Fall to less than 17 yuan.

The sudden epidemic gave Cobos a chance to meet the opportunity to be well known to the public. In 2021, China surpassed the United States to become the largest market for scanning robots, and in the Chinese sweeping robot market in that year, the Kobos family accounted for 43.5%of the online retail share, 86.6%of offline retail share, and stabilized the industry to stabilize the industry First.

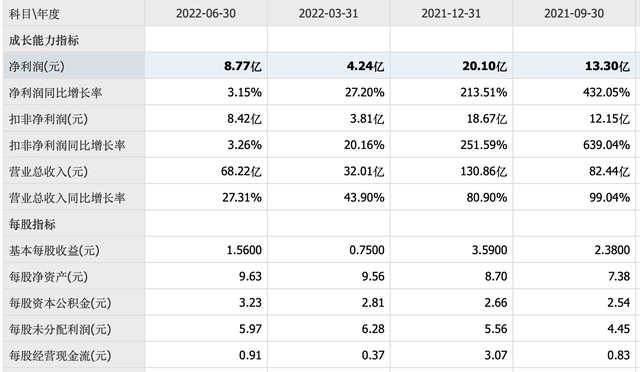

Reflected in terms of performance, Kobos' net profit in 2020 reached 641 million yuan, a year -on -year increase of 431.22%; in 2021, it broke out to 2.01 billion yuan, an increase of 213.51%year -on -year. In less than three years, the net profit increased by 17 times. Under the blessing of capital, Kobos was named "God" in the World War I.

But the capital is always profitable, and the story always has a day of telling.

In July 2021, after Cobos set a record high in history, a long way to decline. At the performance level, there was also a corresponding response.

In the first quarter of 2022, Kobos' net profit was 420 million yuan, an increase of 27.2%year -on -year. In the first half of this year, its net profit was 877 million, a year -on -year increase of only 3.15%.

In other words, "Sweeping Mao" has fallen into the dilemma of increasing income. Farewell to high growth, the story will be difficult to sustain, and those profitable capital sets are inevitable. Reflected in the stock price, Cobos has become a veritable capital market "meat grinder".

In summary, the decline in stock prices is only a manifestation, and the logical changes of enterprises are the core. As for why the capital market is currently giving Cobos such a low valuation, I think this is actually the normal return of valuation. As for whether Cobos can create previous advantages, it is difficult to achieve in the short term.

- END -

Help agricultural products go out!Zhejiang Export Agricultural Products Online Fair launched today

Zhejiang News Client reporter worshiped Li Zhe Zhu MeiOn the afternoon of August 5...

"The first stock of armed escort" is coming?

China Fund Reporter Jiang You Intern Zhao XinyiThe RMB porter, which is mainly res...