Deep cultivation of the three farmers' interpretation mission responsibility

Author:China Agricultural Credit News Time:2022.09.29

Deep cultivation of the three farmers' interpretation mission responsibility

Shi Yanlin, Wang Liping, photography: Jiang Xipeng

In September of Golden Autumn, the rice waves are pan. Five Changs in the country of high-quality rice nationwide, the corner of the peasants who welcomed the harvest smiled. On this "black land" that bred hopes, a rural financial "Jin Journey" -Heongjiang Wuchang Rural Commercial Bank is active. Increase the development of the real economy, determine the inclusive finance as one of the strategic business of the entire bank, start with implementing the new development concept, services and integration into the new development pattern, continuously optimize mechanisms, innovate products, improve services, and take advantage of it. The long -term mechanism of loan, willingness to loan, loan, loan, and loan "has created a good situation of the vigorous development of inclusive finance. As of the end of August, the balance of various loans in the city was 6.6 billion yuan, a year -on -year increase of 822 million, an increase of 14.57%.

Adhere to the development of party building leading business to escort reform and development

Adhering to the party's leadership is the ideological guidance of Wanchang Rural Commercial Bank to adhere to the road of high -quality development. The Wuchang Rural Commercial Bank strengthened the party's construction with the leadership of the party, and adhered to the party's unity to win the overall situation in the new situation and escorted the reform and development of enterprises.

As a local legal person bank, Wuchang Rural Commercial Bank fully implements the provincial and municipal party's party and municipal agencies on the development of inclusive financial decision -making, supporting the positioning of real economic strategic positioning, committed to service and integration into a new development pattern, thinking and reshaping development positioning, and implemented solid implementation Serving the real economy and supporting the strategic deployment of rural revitalization, do a good job in service, do not forget the original intention of inclusive finance, keep in mind the mission of supporting agricultural branches, and integrate into the mainstream of the municipal economy with stronger measures.

Interpretation of the mission to crack "difficult financing" and "expensive financing"

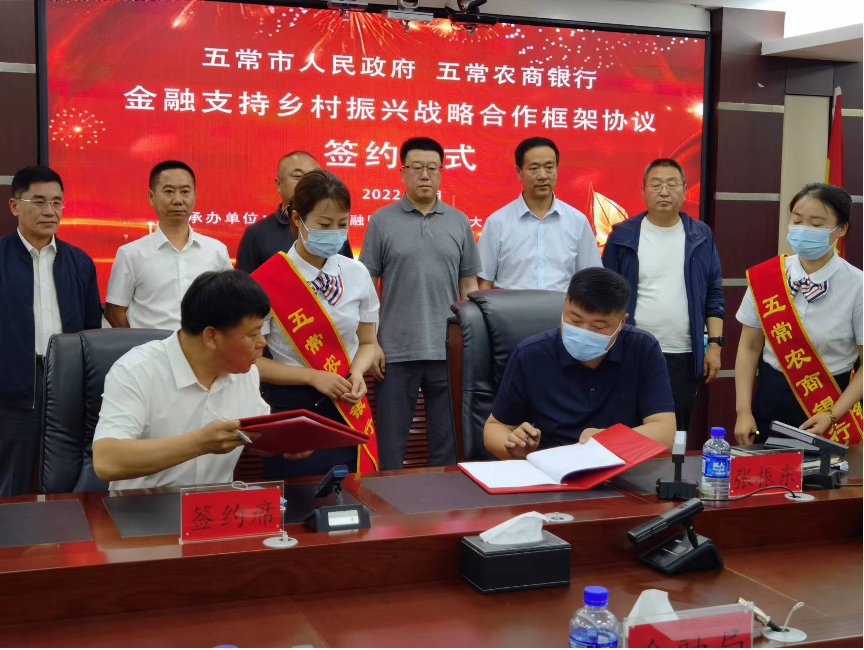

Concentrate to farm, plump five constant land. Wuchang Rural Commercial Bank actively helps the results of poverty alleviation and effectively connect with rural rejuvenation, continue to promote the development of urban and rural integration, rural new industries, and new formats. It exclusively puts out 1,163 loans for "precision poverty alleviation", with an amount of 39.706 million yuan. In the year of the fourteenth five -year plan of February 2022, Wuchang Rural Commercial Bank signed a contract with the government.

10 billion yuan is invested to support rural revitalization, covering all kinds of agricultural -related group financing needs, and helping the improvement of quality improvement in Daoxiang.

The leadership of the Rural Commercial Bank asked in the "Qiaofu Courtyard" on the spot

Based on the origin, blood transfusion small and micro enterprises. Since the beginning of this year, due to the repeated epidemic and the complexity of the external environment, the situation of difficulty in business operation has increased significantly. In response, Wuchang Rural Commercial Bank conscientiously implemented the decision -making and deployment of the Party Central Committee and the State Council, effectively implemented the implementation of the policy of benefiting enterprises and the people's rescue policies, and held a special meeting to study and deploy related work. Methods, we can effectively support enterprises to resume labor and re -production, help the city's economic development. At the same time, Wuchang Rural Commercial Bank coordinated policies, construction mechanisms, and created products to create a credit system of "dare to loan, wishful loan, energy loan, and loan"; continuously optimize the comprehensive service system of inclusive small and micro customer, and develop online business. Innovate the small and micro exhibition model of batching, online, and intelligent. Increase customer support for "first loans" and "renewal loans", and actively implement two direct entities that directly reaches the two direct entities of inclusive small and WeChat loans and extended interest -paying interest loans to fully implement the concept of "reduction of expenses and benefits". Crack the "difficult financing" and "expensive financing".

Kaishan split stone to open up the "last mile" of the real economy

Wuchang Rural Commercial Bank aims to build a service real economy bank, continue to improve the quality and efficiency of inclusive financial services, strengthen the top -level design, and introduce the "Five Chang Rural Commercial Bank's inclusive financial development measures" for two consecutive years. Service work direction and focus. Strengthen the appraisal tilt, and incentive to the inclusive business single -column credit plan, single assessment system, and separate reward incentives to fully mobilize the enthusiasm of small and micro enterprises to serve small and micro enterprises; accelerate product innovation, connect with corporate platforms, and launch "rice loans", "stabilize enterprises", "stabilize enterprises" "Include small and micro -line financing products, realize online applications, rapid approval, flexible lending functions, effectively improve the quality and efficiency of small and micro financing business services; improve operational efficiency, formulate special approval mechanisms, build high -efficiency approval channels, and fully meet the small minor small efficiency The financing needs of the micro -enterprise industry provide new momentum for the development of small and micro enterprises.

Increase demand docking and make the real economy. In recent years, the State and Provincial and Municipal Associations have introduced the "supporting the development of the real economy" and "whoever plant the land" and include a number of preferential policies for supporting micro -rescue, including discounts, guarantees, and risk compensation funds. Wuchang Rural Commercial Bank sorted out support policies in time, implemented responsibilities, and conducted step -by -step transmission, and increased the popularization of policies and transmission with customer docking, and benefited the inclusive financial policies to benefit millions of households. In 2021, all the client managers of all sub -branch under the jurisdiction carried out the "Thousands of Families into Ten Thousand Households" in 261 villages in 24 towns and villages in the city, established files from households, firmly controlled the needs of farmers in the city, accurately connected services, and held a "silver administration enterprise enterprise enterprise enterprise in the same year, held a" silver administrative enterprise enterprise enterprise enterprise "Doing the conference, 2 billion yuan in credit to 20 companies on the spot. In 2022, the "special fund guarantee loan" business affected by the epidemic affected by the epidemic affected by the epidemic was affected by small, medium and micro enterprises, in accordance with the principle of "simplified, as soon as possible, and ascending", simplify credit materials, reduce time occupation, reduce financing costs, solve corporate financing problems Essence

2 The first signing of a contract with the government with the government, and the "Banking Administration Enterprise" signing conference site

Go first, take the lead in docking with the revitalization of Wuchang rural areas. Wuchang Rural Commercial Bank first signed a contract with the government to fully support the work of Wuchang rural revitalization. It plans to grant the total credit in the field of rural revitalization in the next four years, which is not less than 10 billion yuan. Financial consultation, investment and financing planning, risk resolution and other comprehensive services; quickly build a service platform, set up exclusive service groups, and provide policy promotion and service support in all -round and continuousness. Help rural revitalization, build a beautiful home "-2022 Agricultural and Commercial Bank" silver administration and peasants "financial services into rural series, through" government settled on Taiwan, silver farmers singing ", implement various financial support to the rural revitalization and direct real economy Policies, to the greatest extent, transmit the latest financial policies and service information to rural and farmers, transform the achievements of "capacity building" into a vivid practice of financial services, and empower rural revitalization. As of late September, there were 4 townships, with a total credit of 30 million yuan. The "Silver Administration" financial services of the Rural Commercial Bank entered the rural series of "Erhe Township Signing

In the past two years, Wuchang Rural Commercial Bank has invested more than 10 billion yuan in inclusive financial loans. The number of households and scale has basically doubled each year. The inclusive business has maintained high -speed, efficient and high -quality development. In the future, Wuchang Rural Commercial Bank will continue to adhere to the comprehensive leadership of the party, conduct the deployment of the new party committee of the Provincial Federation of the Provincial Federation, give full play to the leading role of party building, and promote the three major projects of "quality improvement and efficiency, empowerment upgrade, and solid base". , Based on the differentiated management model, the "year of ability to build a style", "compliance construction improvement year" as the guarantee, supported by science and technology empowerment and data applications, fully improve the quality and efficiency of inclusive financial services to promote reform of reform and insurance The actual actions and outstanding achievements of high -quality development welcomed the 20th National Congress of the Communist Party of China. "The party secretary of the party and chairman of the party and chairman of the Five Chang Rural Commercial Bank told reporters with confidence.

- END -

Consumption reference 丨 The first -level market is cold, pet companies are scrambling to go public

Reporter He Hongyuan and Chen Sha reports from the 21st Century Business Herald reportersThe development of the pet industry entered the second half.The activity of the market's funds is declining. Ac...

Deeply cultivating the development of Xinjiang's mining industry development potential continuously released

Reporter Wang YayunMineral resources are an important foundation for national econ...